Form 9465 Mailing Address

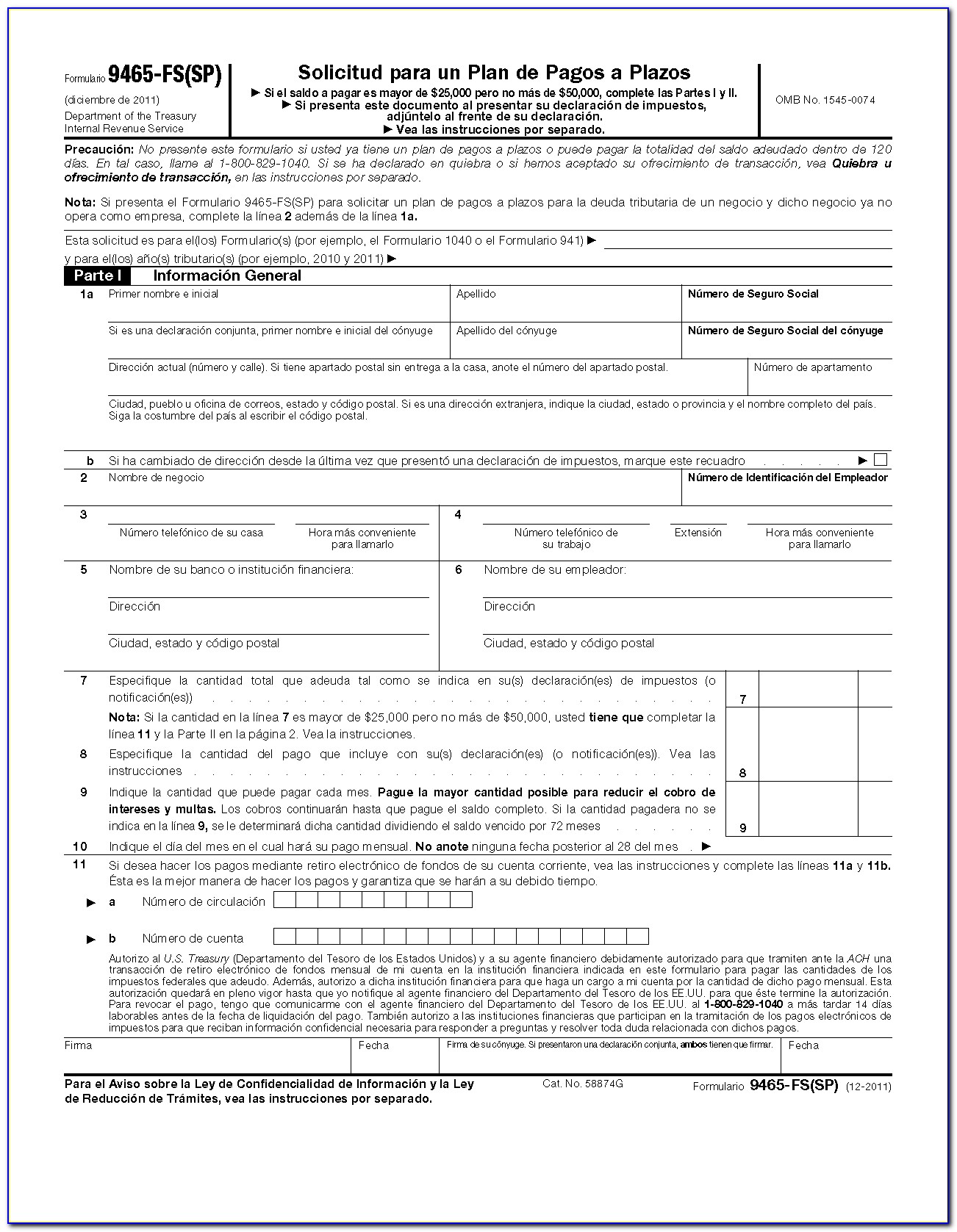

Form 9465 Mailing Address - Web installment agreement request form (rev. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web if you are mailing in your irs form 9465, it depends on where you live. You can reference the irs addresses for form 9465. Some tax prep software also allows you to file form 9465. Look for the forms menu, select this form, and fill it out. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice). Most installment agreements meet our streamlined installment agreement criteria. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Internal revenue service see separate instructions. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Some tax prep software also allows you to file form 9465. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. The maximum term for a streamlined agreement is 72 months. Most installment agreements meet our streamlined installment agreement criteria.

Where to file:attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet. Some tax prep software also allows you to file form 9465. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). *permanent residents of guam or the virgin islands cannot use form 9465. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. December 2018) go to www.irs.gov/form9465 for instructions and the latest information. The maximum term for a streamlined agreement is 72 months. Web if you are mailing in your irs form 9465, it depends on where you live. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you).

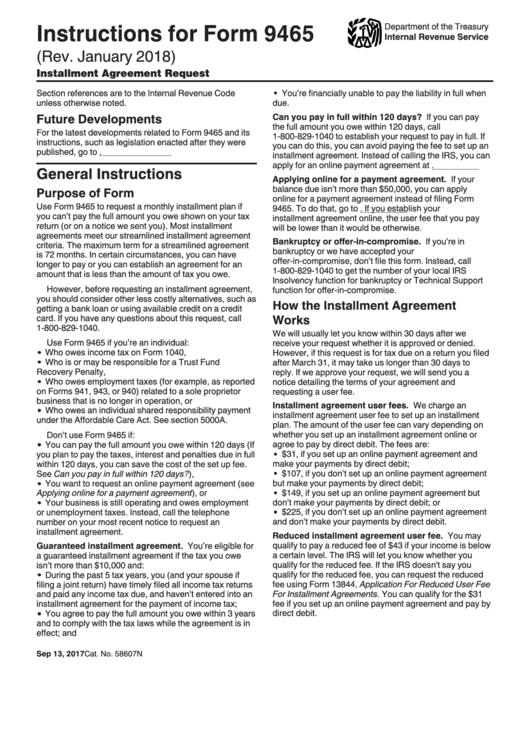

Instructions For Form 9465 Installment Agreement Request printable

Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. You can reference the irs addresses for form.

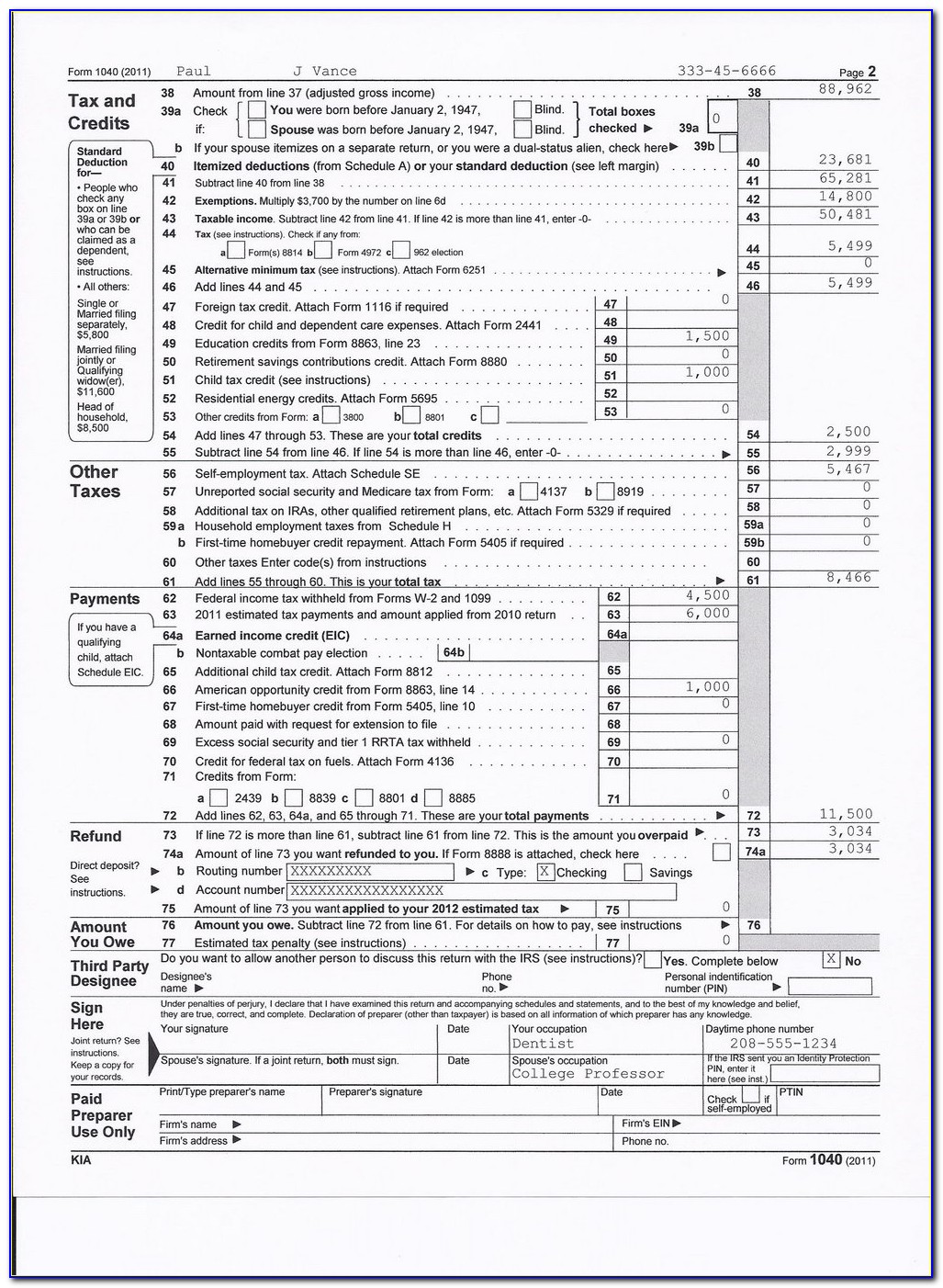

Sample Tax Form 1040ez Valid 35 Beautiful Irs Installment

Most installment agreements meet our streamlined installment agreement criteria. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Internal revenue service see separate instructions. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you.

Irs Installment Agreement Form 433 D Mailing Address Form Resume

December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Where to file:attach the forms 9465 to the front side of tax return and then send it to address given in the tax return booklet. The maximum term for a streamlined agreement is 72 months. Web purpose of form use form 9465 to request a monthly installment agreement (payment.

Irs Form 9465 Installment Agreement Request Software Free Download

If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Internal revenue service see separate instructions. All individual taxpayers who mail form 9465 separate from their returns and who file a.

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself.

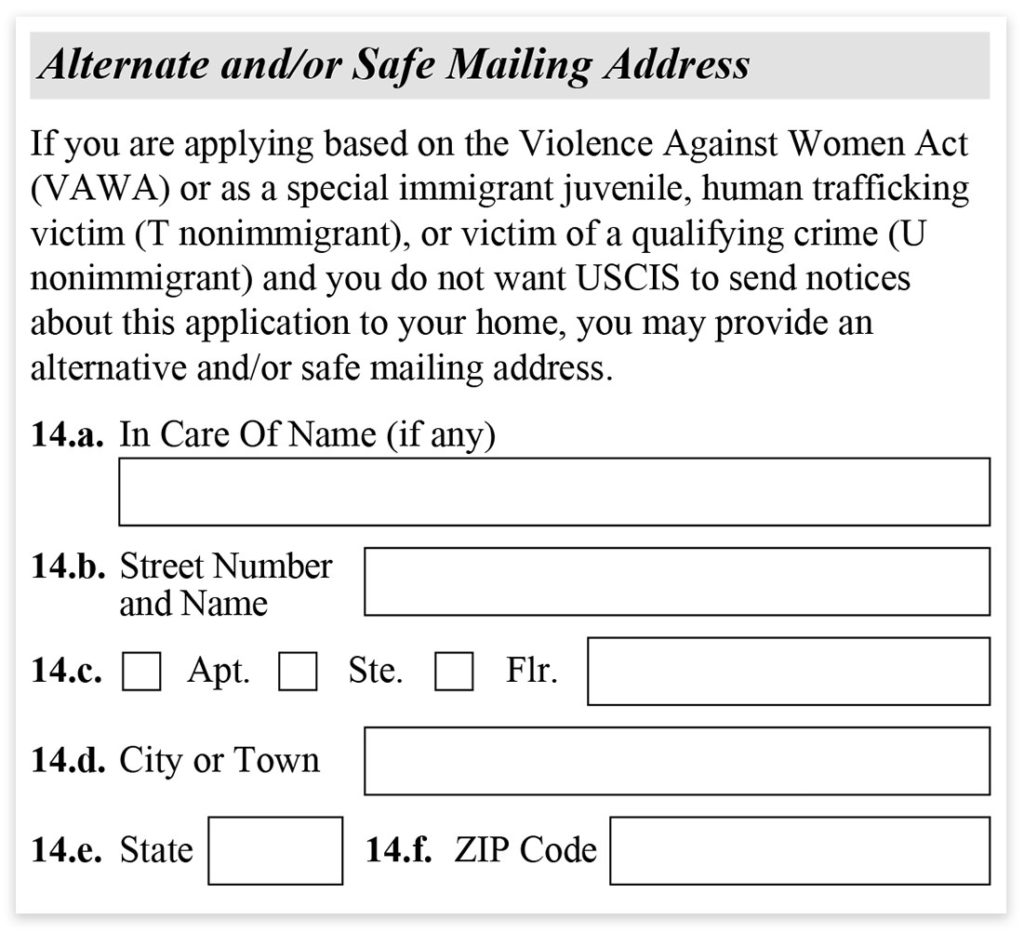

Form I485 Step by Step Instructions SimpleCitizen

The maximum term for a streamlined agreement is 72 months. Look for the forms menu, select this form, and fill it out. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Internal revenue service see separate instructions. Some tax prep software also allows you to.

Federal Tax Form 941 Mailing Address prosecution2012

December 2018) go to www.irs.gov/form9465 for instructions and the latest information. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Most installment agreements meet our streamlined installment agreement criteria. Web if you are mailing in your irs form 9465, it depends on where you live. All individual.

Federal Tax Form 941 Mailing Address prosecution2012

If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Internal revenue service see separate instructions. Web attach form 9465 to the front of your return and send it to the.

Irs Payment Form 9465 Form Resume Examples EvkBqoxO2d

Web if you are mailing in your irs form 9465, it depends on where you live. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice). *permanent residents of guam or the.

Details about Never alone

*permanent residents of guam or the virgin islands cannot use form 9465. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Internal revenue service see separate instructions. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount.

Web Attach Form 9465 To The Front Of Your Return And Send It To The Address Shown In Your Tax Return Booklet.

You can reference the irs addresses for form 9465. All individual taxpayers who mail form 9465 separate from their returns and who file a form 1040 with schedule c, e, or f should mail their form 9465 to the address for their state shown in this table. Web you can find a list of addresses by state on the form 9465 instruction page on the irs website under the section “where to file.” the installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe.

Web If You Are Mailing In Your Irs Form 9465, It Depends On Where You Live.

Web installment agreement request form (rev. Some tax prep software also allows you to file form 9465. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Look for the forms menu, select this form, and fill it out.

Where To File:attach The Forms 9465 To The Front Side Of Tax Return And Then Send It To Address Given In The Tax Return Booklet.

*permanent residents of guam or the virgin islands cannot use form 9465. Internal revenue service see separate instructions. Most installment agreements meet our streamlined installment agreement criteria. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you).

December 2018) Go To Www.irs.gov/Form9465 For Instructions And The Latest Information.

The maximum term for a streamlined agreement is 72 months. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Address city, state, and zip code address city, state, and zip code your work phone number best time for us to call 10 enter the amount of any payment you are making with your tax return (or notice).