Form 8995 Or Form 8995-A

Form 8995 Or Form 8995-A - Voluntary disclosure program delaware recently sent another round of unclaimed property. Web insights july 20, 2023 delaware unclaimed property notices: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web published on october 26, 2022 last modified on july 25, 2023 category: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Include the following schedules (their specific instructions are shown later), as appropriate:. Irs forms table of contents what is qualified business income? The individual has qualified business income. Form 8995 is the simplified form and is used if all of the following are true:

Include the following schedules (their specific instructions are shown later), as appropriate:. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Form 8995 is the simplified form and is used if all of the following are true: Table of contents the qualified business. Web published on october 26, 2022 last modified on july 25, 2023 category: Go to www.irs.gov/form8995a for instructions and the latest. Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web insights july 20, 2023 delaware unclaimed property notices: Web according to the irs:

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 is the simplified form and is used if all of the following are true: Include the following schedules (their specific instructions are shown later), as appropriate:. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web insights july 20, 2023 delaware unclaimed property notices: Go to www.irs.gov/form8995a for instructions and the latest. Web according to the irs:

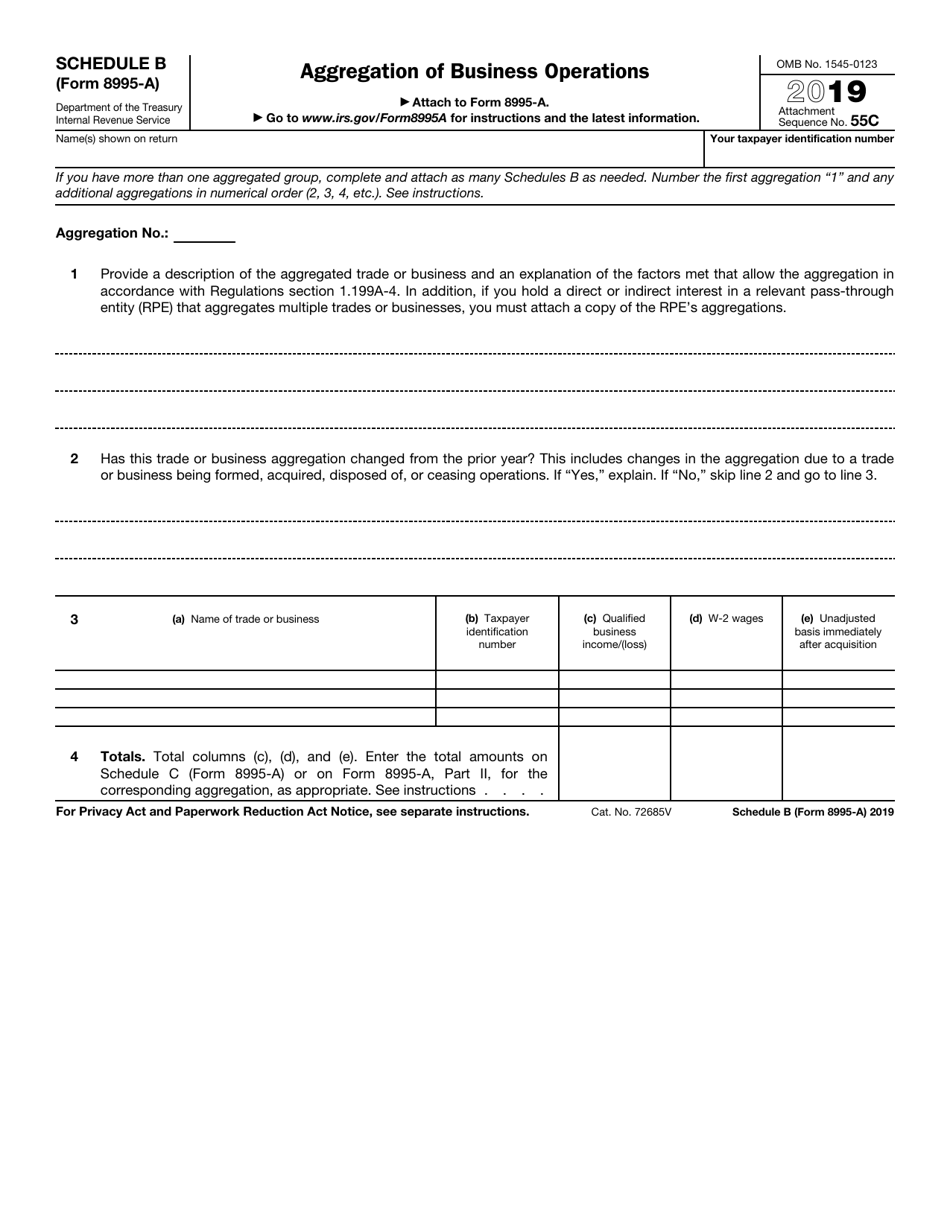

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web published on october 26, 2022 last modified on july 25, 2023 category: The individual has qualified business income. Voluntary disclosure program delaware recently sent another round of unclaimed property. Web according to the irs: Form 8995 is the simplified form and is used if all of the following are true:

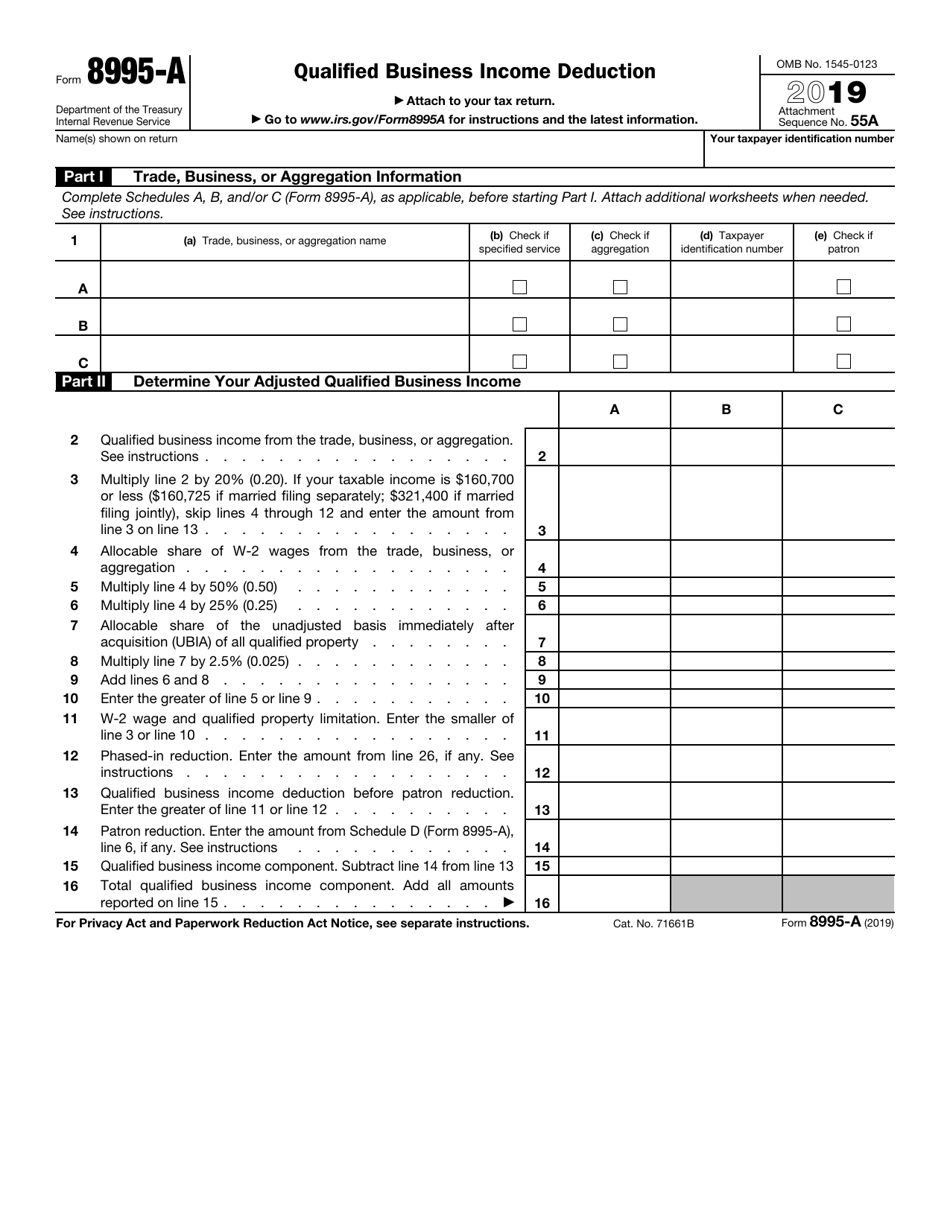

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Irs forms table of contents what is qualified business income? Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Web published on october 26, 2022 last modified on july 25, 2023 category: Form 8995 is the simplified form and is used if all of the following are true: Voluntary disclosure program delaware.

Other Version Form 8995A 8995 Form Product Blog

Include the following schedules (their specific instructions are shown later), as appropriate:. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Irs forms table of contents what is qualified business income? Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach.

8995 Form Updates Patch Notes fo 8995 Form Product Blog

Irs forms table of contents what is qualified business income? Table of contents the qualified business. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Go to www.irs.gov/form8995a for instructions and the latest. Include the following schedules (their specific instructions are shown later), as appropriate:.

What is Form 8995A? TurboTax Tax Tips & Videos

Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Table of contents the qualified business. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your.

Fill Free fillable Form 2020 8995A Qualified Business

Table of contents the qualified business. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Go to www.irs.gov/form8995a for instructions and the latest. Web according to the irs: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Web insights july 20, 2023 delaware unclaimed property notices: Web according to the irs: Form 8995 is the simplified form and is used if all of the following are true: Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Web form 8995 is a newly created tax form used to calculate the.

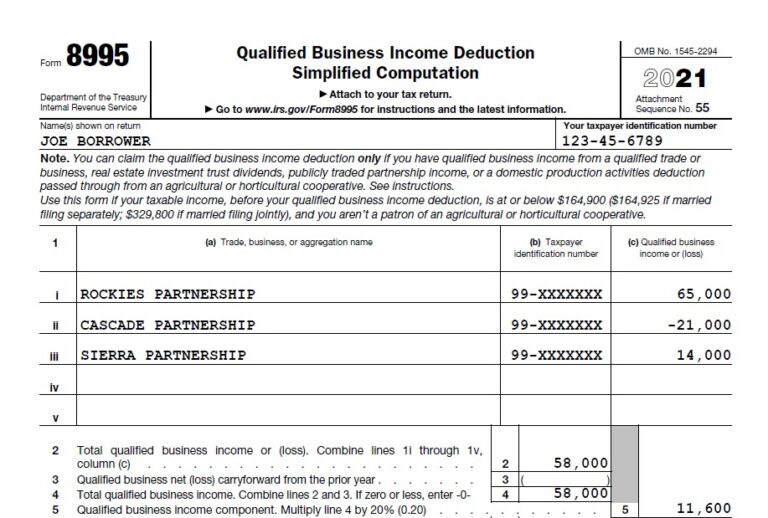

Using Form 8995 to Identify Your Borrower's K1s? Think Again! Bukers

Go to www.irs.gov/form8995a for instructions and the latest. Form 8995 is the simplified form and is used if all of the following are true: Web according to the irs: The individual has qualified business income. Include the following schedules (their specific instructions are shown later), as appropriate:.

Form 8995 Basics & Beyond

Include the following schedules (their specific instructions are shown later), as appropriate:. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Table of contents the qualified business. Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Irs forms table of.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Include the following schedules (their specific instructions are shown later), as appropriate:. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web published on october 26, 2022 last modified on july 25, 2023 category: Table of contents the qualified business. Form 8995 is the simplified form and is used if all.

Form 8995 Is The Simplified Form And Is Used If All Of The Following Are True:

Web department of the treasury internal revenue service qualified business income deduction attach to your tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Table of contents the qualified business. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995.

Voluntary Disclosure Program Delaware Recently Sent Another Round Of Unclaimed Property.

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Irs forms table of contents what is qualified business income? Web published on october 26, 2022 last modified on july 25, 2023 category: Go to www.irs.gov/form8995a for instructions and the latest.

The Individual Has Qualified Business Income.

Web insights july 20, 2023 delaware unclaimed property notices: Include the following schedules (their specific instructions are shown later), as appropriate:. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web according to the irs: