Form 8910 Qualifying Vehicles

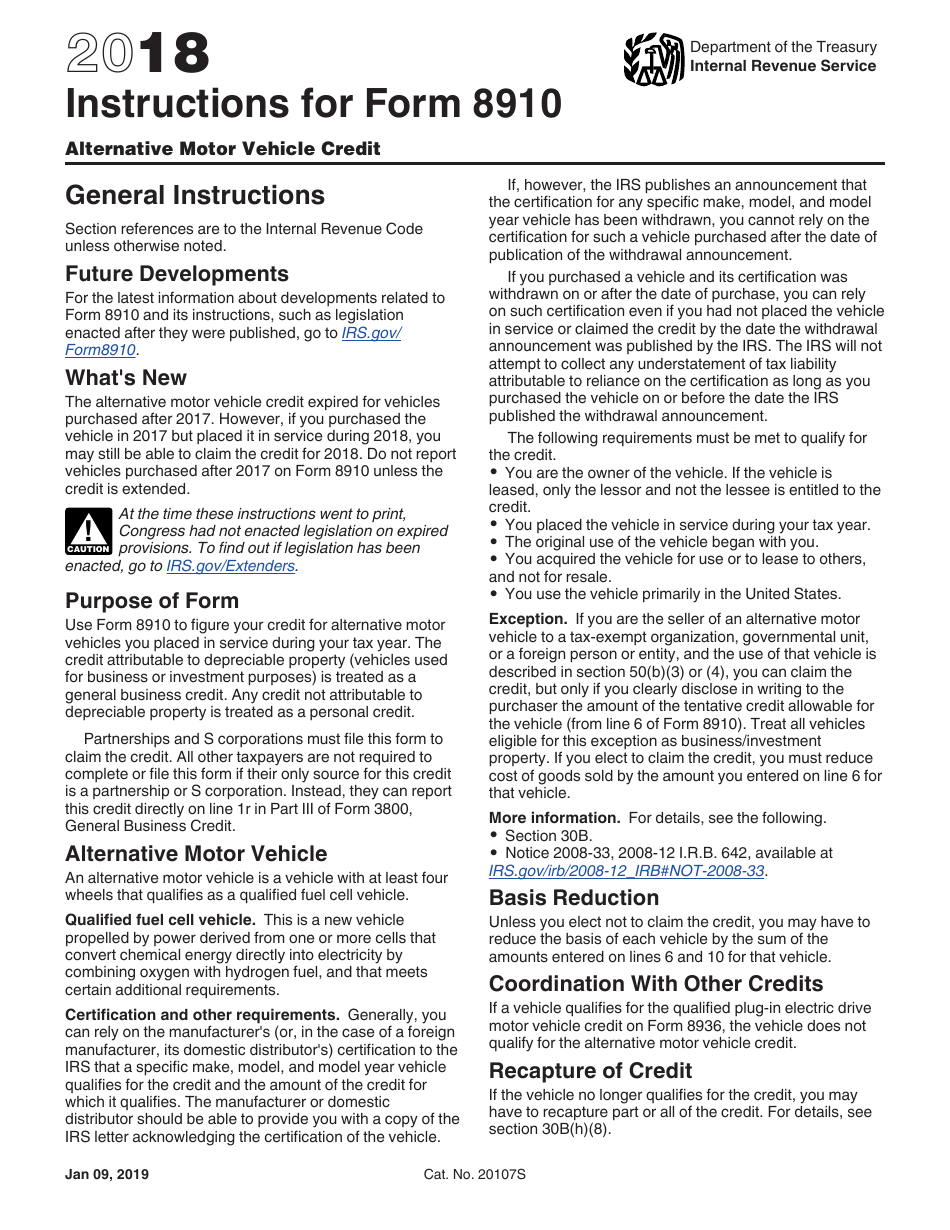

Form 8910 Qualifying Vehicles - You are the owner of the vehicle. The vehicle is transporting hazardous materials and is required to be placarded. Be sure to read the form. The credit attributable to depreciable property (vehicles used for. Web the following requirements must be met to qualify for the credit. Have an external charging source have a gross vehicle weight rating of less than 14,000 pounds be made. If the vehicle is leased, only the lessor and not the lessee is entitled to the. Web in general, to qualify for the ev tax credit, the ev vehicle: Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Proof of age and a photo must be included to qualify and obtain a photo.

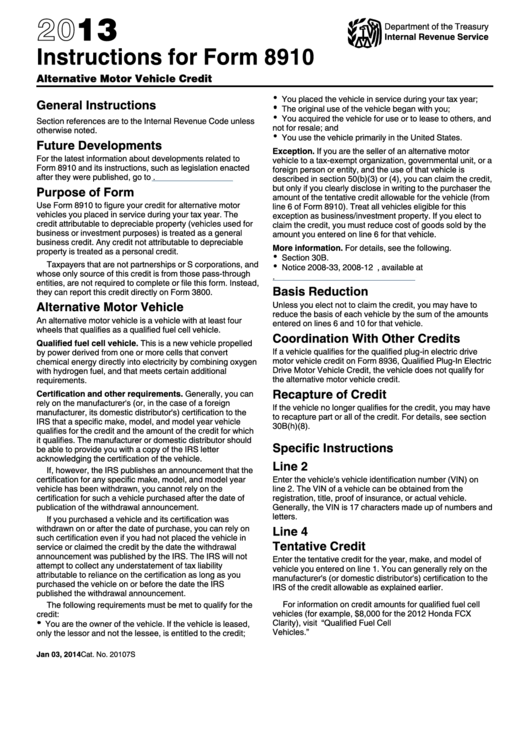

Web in general, to qualify for the ev tax credit, the ev vehicle: It offers a tax credit for qualified hybrid, fuel. This is a new vehicle that draws propulsion energy from onboard sources of stored energy that are both an internal combustion or heat engine using. Web don’t use form 8910 to claim a credit for vehicles purchased after 2020 unless the credit is extended. A completed and signed application for missouri military personalized license plates (form 4601) pdf. Be sure to read the form. Web qualified fuel cell vehicle. Web what are the qualifications for the alternative motor vehicle credit (form 8910)? Complete the first page of section a. The alternative motor vehicle credit expired for vehicles purchased after 2021.

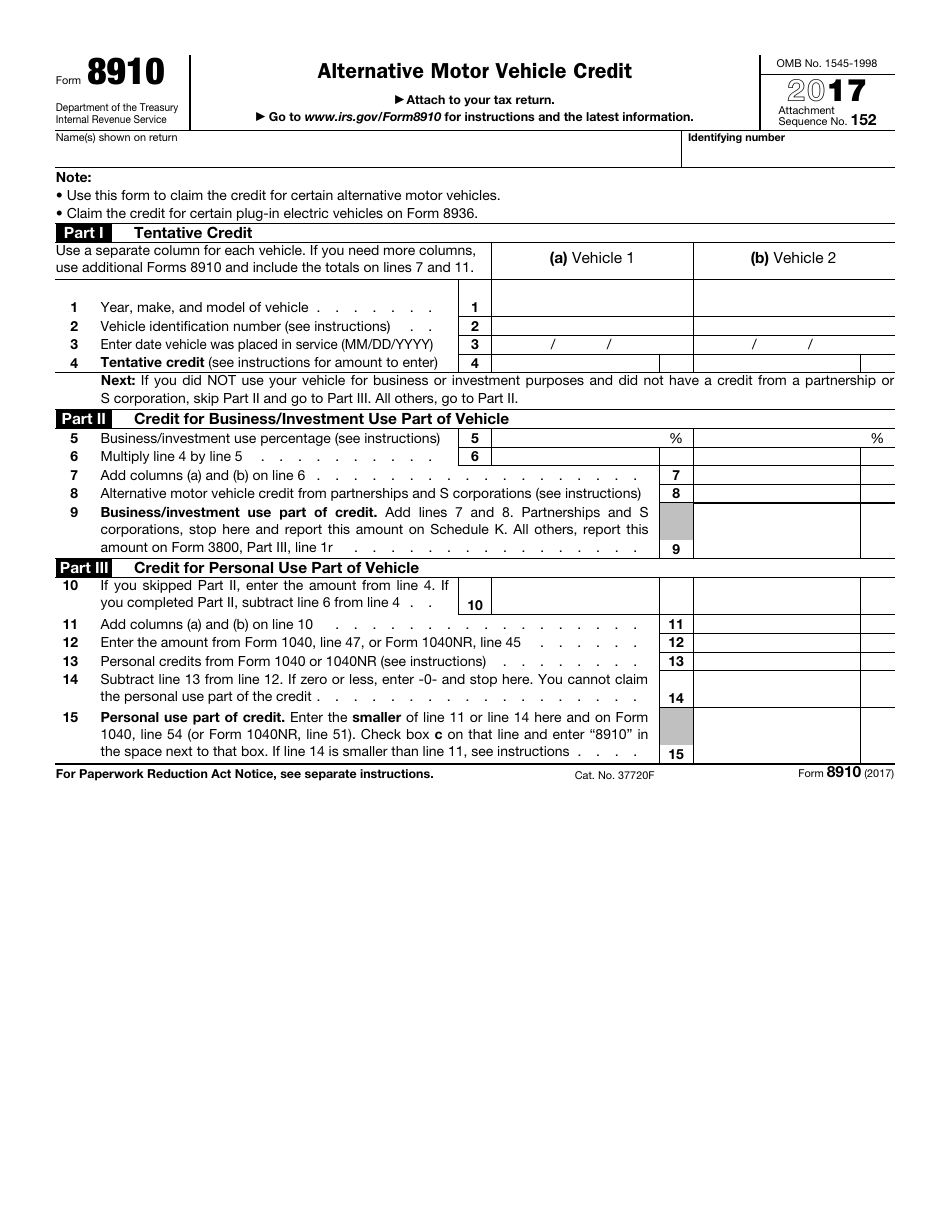

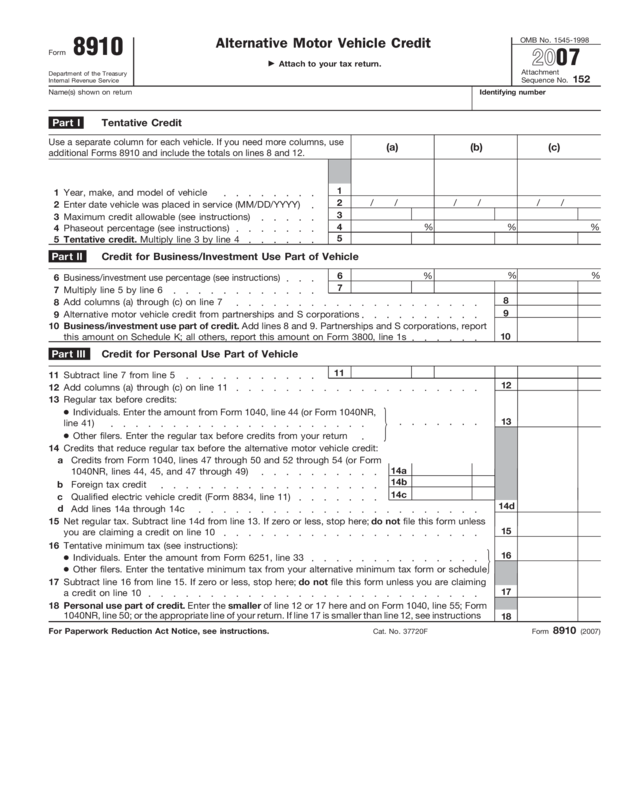

Part i tentative credit next: Web the 2023 chevrolet bolt. It added income limits, price caps and. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. A completed and signed application for missouri military personalized license plates (form 4601) pdf. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle. Alternative motor vehicle an alternative motor vehicle is a vehicle with at. The credit attributable to depreciable property (vehicles. Web what are the qualifications for the alternative motor vehicle credit (form 8910)? The credit attributable to depreciable property (vehicles used for.

Financial Concept Meaning Form 8910 Alternative Motor Vehicle Credit

The following articles are the top questions referring to vehicle credits faqs (8846). Web to apply for disabled veteran license plates, you must submit: The alternative motor vehicle credit was enacted by the energy policy act of 2005. Have an external charging source have a gross vehicle weight rating of less than 14,000 pounds be made. If you qualify based.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

Part i tentative credit next: It offers a tax credit for qualified hybrid, fuel. The following articles are the top questions referring to vehicle credits faqs (8846). Web the 2023 chevrolet bolt. The vehicle is transporting hazardous materials and is required to be placarded.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

It added income limits, price caps and. Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. If the vehicle is leased, only the lessor and not the lessee is entitled to the. The inflation reduction act of 2022 overhauled the ev tax credit, worth.

IRS Form 8910 Download Fillable PDF or Fill Online Alternative Motor

Web the following requirements must be met to qualify for the credit. Web the vehicle is designed to transport 16 or more passengers, including the driver; The alternative motor vehicle credit expired for vehicles purchased after 2021. The credit attributable to depreciable property (vehicles. Entering a vehicle credit for.

Instructions for Form 8910, Alternative Motor Vehicle Credit

Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Be sure to read the form. If the vehicle is leased, only the lessor and not the lessee is entitled to the. Web general instructions purpose of form use form 8910 to figure your credit.

Instructions For Form 8910 Alternative Motor Vehicle Credit 2013

Web credits to enter information for vehicle credits. Web the following requirements must be met to qualify for the credit. If you qualify based on your age (referenced on page 1: This is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with. The vehicle is transporting.

Form 8910 Edit, Fill, Sign Online Handypdf

Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Proof of age and a photo must be included to qualify and obtain a photo. Web the following requirements must be met to qualify for the credit. Part i tentative credit next: Web general instructions.

Form 8910 Edit, Fill, Sign Online Handypdf

This is a new vehicle propelled by power derived from one or more cells that convert chemical energy directly into electricity by combining oxygen with. The alternative motor vehicle credit was enacted by the energy policy act of 2005. The credit attributable to depreciable property (vehicles. The alternative motor vehicle credit expired for vehicles purchased after 2021. If the vehicle.

Fill Free fillable Form 8910 Alternative Motor Vehicle Credit 2019

Web general instructions purpose of form use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle..

Download Instructions for IRS Form 8910 Alternative Motor Vehicle

A completed and signed application for missouri military personalized license plates (form 4601) pdf. The vehicle is transporting hazardous materials and is required to be placarded. Be sure to read the form. Web use this form to claim the credit for certain alternative motor vehicles. Web in general, to qualify for the ev tax credit, the ev vehicle:

Web General Instructions Purpose Of Form Use Form 8910 To Figure Your Credit For Alternative Motor Vehicles You Placed In Service During Your Tax Year.

The credit attributable to depreciable property (vehicles. Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. If you qualify based on your age (referenced on page 1: The alternative motor vehicle credit expired for vehicles purchased after 2021.

The Alternative Motor Vehicle Credit Was Enacted By The Energy Policy Act Of 2005.

Web qualified fuel cell vehicle. A completed and signed application for missouri military personalized license plates (form 4601) pdf. Alternative motor vehicle an alternative motor vehicle is a vehicle with at. Web what vehicles qualify for the alternative motor vehicle credit (form 8910)?

This Is A New Vehicle Propelled By Power Derived From One Or More Cells That Convert Chemical Energy Directly Into Electricity By Combining Oxygen With.

Web the vehicle is designed to transport 16 or more passengers, including the driver; It added income limits, price caps and. This is a new vehicle that draws propulsion energy from onboard sources of stored energy that are both an internal combustion or heat engine using. Part i tentative credit next:

Web Don’t Use Form 8910 To Claim A Credit For Vehicles Purchased After 2020 Unless The Credit Is Extended.

Web use form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year. The credit attributable to depreciable property (vehicles used for. Entering a vehicle credit for. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle.