Form 941X 2021

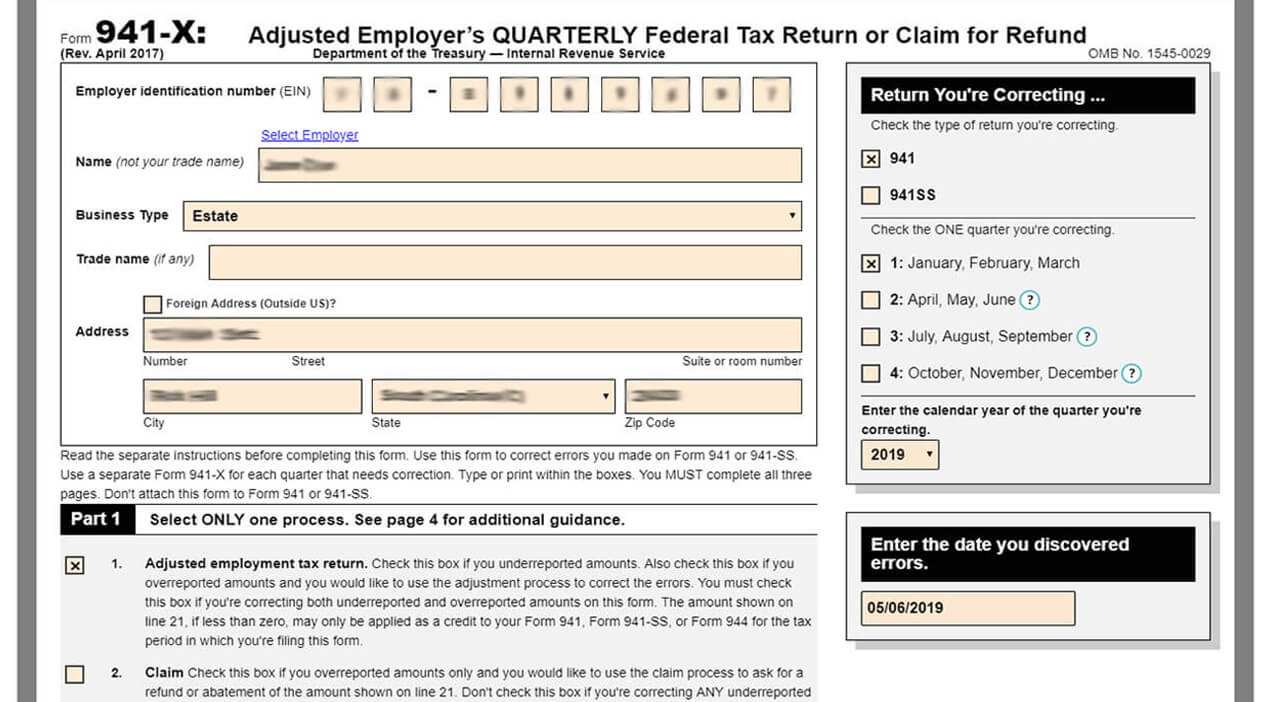

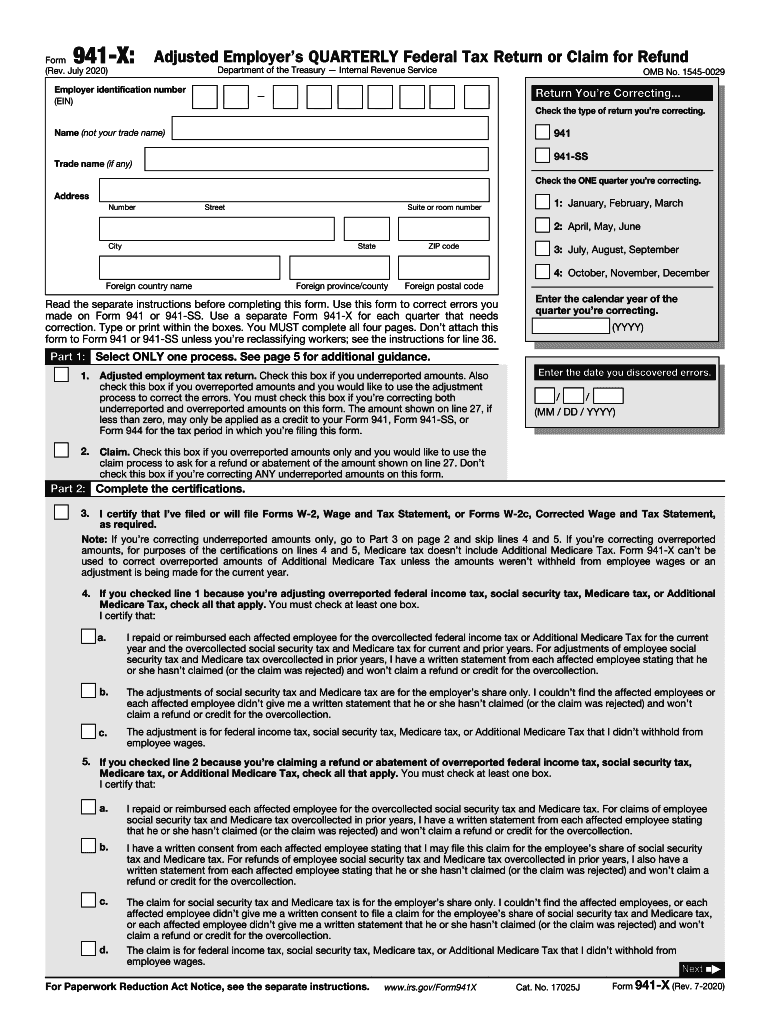

Form 941X 2021 - Type or print within the boxes. You must complete all five pages. Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. Enter the calendar year of the quarter you’re correcting. See the instructions for line 42. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. Employer identification number (ein) — name (not. Don't use an earlier revision of form 941 to report taxes for 2021. Or, the employer can use the claim process to request a refund of the employer’s share of. See the instructions for line 42.

You must complete all five pages. If you are located in. As soon as you discover an error on form 941, you must take the following. You must complete all five pages. Enter the calendar year of the quarter you’re correcting. Web these businesses could claim the irs employee retention credit for wages that were paid after september 30, 2021, and before january 1, 2022. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. Type or print within the boxes. See the instructions for line 42.

You must complete all five pages. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; The instructions have also been revised to help taxpayers accommodate the new reporting guidelines. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Web these businesses could claim the irs employee retention credit for wages that were paid after september 30, 2021, and before january 1, 2022. Check the type of return you’re correcting. 2024, to amend returns for 2020 and until april 15, 2025, to amend returns for 2021. Web here’s everything you need to know to stay on top of your tax game. Enter the calendar year of the quarter you’re correcting. For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc.

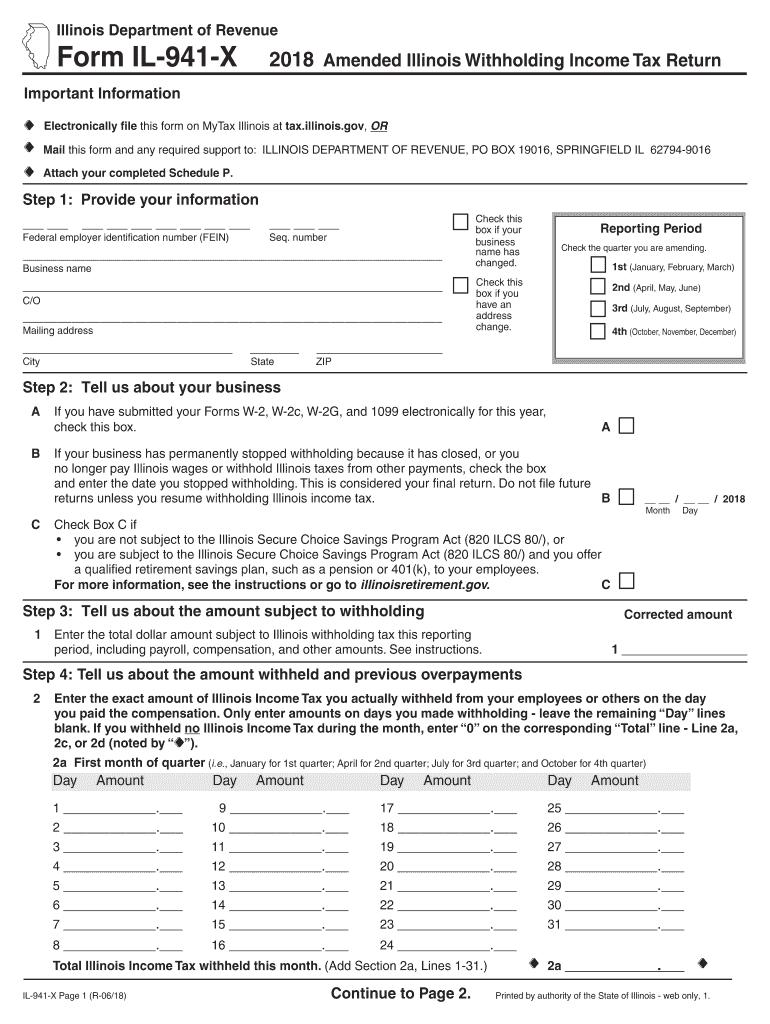

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

If you're correcting a quarter that began An employer is required to file an irs 941x in the event of an error on a previously filed form 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. You must complete all five pages. Check the type of return you’re correcting.

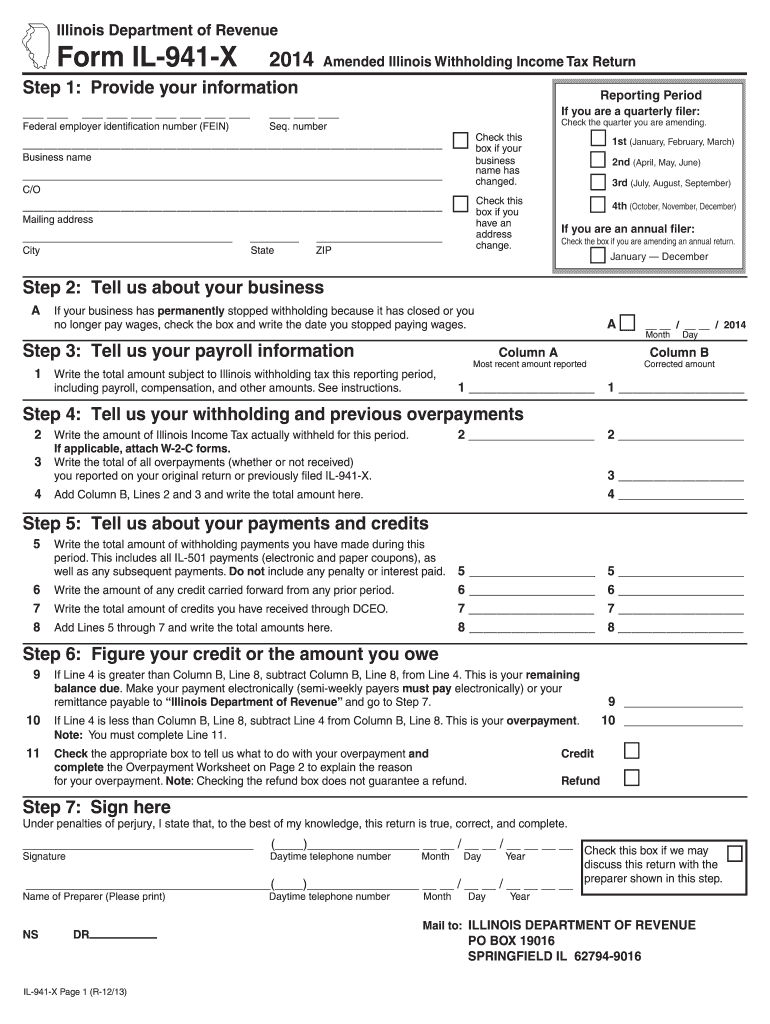

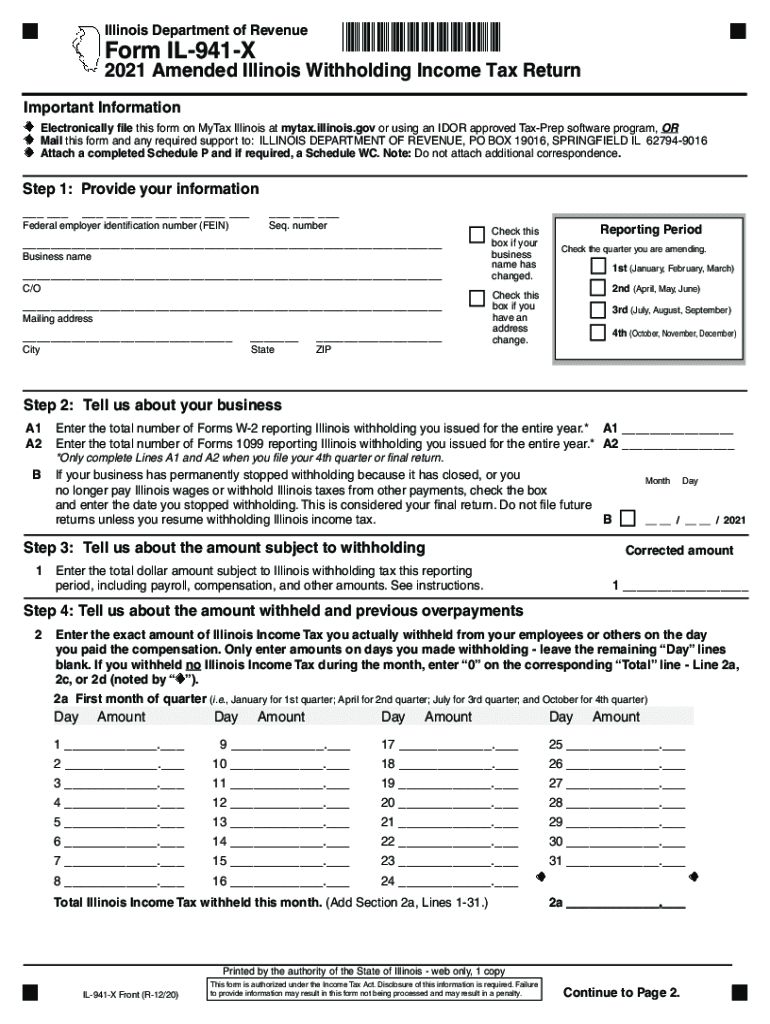

IL DoR IL941X 2021 Fill out Tax Template Online US Legal Forms

Employer identification number (ein) — name (not. Web these businesses could claim the irs employee retention credit for wages that were paid after september 30, 2021, and before january 1, 2022. Don't use an earlier revision of form 941 to report taxes for 2021. If changes in law require additional changes to form 941, the form and/or these instructions may.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

As soon as you discover an error on form 941, you must take the following. For more information about this credit, go to irs.gov/form5884d. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. Don't use the march 2021 revision of form 941 to report taxes for any quarter ending before.

Worksheet 1 941x

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. As soon as.

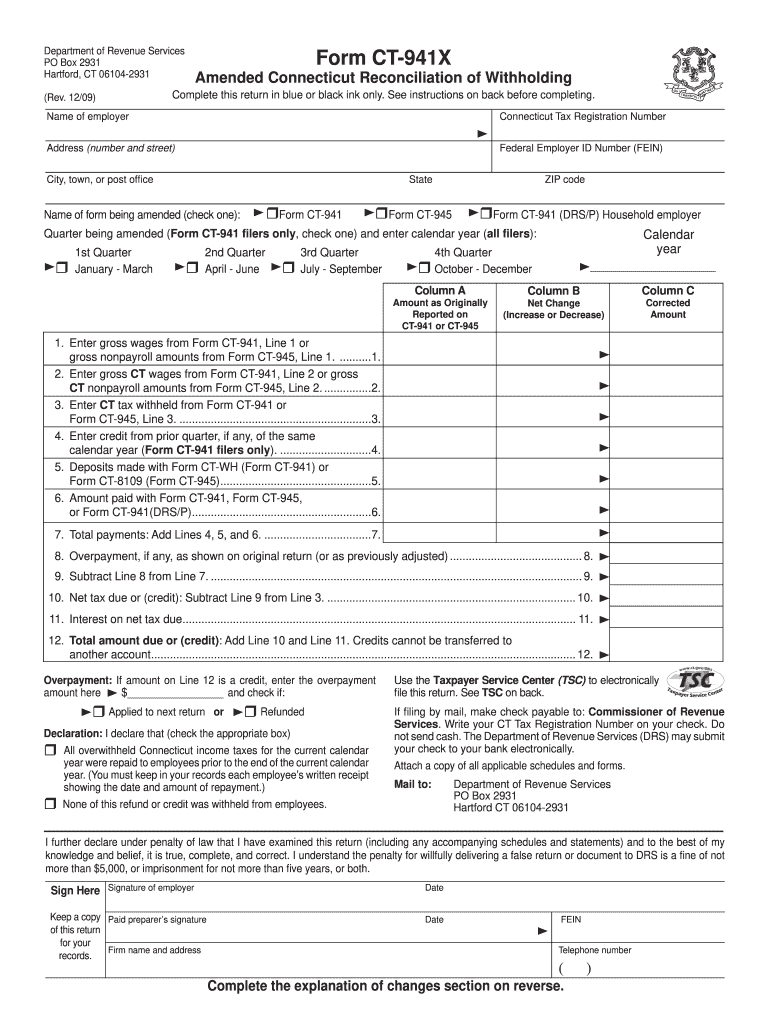

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

Don't use an earlier revision of form 941 to report taxes for 2021. Don't use the march 2021 revision of form 941 to report taxes for any quarter ending before january 1, 2021. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; The adjustments also entail administrative errors and alterations to employee.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Employer identification number (ein) — name (not. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; For more information, see the instructions for form 8974 and go to irs.gov/ researchpayrolltc. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable.

Worksheet 2 941x

See the instructions for line 42. Check the one quarter you’re correcting. If you are located in. If changes in law require additional changes to form 941, the form and/or these instructions may be revised. You must complete all five pages.

IRS Form 941X Complete & Print 941X for 2021

April, may, june read the separate instructions before completing this form. 2024, to amend returns for 2020 and until april 15, 2025, to amend returns for 2021. Or, the employer can use the claim process to request a refund of the employer’s share of. Don't use an earlier revision of form 941 to report taxes for 2021. Form 941 instructions,.

941 X Fill Online, Printable, Fillable, Blank pdfFiller

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; The adjustments also entail administrative errors and alterations to employee retention tax credits. Taxpayers can use form 941x to make changes to the original form 941 that they’ve already filed. Check the type of return you’re correcting. Web form 941 for 2023:

941x Worksheet 1 Excel

Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; The term “nonrefundable” is a misnomer if the taxpayer did not claim the erc, and instead paid the employer’s share of the social security tax via federal tax. If you're correcting a quarter that began Type or print within the boxes. Connecticut,.

Type Or Print Within The Boxes.

Check the one quarter you’re correcting. Form 941 instructions, december 2021 revision pdf for additional information related to the erc for quarters in 2021; If you are located in. Web these businesses could claim the irs employee retention credit for wages that were paid after september 30, 2021, and before january 1, 2022.

See The Instructions For Line 42.

2024, to amend returns for 2020 and until april 15, 2025, to amend returns for 2021. The june 2021 revision of form 941 should be used for the second, third, and fourth quarters of 2021. You must complete all five pages. Don't use an earlier revision of form 941 to report taxes for 2021.

These Instructions Have Been Updated For Changes Under The American Rescue Plan Act Of 2021 (The Arp).

Type or print within the boxes. Type or print within the boxes. Form 941 instructions 2020 revisions pdf for additional information related to the erc for quarters in 2020; An employer is required to file an irs 941x in the event of an error on a previously filed form 941.

Don't Use The March 2021 Revision Of Form 941 To Report Taxes For Any Quarter Ending Before January 1, 2021.

The term “nonrefundable” is a misnomer if the taxpayer did not claim the erc, and instead paid the employer’s share of the social security tax via federal tax. The instructions have also been revised to help taxpayers accommodate the new reporting guidelines. If you're correcting a quarter that began April, may, june read the separate instructions before completing this form.

.jpg)