Form 941 Overpayment Refund

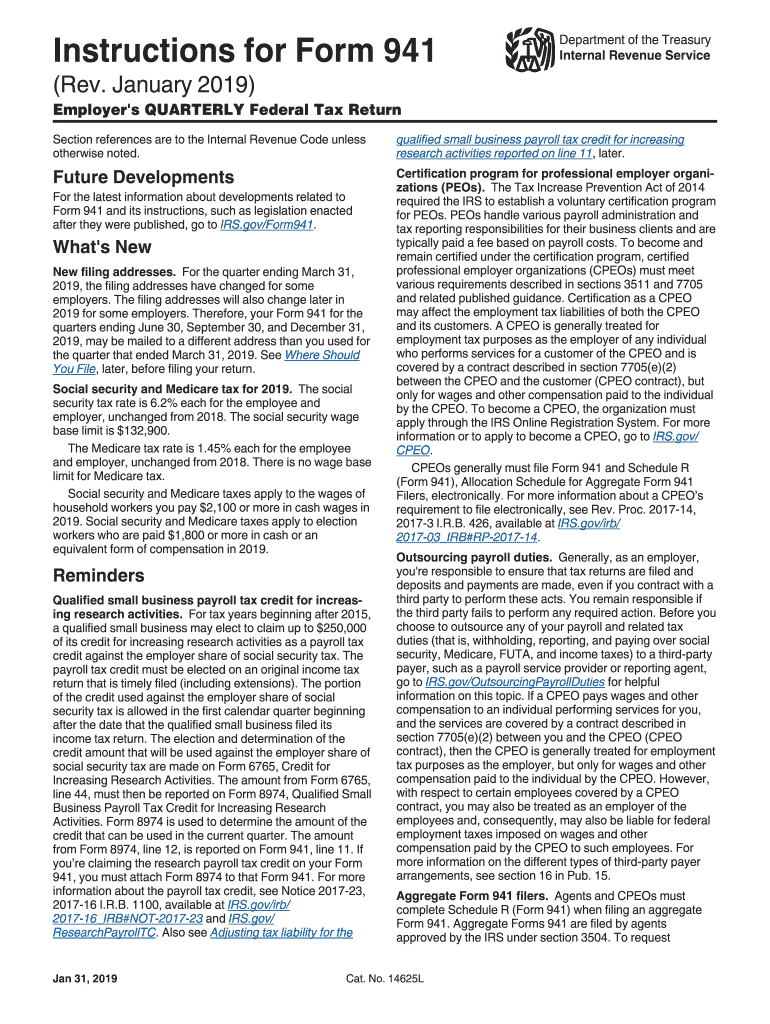

Form 941 Overpayment Refund - It then explains how to check form 941 refund status. Employers do not have to match the federal tax, but must on social security and medicare tax. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer. Pay the employer's portion of social security or medicare tax. A refund for anything should always be posted to same account where expense was originally posted. Stop and start dates for underpayment interest If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Web what to do if you overpay 941 taxes: Web about form 941, employer's quarterly federal tax return employers use form 941 to: Most likely was employer if refund check came to company.

We have qb payroll, so i don't know what is going on, since i pay per the qb. Pay the employer's portion of social security or medicare tax. Stop and start dates for underpayment interest Web laws and regulations when does the irs charge interest? A refund for anything should always be posted to same account where expense was originally posted. Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web what to do if you overpay 941 taxes: Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Most likely was employer if refund check came to company.

A refund for anything should always be posted to same account where expense was originally posted. It then explains how to check form 941 refund status. If you feel uncomfortable applying it to the july deposit required to be made by 8/15/17, you can call the irs and ask them to apply the overpayment to 3q2017 for you. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. We have qb payroll, so i don't know what is going on, since i pay per the qb. Most likely was employer if refund check came to company. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. Stop and start dates for underpayment interest Web what to do if you overpay 941 taxes:

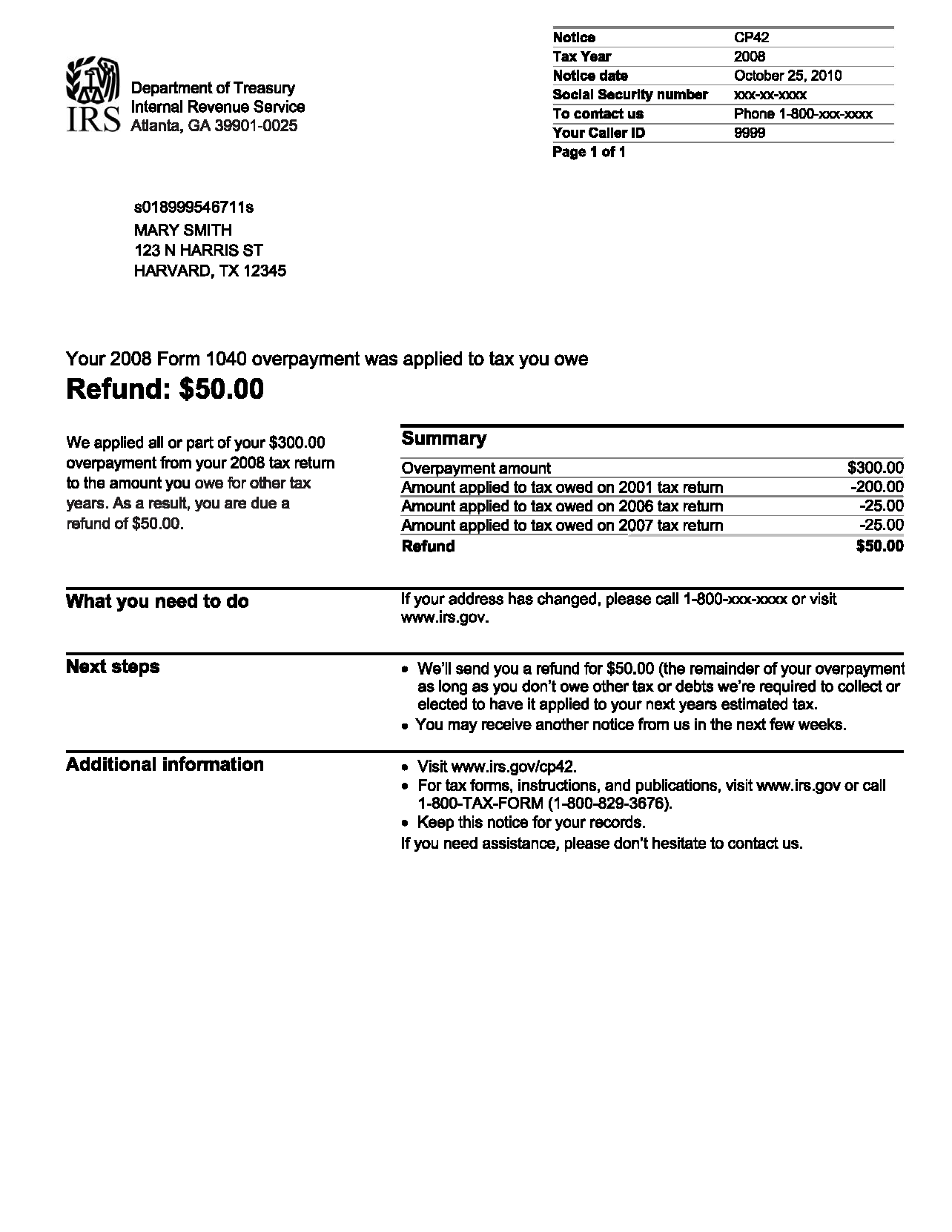

IRS Notice CP42 Form 1040 Overpayment H&R Block

We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Stop and start dates for underpayment interest Most likely was employer if refund check came to company. Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded.

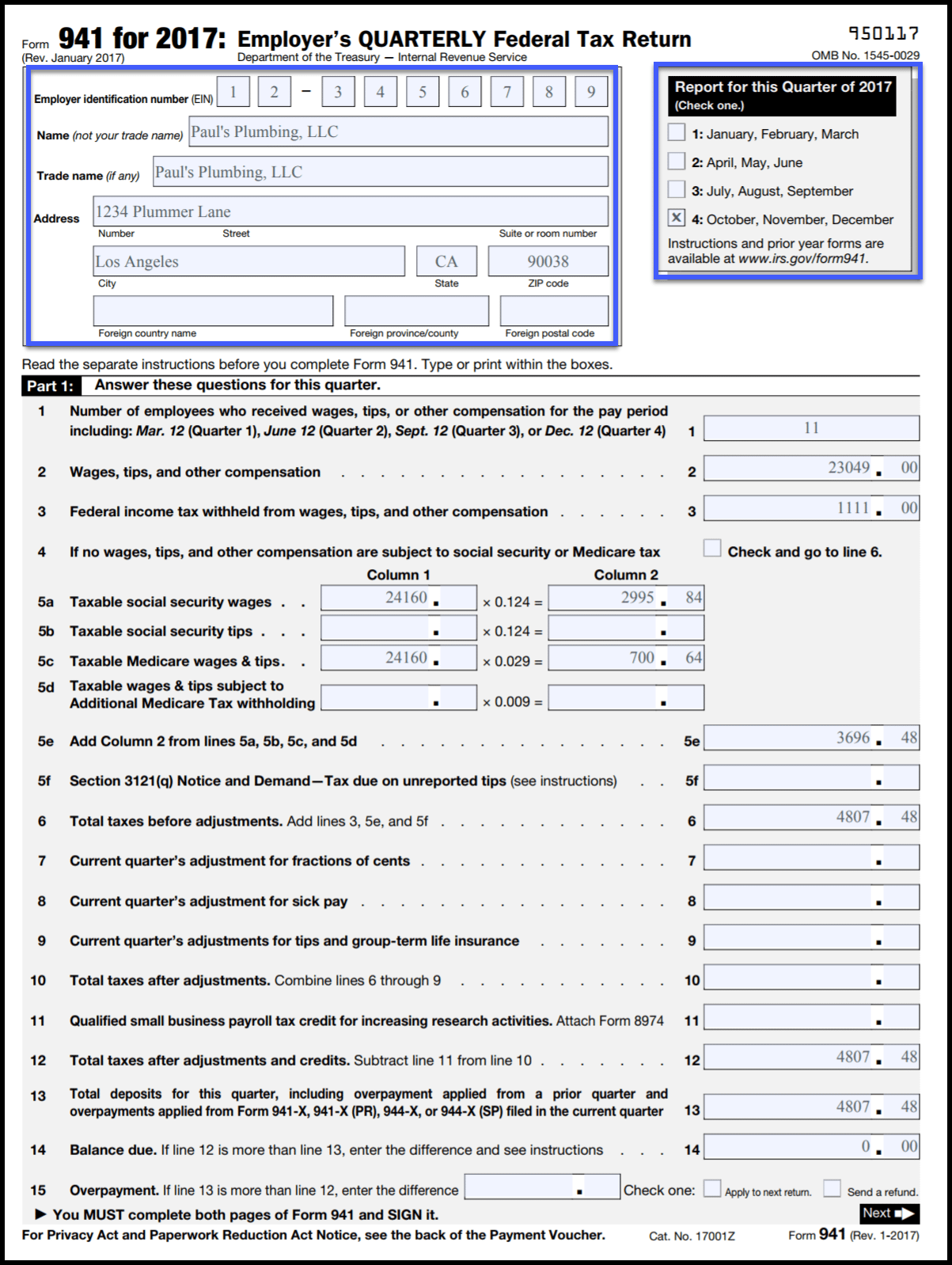

Solved Required Complete Form 941 for Prevosti Farms and

Pay the employer's portion of social security or medicare tax. We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Stop and start dates for underpayment interest Web what to do if you overpay 941 taxes: We have qb payroll, so i don't know what is going on, since i pay.

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

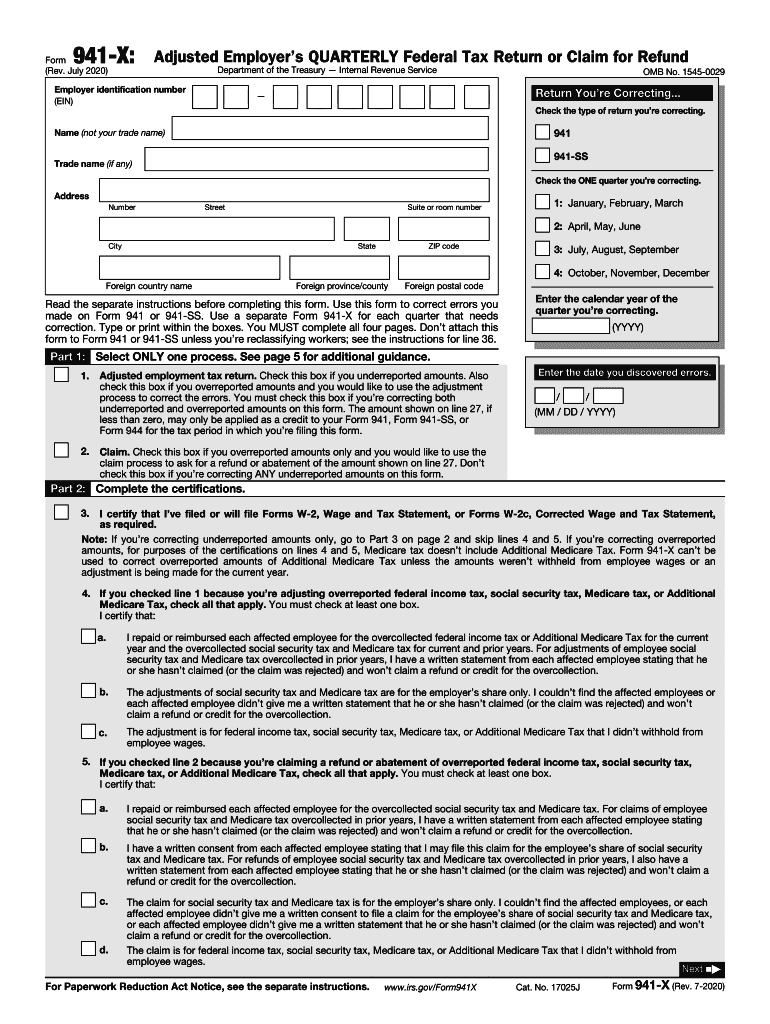

Web what to do if you overpay 941 taxes: It then explains how to check form 941 refund status. Pay the employer's portion of social security or medicare tax. Most likely was employer if refund check came to company. Web the claim process is used to request a refund or abatement of the overpayment.

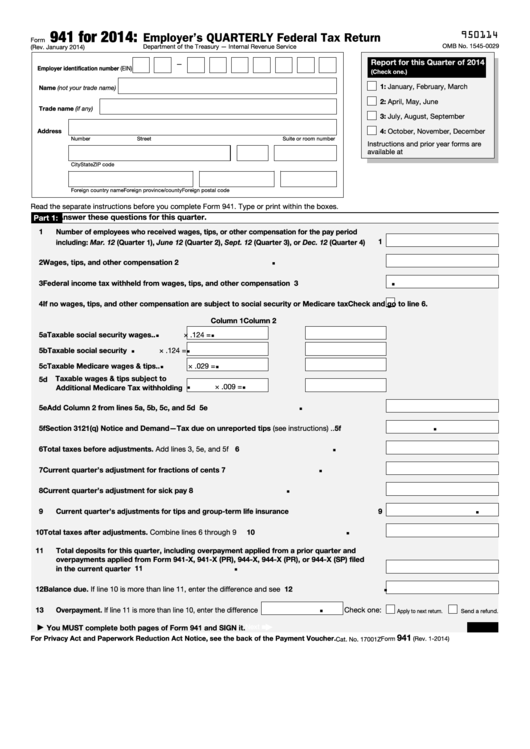

Fill Free fillable Form 941 Employer’s Federal Tax Return PDF form

A refund for anything should always be posted to same account where expense was originally posted. Web the claim process is used to request a refund or abatement of the overpayment. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or.

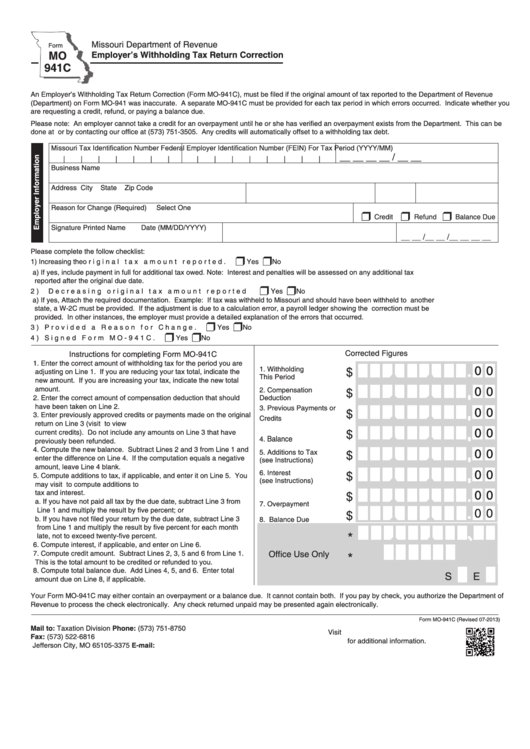

Fillable Form Mo 941c Employers Withholding Tax Return Correction

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. Employers do not have to match the federal.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Most likely was employer if refund check came to company. Web about form 941, employer's quarterly federal tax return employers use form 941 to: Web laws and regulations when does the irs charge interest? Web what to do if you overpay 941 taxes:

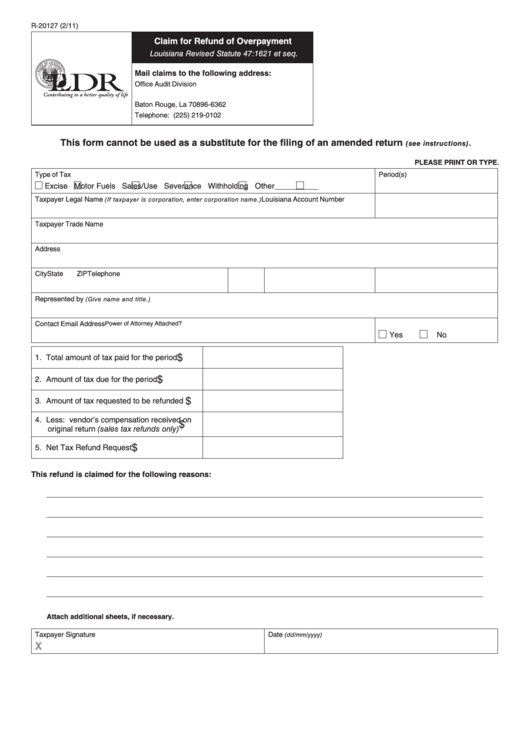

Fillable Form R20127 Claim For Refund Of Overpayment printable pdf

Current revision form 941 pdf instructions for form 941 ( print version pdf) recent developments Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Web the claim process is used to request a refund or abatement of the overpayment. Web.

Download 2013 Form 941 for Free Page 2 FormTemplate

Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee or employer. Most likely was employer if refund check came to company. A refund for anything should always be posted to same account where expense was originally posted. We have qb payroll,.

941 X Form Fill Out and Sign Printable PDF Template signNow

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web the claim process is used to request a refund or abatement of the overpayment. Pay the employer's portion of social security or medicare tax. We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest. Web about form.

2019 Form 941 Instructions Fill Out and Sign Printable PDF Template

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. Employers do not have to match the federal tax, but must on social security and medicare tax. Stop.

Web Irs Form 941 Is Used To Submit Payroll Taxes Paid By Employee And Employer, So First Need To Know Who Overpaid To Determine Who Gets Refund, Employee Or Employer.

Most likely was employer if refund check came to company. We have qb payroll, so i don't know what is going on, since i pay per the qb. Web laws and regulations when does the irs charge interest? Pay the employer's portion of social security or medicare tax.

If You Feel Uncomfortable Applying It To The July Deposit Required To Be Made By 8/15/17, You Can Call The Irs And Ask Them To Apply The Overpayment To 3Q2017 For You.

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web what to do if you overpay 941 taxes: Web the claim process is used to request a refund or abatement of the overpayment. Web about form 941, employer's quarterly federal tax return employers use form 941 to:

Stop And Start Dates For Underpayment Interest

It then explains how to check form 941 refund status. A refund for anything should always be posted to same account where expense was originally posted. Web if employer f does not request an advance payment of the credit, it may request that the $1,000 overpayment be credited or refunded when it files its second quarter form 941, employer's quarterly federal tax return. Employers do not have to match the federal tax, but must on social security and medicare tax.

Current Revision Form 941 Pdf Instructions For Form 941 ( Print Version Pdf) Recent Developments

Web generally you can take this as a payment on the next quarter (3q) as long as you don't have any previous underpayments that exist on your 941 account. We charge interest when a taxpayer has an unpaid liability comprised of tax, penalties, additions to tax, or interest.