Form 8915-F

Form 8915-F - (january 2022) qualified disaster retirement plan distributions and repayments. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. It lets you spread the taxable portion of the distribution over. 2021 covid distribution reporting update. Department of the treasury internal. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. The qualified 2020 disaster distributions for qualified.

It lets you spread the taxable portion of the distribution over. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Department of the treasury internal. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. The qualified 2020 disaster distributions for qualified. 2021 covid distribution reporting update.

Department of the treasury internal. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. 2021 covid distribution reporting update. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. You can choose to use worksheet 1b even if you are not required to do so. (january 2022) qualified disaster retirement plan distributions and repayments. The qualified 2020 disaster distributions for qualified. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. It lets you spread the taxable portion of the distribution over. See worksheet 1b, later, to determine whether you must use worksheet 1b.

About Form 8915F, Qualified Disaster Retirement Plan Distributions and

Department of the treasury internal. (january 2022) qualified disaster retirement plan distributions and repayments. 2021 covid distribution reporting update. See worksheet 1b, later, to determine whether you must use worksheet 1b. The qualified 2020 disaster distributions for qualified.

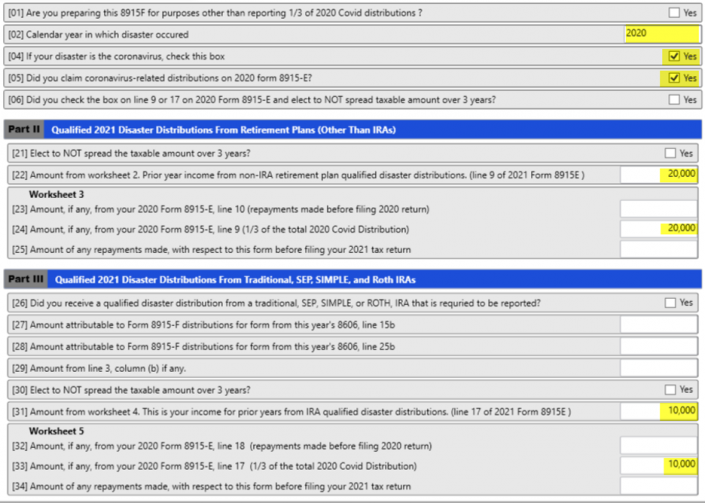

Basic 8915F Instructions for 2021 Taxware Systems

(january 2022) qualified disaster retirement plan distributions and repayments. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. It lets you spread the taxable portion of the distribution over. See worksheet 1b, later, to determine whether you must.

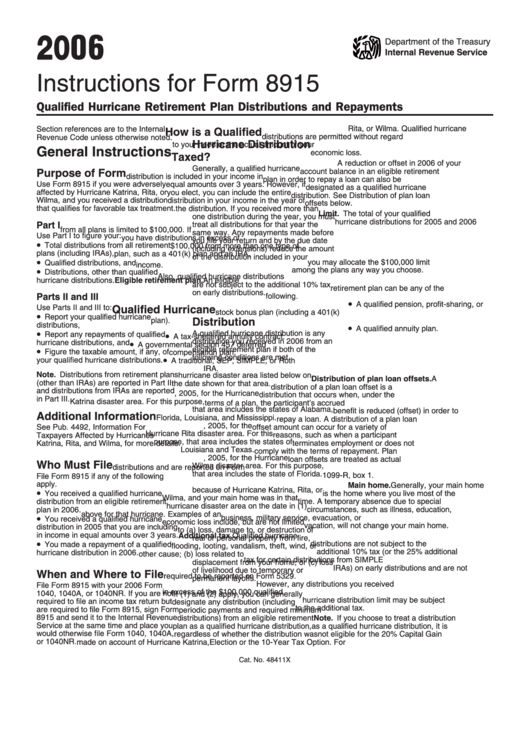

Instructions For Form 8915 2006 printable pdf download

You can choose to use worksheet 1b even if you are not required to do so. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. Department of the treasury internal. Web qualified disaster retirement plan distributions and repayments,.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Department of the treasury internal. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. It lets you spread the taxable portion of the distribution over. The qualified 2020 disaster distributions for qualified.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

The qualified 2020 disaster distributions for qualified. It lets you spread the taxable portion of the distribution over. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. 2021 covid distribution reporting update. See worksheet 1b, later, to determine whether you must use worksheet 1b.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

2021 covid distribution reporting update. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. You can choose to use worksheet 1b even if you are not required to do so. Department of the treasury internal. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs.

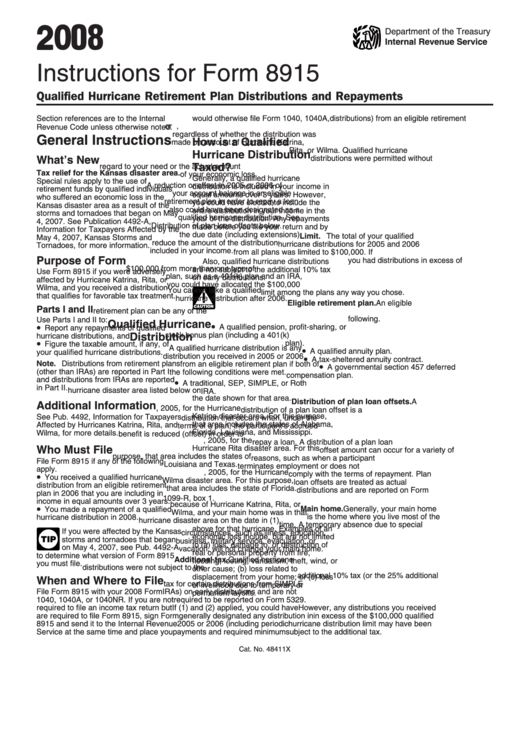

Instructions For Form 8915 2008 printable pdf download

(january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. See worksheet 1b, later, to determine whether you must use worksheet 1b. The qualified 2020 disaster distributions for qualified. Department of the treasury internal.

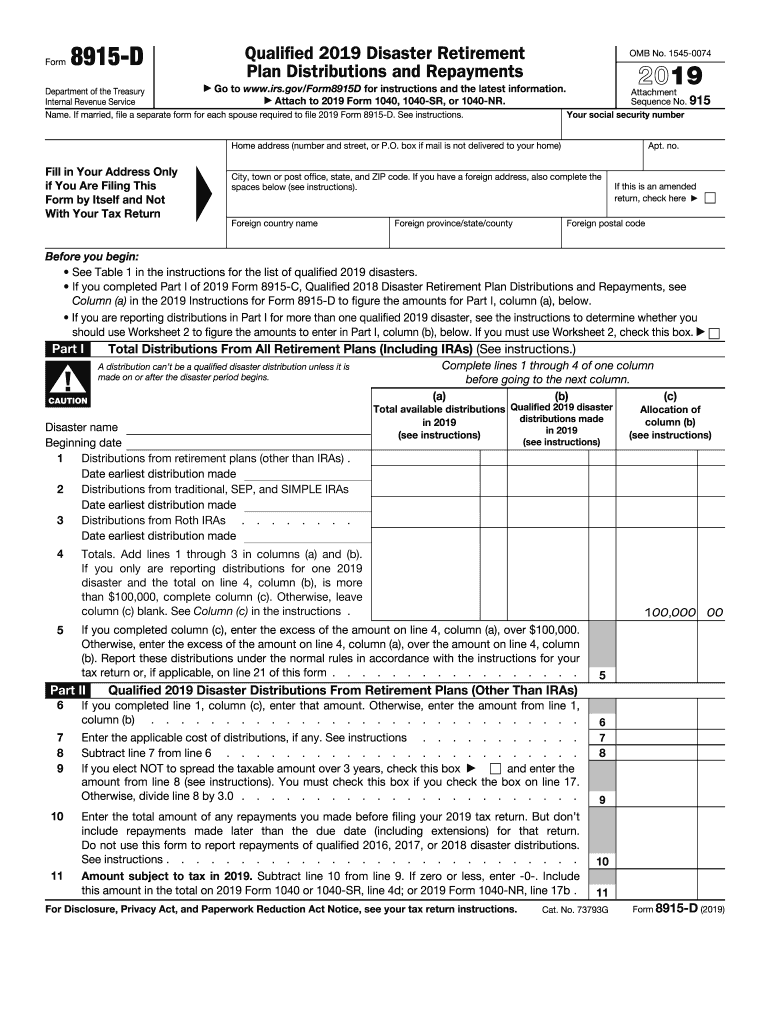

8915 D Form Fill Out and Sign Printable PDF Template signNow

The qualified 2020 disaster distributions for qualified. Department of the treasury internal. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. See worksheet 1b, later, to determine whether you must use worksheet 1b. (january 2022) qualified disaster retirement plan distributions and repayments.

Where can I find the 8915 F form on the TurboTax app?

Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Department of the treasury internal. The qualified 2020 disaster distributions for qualified. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

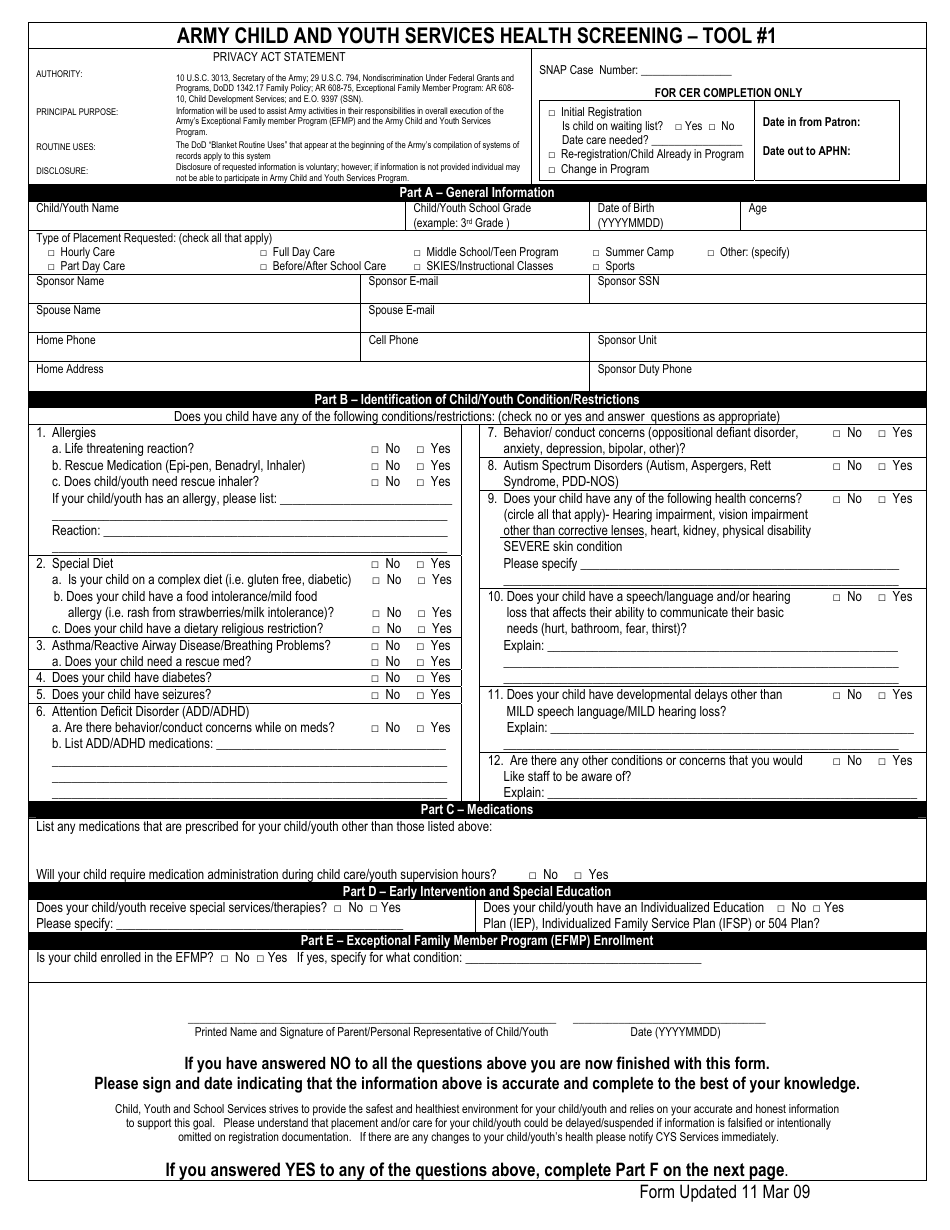

Army Child and Youth Services Health Screening Tool 1 Download

The qualified 2020 disaster distributions for qualified. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. (january 2022) qualified disaster retirement plan distributions and repayments.

Web Qualified Disaster Retirement Plan Distributions And Repayments, Forms 8915, Are Available In Drake Tax.

You can choose to use worksheet 1b even if you are not required to do so. Web irs form 8915 reports distributions from retirement plans due to qualified disasters and repayments. Department of the treasury internal. See worksheet 1b, later, to determine whether you must use worksheet 1b.

It Lets You Spread The Taxable Portion Of The Distribution Over.

Form 9000 this form allows taxpayers to indicate that they’d like to communicate with the irs. (january 2022) qualified disaster retirement plan distributions and repayments. The qualified 2020 disaster distributions for qualified. 2021 covid distribution reporting update.