Form 941 Refund Check

Form 941 Refund Check - You can check your payroll liability balance report. Web this is for information purposes only, and may not be current. Web check the status of your income tax refund for recent tax years. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Web adjusted employment tax return. Those returns are processed in. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee. It then explains how to check form 941 refund status. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web september 3, 2021 attention clients!

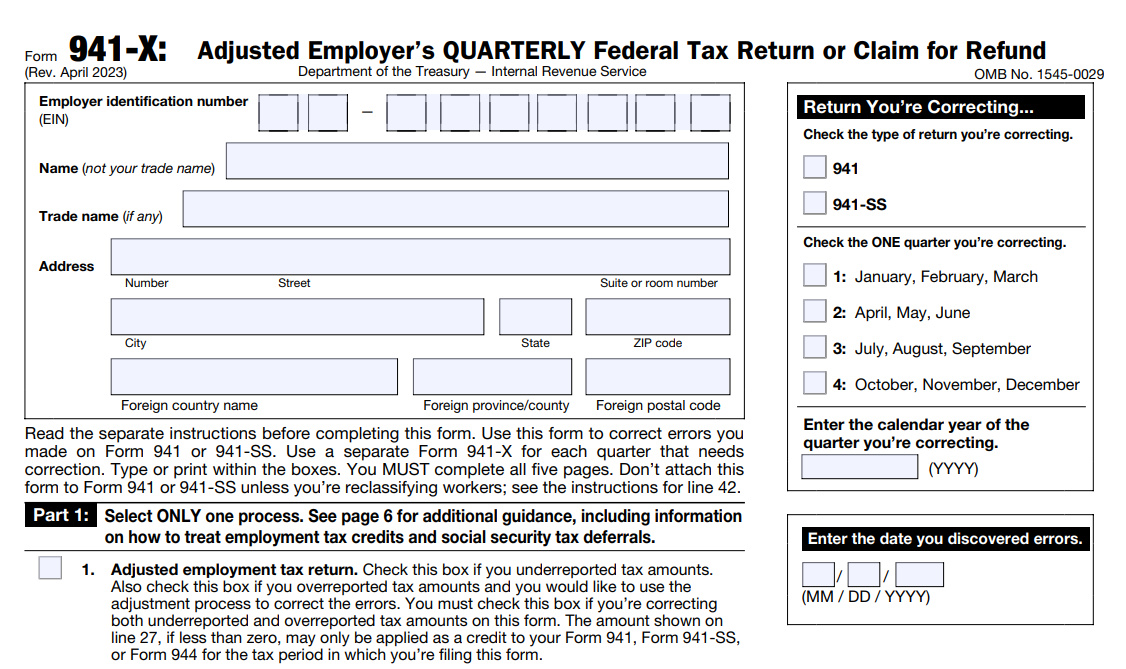

Web to use where’s my refund, you need to provide your social security number, filing status and the exact whole dollar amount of your expected refund. If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please reach out to. Form 941, write “applied for” and the date you applied. Web november 30, 2021 08:20 am hello! Is not responsible for penalties or damages as a result of filing incorrectly. Web adjusted employment tax return. Check this box if you underreported tax amounts. Web september 3, 2021 attention clients! Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order.

Is not responsible for penalties or damages as a result of filing incorrectly. Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500,. Web how long does it take to get the 941 refund? You can check your payroll liability balance report. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Those returns are processed in. If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please reach out to. Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee. Web to use where’s my refund, you need to provide your social security number, filing status and the exact whole dollar amount of your expected refund. Also check this box if you overreported tax amounts and you would like to use the adjustment.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Web this is for information purposes only, and may not be current. Check this box if you underreported tax amounts. Looking to see if anyone has input on how long things are taking. Form 941, write “applied for” and the date you applied. It then explains how to check form 941 refund status.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Web check the status of your income tax refund for recent tax years. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Check this box if you underreported tax amounts. Web this is for information purposes only, and may not be current. Web irs form 941 is used to submit payroll taxes.

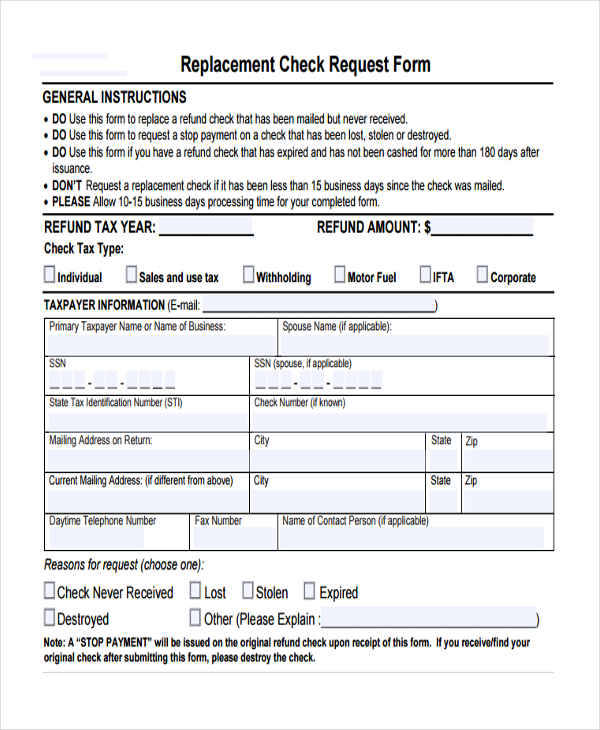

FREE 31+ Sample Check Request Forms in PDF Ms Word

Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web to use where’s my refund, you need to provide your social security number, filing status and the exact whole dollar amount of your expected refund. If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please.

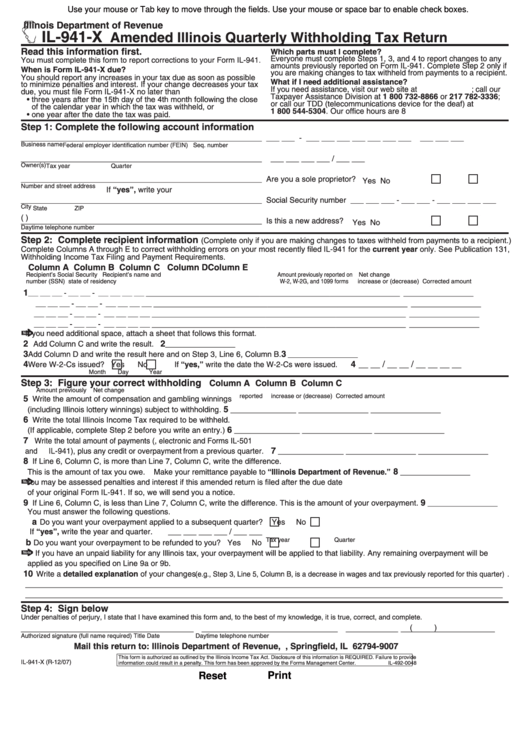

Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

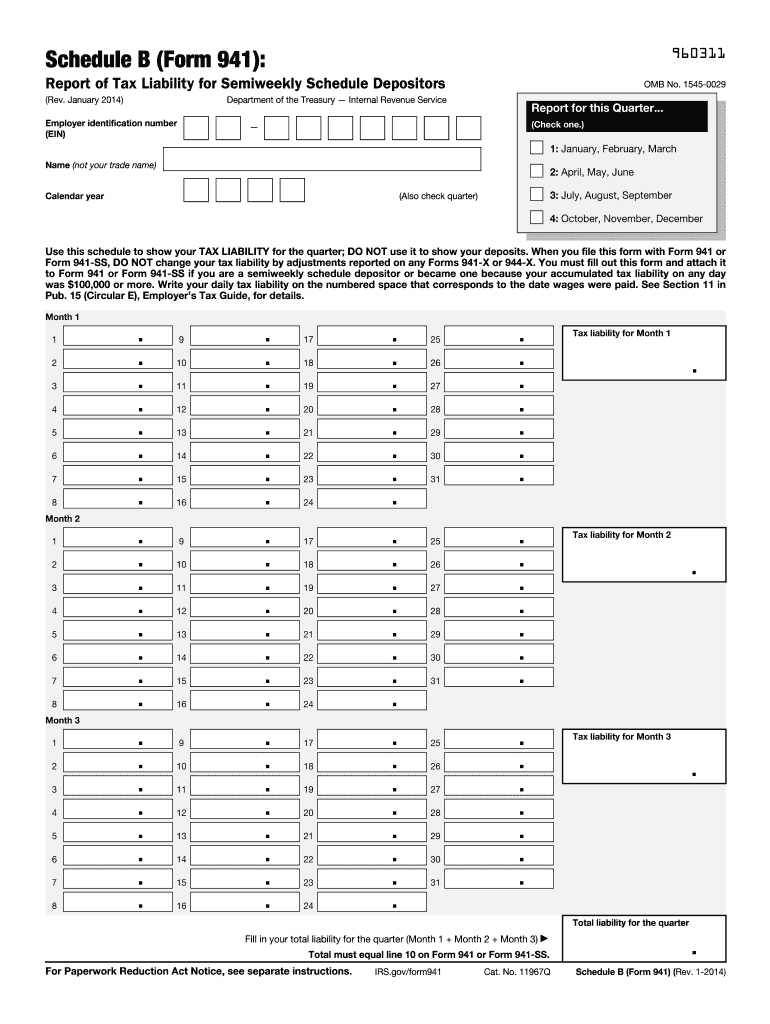

Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Web employers are responsible for filing form 941 to report the federal income tax, social security tax, and medicare tax withheld from each of their employee’s salary. Web irs form 941 is.

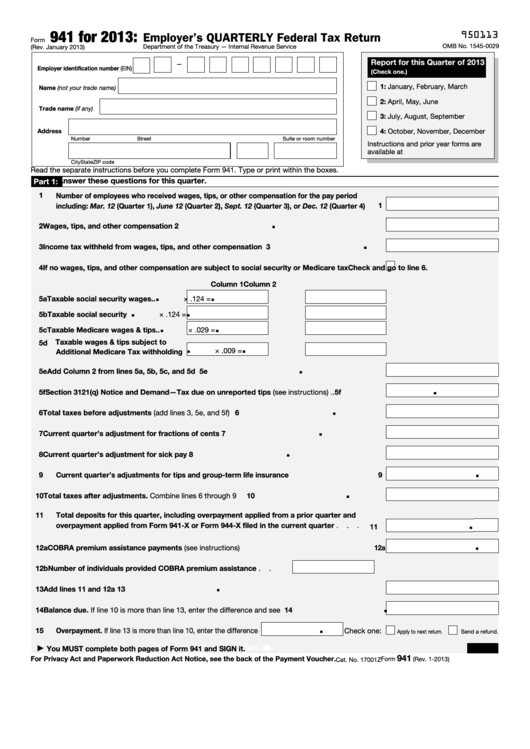

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Irs2go app check your refund.

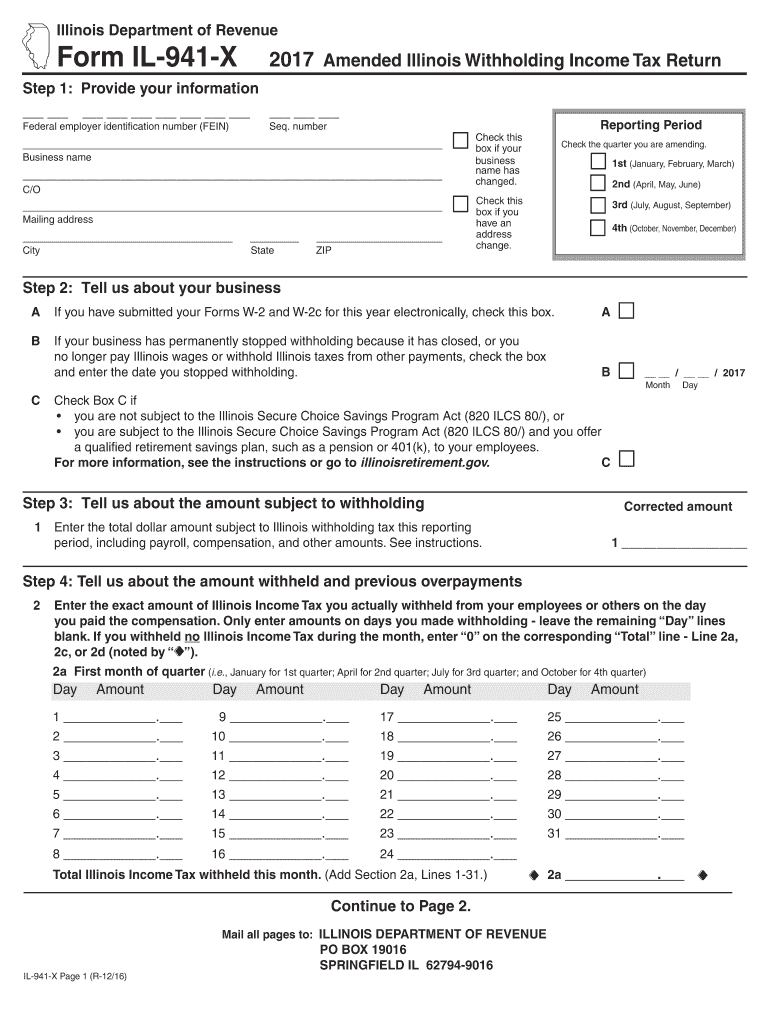

Il 941 Form 2020 Fill Out and Sign Printable PDF Template signNow

If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please reach out to. Is not responsible for penalties or damages as a result of filing incorrectly. Web check the status of your income tax refund for recent tax years. Web ein, “form 941,” and the tax period (“1st quarter 2023,”.

How to Complete Form 941 in 5 Simple Steps

Web payroll tax returns. If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please reach out to. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet,.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Also check this box if you overreported tax amounts and you would like to use the adjustment. Before checking on your refund, have your social security number, filing status, and the exact whole dollar amount of your. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Web november 21, 2022 01:42 pm hello there. Those.

File 941 Online How to File 2023 Form 941 electronically

Looking to see if anyone has input on how long things are taking. Web check the status of your income tax refund for recent tax years. Web check your federal tax refund status. Irs2go app check your refund status, make a payment, find free tax preparation assistance,. Check this box if you underreported tax amounts.

Irs Form 941 Instructions 2016

Check this box if you underreported tax amounts. Web check the status of your income tax refund for recent tax years. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Web form 3911 is provided to individuals who do not qualify to.

You Can Check Your Payroll Liability Balance Report.

Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500,. Web to use where’s my refund, you need to provide your social security number, filing status and the exact whole dollar amount of your expected refund. Web form 3911 is provided to individuals who do not qualify to request a replacement check through the internet, automated phone system or by contacting a customer service. Web ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order.

Before Checking On Your Refund, Have Your Social Security Number, Filing Status, And The Exact Whole Dollar Amount Of Your.

Also check this box if you overreported tax amounts and you would like to use the adjustment. Check this box if you underreported tax amounts. Web payroll tax returns. Web november 30, 2021 08:20 am hello!

Web This Is For Information Purposes Only, And May Not Be Current.

Web november 21, 2022 01:42 pm hello there. Web september 3, 2021 attention clients! Web employers are responsible for filing form 941 to report the federal income tax, social security tax, and medicare tax withheld from each of their employee’s salary. It then explains how to check form 941 refund status.

You May Receive A Refund Check If You Have Overpaid Payroll Taxes.

Web adjusted employment tax return. If you received an unexpected refund check or notice in the mail from the irs regarding your form 941, please reach out to. Web how long does it take to get the 941 refund? Web irs form 941 is used to submit payroll taxes paid by employee and employer, so first need to know who overpaid to determine who gets refund, employee.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461.png)