Form 943 Mailing Address

Form 943 Mailing Address - If you don't have an ein, you may apply for one online by. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. If you want to file online, you can either search for a tax professional to guide you through the. Web you have two options for filing form 943: Must be removed before printing. Web if you choose paper filing, keep reading to learn more about the form 943 deadline and mailing address details. Web if you file a paper return, where you file depends on whether you include a payment with form 943. Mail your return to the address listed for your location in the table that follows. Enter your name and address as shown on form 943. And indian tribal governmental entities regardless of location.

Web trade name, and address irs instructions: If you want to file online, you can either search for a tax professional to guide you through the. • enclose your check or money order made payable to “united states treasury.” be. And indian tribal governmental entities regardless of location. Enter your name and address as shown on form 943. Employer identification number (ein) trade. Must be removed before printing. Web mailing addresses for forms 941. Web if you choose paper filing, keep reading to learn more about the form 943 deadline and mailing address details. Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year.

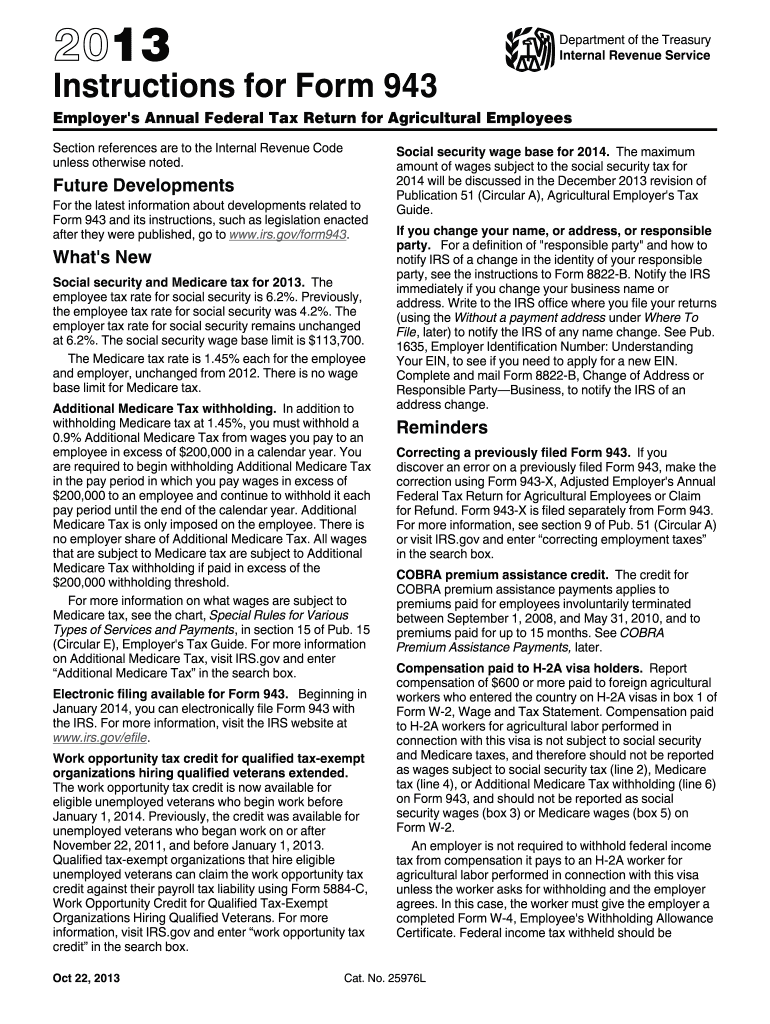

Web you have two options for filing form 943: The irs states agricultural employers are subject to. Web special filing addresses for exempt organizations; Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. • enclose your check or money order made payable to “united states treasury.” be. If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Web trade name, and address irs instructions: Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. If you don't have an ein, you may apply for one online by. Must be removed before printing.

Form 943 Fill Out and Sign Printable PDF Template signNow

If you haven't received your ein by the due date of form 943, write “applied for” and the date you applied in this. Must be removed before printing. Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: Get ready for tax season deadlines by completing any.

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

If you haven't received your ein by the due date of form 943, write “applied for” and the date you applied in this. Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: If you don't have an ein, you may apply for one online by. Web.

Editable IRS Form 943A 2017 2019 Create A Digital Sample in PDF

Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. Complete, edit or print tax forms instantly. Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: If you want to file online,.

2011 Form IRS Instruction 943 Fill Online, Printable, Fillable, Blank

Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. If you want to file online, you can either search for a tax professional to guide you through the. Must be removed before printing. Employer identification number (ein), name, trade name, and address. Web irs.

IRS Form 943 Complete PDF Tenplate Online in PDF

If you don't have an ein, you may apply for one online by. Web you have two options for filing form 943: Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. If you are filing form 843 to request a claim for refund in form.

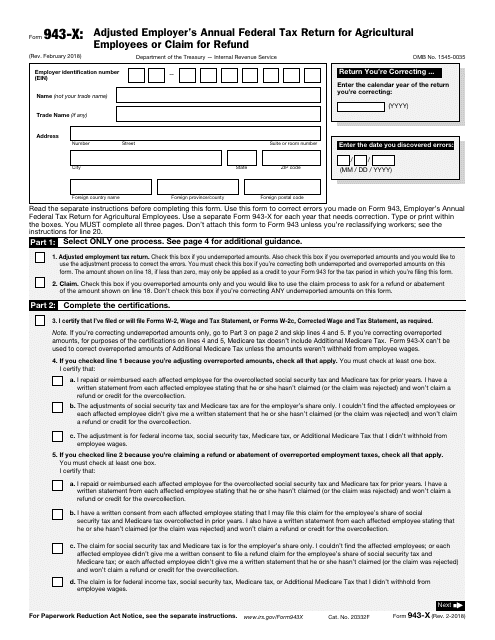

IRS Form 943X Download Fillable PDF or Fill Online Adjusted Employer's

If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: If you haven't received your ein by the due date of form 943, write “applied for” and the date you applied in this. Web mailing addresses for forms 941. Web you have two options for filing form.

Form 943 Joins The TaxBandits Lineup Blog TaxBandits

Employer identification number (ein), name, trade name, and address. Employer identification number (ein) trade. Web mailing addresses for forms 941. Enter your name and address as shown on form 943. If you want to file online, you can either search for a tax professional to guide you through the.

943 Form Fill Out and Sign Printable PDF Template signNow

Employer identification number (ein), name, trade name, and address. Mail your return to the address listed for your location in the table that follows. And indian tribal governmental entities regardless of location. Web for the latest information about developments related to form 943 and its instructions, such as legislation enacted after they were published, go to irs.gov/form943. Web trade name,.

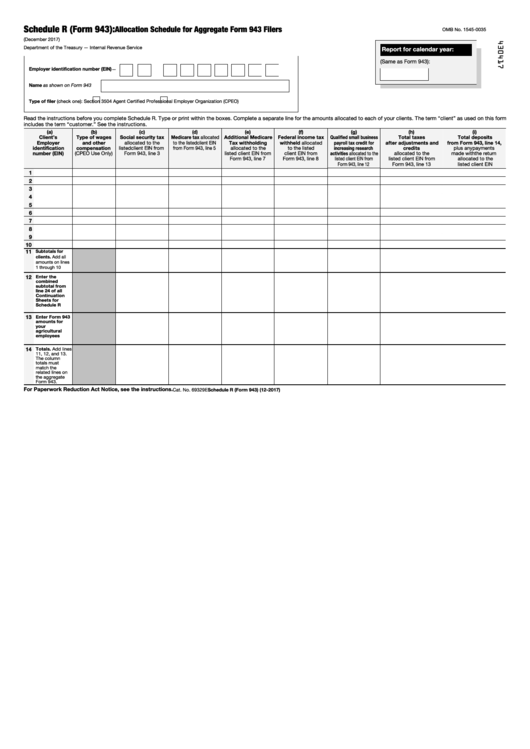

Fillable Schedule R (Form 943) Allocation Schedule For Aggregate Form

Must be removed before printing. And indian tribal governmental entities regardless of location. Federal, state, and local governmental entities; If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Web if you file a paper return, where you file depends on whether you include a payment with.

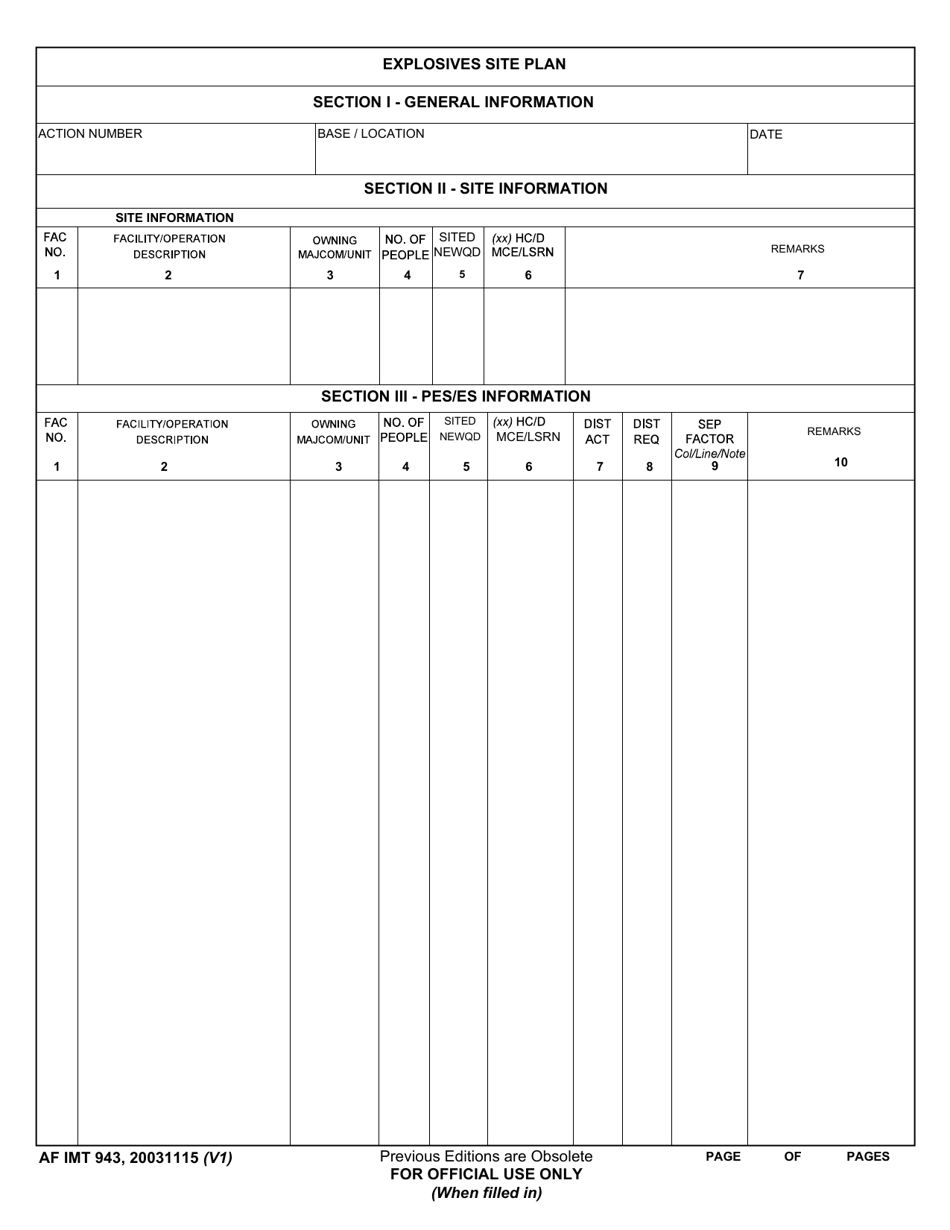

AF IMT Form 943 Download Fillable PDF or Fill Online Explosives Site

Web the address is shown in the notice. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web special filing addresses for exempt organizations; Get ready for tax season deadlines by completing any required tax forms today. • enclose your check or money order.

Employer Identification Number (Ein) Trade.

If you are filing form 843 to request a claim for refund in form 706/709 only tax matters, then mail the form to: Employer identification number (ein), name, trade name, and address. Enter your name and address as shown on form 943. If you don't have an ein, you may apply for one online by.

Web Mailing Addresses For Forms 941.

Web how to complete a form 943 (step by step) to complete a form 943, you will need to provide the following information: And indian tribal governmental entities regardless of location. Must be removed before printing. Web the address is shown in the notice.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be.

Connecticut, delaware, district of columbia, georgia,. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web you have two options for filing form 943: The irs states agricultural employers are subject to.

Mail Your Return To The Address Listed For Your Location In The Table That Follows.

Federal, state, and local governmental entities; Web form 943 is the tax document used to show the irs the amount of taxes that you withheld from your employees each year. If you want to file online, you can either search for a tax professional to guide you through the. Complete, edit or print tax forms instantly.