Form 941-V

Form 941-V - Web check if you are a semiweekly depositor. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. See deposit penalties in section 11 of pub. Pay the employer's portion of social security or medicare tax. Web 4506 request for copy of tax return. If you don’t have an ein, you may apply for one online by Employers use form 941 to: Complete and attach schedule b (form 941vi). Web mailing addresses for forms 941. If you are required to make deposits electronically but do not wish to use the.

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: See deposit penalties in section 11 of pub. • your total taxes for either the current quarter (form 941, line. Pay the employer's portion of social security or medicare tax. Web check if you are a semiweekly depositor. Making payments with form 941. Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments.

See deposit penalties in section 11 of pub. Web check if you are a semiweekly depositor. Pay the employer's portion of social security or medicare tax. • your total taxes for either the current quarter (form 941, line. To avoid a penalty, make your payment with form 941. You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Complete and attach schedule b (form 941vi). Making payments with form 941. Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows.

form 941 v Fill out & sign online DocHub

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Gross receipts monthly tax return. 721vi mwk excise manufacturer worksheet. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web check if you are.

IRS Form 941V Payment Voucher Blank Lies on Empty Calendar Page

721vi mwk excise manufacturer worksheet. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Specific instructions box 1—employer identification number (ein). We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. If you are required to make deposits electronically but do not wish to use.

IRS Form 941V Payment Voucher blank lies with pen and many hundred

Web about form 941, employer's quarterly federal tax return. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Making payments with form 941. Employers use form 941 to:

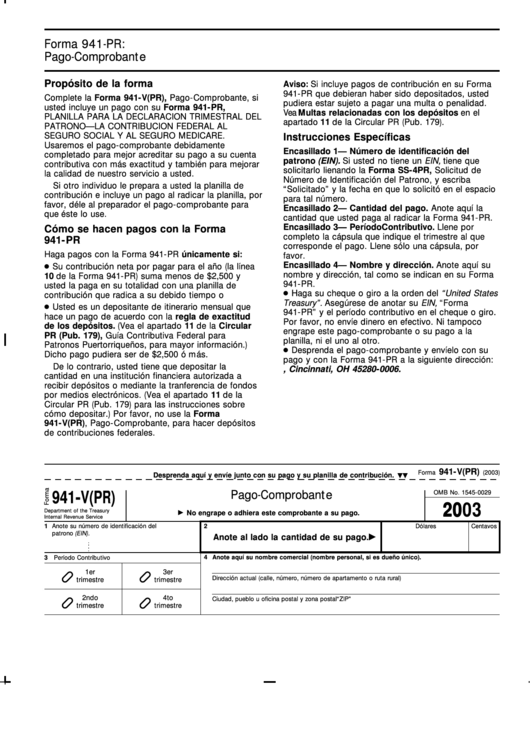

Form 941V(Pr) 2003 printable pdf download

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. • your total taxes for either the current quarter (form 941, line. 721vi mwk excise manufacturer worksheet. Filing deadlines are in april, july, october and january. Making payments with form 941.

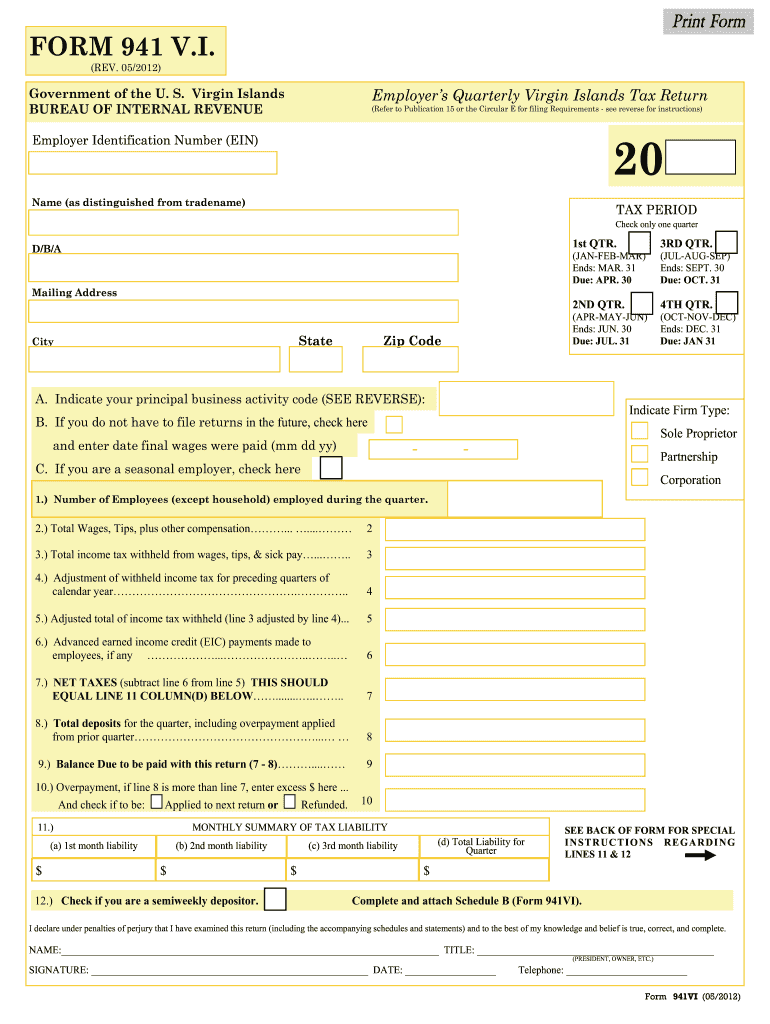

Form 941 V I Fill Out and Sign Printable PDF Template signNow

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Employers use form 941 to: Filing deadlines are in april, july, october and january. Making payments with form 941.

Form 941v, Payment Voucher and Pen on Wooden Desk Editorial Image

• your total taxes for either the current quarter (form 941, line. Specific instructions box 1—employer identification number (ein). If you are required to make deposits electronically but do not wish to use the. Pay the employer's portion of social security or medicare tax. Employers use form 941 to:

Form 941SS Employer's Quarterly Federal Tax Return American Samoa…

721vi mwk excise manufacturer worksheet. Complete and attach schedule b (form 941vi). Making payments with form 941. See deposit penalties in section 11 of pub. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks.

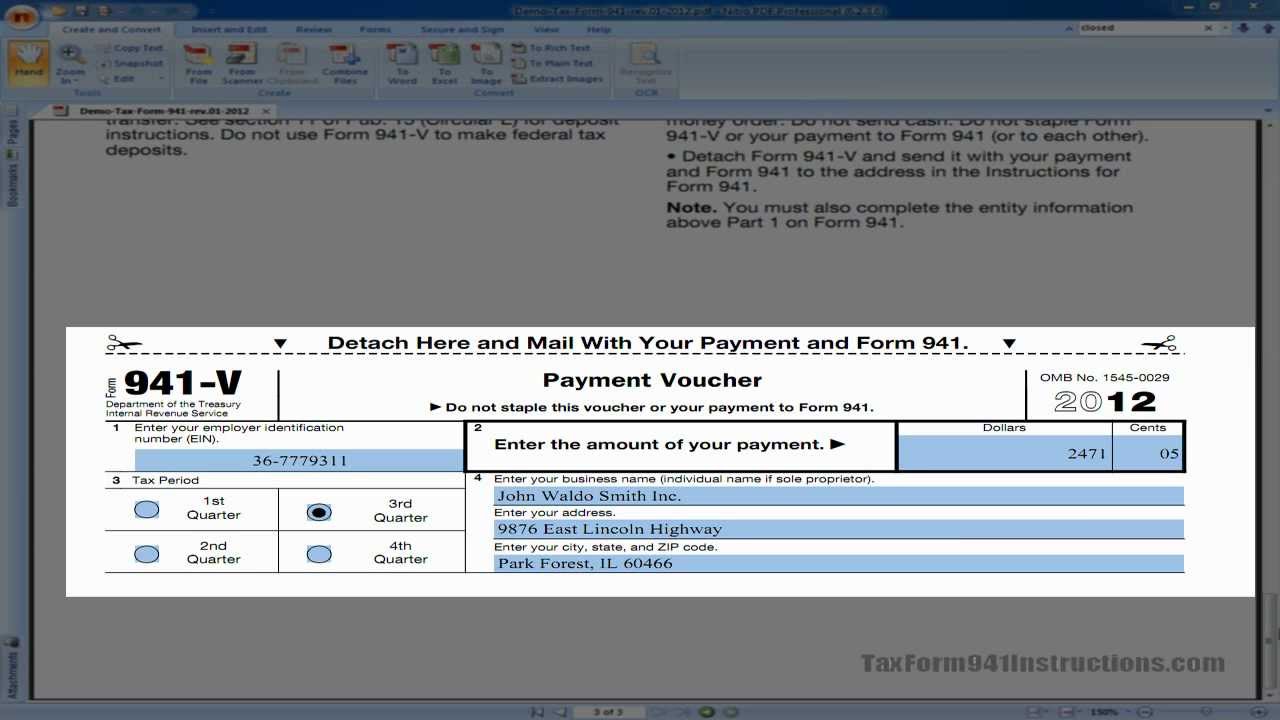

Tax Form 941V Payment Voucher Video YouTube

Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Filing deadlines are in april, july, october and january. • your total taxes for either the current quarter (form 941, line.

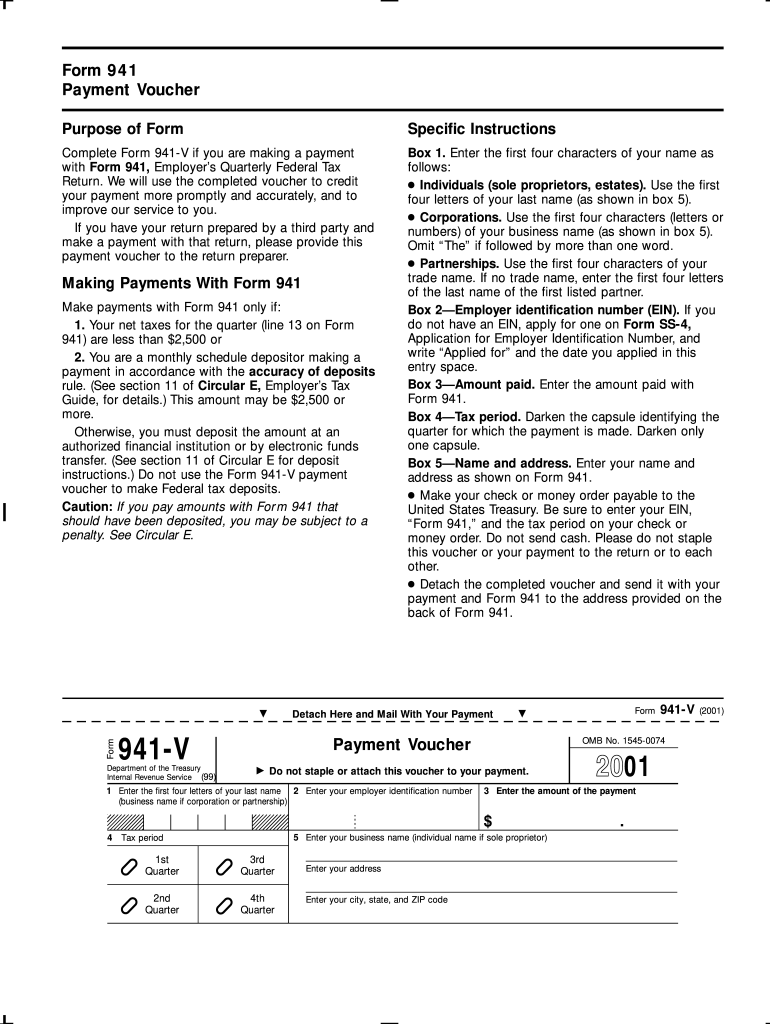

2001 Form IRS 941V Fill Online, Printable, Fillable, Blank pdfFiller

If you are required to make deposits electronically but do not wish to use the. Specific instructions box 1—employer identification number (ein). However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Complete and attach schedule b (form 941vi). Web about form 941, employer's quarterly federal tax return.

IRS Form 941V Payment Voucher blank lies with pen and many hundred

Web 4506 request for copy of tax return. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Gross receipts monthly tax return. Web mailing addresses for forms 941. Specific instructions box 1—employer identification number (ein).

If You Don’t Have An Ein, You May Apply For One Online By

Web about form 941, employer's quarterly federal tax return. 721vi mwk excise manufacturer worksheet. • your total taxes for either the current quarter (form 941, line. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks.

Web This Eftps® Tax Payment Service Web Site Supports Microsoft Internet Explorer For Windows, Google Chrome For Windows And Mozilla Firefox For Windows.

See deposit penalties in section 11 of pub. Complete and attach schedule b (form 941vi). Making payments with form 941. Specific instructions box 1—employer identification number (ein).

Web Mailing Addresses For Forms 941.

Pay the employer's portion of social security or medicare tax. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Web 4506 request for copy of tax return. If you are required to make deposits electronically but do not wish to use the.

Employers Use Form 941 To:

Web check if you are a semiweekly depositor. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Gross receipts monthly tax return.