Form 8990 Example

Form 8990 Example - Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web calculating adjusted taxable income perform the following steps to force the application to calculate taxable income, as well as other amounts for form 8990. Web irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate the amount of interest. Web index support section 163 (j) and form 8990 (1065) overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business. Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Many of my larger individual clients who invest in. Web if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web form 8990 for individuals. 163 (j) had rules in place intended to prevent multinational entities from using interest. If the partnership reports excess business interest expense to the partner, the partner is required to file form 8990.

163 (j) had rules in place intended to prevent multinational entities from using interest. Solved•by intuit•27•updated february 07, 2023. Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Name of foreign entity employer identification number, if any. Form 8990 calculates the business interest expense deduction and carryover. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. Web per the irs, form 8990 is used to calculate the amount of business interest expense that can be deducted and the amount to carry forward to the next year. Web form 8990 for individuals. Web first, some background may be helpful. Web this article provides information about how to file form 8990 in ultratax cs/1040.

Prior to the passage of the tcja, sec. Web go to omb no. Web for example, to limit the interest expense reported on form 1065, line 15: Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: However, if the section 163 (j) limitation applies, the amount of deductible business. Name of foreign entity employer identification number, if any reference id. Solved•by intuit•27•updated february 07, 2023. Web form 8990 for individuals. Name of foreign entity employer identification number, if any.

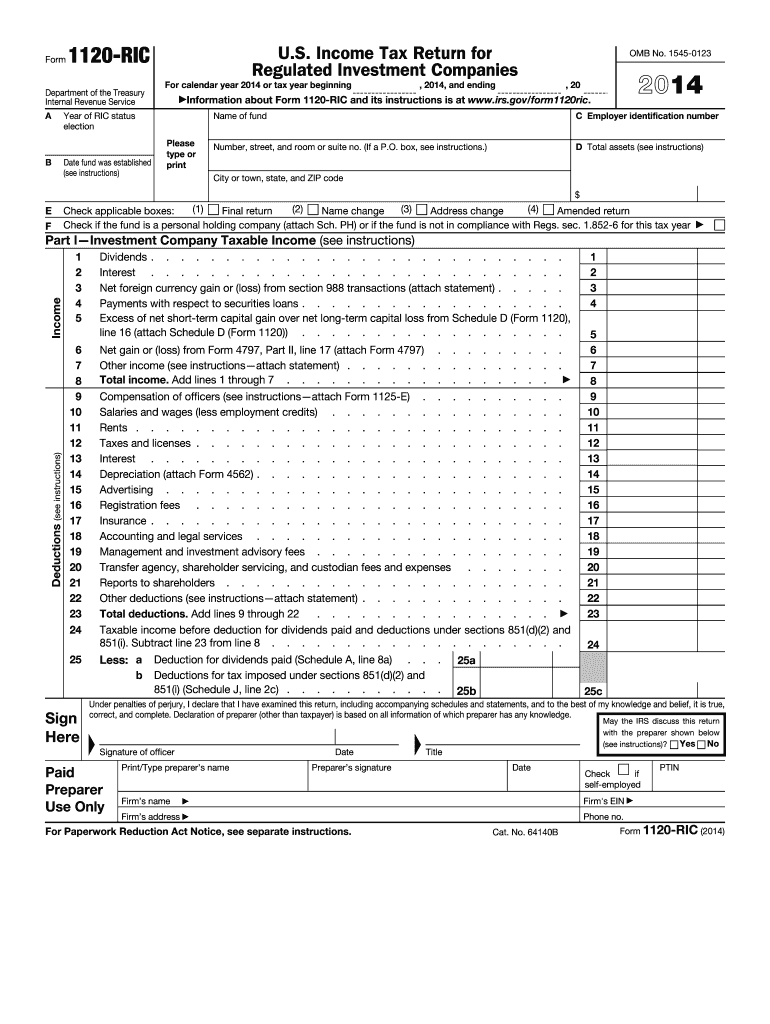

2014 Form IRS 1120RIC Fill Online, Printable, Fillable, Blank pdfFiller

Web calculating adjusted taxable income perform the following steps to force the application to calculate taxable income, as well as other amounts for form 8990. Name of foreign entity employer identification number, if any. Form 8990 calculates the business interest expense deduction and carryover. However, if the section 163 (j) limitation applies, the amount of deductible business. Generally, taxpayers can.

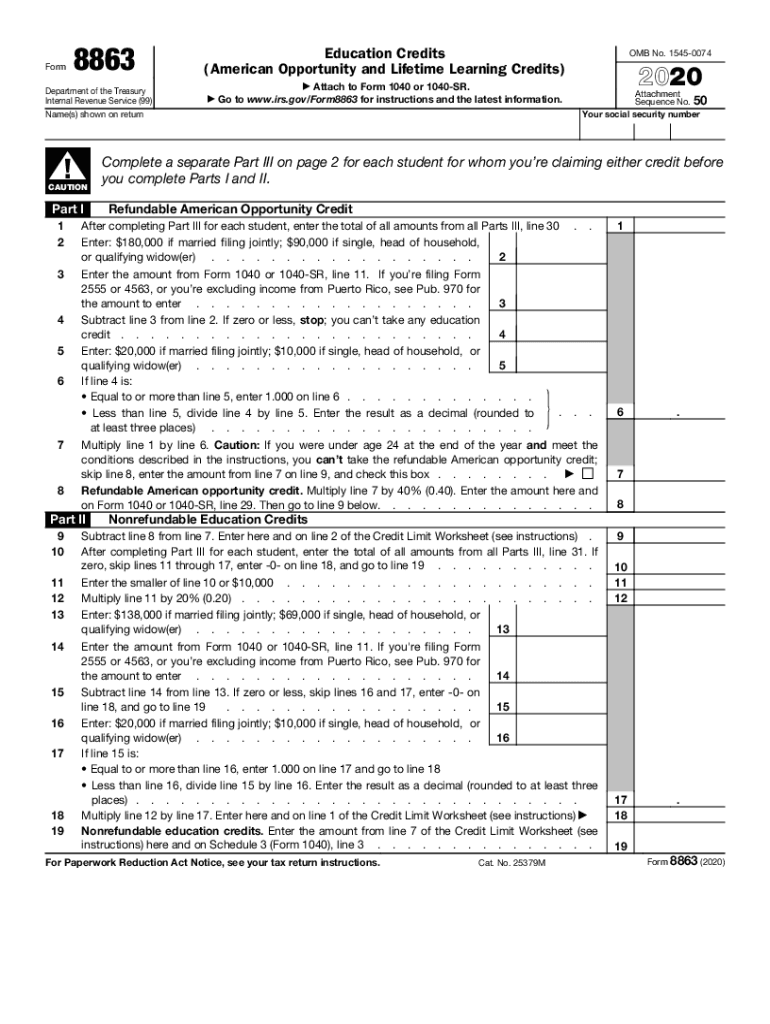

Form 8863 Fill out & sign online DocHub

Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Web for example, to limit the interest expense reported on form 1065, line 15: Solved•by intuit•27•updated february 07, 2023. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. Web per the irs, form 8990.

form 8990 example Fill Online, Printable, Fillable Blank

Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. Web per the irs, form 8990 is used to calculate the amount of business interest expense that can be deducted and the amount to carry forward to the next year. Web.

Fill Free fillable form 8990 limitation on business interest expense

Web form 8990 for individuals. Name of foreign entity employer identification number, if any. Name of foreign entity employer identification number, if any reference id. Web index support section 163 (j) and form 8990 (1065) overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business. Generally, taxpayers can deduct interest expense paid or accrued in the.

1040NJ Data entry guidelines for a New Jersey partnership K1

Name of foreign entity employer identification number, if any reference id. If the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Taxpayer name(s) shown on tax return identification number if form 8990..

Instructions for Form 8990 (12/2021) Internal Revenue Service

Prior to the passage of the tcja, sec. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Web a if form 8990 relates to an information return for a foreign entity (for example, form.

What Is Sale/gross Receipts Of Business In Itr 5 Tabitha Corral's

163 (j) had rules in place intended to prevent multinational entities from using interest. Taxpayer name(s) shown on tax return identification number if form 8990. Solved•by intuit•27•updated february 07, 2023. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. Web calculating adjusted taxable income perform the following.

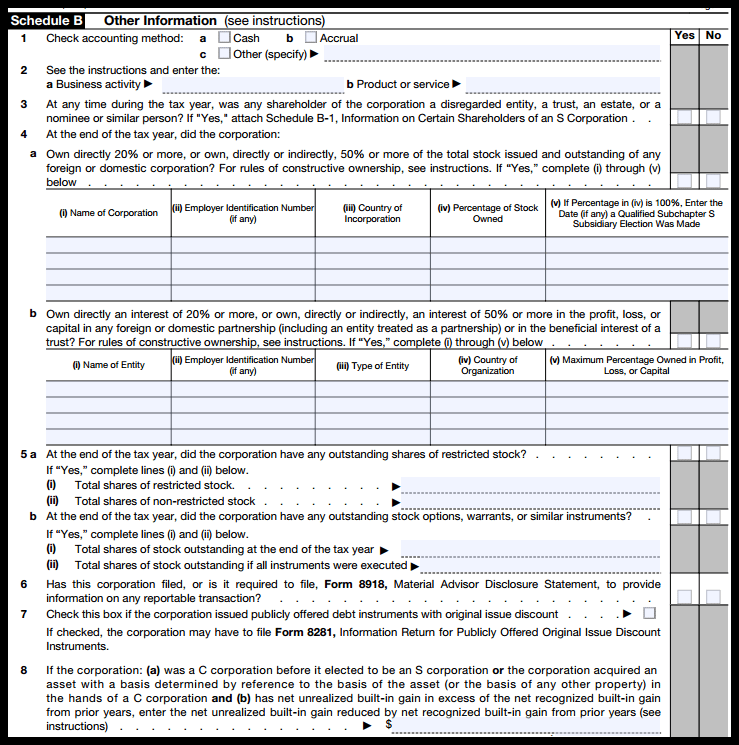

IRS Form 1120S Definition, Download, & 1120S Instructions

Web this article provides information about how to file form 8990 in ultratax cs/1040. Name of foreign entity employer identification number, if any reference id. Taxpayer name(s) shown on tax return identification number if form 8990. Web first, some background may be helpful. However, if the section 163 (j) limitation applies, the amount of deductible business.

Instructions for Form 8990 (12/2021) Internal Revenue Service

Web index support section 163 (j) and form 8990 (1065) overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business. Web irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate the amount of interest. Form 8990 calculates the business interest expense deduction and carryover. Web.

3.11.217 Form 1120S Corporation Tax Returns Internal Revenue

However, if the section 163 (j) limitation applies, the amount of deductible business. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web.

163 (J) Had Rules In Place Intended To Prevent Multinational Entities From Using Interest.

Prior to the passage of the tcja, sec. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. Web how to generate form 8990 in proconnect. Name of foreign entity employer identification number, if any.

Solved•By Intuit•27•Updated February 07, 2023.

Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Many of my larger individual clients who invest in. Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section. However, if the section 163 (j) limitation applies, the amount of deductible business.

Web Per The Irs, Form 8990 Is Used To Calculate The Amount Of Business Interest Expense That Can Be Deducted And The Amount To Carry Forward To The Next Year.

This article will help you enter information for form 8990, limitation. Taxpayer name(s) shown on tax return identification number if form 8990. Web if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web index support section 163 (j) and form 8990 (1065) overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business.

Web First, Some Background May Be Helpful.

Web form 8990 for individuals. Web irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate the amount of interest. Generally, taxpayers can deduct interest expense paid or accrued in the taxable year. Web calculating adjusted taxable income perform the following steps to force the application to calculate taxable income, as well as other amounts for form 8990.