Form 941 Sch B

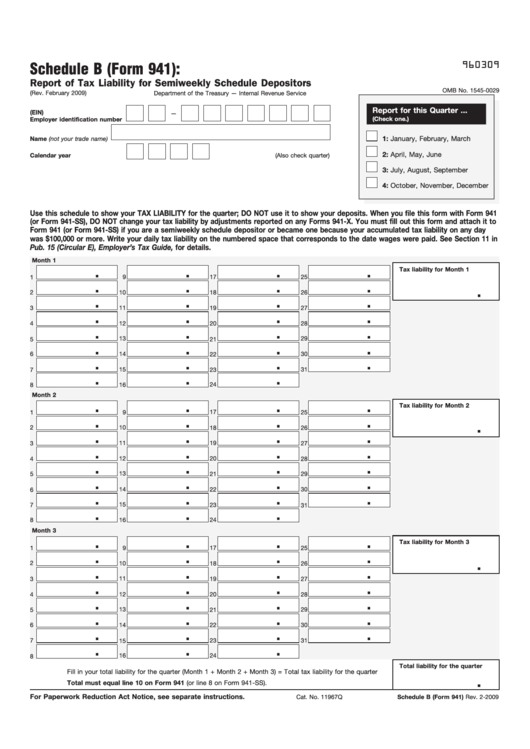

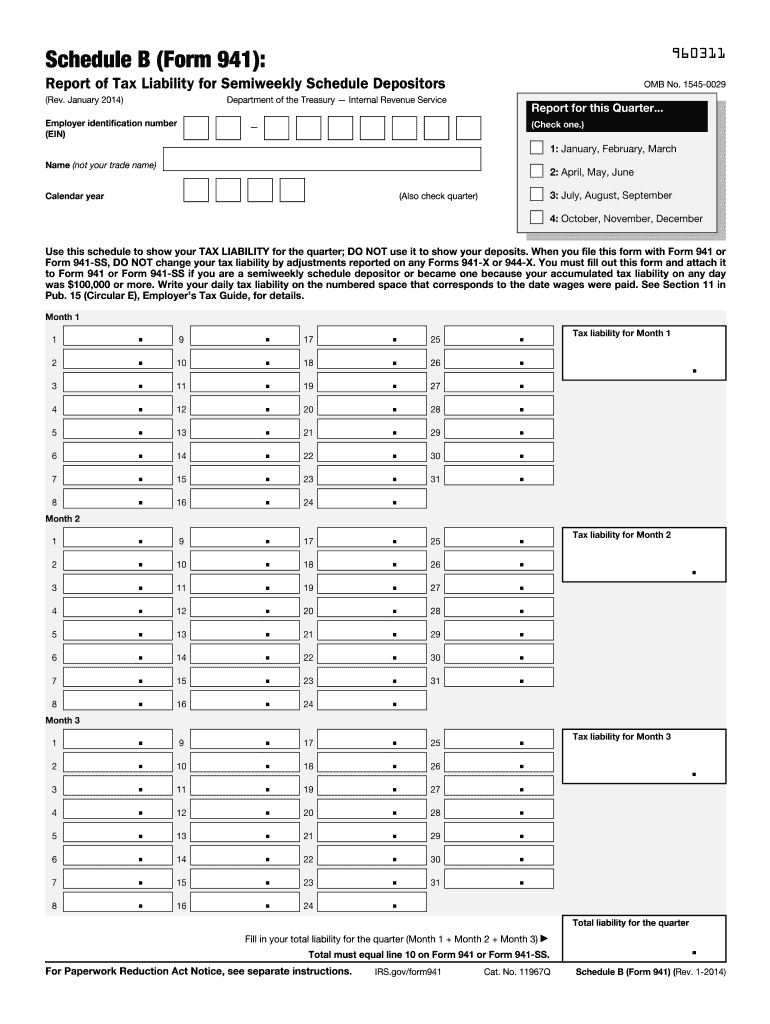

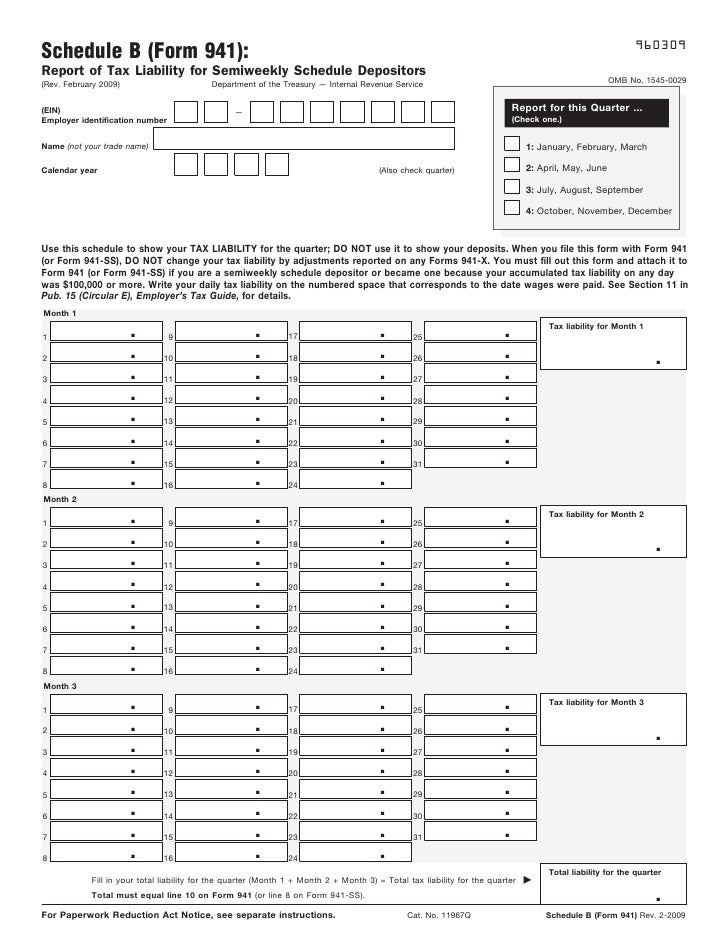

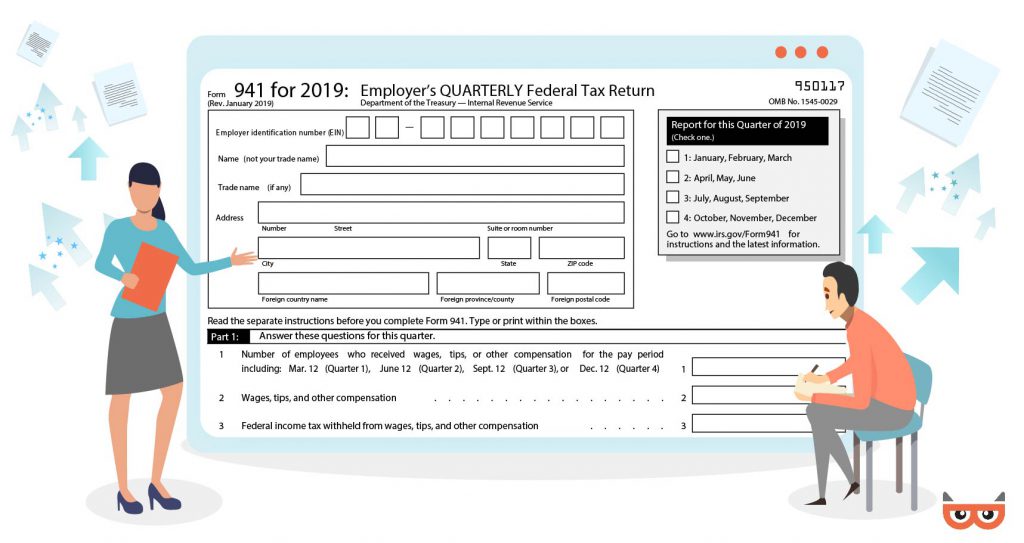

Form 941 Sch B - Report of tax liability for semiweekly schedule depositors (rev. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. The 941 form reports the total amount of tax withheld during each quarter. 15 or section 8 of pub. File schedule b if you’re a semiweekly schedule depositor. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You’re a semiweekly depositor if you reported January 2017) department of the treasury — internal revenue service. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the 15 or section 8 of pub.

15 or section 8 of pub. If your penalty is decreased, the irs will include the. See deposit penalties in section 11 of pub. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Installment agreement request popular for tax pros; Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Web schedule b (form 941): See deposit penalties in section 11 of pub.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. File schedule b if you’re a semiweekly schedule depositor. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the The 941 form reports the total amount of tax withheld during each quarter. Installment agreement request popular for tax pros; See deposit penalties in section 11 of pub. You’re a semiweekly depositor if you reported The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

ezPaycheck Payroll How to Prepare Quarterly Tax Report

You’re a semiweekly depositor if you reported Report of tax liability for semiweekly schedule depositors (rev. If your penalty is decreased, the irs will include the. The 941 form reports the total amount of tax withheld during each quarter. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the

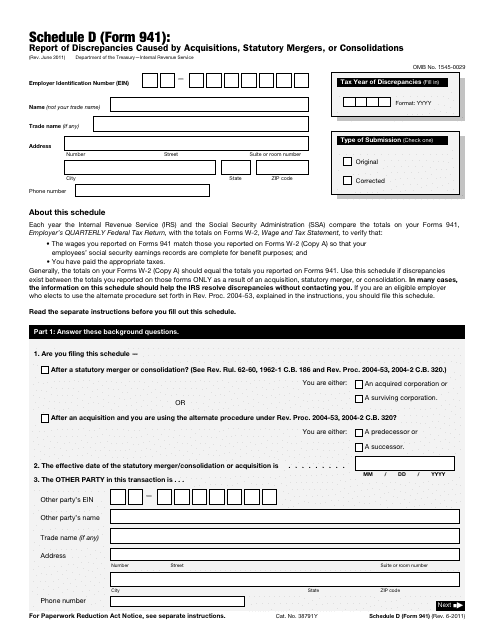

IRS Form 941 Schedule D Download Fillable PDF or Fill Online Report of

Web schedule b is filed with form 941. This will help taxpayers feel more prepared when. See deposit penalties in section 11 of pub. Web schedule b (form 941): Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this quarter.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Installment agreement request popular for tax pros; January 2017) department of the treasury — internal revenue service. Report of tax liability for semiweekly schedule depositors (rev. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment.

Form 941 Schedule B YouTube

Filing deadlines are in april, july, october and january. Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this quarter. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. 15 or section 8 of pub. You’re a semiweekly schedule depositor if.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. If your penalty is decreased, the irs will include the. Web schedule b with form 941, the irs may propose.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

If your penalty is decreased, the irs will include the. Web schedule b is filed with form 941. The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. See deposit penalties in section 11 of pub. Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this.

2018 Schedule 941 Fill Out and Sign Printable PDF Template signNow

You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. January 2017) department of the treasury — internal revenue service. Employer identification number (ein) — name (not your trade name) calendar year (also.

Sage Releases 2011 941 Form Update Aries Technology Group LLCAries

The 941 form reports the total amount of tax withheld during each quarter. Report of tax liability for semiweekly schedule depositors (rev. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The employer is required to withhold federal income tax and payroll taxes from the employee’s paychecks. File.

Your Ultimate Form 941 HowTo Guide Blog TaxBandits

Filing deadlines are in april, july, october and january. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. See deposit penalties in section 11 of pub. Report of tax liability for semiweekly schedule depositors (rev.

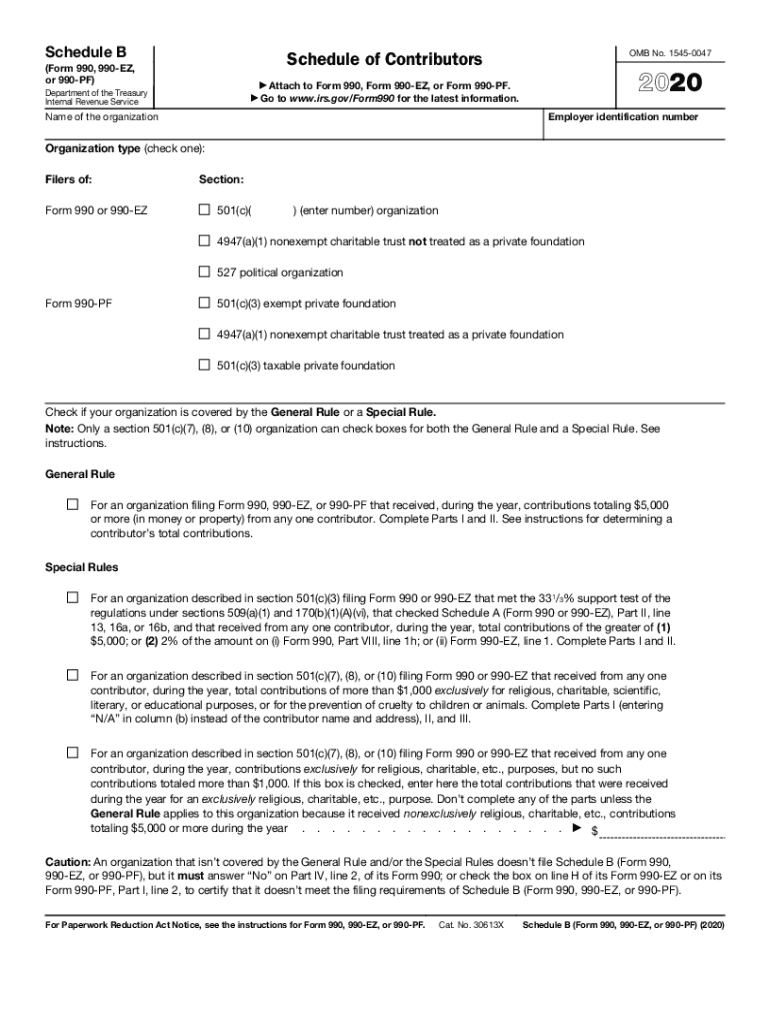

2020 Form IRS 990 Schedule B Fill Online, Printable, Fillable, Blank

15 or section 8 of pub. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. This will help taxpayers feel more prepared when. Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this quarter. Report of tax liability for semiweekly schedule depositors (rev.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Web schedule b is filed with form 941. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the The 941 form reports the total amount of tax withheld during each quarter. January 2017) department of the treasury — internal revenue service.

The Employer Is Required To Withhold Federal Income Tax And Payroll Taxes From The Employee’s Paychecks.

Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this quarter. Web schedule b (form 941): If your penalty is decreased, the irs will include the. Report of tax liability for semiweekly schedule depositors (rev.

File Schedule B If You’re A Semiweekly Schedule Depositor.

Installment agreement request popular for tax pros; Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. See deposit penalties in section 11 of pub. Employers engaged in a trade or business who pay compensation form 9465;

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

See deposit penalties in section 11 of pub. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. 15 or section 8 of pub. You’re a semiweekly depositor if you reported