Form 8843 Where To Send

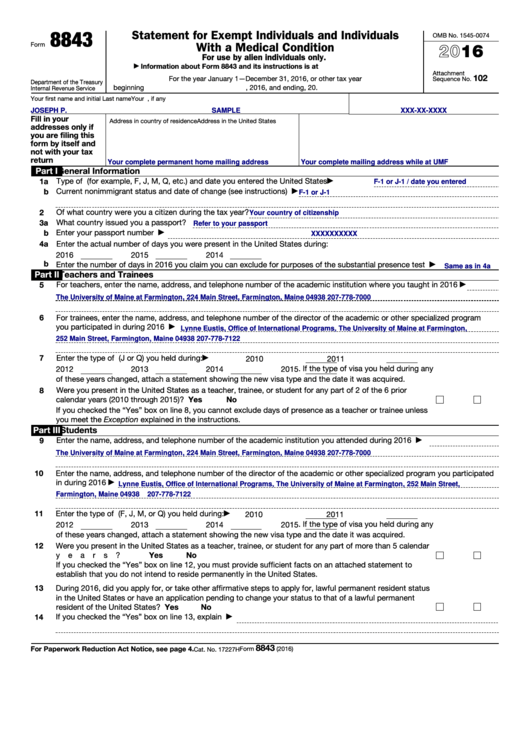

Form 8843 Where To Send - A refund of tax, other than a tax for which a different form must be used. Department of the treasury internal revenue service center austin, tx 73301. Web mailing addresses for form 843; How do i complete form 8843?. Web yes no 10 enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020 11 enter the type of u.s. If you need to complete. Web attach form 8843 to your 2021 income tax return. If you do not have to file a return, send form 8843 to the following address. Web if you were physically in the u.s. If you are filing form 843.

Tax agency irs, even if you. Web mailing addresses for form 843; Web mail form 8843 and supporting documents in an envelope to the following address: Department of the treasury internal revenue. Web mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax return instructions. How do i complete form 8843?. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. If you do not have to file a return, send form 8843 to the following address. (see do not use form 843 when you must. Department of the treasury internal revenue service center austin, tx 73301.

Source income in the prior calendar year, year, this is the only form needed. Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. Tax agency irs, even if you. Department of the treasury internal revenue service center austin, tx 73301. In f or j status anytime between jan. Web mailing addresses for form 843; Web you must file form 8843 if both of the following conditions are met: Web if you were physically in the u.s. Web mail form 8843 and supporting documents in an envelope to the following address:

IRS Form 8843 Editable and Printable Statement to Fill out

Tax agency irs, even if you. 31, 2022, you are obligated to send one form, form 8843, to the u.s. How do i complete form 8843?. Web attach form 8843 to your 2021 income tax return. You were present in the u.s.

Fillable Form 8843 Statement For Exempt Individuals And Individuals

(there is no street address needed) each individual who has no income and files only a form 8843 must send the form in a separate envelope. Web mailing addresses for form 843; Web attach form 8843 to your 2021 income tax return. Department of the treasury internal revenue service center austin, tx 73301. Web 49 rows form 8843, statement for.

Download 2012 8843 Form for Free Page 3 FormTemplate

Web attach form 8843 to your 2021 income tax return. Web mail form 8843 and supporting documents in an envelope to the following address: Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Department of the treasury internal revenue. If you do not have to file a return,.

Form 8843 Edit, Fill, Sign Online Handypdf

A refund of tax, other than a tax for which a different form must be used. 31, 2022, you are obligated to send one form, form 8843, to the u.s. Web attach form 8843 to your 2021 income tax return. Web mailing addresses for form 843; Tax agency irs, even if you.

Close Up Of Usa Tax Form Type 8843 Statement For Exempt Individuals And

How do i complete form 8843?. If you need to complete. Web if you were physically in the u.s. Web yes no 10 enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020 11 enter the type of u.s. Then mail the form to… in response to an.

[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone

A refund of tax, other than a tax for which a different form must be used. Source income in the prior calendar year, year, this is the only form needed. Web mailing addresses for form 843; In f/j status for any portion of the previous calendar year (the year for which. (there is no street address needed) each individual who.

AnnaLeah & Mary for Truck Safety received word of IRS TaxExempt Status

Web if you were physically in the u.s. 31, 2022, you are obligated to send one form, form 8843, to the u.s. Source income in the prior calendar year, year, this is the only form needed. The same due date applies if the taxpayer does not. A refund of tax, other than a tax for which a different form must.

What is Form 8843 and How Do I File it? Sprintax Blog

(see do not use form 843 when you must. The irs instructions for form 8843 summarizes who qualifies as an exempt individual. In f/j status for any portion of the previous calendar year (the year for which. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. Web yes no 10.

Should those on F1 OPT submit both Form 8843 and Form 1040NR? Quora

Web mailing addresses for form 843; If you do not have to file a return, send form 8843 to the following address. Web if you were physically in the u.s. Web attach form 8843 to your 2021 income tax return. In f/j status for any portion of the previous calendar year (the year for which.

Form 8843. What is it? And how do I file it? Official

Web yes no 10 enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020 11 enter the type of u.s. In f/j status for any portion of the previous calendar year (the year for which. Web mail form 8843 and supporting documents in an envelope to the following.

Web Mail The Tax Return And The Form 8843 By The Due Date (Including Extensions) To The Address Shown In The Tax Return Instructions.

Web 49 rows form 8843, statement for exempt individuals and individuals. How do i complete form 8843?. Web if you were physically in the u.s. Web yes no 10 enter the name, address, and telephone number of the director of the academic or other specialized program you participated in during 2020 11 enter the type of u.s.

You Were Present In The U.s.

If you are filing form 843. If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. Department of the treasury internal revenue.

Web Mail Form 8843 And Supporting Documents In An Envelope To The Following Address:

In f/j status for any portion of the previous calendar year (the year for which. Department of the treasury internal revenue service center austin, tx 73301. In f or j status anytime between jan. If you do not have to file a return, send form 8843 to the following address.

Web Use Form 843 To Claim Or Request The Following.

31, 2022, you are obligated to send one form, form 8843, to the u.s. Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Web attach form 8843 to your 2021 income tax return. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions.

![[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone](https://img1.daumcdn.net/thumb/R800x0/?scode=mtistory2&fname=https:%2F%2Ft1.daumcdn.net%2Fcfile%2Ftistory%2F2638E83958C218ED0B)