Form 943 Address

Form 943 Address - Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web ein by the due date of form 943, file a paper return and write applied for and the date you applied in this entry space. Web how should you complete form 943? • enclose your check or money order made payable to “united states treasury.” be. If you don’t already have an ein, you. Form 943 has to be filed before the deadline and has to be sent to the irs. You’ll file this form with the irs annually. Web then use this address. Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Enter your name and address as shown on form 943.

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Must be removed before printing. Web how should you complete form 943? Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. If you don’t already have an ein, you. Web ein by the due date of form 943, file a paper return and write applied for and the date you applied in this entry space. R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. Taxbandits helps you to file before the deadline. Web brette sember, j.d. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. You’ll file this form with the irs annually. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. Web then use this address. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. If you don’t already have an ein, you. Must be removed before printing. Some businesses may be required to file both a 943 and. Web file form 943 before the due date for 2022 and get to know the form 943 mailing address with & without payment.

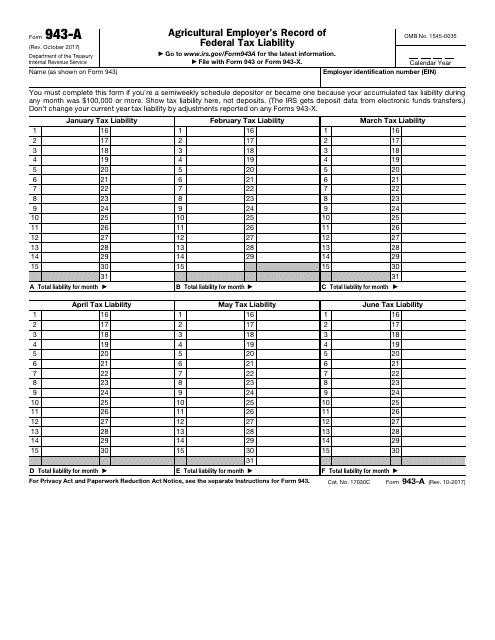

IRS Form 943A Download Fillable PDF or Fill Online Agricultural

Web form 943 due date & mailing address. If returns do not have to be filed in the future (i.e., because the employer ceases operations or stops. Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Connecticut, delaware, district of columbia, florida, georgia, illinois,.

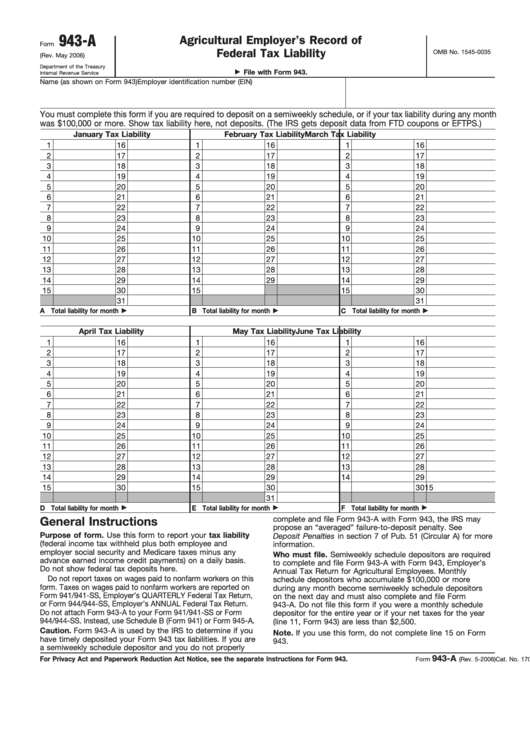

Fillable Form 943A Agricultural Employer'S Record Of Federal Tax

Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Don't use your social security number (ssn) or individual taxpayer. R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. Web the employee retention credit enacted under the coronavirus.

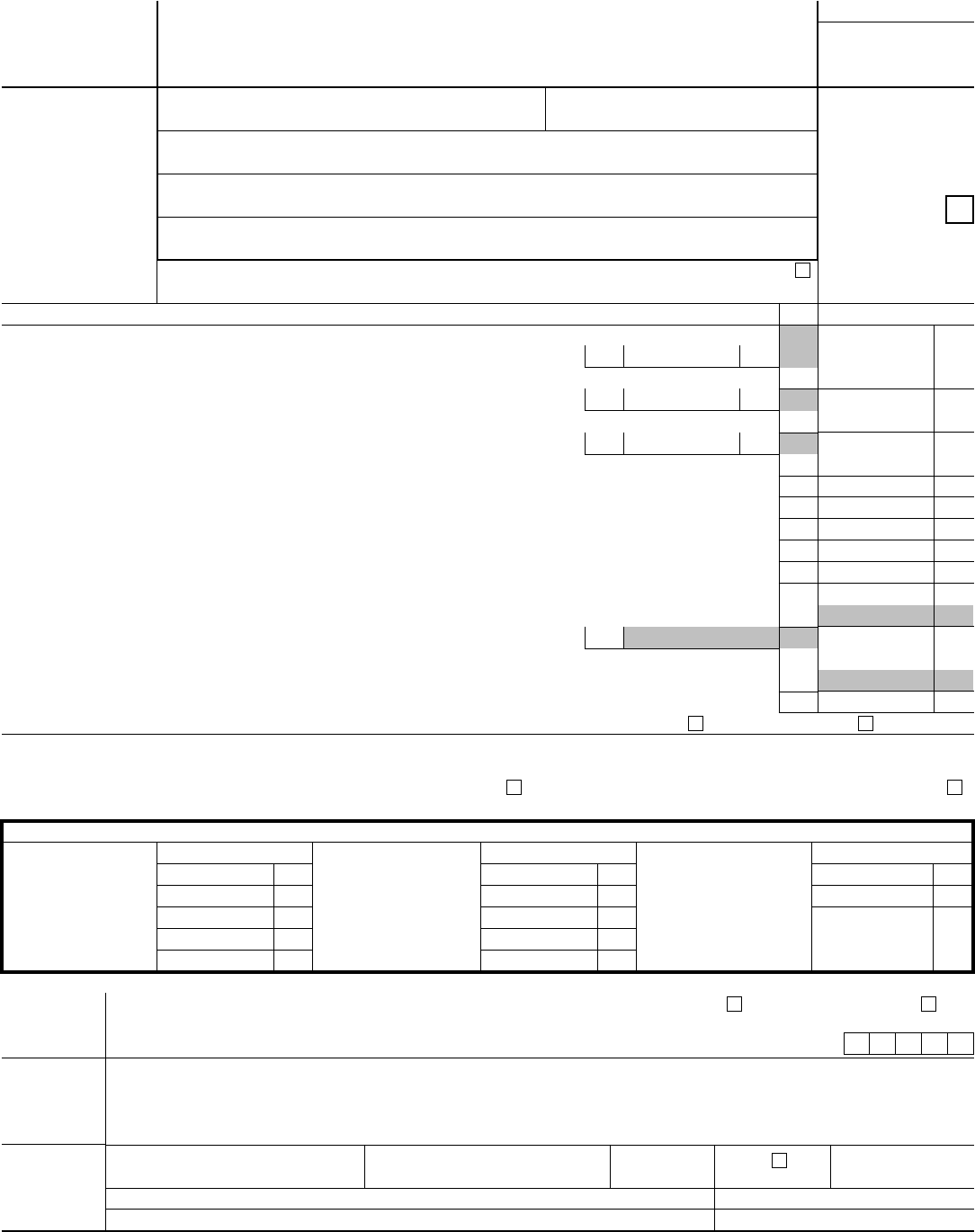

Form 943 Edit, Fill, Sign Online Handypdf

Apr 25, 2023, 1:00pm editorial note: Web form 943 due date & mailing address. Web how should you complete form 943? Web ein by the due date of form 943, file a paper return and write applied for and the date you applied in this entry space. Some businesses may be required to file both a 943 and.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts,. Form 943 has to be filed before the deadline and has to be sent to the irs. Web form 943 is required for agricultural businesses with farmworkers. Enter your ein, name, and address in the spaces provided. Web we last updated the employer's annual federal tax return.

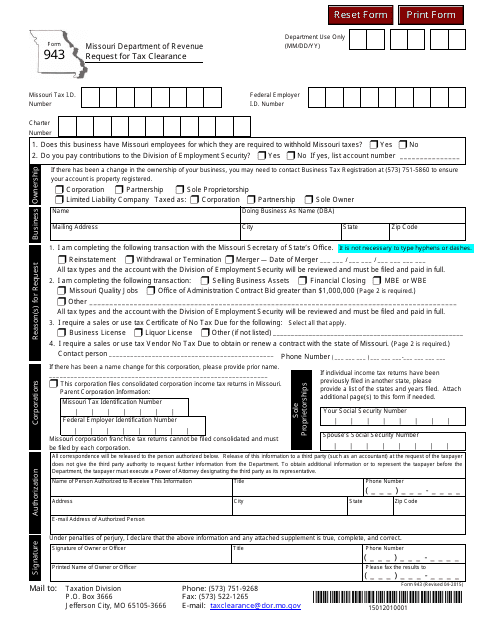

Form 943 Download Printable PDF, Request for Tax Clearance Missouri

I am completing the following transaction with the missouri secretary of state’s office. For a detailed 943 due date and mailing address, read this article. Taxbandits helps you to file before the deadline. Apr 25, 2023, 1:00pm editorial note: Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. You’ll file this form with the irs annually. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web form.

2011 Form IRS Instruction 943 Fill Online, Printable, Fillable, Blank

• enclose your check or money order made payable to “united states treasury.” be. Enter your ein, name, and address in the spaces provided. Taxbandits helps you to file before the deadline. For a detailed 943 due date and mailing address, read this article. Web to fill out form 943, you need your employer identification number (ein), your legal name,.

IRS Form 943 Complete PDF Tenplate Online in PDF

Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web then, marking the box on form 943 that indicates an address change? Taxbandits helps you to file before the deadline. It is used to record. Must be removed before printing.

Form 943 Fill Out and Sign Printable PDF Template signNow

R reinstatement r withdrawal or termination r merger — date of merger ___ ___ / ___. If you don’t already have an ein, you. It is used to record. Don't use your social security number (ssn) or individual taxpayer. Web then use this address.

Form 943 What You Need to Know About Agricultural Withholding

We earn a commission from partner links on forbes advisor. Some businesses may be required to file both a 943 and. Web brette sember, j.d. Enter your ein, name, and address in the spaces provided. Web ein by the due date of form 943, file a paper return and write applied for and the date you applied in this entry.

Connecticut, Delaware, District Of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts,.

Web form 943 is required for agricultural businesses with farmworkers. To determine if you're a semiweekly schedule. Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Must be removed before printing.

It Is Used To Record.

Some businesses may be required to file both a 943 and. Enter your name and address as shown on form 943. Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Enter your ein, name, and address in the spaces provided.

If Returns Do Not Have To Be Filed In The Future (I.e., Because The Employer Ceases Operations Or Stops.

I am completing the following transaction with the missouri secretary of state’s office. We earn a commission from partner links on forbes advisor. • enclose your check or money order made payable to “united states treasury.” be. Apr 25, 2023, 1:00pm editorial note:

Web To Fill Out Form 943, You Need Your Employer Identification Number (Ein), Your Legal Name, And Your Business Address.

Enter your ein, name, and address in the spaces provided. Web brette sember, j.d. You’ll file this form with the irs annually. Form 943 has to be filed before the deadline and has to be sent to the irs.