Form 8862 Printable

Form 8862 Printable - Your eic, ctc/rctc/actc/odc, or aotc was previously reduced or disallowed for any reason other than a math or clerical error. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Ainformation about form 8862 and its instructions is at www.irs.gov/form8862. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Create custom documents by adding smart fillable fields. Form 8862, information to claim earned income credit after disallowance. After that, you can use a special tool on the irs website to track the processing progress. More about the federal form 8862 tax credit we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web how do i enter form 8862? If you checked “yes,” stop.

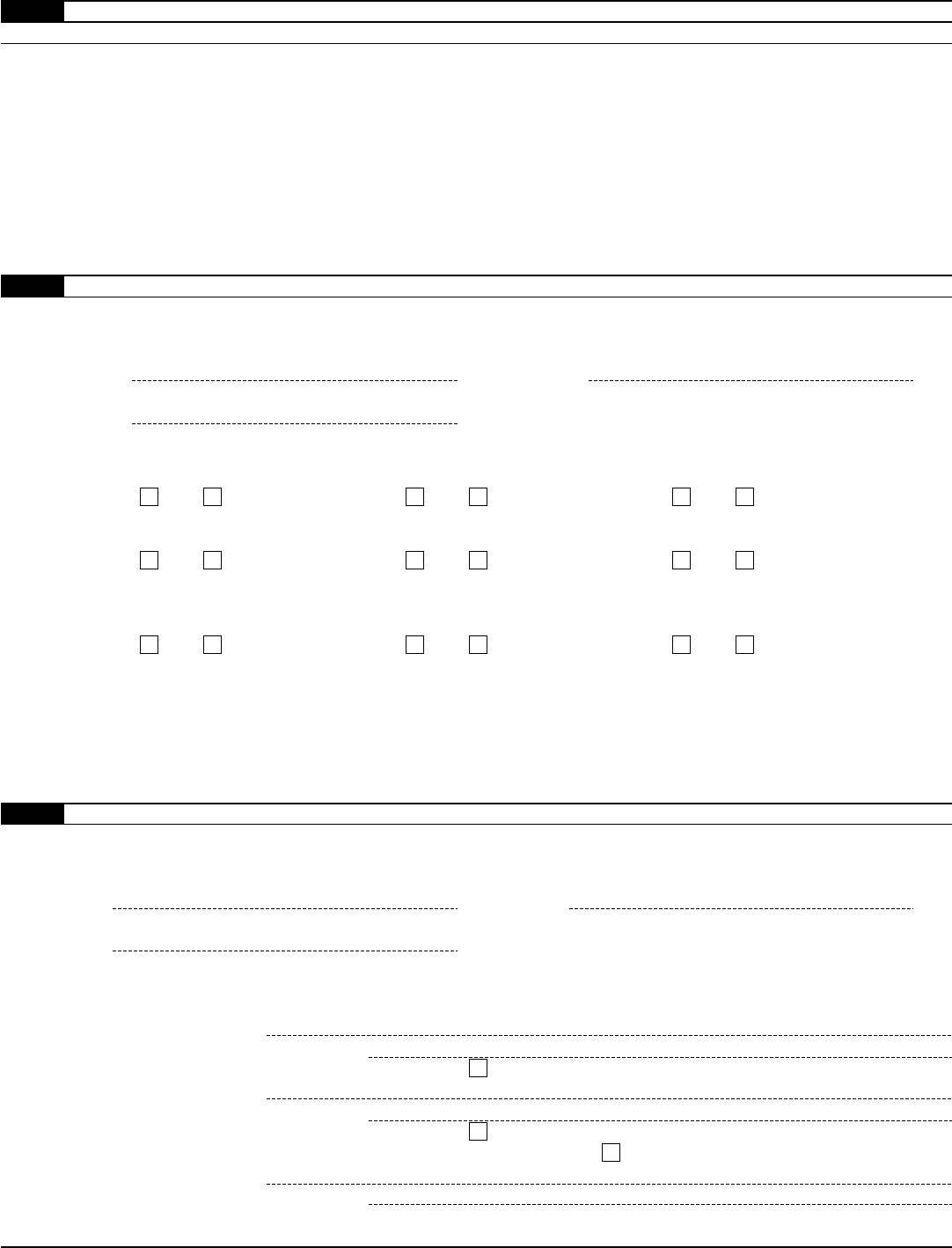

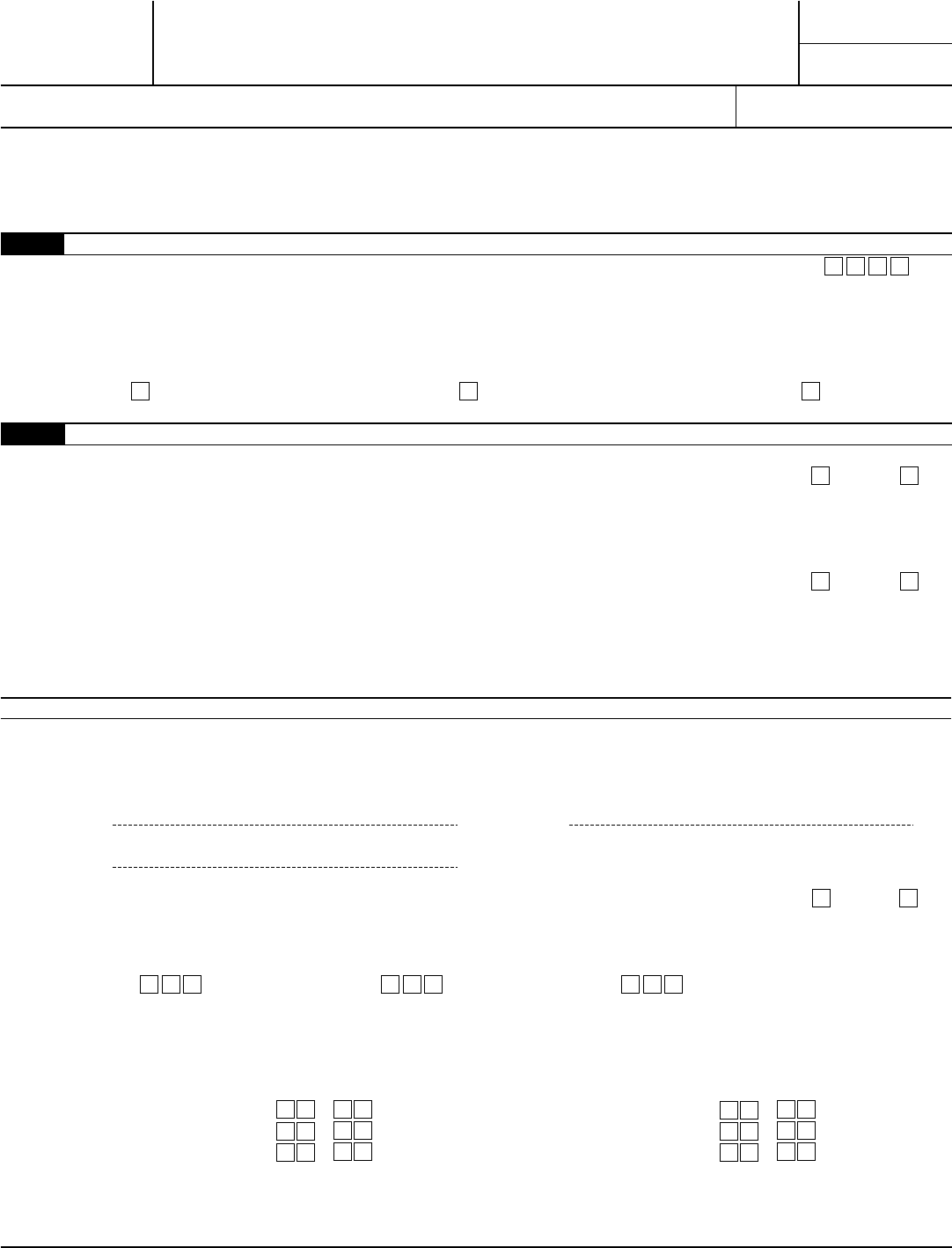

Web instructions for form 8862 (rev. Use get form or simply click on the template preview to open it in the editor. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Use the cross or check marks in the top toolbar to select your answers in the list boxes. December 2012) department of the treasury internal revenue service information to claim earned income credit after disallowance a attach to your tax return. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service allows you to use the credit again. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. After that, you can use a special tool on the irs website to track the processing progress. Web purpose of form you must complete form 8862 and attach it to your tax return if both of the following apply.

Start completing the fillable fields and carefully type in required information. Web follow the simple instructions below: December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section references are to the internal revenue code unless otherwise noted. Your eic was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. Taxpayers complete this form and attach it to their tax return if:. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc) More about the federal form 8862 tax credit we last updated federal form 8862 in december 2022 from the federal internal revenue service. Form 8862, information to claim earned income credit after disallowance. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply.

Download Instructions for IRS Form 8862 Information to Claim Certain

Earned income credit (eic), american opportunity tax credit (aotc), child tax credit (ctc), additional child tax credit (actc), and credit for other dependents (odc). Upon completion, there will be an exact date when you can expect your refund. Attach to your tax return. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits..

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Attach to your tax return. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. Web follow the simple instructions below: This form is for income earned in tax year 2022, with tax.

8862 24/24V MASCOT DC/DC Converter, Panel, Fixed, 1, 81 W, 24 V, 6

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before.

Form 8867*Paid Preparer's Earned Credit Checklist

Create custom documents by adding smart fillable fields. Information to claim certain credits after disallowance. Information to claim certain credits after disallowance. Start completing the fillable fields and carefully type in required information. Taxpayers complete this form and attach it to their tax return if:.

Form 8862 Information to Claim Earned Credit After

Web export or print download your fillable irs form 8862 in pdf table of contents who should use form 8862 reasons for disallowance how to fill out form 8862 this paper is created by taxpayers if their tax credit is rejected or decreased. Form 8862, information to claim earned income credit after disallowance. Web if your eic was disallowed or.

Form 8862 Edit, Fill, Sign Online Handypdf

You can download form 8862 from the irs website and file it. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service allows you to use the credit again. Attach to your tax return. Start completing the fillable fields and.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Information to claim certain credits after disallowance. Earned income credit (eic), american opportunity tax credit (aotc), child tax credit (ctc), additional child tax credit (actc), and credit for other dependents (odc). Ainformation about form 8862 and its instructions is at www.irs.gov/form8862. December 2022) department of the treasury internal revenue service. Web purpose of form you must complete form 8862 and.

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

But do not file form 8862 if either of the following applies. Ainformation about form 8862 and its instructions is at www.irs.gov/form8862. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service allows you to use the credit again. Start.

Top 14 Form 8862 Templates free to download in PDF format

More about the federal form 8862 tax credit we last updated federal form 8862 in december 2022 from the federal internal revenue service. Your eic, ctc/rctc/actc/odc, or aotc was previously reduced or disallowed for any reason other than a math or clerical error. November 2018) department of the treasury internal revenue service. Web form 8862 is required when the irs.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. Our service provides you with an extensive selection of templates that are offered for filling out on the internet. Organizations that work with form 8862. After that, you can use a special tool on the irs website to track the processing progress. Taxpayers.

Web We Last Updated The Information To Claim Earned Income Credit After Disallowance In December 2022, So This Is The Latest Version Of Form 8862, Fully Updated For Tax Year 2022.

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web taxpayers complete form 8862 and attach it to their tax return if: Web instructions for form 8862 (rev. Your eic, ctc/rctc/actc/odc, or aotc was previously reduced or disallowed for any reason other than a math or clerical error.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Information to claim certain credits after disallowance. Web part i all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you incorrectlyreported your earned income or investment income, check “yes.” otherwise, check “no”yesnocaution. Earned income credit (eic), american opportunity tax credit (aotc), child tax credit (ctc), additional child tax credit (actc), and credit for other dependents (odc). Organizations that work with form 8862.

Web Complete And Download Form 8862 And Form 1040 And Submit These Files Electronically.

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it: Create custom documents by adding smart fillable fields. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price?

More About The Federal Form 8862 Tax Credit We Last Updated Federal Form 8862 In December 2022 From The Federal Internal Revenue Service.

Web how do i enter form 8862? Web export or print download your fillable irs form 8862 in pdf table of contents who should use form 8862 reasons for disallowance how to fill out form 8862 this paper is created by taxpayers if their tax credit is rejected or decreased. Information to claim certain credits after disallowance. Form 8862, information to claim earned income credit after disallowance.