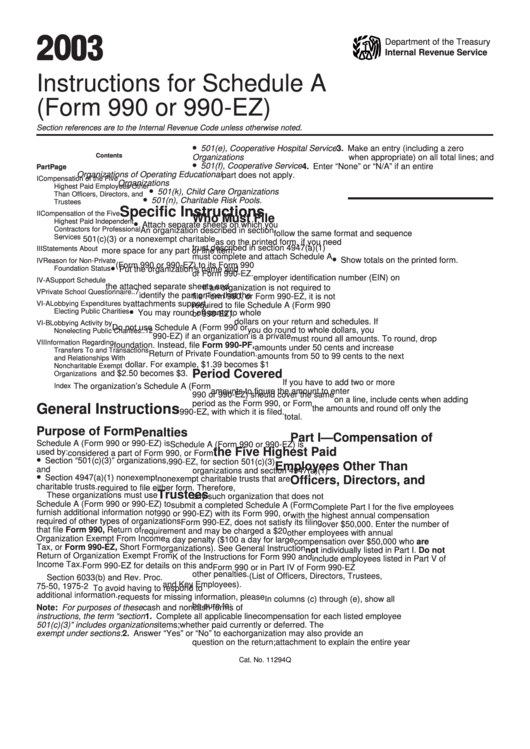

Form 990 Schedule I Instructions

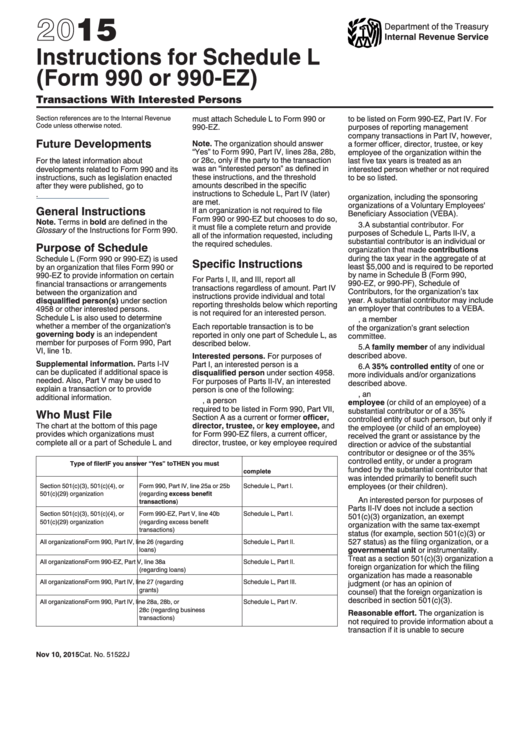

Form 990 Schedule I Instructions - Also, organizations with gross receipts greater than or equal to $200,000 or total assets. Example—list of donors other than governmental. Ad access irs tax forms. Web organizations listed on schedule i (form 990), part ii, line 1, that aren’t described on line. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). If you checked 12d of part i, complete sections a and d, and complete part v.). A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. In addition, they contain the following items to help. (column (b) must equal form 990, part x, col. See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those.

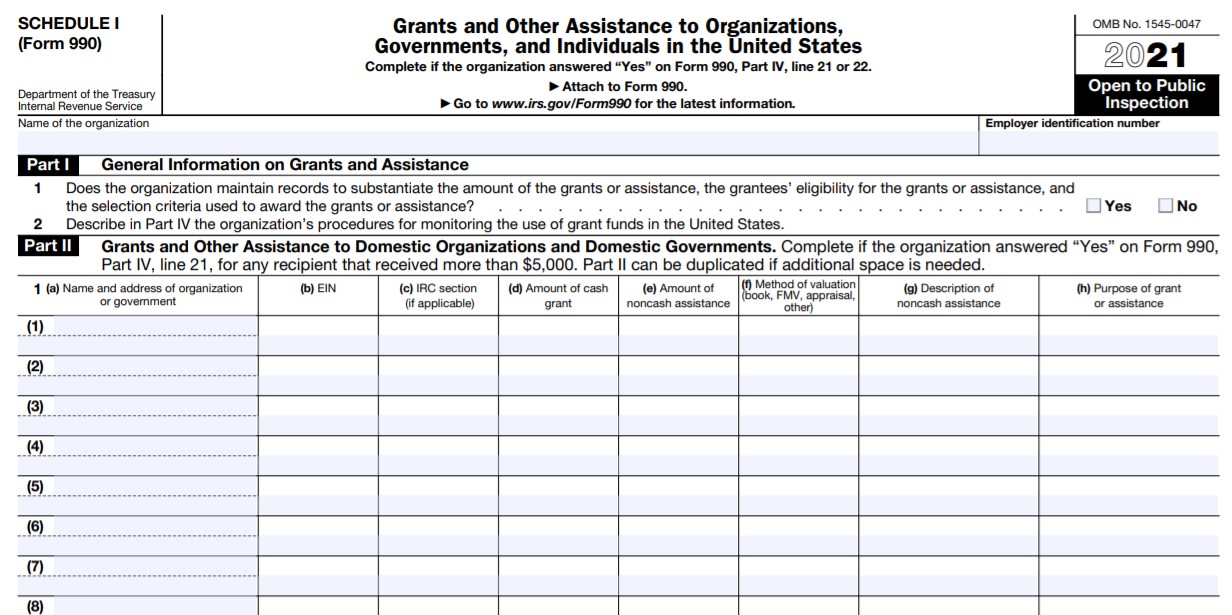

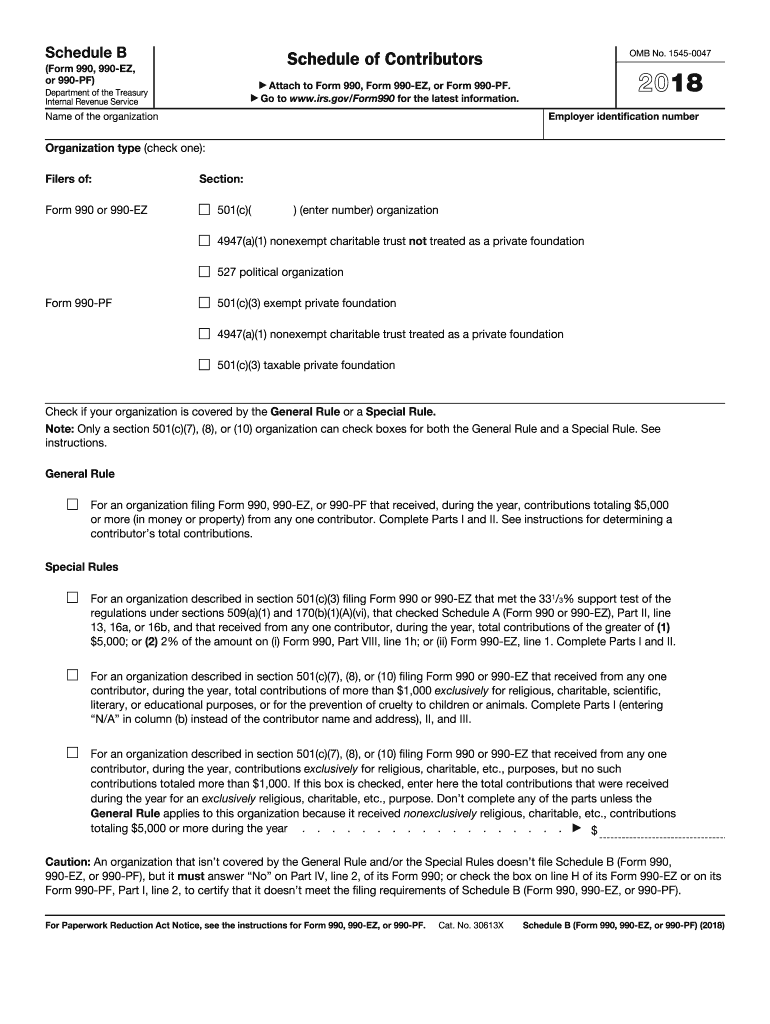

Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information regarding grants and other assistance. Web report error it appears you don't have a pdf plugin for this browser. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev. Complete part vi of form 990. If you checked 12d of part i, complete sections a and d, and complete part v.). (column (b) must equal form 990, part x, col. Web change on schedule o. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. Get ready for tax season deadlines by completing any required tax forms today.

Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information regarding grants and other assistance. If you checked 12d of part i, complete sections a and d, and complete part v.). Web change on schedule o. Example—list of donors other than governmental. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: In addition, they contain the following items to help. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

IRS 990 Schedule A 20202022 Fill out Tax Template Online

Web — revisions to the instructions for schedule e of the form 990 related to the new online method for publication of the racially nondiscriminatory policy provided for in rev. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

Complete part vi of form 990. Complete, edit or print tax forms instantly. Also, organizations with gross receipts greater than or equal to $200,000 or total assets. Web report error it appears you don't have a pdf plugin for this browser. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

Form 990 (Schedule H) Hospitals (2014) Free Download

Web change on schedule o. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Example—list of donors other than governmental..

Instructions For Schedule A (Form 990 Or 990Ez) 2003 printable pdf

Reason for public charity status. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web organizations listed on schedule i (form 990), part ii, line 1, that aren’t described on line. Get ready for tax season deadlines by completing any required tax forms today. Web — revisions to the instructions for schedule e of the form 990.

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Ad access irs tax forms. Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information regarding grants and other assistance. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. A section 501(c)(3) or section 4947(a)(1).

Instructions For Schedule L (Form 990 Or 990Ez) Transactions With

Get ready for tax season deadlines by completing any required tax forms today. (column (b) must equal form 990, part x, col. Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. In addition, they contain the following items to help. Web schedule d.

Form 990 Schedule O Fill Out and Sign Printable PDF Template signNow

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; In addition, they contain the following items to help. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax.

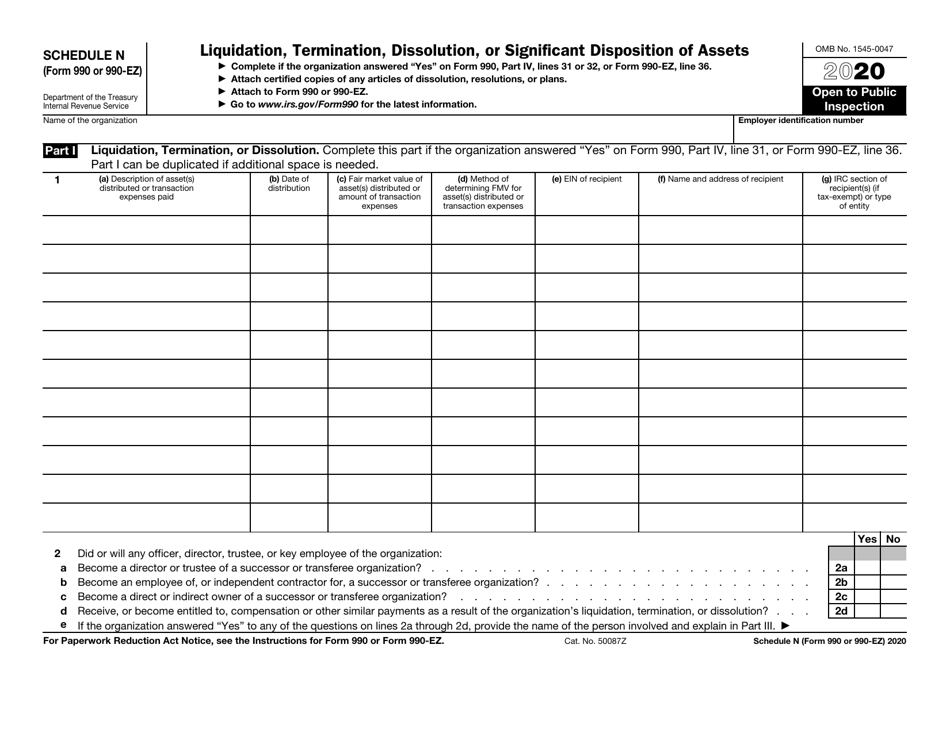

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Web report error it appears you don't have a pdf plugin for this browser. Ad access irs tax forms. Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information.

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. In addition, they contain the following items to help. Reason for public charity status. Web organizations listed on schedule i (form 990), part ii, line 1, that aren’t described on line.

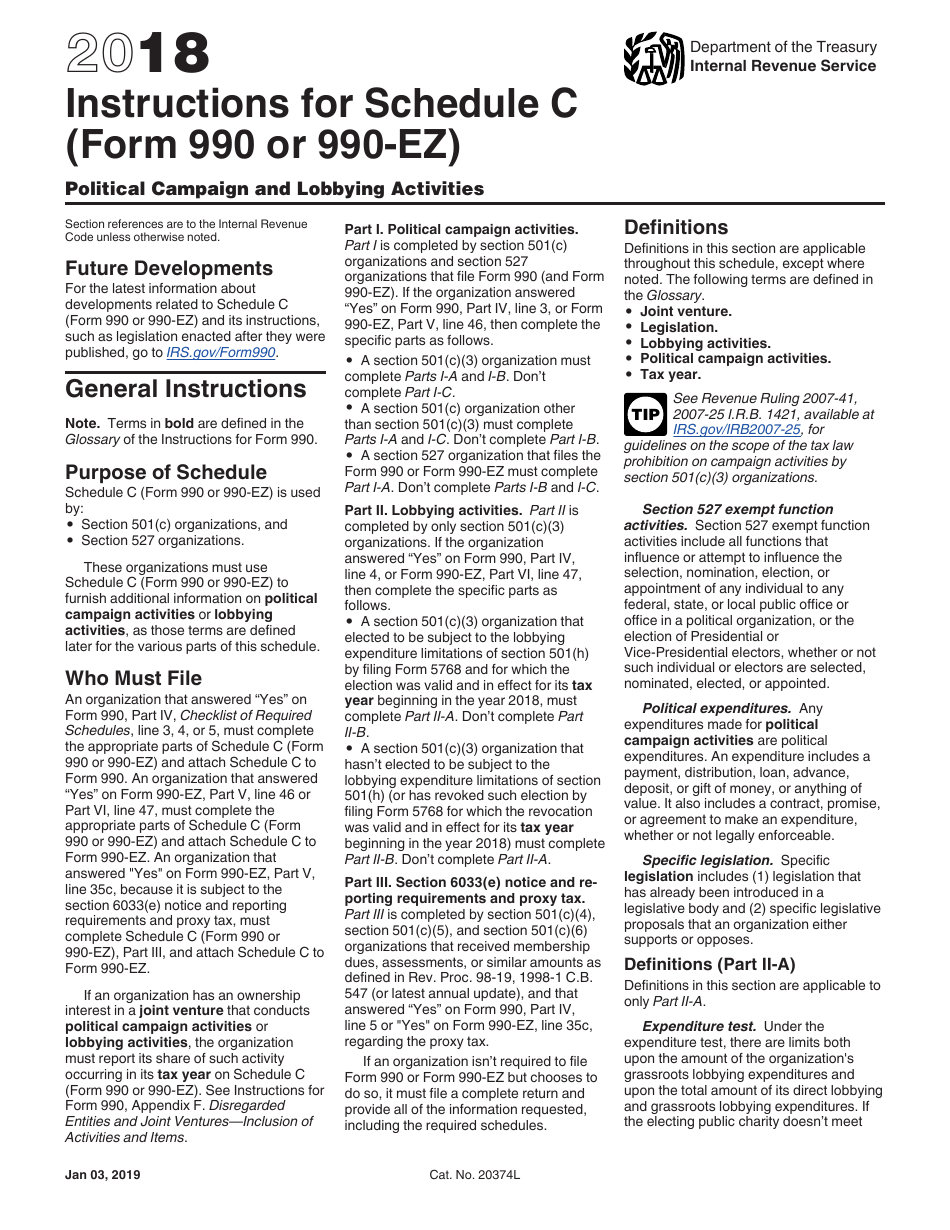

Download Instructions for IRS Form 990, 990EZ Schedule C Political

Web change on schedule o. Schedule a (form 990) 2022 (all organizations must complete this part.) see. A section 501(c)(3) or section 4947(a)(1) organization should refer to the instructions for. Example—list of donors other than governmental. Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

A Section 501(C)(3) Or Section 4947(A)(1) Organization Should Refer To The Instructions For.

Web june 2021 in brief the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. In addition, they contain the following items to help. Web change on schedule o.

Reason For Public Charity Status.

Web for the latest information about developments related to schedule g (form 990) and its instructions, such as legislation enacted after they were published, go to. Ad access irs tax forms. Web organizations listed on schedule i (form 990), part ii, line 1, that aren’t described on line. Also, organizations with gross receipts greater than or equal to $200,000 or total assets.

Web Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

Web nonprofit organizations that file form 990 may be required to include schedule i for reporting additional information regarding grants and other assistance. Web see the instructions for schedule l (form 990), transactions with interested persons, and complete schedule l (form 990) (if required). Schedule a (form 990) 2022 (all organizations must complete this part.) see. (column (b) must equal form 990, part x, col.

Web — Revisions To The Instructions For Schedule E Of The Form 990 Related To The New Online Method For Publication Of The Racially Nondiscriminatory Policy Provided For In Rev.

See instructions did the organization have unrelated business gross income of $1,000 or more during the year from business activities (such as those. Example—list of donors other than governmental. Complete part vi of form 990. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990;