Form 990 Ez Schedule G

Form 990 Ez Schedule G - Amounts in fees paid to or fees withheld complete and attach schedule g (form by the fundraiser for its. Get ready for tax season deadlines by completing any required tax forms today. Telephone number group exemption number accounting method: How do i generate form 990 schedule g? Ad access irs tax forms. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Cash accrual other (specify) check if the. Web if the sum of the organization's gross income and contributions from fundraising events (including the amounts reported on line 6b and in the parentheses for line 6b) is greater. Rate (4.8 / 5) 76 votes. Web schedule g is used to report professional fundraising services, fundraising events, and gaming.

Amounts in fees paid to or fees withheld complete and attach schedule g (form by the fundraiser for its. How to complete schedule g? Cash accrual other (specify) check if the. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Web go to www.irs.gov/form990ez for instructions and the latest information. How do i generate form 990 schedule g? What is the purpose of schedule g? Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web solved•by intuit•9•updated may 30, 2023.

Amounts in fees paid to or fees withheld complete and attach schedule g (form by the fundraiser for its. Who must file schedule g? Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Ad access irs tax forms. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Organizations that report more than $15,000 of expenses for. Telephone number group exemption number accounting method: Rate (4.8 / 5) 76 votes. Cash accrual other (specify) check if the.

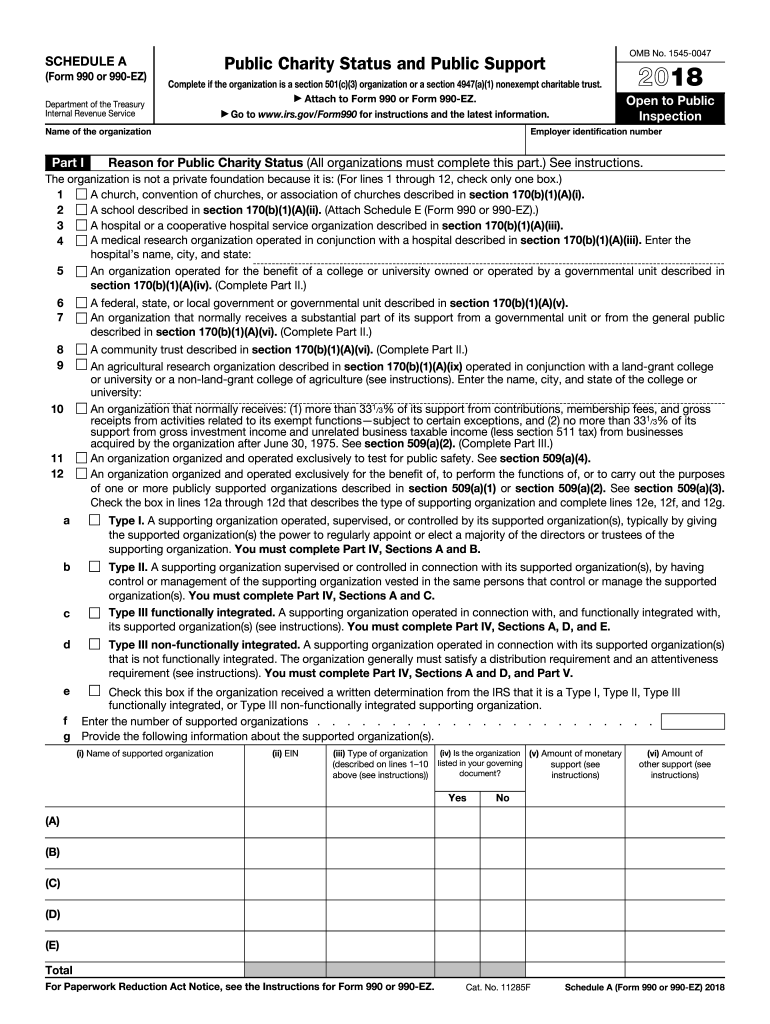

2018 Schedule A Form 990 Or 990 Ez Fill Out and Sign Printable PDF

Who must file schedule g? Web solved•by intuit•9•updated may 30, 2023. Web what is schedule g? Complete, edit or print tax forms instantly. Amounts in fees paid to or fees withheld complete and attach schedule g (form by the fundraiser for its.

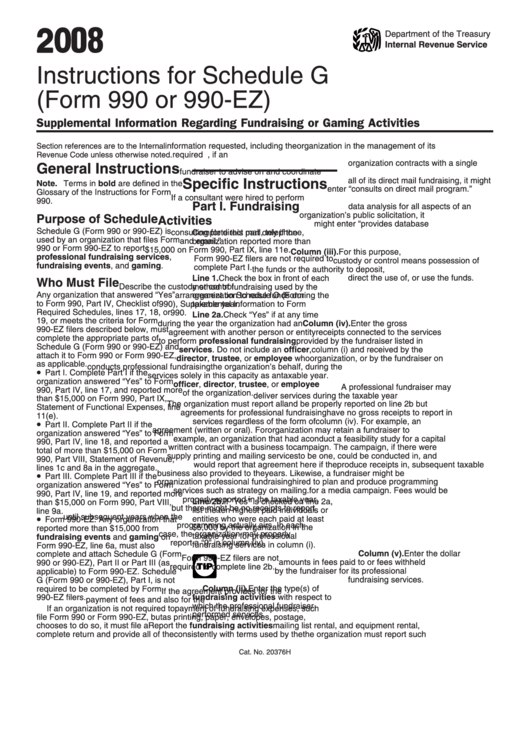

2008 Instructions For Schedule G (Form 990 Or 990Ez) printable pdf

Complete, edit or print tax forms instantly. Web go to www.irs.gov/form990ez for instructions and the latest information. Web solved•by intuit•9•updated may 30, 2023. Ad get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

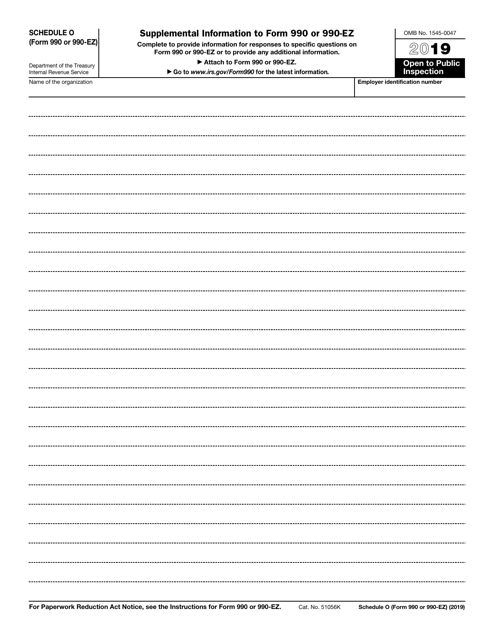

2018 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Telephone number group exemption number accounting method: How do i generate form 990 schedule g? Complete, edit or print tax forms instantly. Web solved•by intuit•9•updated may 30, 2023. Get ready for tax season deadlines by completing any required tax forms today.

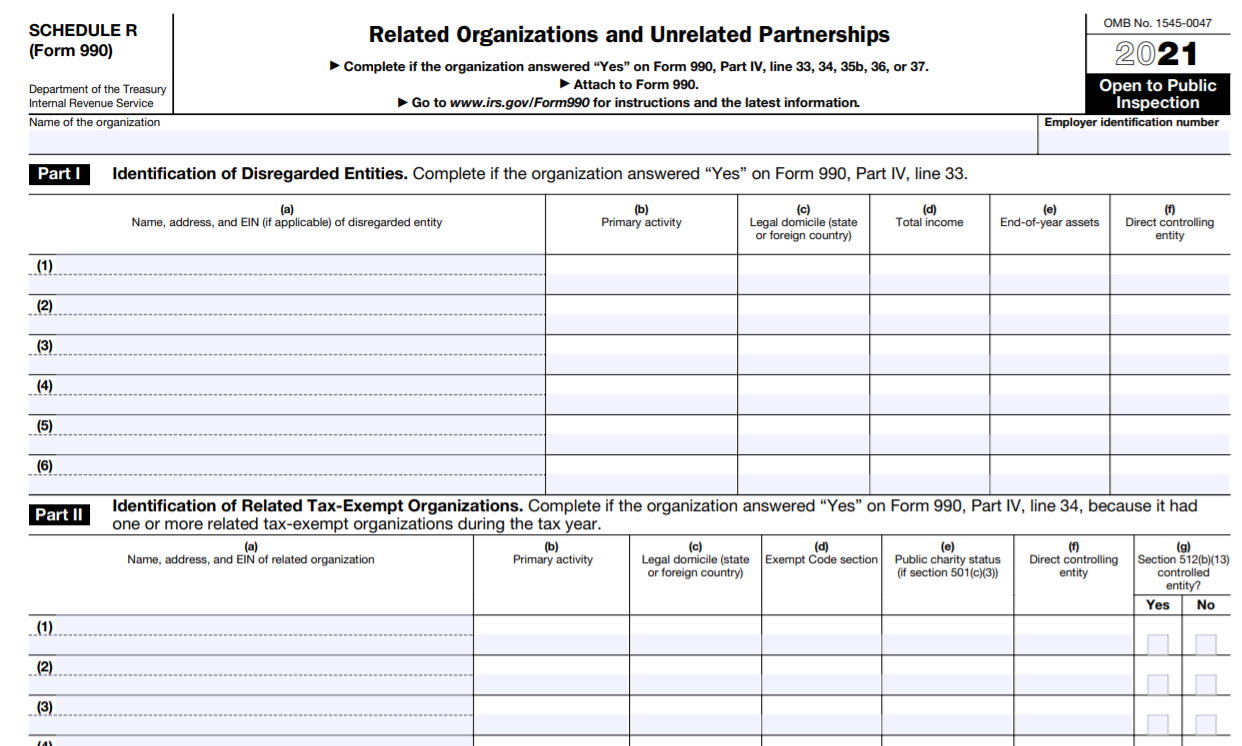

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

Who must file schedule g? Web if the sum of the organization's gross income and contributions from fundraising events (including the amounts reported on line 6b and in the parentheses for line 6b) is greater. Complete if the organization answered “yes” to form 990, part iv, line 18, or reported more than. How do i generate form 990 schedule g?.

IRS Form 990 (990EZ) Schedule O Download Fillable PDF or Fill Online

How do i generate form 990 schedule g? Ad get ready for tax season deadlines by completing any required tax forms today. Telephone number group exemption number accounting method: Web what is schedule g? How to complete schedule g?

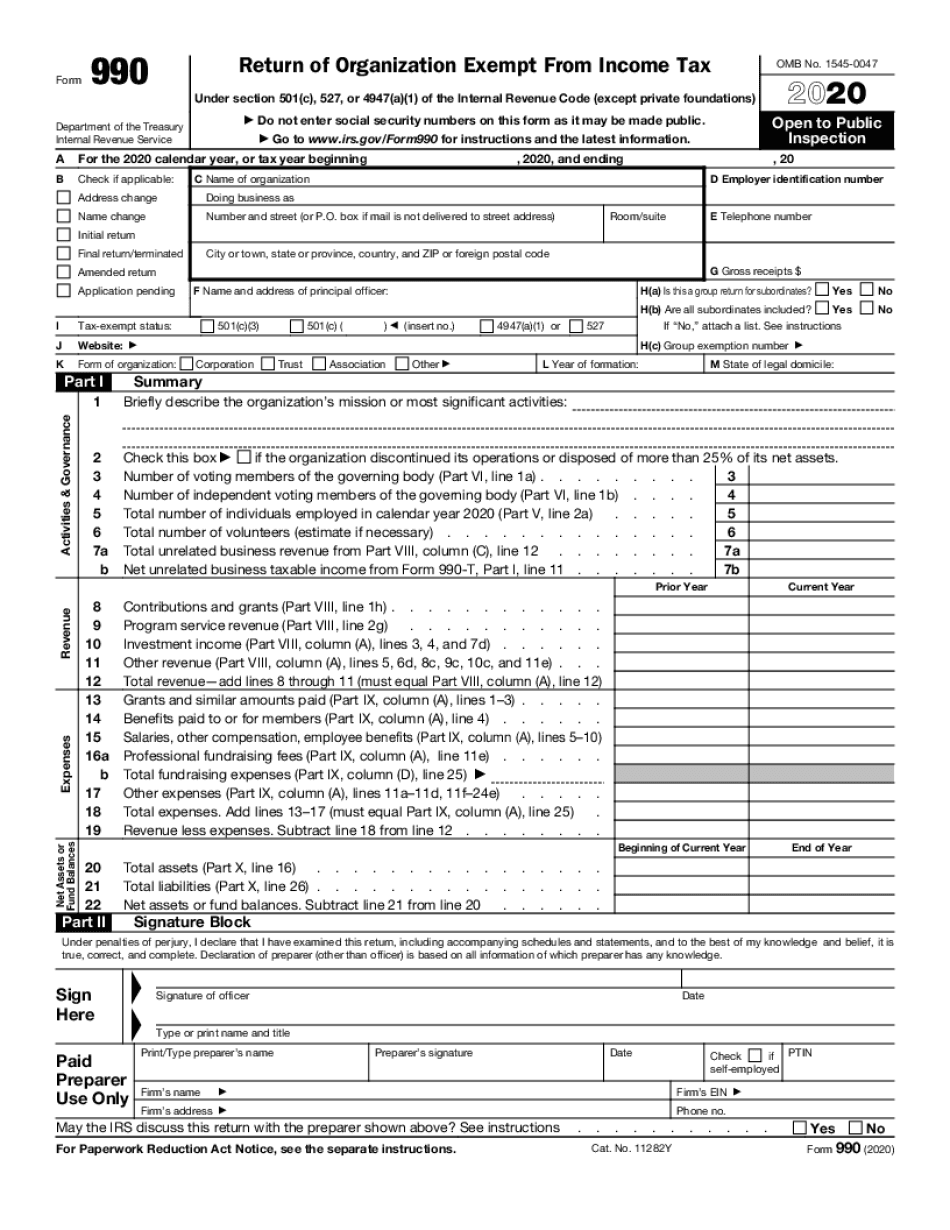

990 ez form Fill Online, Printable, Fillable Blank

Web glossary of the instructions for form 990. Web if the sum of the organization's gross income and contributions from fundraising events (including the amounts reported on line 6b and in the parentheses for line 6b) is greater. Organizations that report more than $15,000 of expenses for. Web solved•by intuit•9•updated may 30, 2023. Web go to www.irs.gov/form990ez for instructions and.

Download Instructions for IRS Form 990, 990EZ Schedule G Supplemental

Cash accrual other (specify) check if the. Organizations that report more than $15,000 of expenses for. Get ready for tax season deadlines by completing any required tax forms today. Web go to www.irs.gov/form990ez for instructions and the latest information. Ad get ready for tax season deadlines by completing any required tax forms today.

Printable Form 990ez 2019 Printable Word Searches

Ad get ready for tax season deadlines by completing any required tax forms today. How do i generate form 990 schedule g? Schedule g (form 990) 2022 omb no. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

What is the purpose of schedule g? Ad get ready for tax season deadlines by completing any required tax forms today. Who must file schedule g? Complete if the organization answered “yes” to form 990, part iv, line 18, or reported more than. Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community.

IRS Form 990 Schedule R Instructions Related Organizations and

Web schedule g is used to report professional fundraising services, fundraising events, and gaming. Rate (4.8 / 5) 76 votes. Ad access irs tax forms. Web if the sum of the organization's gross income and contributions from fundraising events (including the amounts reported on line 6b and in the parentheses for line 6b) is greater. Schedule a (form 990) 2022.

Complete, Edit Or Print Tax Forms Instantly.

Complete, edit or print tax forms instantly. What is the purpose of schedule g? Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

Cash Accrual Other (Specify) Check If The.

Schedule a (form 990) 2022 teea0401l 09/09/22 northwest ct community. Web what is schedule g? Web solved•by intuit•9•updated may 30, 2023. Organizations that report more than $15,000 of expenses for.

How To Complete Schedule G?

Rate (4.8 / 5) 76 votes. Amounts in fees paid to or fees withheld complete and attach schedule g (form by the fundraiser for its. Who must file schedule g? Web if the sum of the organization's gross income and contributions from fundraising events (including the amounts reported on line 6b and in the parentheses for line 6b) is greater.

Web Go To Www.irs.gov/Form990Ez For Instructions And The Latest Information.

Schedule g (form 990) 2022 omb no. Schedule a (form 990) 2021 (all organizations must complete this part.) see. Telephone number group exemption number accounting method: Schedule a (form 990) 2022 (all organizations must complete this part.) see.