Form 8975 Instructions

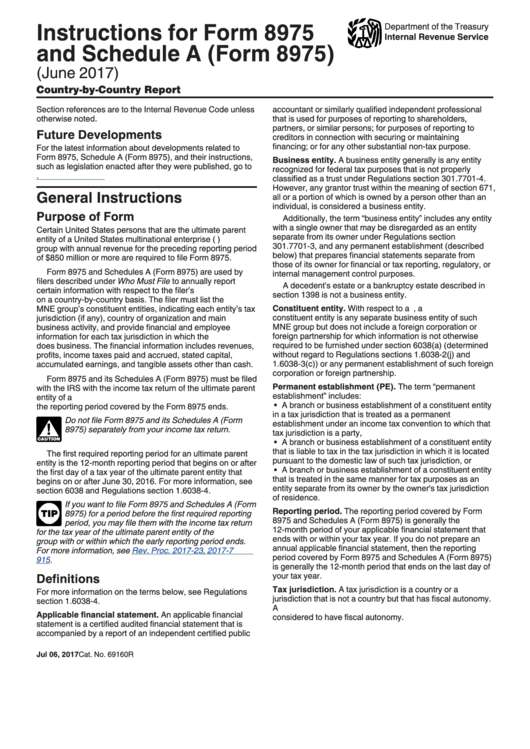

Form 8975 Instructions - For reporting period beginning, 20, and ending, 20 omb no. December 2020) tax jurisdiction and constituent entity information department of the treasury internal revenue service a separate schedule a (form 8975) is to be completed for each tax jurisdiction of the multinational enterprise group. Enter the number of schedules a (form 8975) attached to this form 8975. Schedule a (form 8975) tax jurisdiction and constituent entity information pdf. Name of the reporting entity. Web form 8975 and its schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. Web form 8975 to clarify that income of certain partnerships that is reported on the stateless line of the cbc report is taxed at the partner level. Part i identification of filer. Web when can i file form 8975? How many schedules a (form 8975 should a u.s mne file?

Go to www.irs.gov/form8975 for instructions and the latest information. Web form 8975 and schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. Enter the number of schedules a (form 8975) attached to this form 8975. Schedule a (form 8975) tax jurisdiction and constituent entity information pdf. Web when can i file form 8975? Mne group for the tax year in or within which the reporting period covered by the form 8975 ends. Web form 8975 to clarify that income of certain partnerships that is reported on the stateless line of the cbc report is taxed at the partner level. Web the final regulations in regs. For reporting period beginning, 20, and ending, 20 omb no. Persons that are the ultimate parent entity of a u.s.

Web form 8975 and its schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. Name of the reporting entity. For reporting period beginning, 20, and ending, 20 omb no. Do not file form 8975 and its schedules a (form ! Web information about form 8975, country by country report, including recent updates, related forms and instructions on how to file. Web when can i file form 8975? Multinational enterprise (mne) group with annual revenue for the preceding reporting period of. How many schedules a (form 8975 should a u.s mne file? December 2020) tax jurisdiction and constituent entity information department of the treasury internal revenue service a separate schedule a (form 8975) is to be completed for each tax jurisdiction of the multinational enterprise group. Web the final regulations in regs.

Fill Free fillable CountrybyCountry Report 2017 Form8975 PDF form

Do not file form 8975 and its schedules a (form ! Web for instructions and the latest information. Web the final regulations in regs. How many schedules a (form 8975 should a u.s mne file? Web information about form 8975, country by country report, including recent updates, related forms and instructions on how to file.

Tax form 1120 instructions

Enter the number of schedules a (form 8975) attached to this form 8975. For reporting period beginning, 20, and ending, 20 omb no. Web form 8975 and schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. Web the final regulations in regs. 8975) separately from your.

Download Instructions for IRS Form 8975 Schedule A PDF Templateroller

Go to www.irs.gov/form8975 for instructions and the latest information. Web for instructions and the latest information. Web when can i file form 8975? Web form 8975 and schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. Multinational enterprise (mne) group with annual revenue for the preceding.

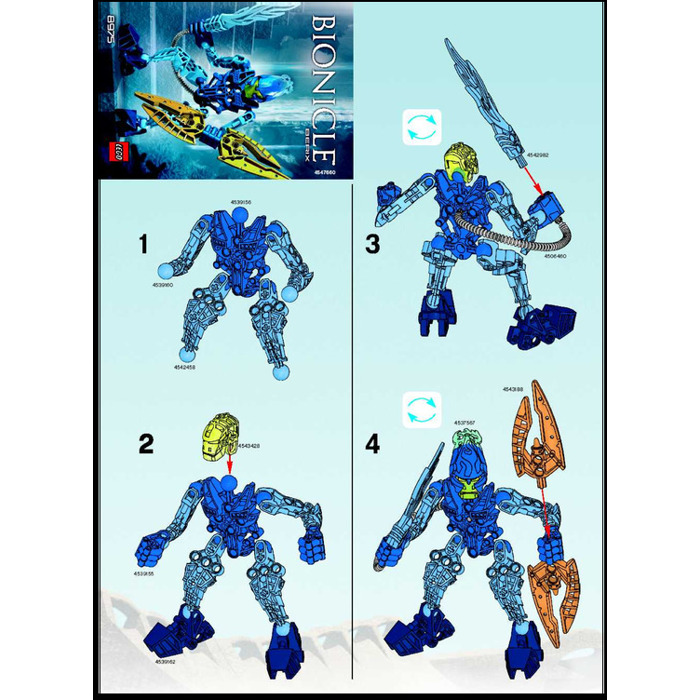

LEGO 8975 Berix Set Parts Inventory and Instructions LEGO Reference Guide

Schedule a (form 8975) tax jurisdiction and constituent entity information pdf. Do not file form 8975 and its schedules a (form ! Mne group filed form 8975 and schedule a (form 8975), is it required to mail a copy of page 1 of form 8975 to the mailbox in ogden? 8975) separately from your income tax return. Name of the.

Instructions For Form 8975 And Schedule A (Form 8975) CountryBy

Multinational enterprise (mne) group with annual revenue for the preceding reporting period of. Mne group filed form 8975 and schedule a (form 8975), is it required to mail a copy of page 1 of form 8975 to the mailbox in ogden? Name of the reporting entity. Do not file form 8975 and its schedules a (form ! Web for instructions.

IRS Form 8975 Schedule A Download Fillable PDF or Fill Online Tax

Mne group filed form 8975 and schedule a (form 8975), is it required to mail a copy of page 1 of form 8975 to the mailbox in ogden? Part i identification of filer. Multinational enterprise (mne) group with annual revenue for the preceding reporting period of. How many schedules a (form 8975 should a u.s mne file? Web form 8975.

8975 Berix Brickset LEGO set guide and database

Part i identification of filer. Do not file form 8975 and its schedules a (form ! December 2020) tax jurisdiction and constituent entity information department of the treasury internal revenue service a separate schedule a (form 8975) is to be completed for each tax jurisdiction of the multinational enterprise group. Schedule a (form 8975) tax jurisdiction and constituent entity information.

LEGO Berix 8975 Instructions Brick Owl LEGO Marché

For reporting period beginning, 20, and ending, 20 omb no. Mne group for the tax year in or within which the reporting period covered by the form 8975 ends. Multinational enterprise (mne) group with annual revenue for the preceding reporting period of. Do not file form 8975 and its schedules a (form ! Go to www.irs.gov/form8975 for instructions and the.

31072 Receiving Extracting And Sorting Internal —

Web for instructions and the latest information. Web form 8975 and its schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s. If this is an amended report, check here. Name of the reporting entity. Mne group for the tax year in or within which the reporting.

MSD 8676 Timing Retard Controls at

Go to www.irs.gov/form8975 for instructions and the latest information. Web for instructions and the latest information. Mne group for the tax year in or within which the reporting period covered by the form 8975 ends. December 2020) tax jurisdiction and constituent entity information department of the treasury internal revenue service a separate schedule a (form 8975) is to be completed.

Web Information About Form 8975, Country By Country Report, Including Recent Updates, Related Forms And Instructions On How To File.

Mne group for the tax year in or within which the reporting period covered by the form 8975 ends. Mne group filed form 8975 and schedule a (form 8975), is it required to mail a copy of page 1 of form 8975 to the mailbox in ogden? Schedule a (form 8975) tax jurisdiction and constituent entity information pdf. Web when can i file form 8975?

For Reporting Period Beginning, 20, And Ending, 20 Omb No.

Enter the number of schedules a (form 8975) attached to this form 8975. Web for instructions and the latest information. December 2020) tax jurisdiction and constituent entity information department of the treasury internal revenue service a separate schedule a (form 8975) is to be completed for each tax jurisdiction of the multinational enterprise group. 8975) separately from your income tax return.

Multinational Enterprise (Mne) Group With Annual Revenue For The Preceding Reporting Period Of.

If this is an amended report, check here. Do not file form 8975 and its schedules a (form ! Go to www.irs.gov/form8975 for instructions and the latest information. Web form 8975 and schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s.

Persons That Are The Ultimate Parent Entity Of A U.s.

Mne group for the tax year in or within which the reporting period covered by the form 8975 ends. Name of the reporting entity. Web the final regulations in regs. Web form 8975 and its schedules a (form 8975) must be filed with the irs with the income tax return of the ultimate parent entity of a u.s.