Form 990 Schedule I

Form 990 Schedule I - The purpose is to show financial information from a group of entities and give the irs an easy way to tell. Web tax filings by year. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Instructions for form 990 pdf. Read the irs instructions for 990 forms. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Public charity status and public support pdf. Web purpose of schedule schedule i (form 990) is used by an organization that files form 990 to provide information on grants and other assistance made by the filing organization. Use california amounts where there are california and federal differences. For most grantmakers, you can find 990s for the last 10 years.

Complete, edit or print tax forms instantly. Web you can find 990s from the last 3 years. Use california amounts where there are california and federal differences. Compensation information for certain officers, directors, individual trustees, key employees, and highest. For most grantmakers, you can find 990s for the last 10 years. Web tax filings by year. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Get ready for tax season deadlines by completing any required tax forms today. Part iii can be duplicated if.

For other organizations that file. For most grantmakers, you can find 990s for the last 10 years. Example—list of donors other than governmental. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Complete, edit or print tax forms instantly. (column (b) must equal form 990, part x, col. Read the irs instructions for 990 forms. Compensation information for certain officers, directors, individual trustees, key employees, and highest. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Read the irs instructions for 990 forms.

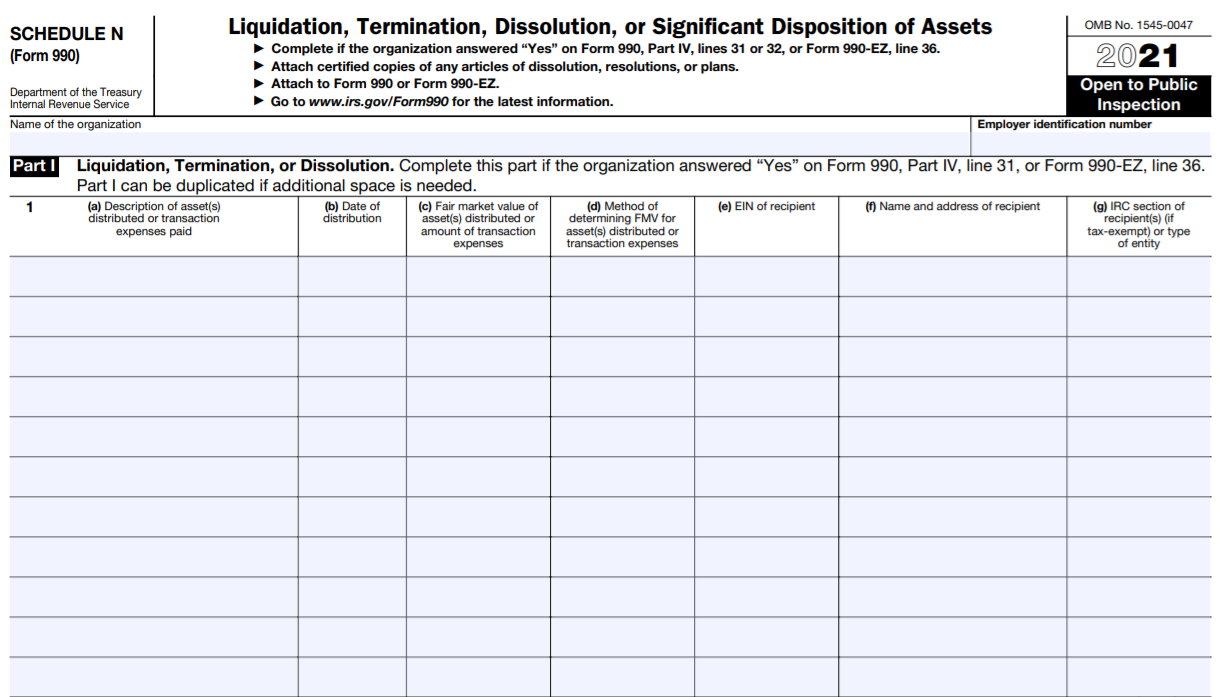

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. For other organizations that file. Web tax filings by year. Web organizations that file form 990 use this schedule to report: Example—list of donors other than governmental.

Form 990 (Schedule H) Hospitals (2014) Free Download

(column (b) must equal form 990, part x, col. Public charity status and public support pdf. Web schedule i (form 990) 2022 schedule i (form 990) 2022 page complete if the organization answered yes on form 990, part iv, line 22. Ad access irs tax forms. Use california amounts where there are california and federal differences.

Fillable IRS Form 990 Schedule A 2019 2020 Online PDF Template

Compensation information for certain officers, directors, individual trustees, key employees, and highest. Form 990, schedule i grants and other assistance. Web schedule i (form 990) 2022 schedule i (form 990) 2022 page complete if the organization answered yes on form 990, part iv, line 22. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of.

Editable IRS Form 990 Schedule G 2018 2019 Create A Digital

Web use schedule i (form 990) to report amounts over $5,000 paid by the black lung trust to or for the benefit of miners or their beneficiaries other than amounts included on. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form.

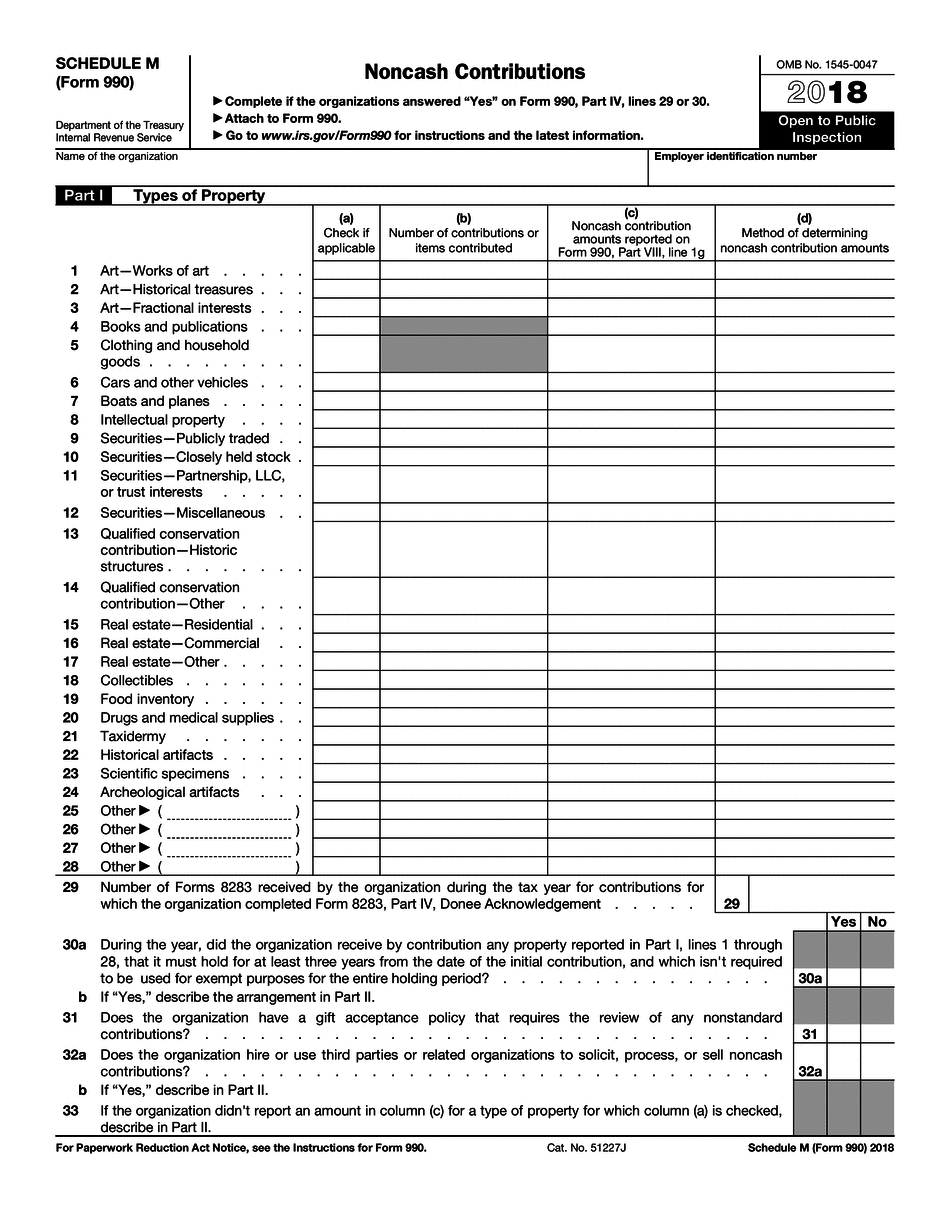

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

Read the irs instructions for 990 forms. Web you can find 990s from the last 3 years. Public charity status and public support pdf. For most grantmakers, you can find 990s for the last 10 years. Use california amounts where there are california and federal differences.

Form 990 (Schedule I) Grants and Other Assistance to Organizations

Web schedule a (form 990) using the cash method, it should report in the 2018 through 2021 columns on the 2022 schedule a (form 990) the same amounts that it reported in the. Part iii can be duplicated if. Public charity status and public support pdf. Web you can find 990s from the last 3 years. Form 990, schedule i.

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a.

Form 990 (Schedule J2) Continuation Sheet (2009) Free Download

Read the irs instructions for 990 forms. On this page you may download the 990 series filings on record for 2021. Web schedule a (form 990) using the cash method, it should report in the 2018 through 2021 columns on the 2022 schedule a (form 990) the same amounts that it reported in the. Web nonprofit explorer has organizations claiming.

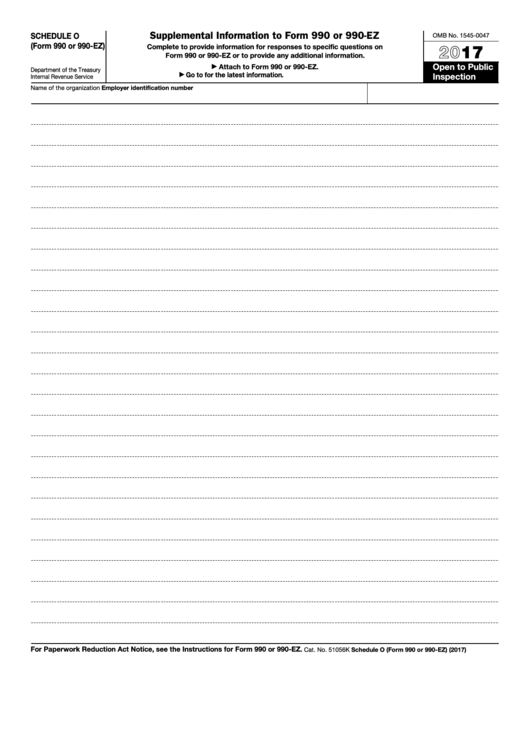

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Web purpose of schedule schedule i (form 990) is used by an organization that files form 990 to provide information on grants and other assistance made by the filing organization. Web schedule i (form 990) 2022 schedule i (form 990) 2022 page complete if the organization answered yes on form 990, part iv, line 22. Read the irs instructions for.

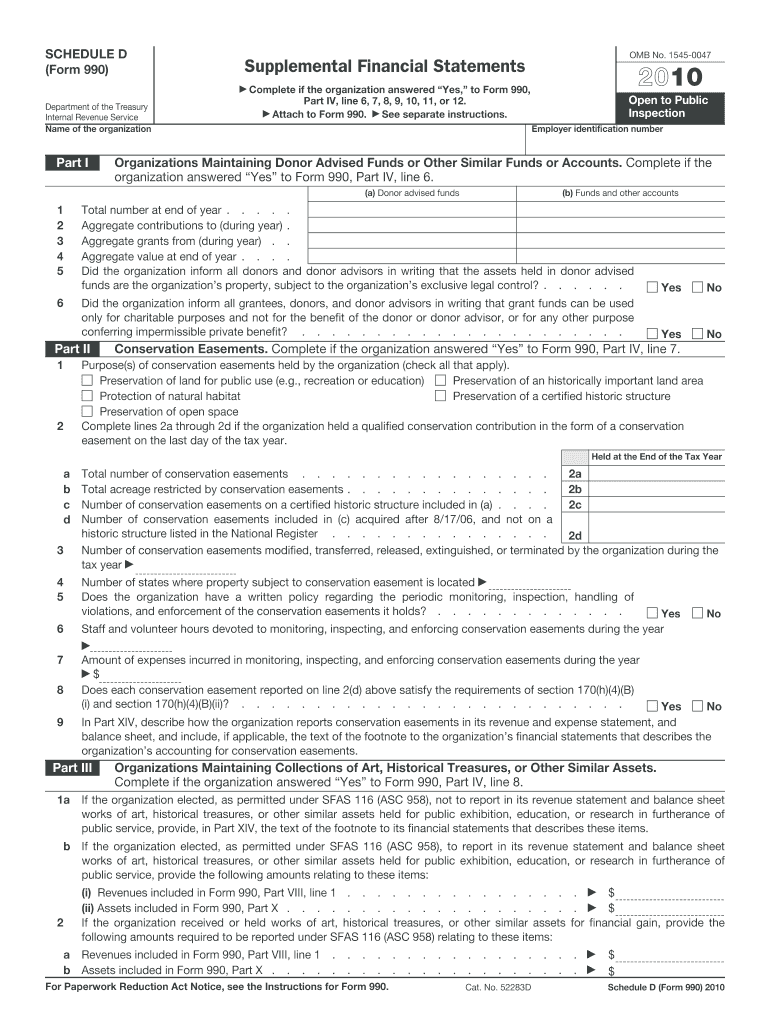

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

On this page you may download the 990 series filings on record for 2021. Ad access irs tax forms. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Compensation information for certain officers, directors, individual trustees, key employees, and highest. Complete, edit or print tax forms instantly.

Public Charity Status And Public Support Pdf.

Instructions for form 990 pdf. Read the irs instructions for 990 forms. For other organizations that file. On this page you may download the 990 series filings on record for 2021.

Ad Access Irs Tax Forms.

Example—list of donors other than governmental. (column (b) must equal form 990, part x, col. Part iii can be duplicated if. For most grantmakers, you can find 990s for the last 10 years.

Web Schedule D (Form 990) 2022 Schedule D (Form 990) 2022 Page Total.

Use california amounts where there are california and federal differences. Read the irs instructions for 990 forms. Foundation directory subscription plans also link to 990s. Web form 990 (schedule i), grants and other assistance to organizations, governments, and individuals in the united states pdf.

Compensation Information For Certain Officers, Directors, Individual Trustees, Key Employees, And Highest.

Web you can find 990s from the last 3 years. Get ready for tax season deadlines by completing any required tax forms today. Web schedule i (form 990) 2022 schedule i (form 990) 2022 page complete if the organization answered yes on form 990, part iv, line 22. Complete, edit or print tax forms instantly.