Form 8862 Pdf

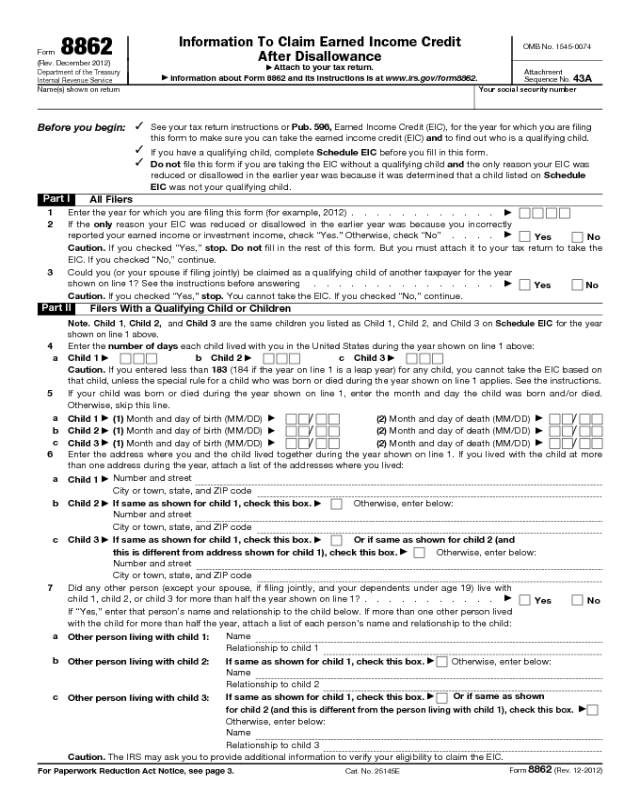

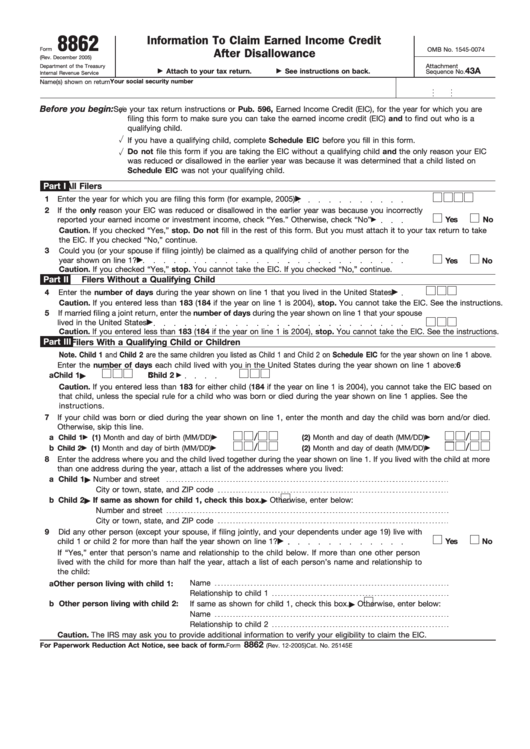

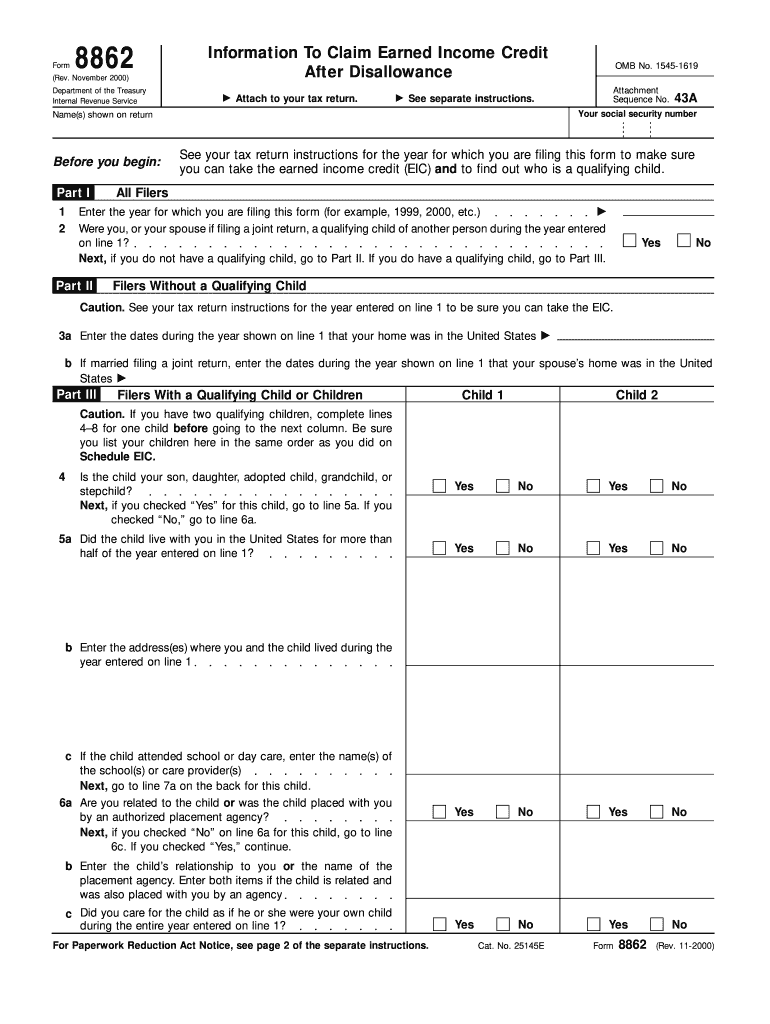

Form 8862 Pdf - Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Download this form print this form Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Web filing tax form 8862: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Attach to your tax return. Web taxpayers complete form 8862 and attach it to their tax return if: December 2012) department of the treasury internal revenue service. Do not enter the year the credit(s) was disallowed.

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Do not enter the year the credit(s) was disallowed. Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution. Key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Our service provides you with an extensive selection of templates that are offered for filling out on the internet. Check the box(es) that applies to the credit(s) you are now claiming. December 2012) department of the treasury internal revenue service. Information to claim certain credits after disallowance. Information about form 8862 and its instructions is at.

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? If you checked “yes,” stop. Web filing tax form 8862: Enter the year for which you are filing this form to claim the credit(s) (for example, 2022). Information about form 8862 and its instructions is at. Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:08 am overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and. Check the box(es) that applies to the credit(s) you are now claiming. Web correspond with the line number on form 8862. Web taxpayers complete form 8862 and attach it to their tax return if: Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error.

37 INFO PRINTABLE TAX FORM 8862 PDF ZIP DOCX PRINTABLE DOWNLOAD * Tax

Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web form 8862 allows taxpayers to.

How to claim an earned credit by electronically filing IRS Form 8862

Web filing tax form 8862: Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web follow the simple instructions below: Information to claim earned income credit after disallowance. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and.

Form 8862 Information to Claim Earned Credit After

Web follow the simple instructions below: December 2022) department of the treasury internal revenue service. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Attach to your tax return. Do not enter the year the credit(s) was disallowed.

Irs Form 8862 Printable Master of Documents

December 2012) department of the treasury internal revenue service. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Check the box(es) that applies to the credit(s) you are now claiming. Key takeaways form 8862 is required when the irs has previously.

Instructions for IRS Form 8862 Information to Claim Certain Credits

December 2022) department of the treasury internal revenue service. Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated.

Irs Form 8862 Printable Master of Documents

Download this form print this form Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:08 am overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and. Their earned income credit.

Form 8862 Edit, Fill, Sign Online Handypdf

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. Check the box(es) that applies to the credit(s) you are now claiming. Information to claim earned income credit after disallowance. Web filing tax form 8862: Web follow the simple.

Form 8862 Information To Claim Earned Credit After

Do not enter the year the credit(s) was disallowed. December 2012) department of the treasury internal revenue service. Key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Our service provides you with an extensive selection of templates that are offered for filling out on the internet. December 2022) department of the.

8862 Form Fill Out and Sign Printable PDF Template signNow

If you checked “yes,” stop. Information about form 8862 and its instructions is at. December 2012) department of the treasury internal revenue service. Our service provides you with an extensive selection of templates that are offered for filling out on the internet. Web taxpayers complete form 8862 and attach it to their tax return if:

Form 8862 Edit, Fill, Sign Online Handypdf

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. Web taxpayers complete form 8862 and attach it to their tax return if: If you checked “yes,” stop. Web filing tax form 8862: Check the box(es) that applies to.

Attach To Your Tax Return.

Web taxpayers complete form 8862 and attach it to their tax return if: Information to claim certain credits after disallowance. Web correspond with the line number on form 8862. December 2012) department of the treasury internal revenue service.

Web Part I All Filers Enter The Year For Which You Are Filing This Form (For Example, 2008) If The Only Reason Your Eic Was Reduced Or Disallowed In The Earlier Year Was Because You Incorrectlyreported Your Earned Income Or Investment Income, Check “Yes.” Otherwise, Check “No”Yesnocaution.

Information to claim earned income credit after disallowance written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:08 am overview the earned income credit (eic) is a valuable, refundable tax credit available to low and moderate income taxpayers and. Web federal information to claim earned income credit after disallowance form 8862 pdf form content report error it appears you don't have a pdf plugin for this browser. Our service provides you with an extensive selection of templates that are offered for filling out on the internet. Do not enter the year the credit(s) was disallowed.

Are You Still Seeking A Fast And Convenient Tool To Complete Irs 8862 At An Affordable Price?

Web form 8862 allows taxpayers to reclaim tax credits that were disallowed on their previous tax returns due to circumstances with the internal revenue service (irs) that have now been resolved. December 2022) department of the treasury internal revenue service. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Download this form print this form

Information To Claim Earned Income Credit After Disallowance.

If you checked “yes,” stop. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Check the box(es) that applies to the credit(s) you are now claiming. Information about form 8862 and its instructions is at.