Form 8974 Pdf

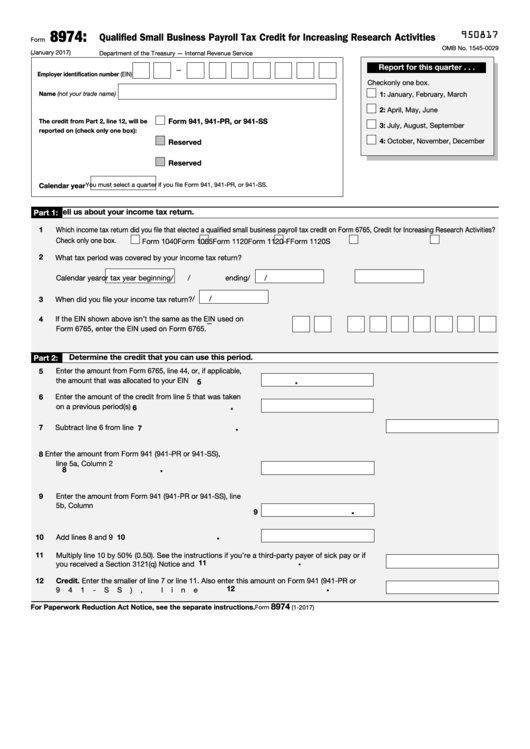

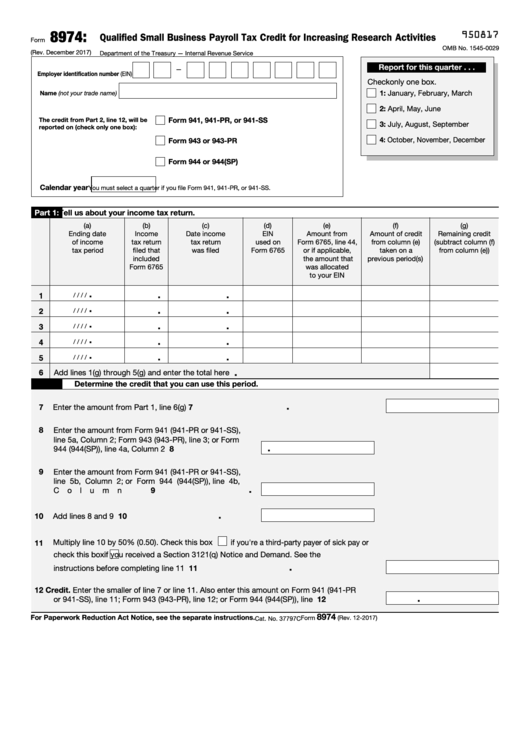

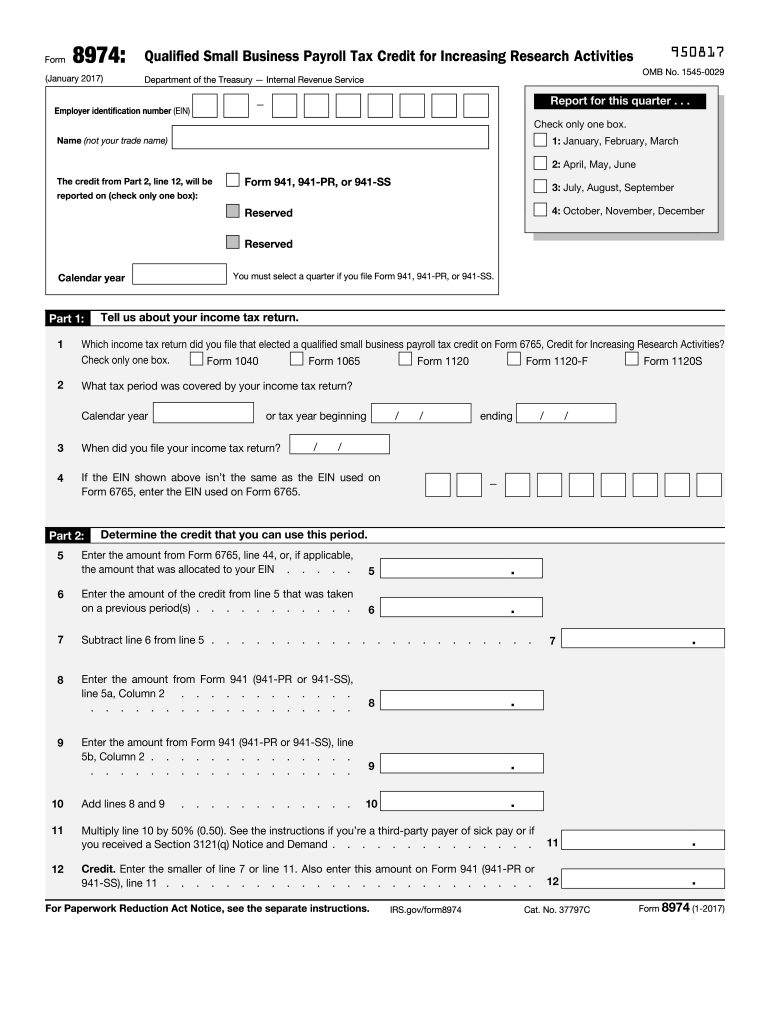

Form 8974 Pdf - Web what is form 8974? Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years. Complete, edit or print tax forms instantly. If you are required to complete this form. Web form 8974 is used to determine the amount of qualified small business r&d payroll tax credits generated, used, and remaining for increased research and. Ad complete irs tax forms online or print government tax documents. Web form 8974, part 1, redesigned. Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link. Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. A qualified small business claiming a portion of the research credit as a payroll tax credit.

Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. Web what is form 8974? Sign it in a few clicks. Get the form 5674 you need. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Type text, add images, blackout confidential details, add comments, highlights and more. Ad complete irs tax forms online or print government tax documents. Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds, other securities, or commodities. Ad complete irs tax forms online or print government tax documents. Edit about form 8974, qualified.

Web form 8974, part 1, redesigned. Ad complete irs tax forms online or print government tax documents. Edit about form 8974, qualified. A qualified small business claiming a portion of the research credit as a payroll tax credit. Save or instantly send your ready documents. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Web a new form has been created for the city of chicago to use in order to process requests. Web form 8974 is a document that most business owners utilize to determine the qualified small business r&d payroll tax credit amount produced, the amount used. Web employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their. Draw your signature, type it,.

Financial Concept about Form 8974 Qualified Small Business Payroll Tax

Web form 8974 is a document that most business owners utilize to determine the qualified small business r&d payroll tax credit amount produced, the amount used. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up.

Form 8974 Payroll Tax Credit

December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Part 1 also tracks the amount of credit. Get the form 5674 you need. Complete, edit or print tax forms instantly. Web form 8974, part 1, redesigned.

Fill Free fillable IRS PDF forms

Web form 8974 is used to determine the amount of qualified small business r&d payroll tax credits generated, used, and remaining for increased research and. Type text, add images, blackout confidential details, add comments, highlights and more. Web the 8974 form is a tax reporting document that is used to report any transactions involving stocks, bonds, other securities, or commodities..

Form 8974 (Qualified Small Business Payroll Tax Credit for Increasing

You must attach this form to your payroll tax return, for example, your form 941, employer's quarterly. Save or instantly send your ready documents. Web form 8974, part 1, redesigned. Ad complete irs tax forms online or print government tax documents. Web a new form has been created for the city of chicago to use in order to process requests.

Form 8974 Complete Guide & FAQs TaxRobot

Web a new form has been created for the city of chicago to use in order to process requests. Type text, add images, blackout confidential details, add comments, highlights and more. You must attach this form to your payroll tax return, for example, your form 941, employer's quarterly. If you are required to complete this form. Web use form 8974.

Fill Free fillable F8974 Form 8974 (Rev. December 2017) PDF form

Ad complete irs tax forms online or print government tax documents. A qualified small business claiming a portion of the research credit as a payroll tax credit. Get the form 5674 you need. Web a new form has been created for the city of chicago to use in order to process requests. Web form 8974, part 1, redesigned.

Internal Revenue Bulletin 202213 Internal Revenue Service

You must attach this form to your payroll tax return, for example, your form 941, employer's quarterly. Web employers use this form to determine the amount of qualified small business payroll tax credit for increasing research activities they can claim on their. Easily fill out pdf blank, edit, and sign them. If you are required to complete this form. Type.

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

A qualified small business claiming a portion of the research credit as a payroll tax credit. Edit about form 8974, qualified. Part 1 also tracks the amount of credit. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Web the 8974 form is a tax reporting document that is.

Fillable Form 8974 Qualified Small Business Payroll Tax Credit For

Get the form 5674 you need. Type text, add images, blackout confidential details, add comments, highlights and more. Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years. Draw your signature, type it,. Complete, edit or print tax forms instantly.

Form 8974 (January 2017). Quarterly Small Business Payroll Tax Credit

Complete, edit or print tax forms instantly. A qualified small business claiming a portion of the research credit as a payroll tax credit. Web you must file form 8974 and attach it to form 941, 943, or 944 if you made an election on your income tax return to claim the qualified small business payroll tax credit for. Type text,.

Ad Complete Irs Tax Forms Online Or Print Government Tax Documents.

If you are required to complete this form. Easily fill out pdf blank, edit, and sign them. Draw your signature, type it,. Drag and drop the file from your device or add it from other services, like google drive, onedrive, dropbox, or an external link.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

A qualified small business claiming a portion of the research credit as a payroll tax credit. December 2017) qualified small business payroll tax credit for increasing research activities department of the treasury — internal revenue service. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents.

Part 1 Also Tracks The Amount Of Credit.

Web use form 8974 to determine the amount of the qualified small business payroll tax credit for increasing research activities that you can claim on form 941, employer’s quarterly. Part 1 of form 8974 has been redesigned to allow reporting of income tax return information for up to 5 years. Save or instantly send your ready documents. Claim the payroll tax credit by completing form 8974 pdf.

You Must Attach This Form To Your Payroll Tax Return, For Example, Your Form 941, Employer's Quarterly.

The form is called the 8974 form and it will be used by all departments that receive. Get the form 5674 you need. Edit about form 8974, qualified. Web what is form 8974?