Form 8862 Pdf 2020

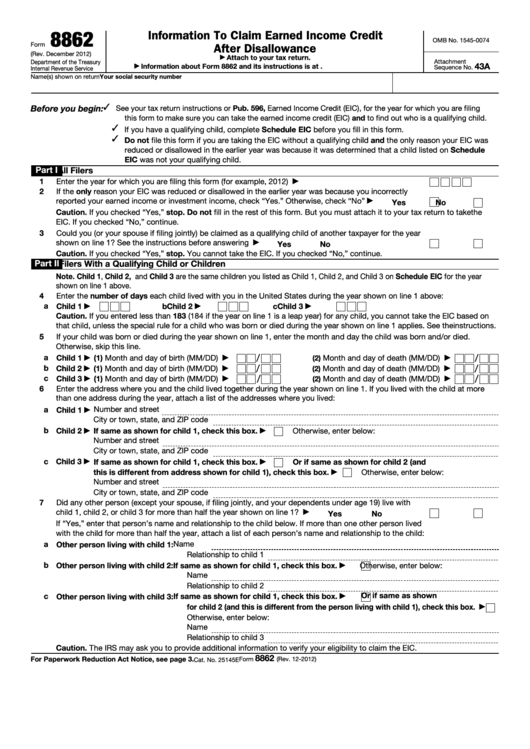

Form 8862 Pdf 2020 - Information to claim certain credits after disallowance. • 2 years after the most recent tax year for which there was a final determination that. You do not need to file form 8862 in the year the credit. More about the federal form 8862 tax credit we last. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web form 8862 if you meet all the credit’s eligibility requirements. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service. Information to claim certain credits after disallowance. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. As the society takes a step away from office working conditions, the execution of paperwork more and more takes place.

Web 12 hours agoa grand jury indicted trump for a raft of alleged crimes stemming from his efforts to overturn the results of the 2020 election. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. The full pdf is available here. Easily fill out pdf blank, edit, and sign them. November 2018) department of the treasury internal revenue service. Web 119 votes what makes the form 8862 pdf legally binding? Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs). Form 8862 information to claim certain credits after disallowance is used to claim the earned income credit. Ad download or email irs 8862 & more fillable forms, register and subscribe now!

Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs). Information to claim certain credits after disallowance. Web 119 votes what makes the form 8862 pdf legally binding? December 2021) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. • 2 years after the most recent tax year for which there was a final determination that. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

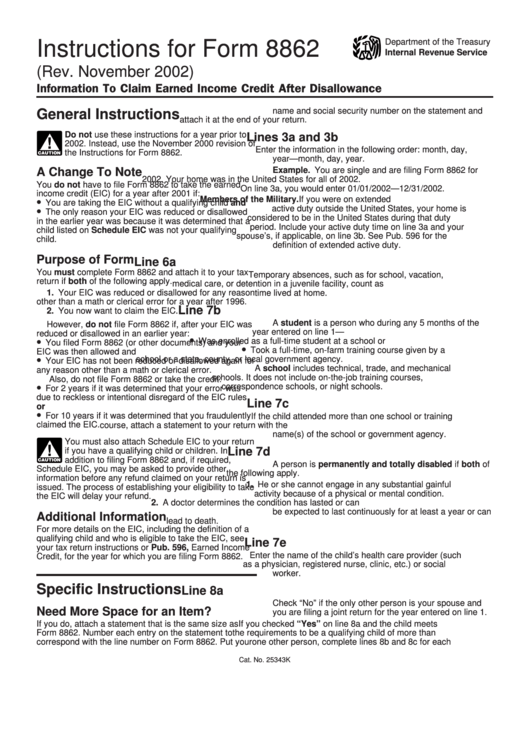

Instructions For Form 8862 Information To Claim Earned Credit

Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Web 12 hours agoa grand jury indicted trump for a raft of alleged crimes stemming from his efforts to overturn the results of the 2020 election. December 2021) department of the treasury internal revenue service information to claim certain.

Top 14 Form 8862 Templates free to download in PDF format

The full pdf is available here. Web 12 hours agoa federal grand jury has indicted former president donald trump in special counsel jack smith’s investigation into efforts to overturn the 2020 election leading up to. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Save or instantly send.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Information to claim certain credits after disallowance. Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue.

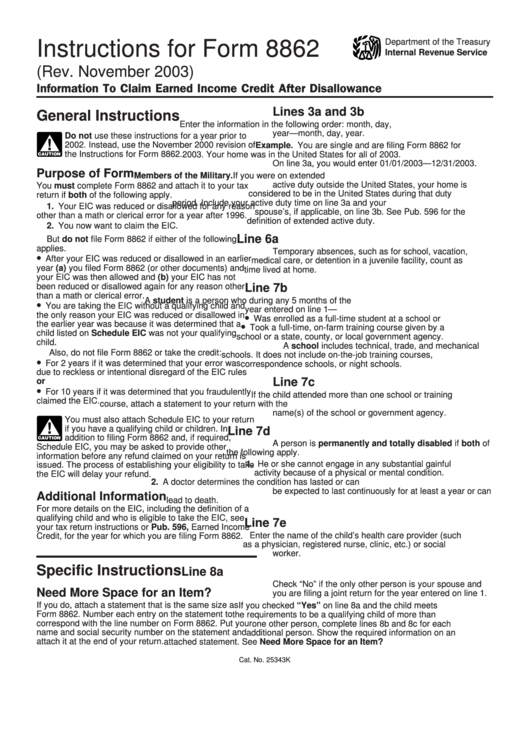

Instructions For Form 8862 Information To Claim Earned Credit

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs). Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. As the society takes a step away from office working conditions, the execution.

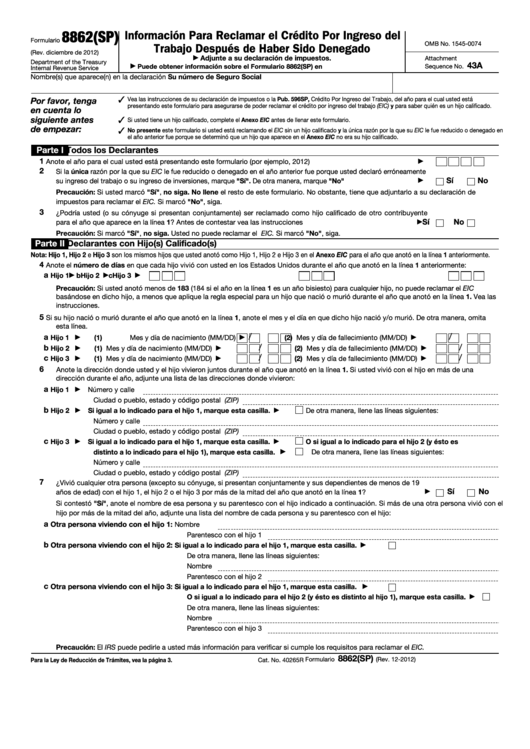

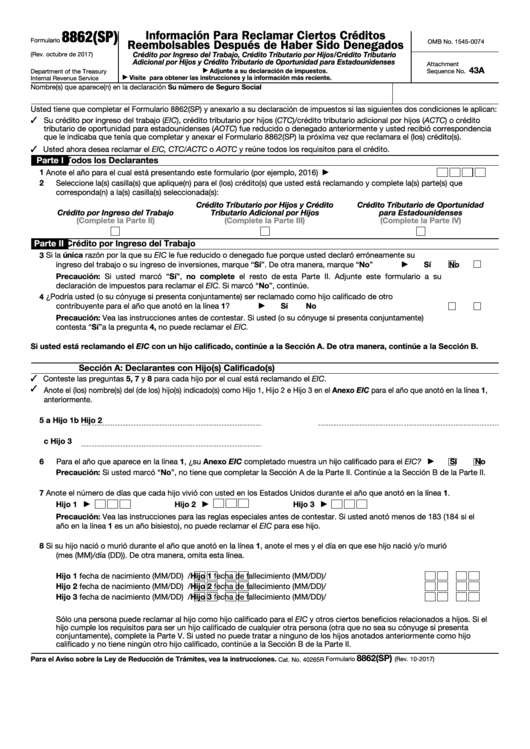

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Save or instantly send your ready documents. Web be sure to follow the instructions from the irs if you received a notice requiring you to file form 8862. Web form 8862 if you meet all the credit’s eligibility requirements. Ad download or email irs 8862 & more fillable forms, register and subscribe now! As the society takes a step away.

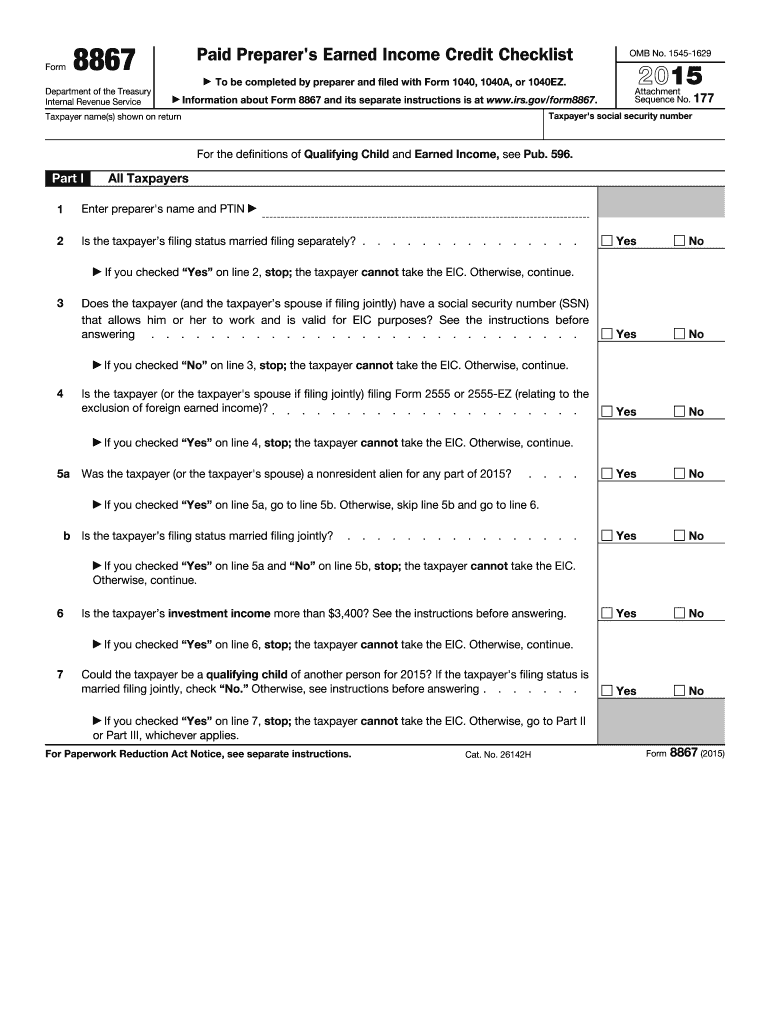

2015 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Information to claim certain credits after disallowance. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. December 2021) department of the treasury internal revenue service information to claim.

Top 14 Form 8862 Templates free to download in PDF format

Do not file form 8862 for the: Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Information to claim certain credits after disallowance. December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),.

Form 8862Information to Claim Earned Credit for Disallowance

More about the federal form 8862 tax credit we last. Complete, edit or print tax forms instantly. Form 8862, information to claim earned. Information to claim certain credits after disallowance. Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must.

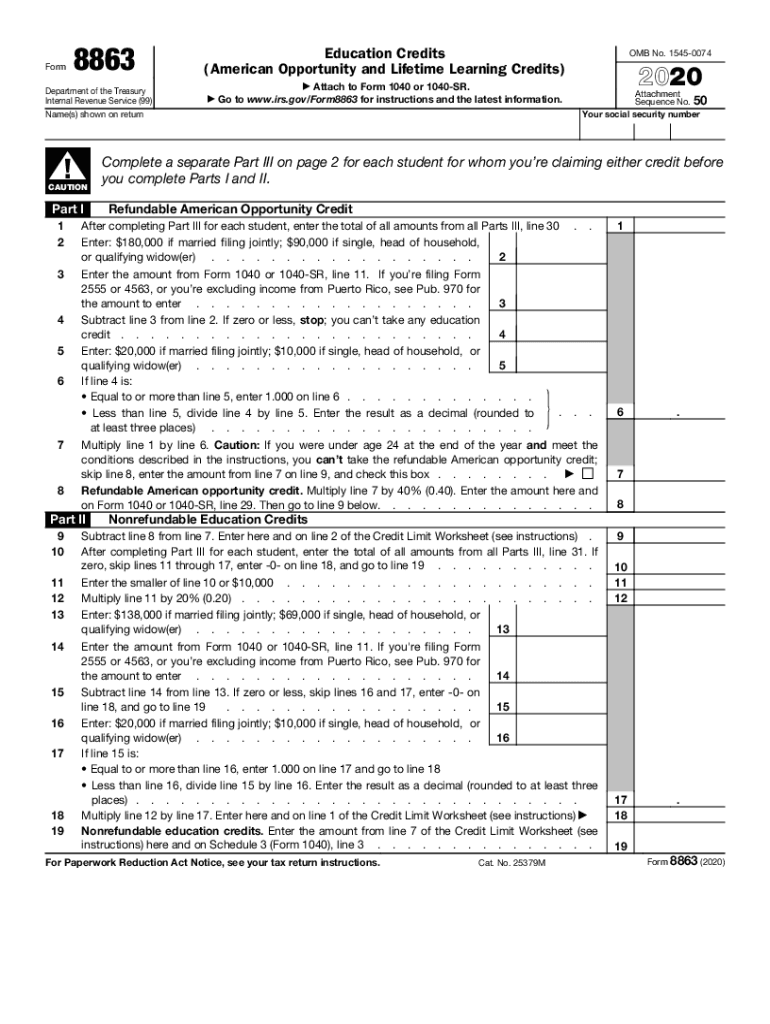

IRS 8863 20202022 Fill out Tax Template Online US Legal Forms

Information to claim certain credits after disallowance. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs). Complete, edit or print tax forms instantly. Form 8862 information to claim certain credits after disallowance is used to claim the earned income credit. Web 12 hours.

Fillable Form 8862 Information To Claim Earned Credit After

Web if your earned income credit (eic), child tax credit (ctc), additional child tax credit (actc), or american opportunity tax credit (aotc) was disallowed by the irs, you must. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service. Information.

Web Be Sure To Follow The Instructions From The Irs If You Received A Notice Requiring You To File Form 8862.

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs). • 2 years after the most recent tax year for which there was a final determination that. More about the federal form 8862 tax credit we last. Do not file form 8862 for the:

As The Society Takes A Step Away From Office Working Conditions, The Execution Of Paperwork More And More Takes Place.

December 2021) department of the treasury internal revenue service information to claim certain credits after disallowance earned income credit (eic),. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service. Information to claim certain credits after disallowance. You do not need to file form 8862 in the year the credit.

Ad Download Or Email Irs 8862 & More Fillable Forms, Register And Subscribe Now!

Save or instantly send your ready documents. Form 8862, information to claim earned. Complete, edit or print tax forms instantly. Web 12 hours agoa grand jury indicted trump for a raft of alleged crimes stemming from his efforts to overturn the results of the 2020 election.

Web 12 Hours Agoa Federal Grand Jury Has Indicted Former President Donald Trump In Special Counsel Jack Smith’s Investigation Into Efforts To Overturn The 2020 Election Leading Up To.

Easily fill out pdf blank, edit, and sign them. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Form 8862 information to claim certain credits after disallowance is used to claim the earned income credit. Information to claim certain credits after disallowance.