Form 8862 Required

Form 8862 Required - Ad download or email irs 8862 & more fillable forms, try for free now! Web form 8862 irs rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 38 votes how to fill out and sign form 8862 turbotax online? Get your online template and fill it in using. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. The irs — not efile.com — has rejected your return, as form 8862 is required. Web taxpayers may use form 8862 to claim one or more of the following tax credits: Number each entry on the statement to correspond with the line number on form 8862. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Watch this turbotax guide to learn more.turbotax home:. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed.

December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Web follow the simple instructions below: Number each entry on the statement to correspond with the line number on form 8862. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Ad download or email irs 8862 & more fillable forms, try for free now! Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for.

Web if the irs rejected one or more of these credits: Web taxpayers may use form 8862 to claim one or more of the following tax credits: Complete, edit or print tax forms instantly. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Edit, sign and save irs 8862 form. Web form 8862 irs rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 38 votes how to fill out and sign form 8862 turbotax online? Irs form 8862 where do i enter my estimated tax payments?. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies.

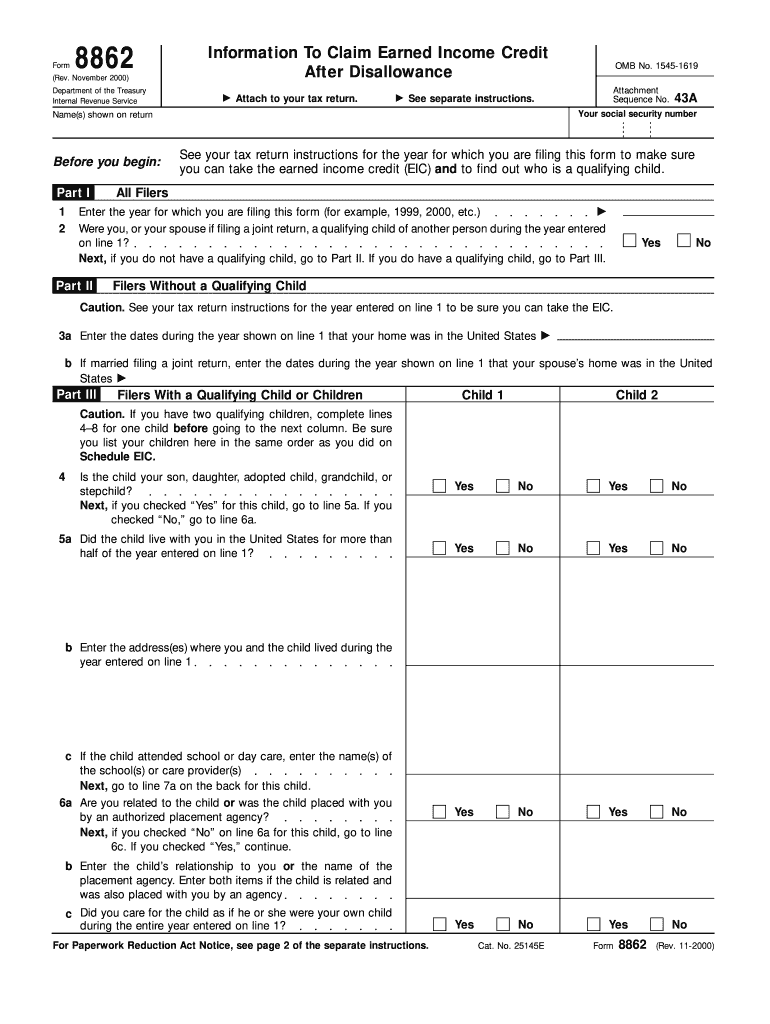

Irs Form 8862 Printable Master of Documents

Earned income credit (eic), child tax credit (ctc), refundable child tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Ad download or email irs 8862 & more fillable forms, try for free now! Edit, sign.

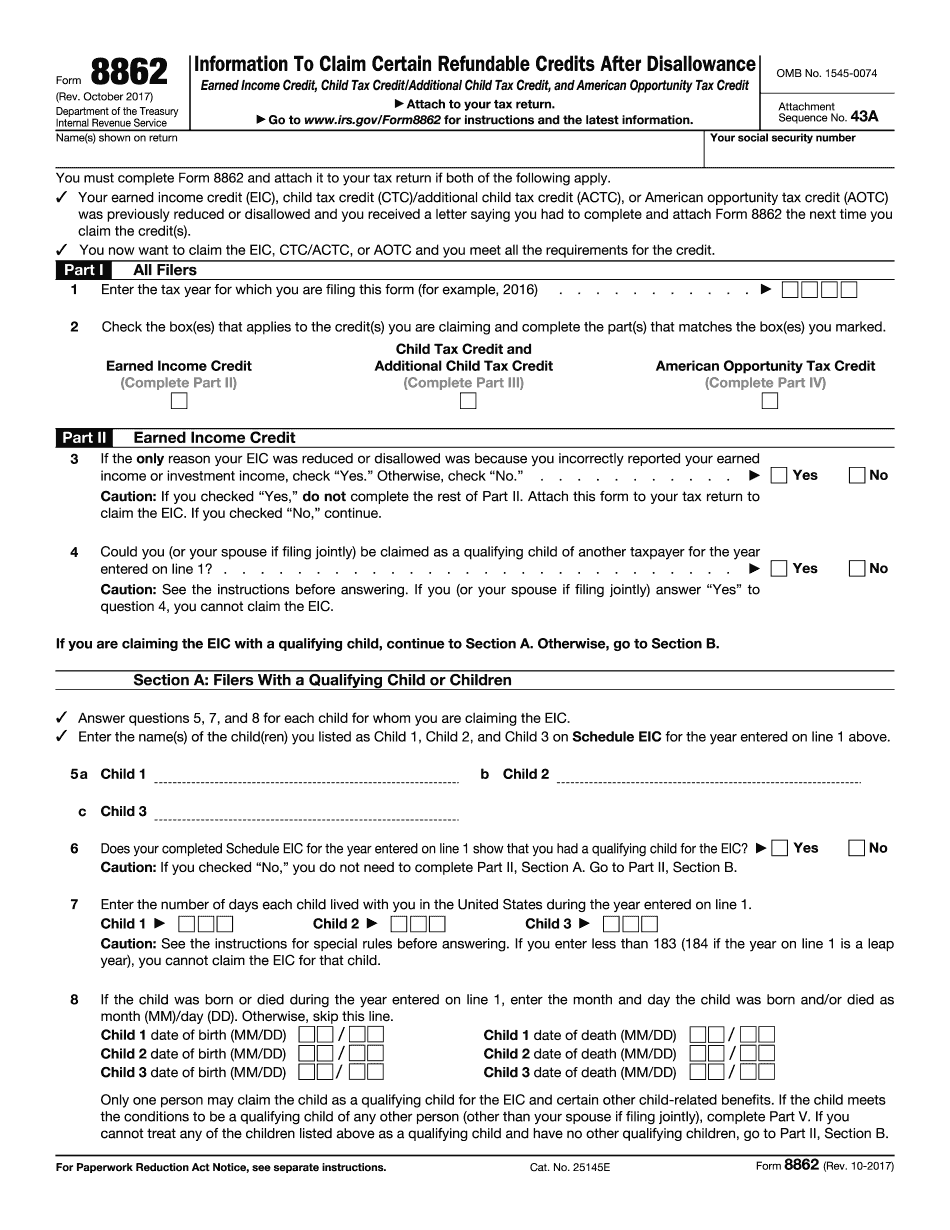

8862 Form Fill Out and Sign Printable PDF Template signNow

Number each entry on the statement to correspond with the line number on form 8862. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web instructions for form 8862 irs form 8862 do you live in the us for more than six months in 2021? Web all filers enter the year for.

Irs Form 8862 Printable Master of Documents

Please sign in to your. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. Web instructions for form 8862 (rev. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Earned income credit (eic),.

Form 8862 Claim Earned Credit After Disallowance YouTube

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. If you wish to take the credit in a. Web how do.

IRS 8862 2022 Form Printable Blank PDF Online

Ad download or email irs 8862 & more fillable forms, try for free now! Get your online template and fill it in using. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the.

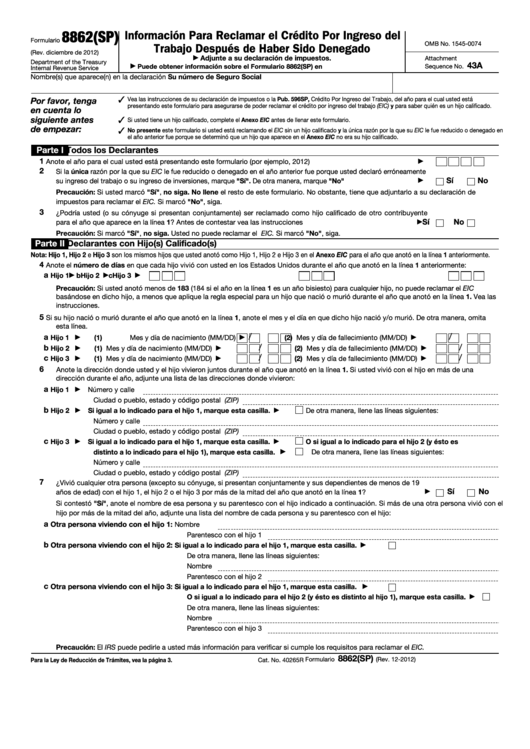

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Our service provides you with an extensive. The irs — not efile.com — has rejected your return, as form 8862 is required. Web taxpayers may use form 8862 to claim one or more of the following tax credits: Watch this turbotax guide to learn more.turbotax.

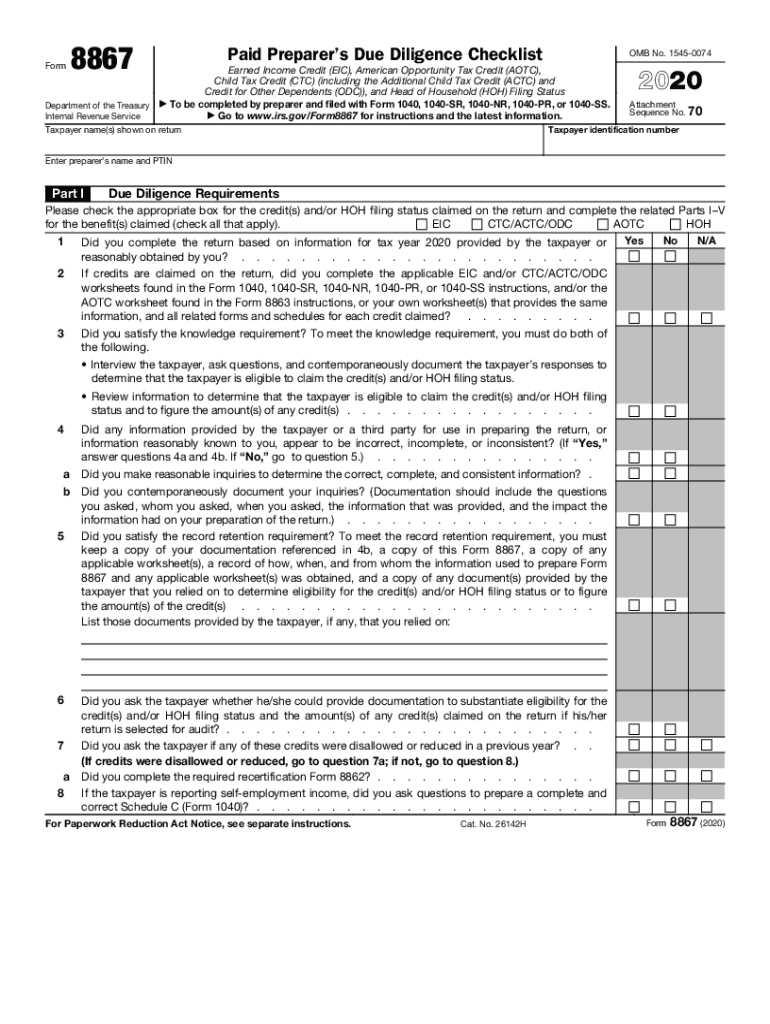

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. Get your online template and fill it in using. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc.

IRS Form 8862 Diagram Quizlet

Web instructions for form 8862 (rev. Web all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you. Web the taxpayer may be required to include form 8862 information to claim earned income credit after disallowance on the next.

2020 Form IRS 1040 Instructions Fill Online, Printable, Fillable, Blank

Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Watch this turbotax guide to learn more.turbotax home:. Web all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you. Web taxpayers may use form 8862 to.

Notice Of Disallowance Of Claim

Web all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you. Complete, edit or print tax forms instantly. Put your name and social security number on the statement and attach it at. Solved • by turbotax • 7249.

Web You Must Complete Form 8862 And Attach It To Your Tax Return To Claim The Eic, Ctc, Rctc, Actc, Odc, Or Aotc If You Meet The Following Criteria For Any Of The Credits.

Number each entry on the statement to correspond with the line number on form 8862. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Irs form 8862 where do i enter my estimated tax payments?.

Complete, Edit Or Print Tax Forms Instantly.

This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for form 8862 irs form 8862 do you live in the us for more than six months in 2021? Web how do i enter form 8862? Put your name and social security number on the statement and attach it at.

Earned Income Credit (Eic), Child Tax Credit (Ctc), Refundable Child Tax Credit.

Ad download or email irs 8862 & more fillable forms, try for free now! Web instructions for form 8862 (rev. Edit, sign and save irs 8862 form. If you wish to take the credit in a.

Web The Taxpayer May Be Required To Include Form 8862 Information To Claim Earned Income Credit After Disallowance On The Next Tax Return In Order To Qualify For Eic When The Irs.

Web follow the simple instructions below: Web taxpayers may use form 8862 to claim one or more of the following tax credits: Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies.