Form 990-T Schedule A

Form 990-T Schedule A - (for lines 1 through 12, check. Ad access irs tax forms. Exempt organizations that file form. Check box if reporting two or more periodicals on a consolidated basis. Name of controlled organization 2. If you checked 12d of part i, complete sections a and d, and complete part v.). The organization is not a private foundation because it is: Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Get ready for tax season deadlines by completing any required tax forms today. Supports current & prior year filings.

Ad access irs tax forms. Go to the input return tab. (column (b) must equal form 990, part x, col. Name of controlled organization 2. Check box if reporting two or more periodicals on a consolidated basis. If 'no' to line 3b,. If you checked 12d of part i, complete sections a and d, and complete part v.). Supports current & prior year filings. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. The organization is not a private foundation because it is:

The organization is not a private foundation because it is: Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Go to the input return tab. (column (b) must equal form 990, part x, col. If 'no' to line 3b,. (for lines 1 through 12, check. Supports current & prior year filings. Exempt organizations that file form. Complete, edit or print tax forms instantly. Name of controlled organization 2.

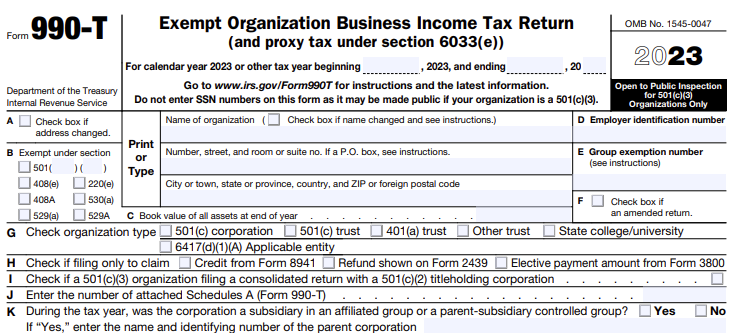

2022 IRS Form 990T Instructions ┃ How to fill out 990T?

Exempt organizations that file form. The organization is not a private foundation because it is: Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form.

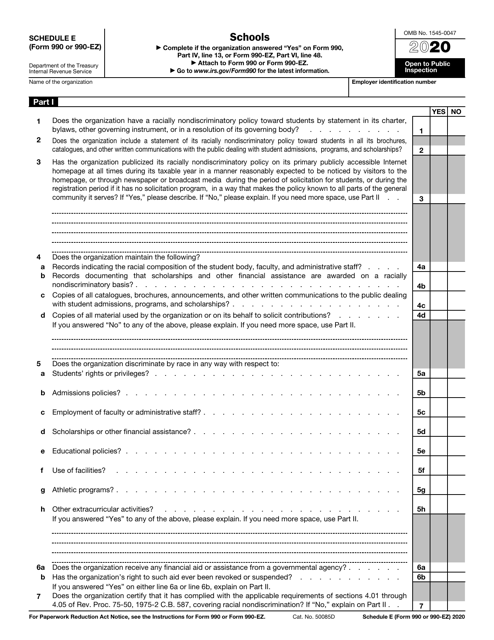

IRS Form 990 (990EZ) Schedule E Download Fillable PDF or Fill Online

(column (b) must equal form 990, part x, col. Name of controlled organization 2. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Check box if reporting two or more periodicals on a consolidated basis. Ad access irs tax forms.

Form 990T Exempt Organization Business Tax Return Form (2014

Supports current & prior year filings. Ad access irs tax forms. Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Exempt organizations that file form. Check box if reporting two or more periodicals on a consolidated.

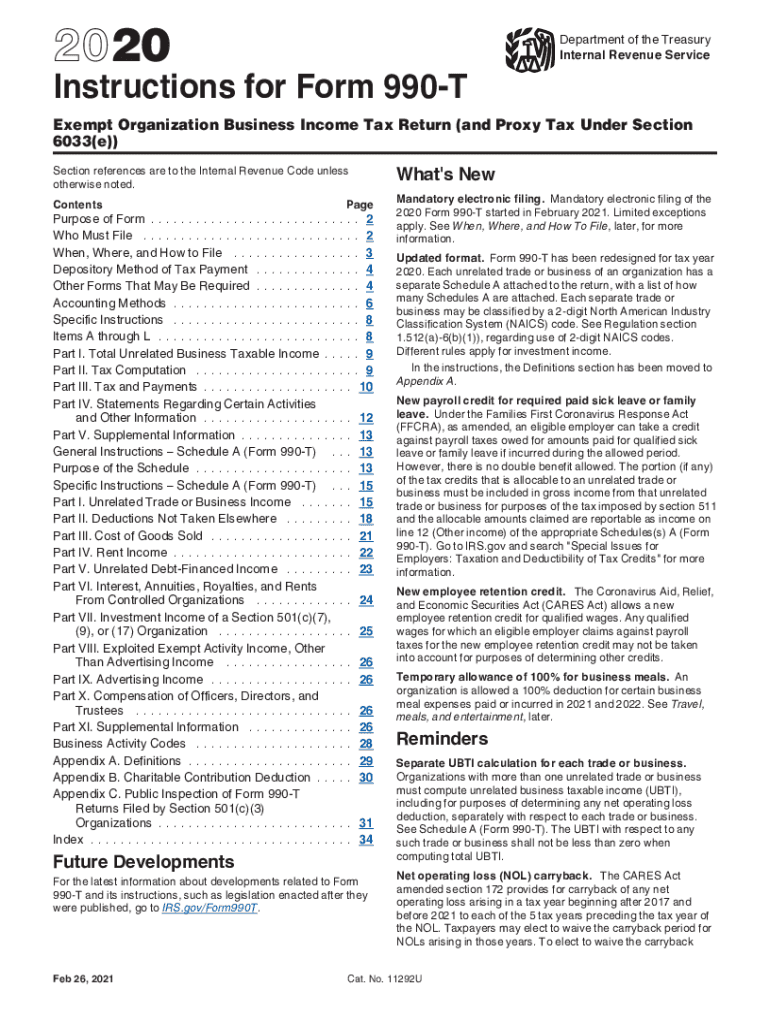

Instructions 990 T Fill Out and Sign Printable PDF Template signNow

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. (column (b) must equal form 990, part x, col. The organization is not a private foundation because.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Web an organization that isn’t covered by the general rule and/or the special rules doesn’t file schedule b (form 990), but it answer no on part iv, line 2, of its form 990; Exempt organizations that file form. Name of controlled organization 2. If 'no' to line 3b,. Once you’ve gathered the necessary information, you can begin filling out your.

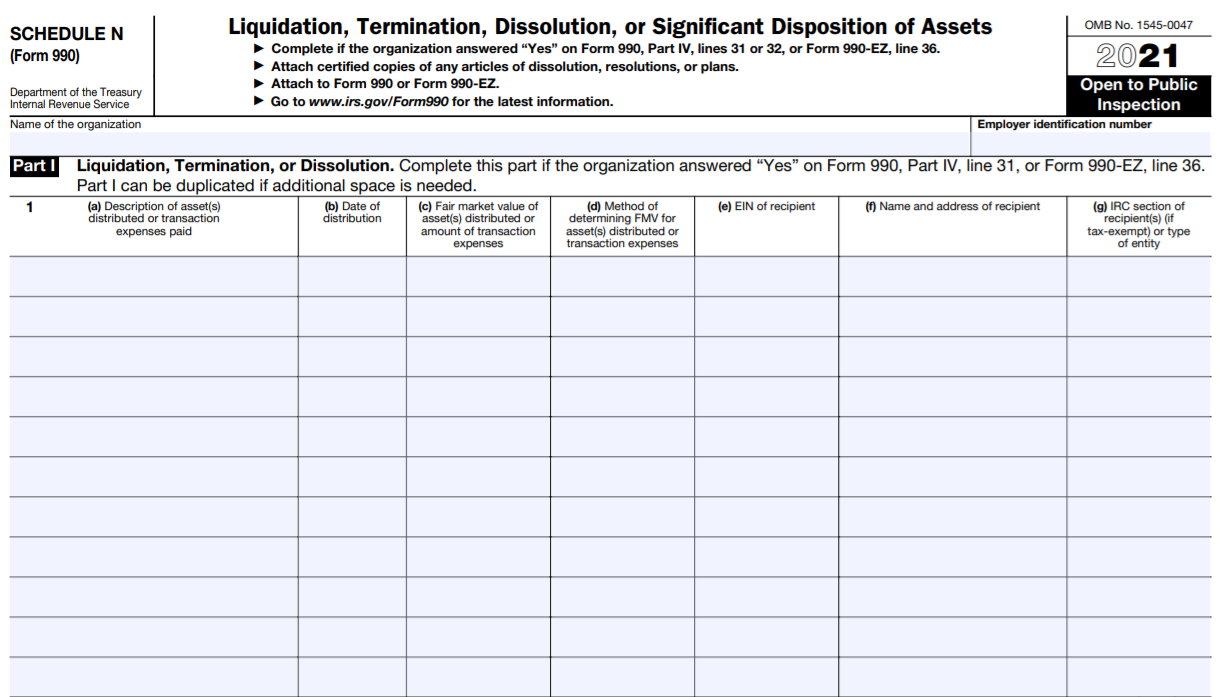

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Get ready for tax season deadlines by completing any required tax forms today. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Name of controlled organization 2. (for lines 1 through 12, check. If 'no' to line 3b,.

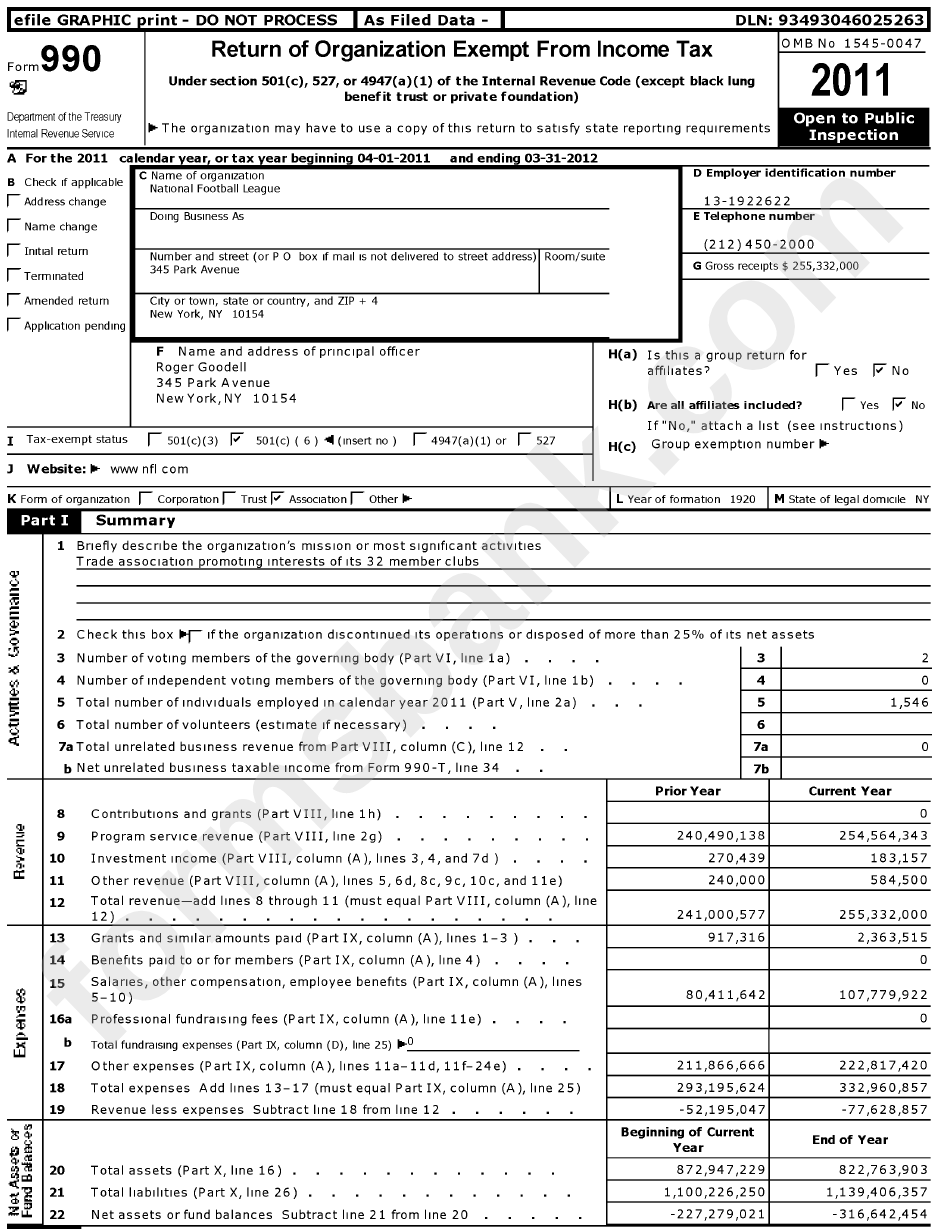

Form 990 2011 Sample printable pdf download

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The organization is not a private foundation because it is: (for lines 1 through 12, check.

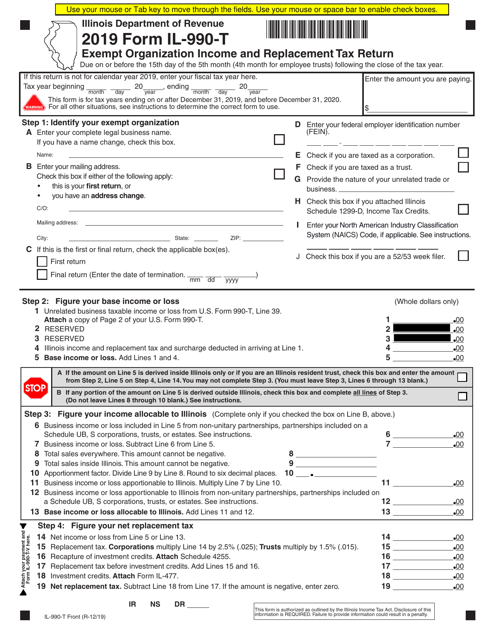

Form IL990T Download Fillable PDF or Fill Online Exempt Organization

The organization is not a private foundation because it is: Ad access irs tax forms. If 'no' to line 3b,. Exempt organizations that file form. Name of controlled organization 2.

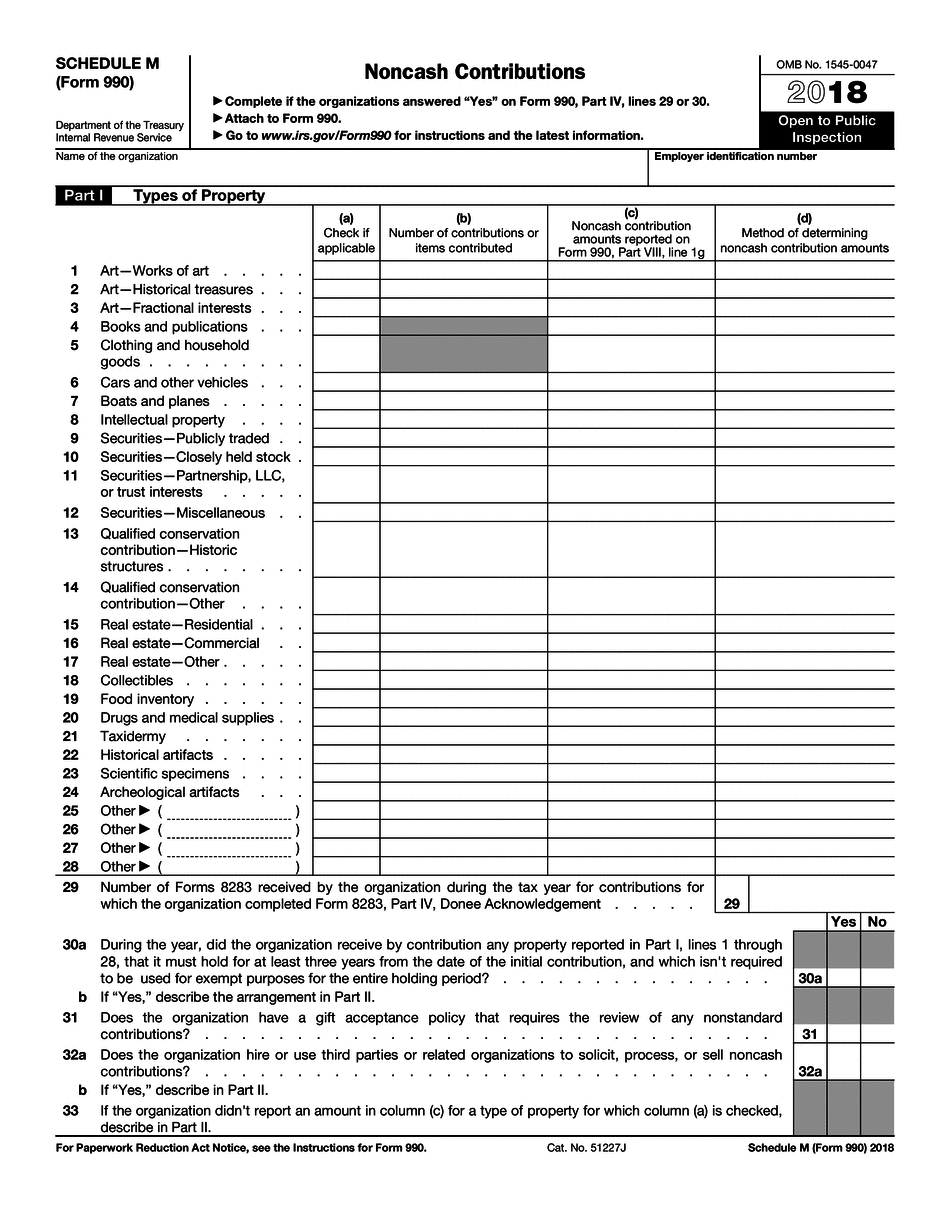

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

Check box if reporting two or more periodicals on a consolidated basis. Supports current & prior year filings. Exempt organizations that file form. Ad access irs tax forms. (column (b) must equal form 990, part x, col.

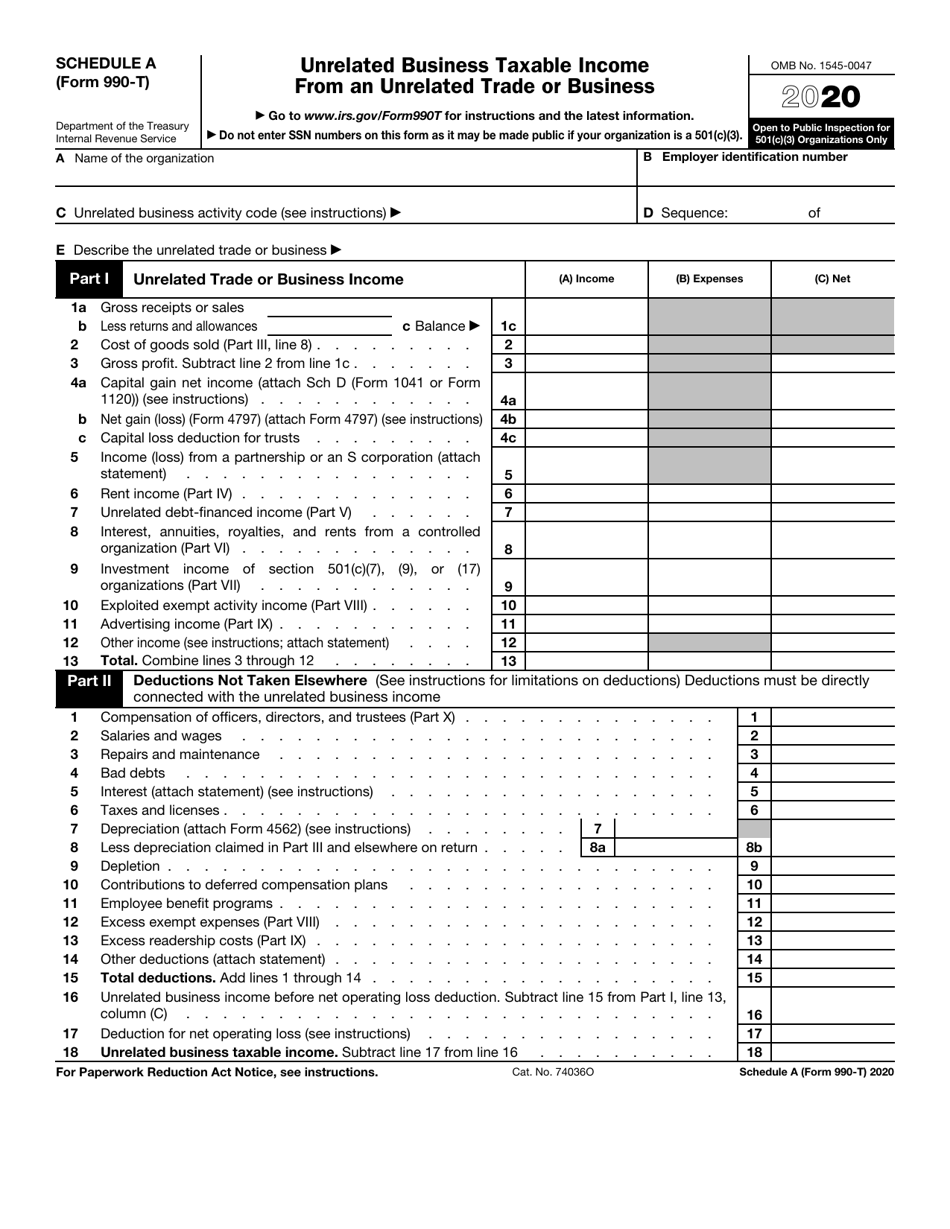

IRS Form 990T Schedule A Download Fillable PDF or Fill Online

Exempt organizations that file form. Go to the input return tab. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. If you checked 12d of part i, complete sections a and d, and complete part v.). (for lines 1 through 12, check.

Go To The Input Return Tab.

Get ready for tax season deadlines by completing any required tax forms today. Once you’ve gathered the necessary information, you can begin filling out your form. Supports current & prior year filings. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions.

Web An Organization That Isn’t Covered By The General Rule And/Or The Special Rules Doesn’t File Schedule B (Form 990), But It Answer No On Part Iv, Line 2, Of Its Form 990;

Name of controlled organization 2. Exempt organizations that file form. If you checked 12d of part i, complete sections a and d, and complete part v.). If 'no' to line 3b,.

(For Lines 1 Through 12, Check.

Check box if reporting two or more periodicals on a consolidated basis. (column (b) must equal form 990, part x, col. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Complete, edit or print tax forms instantly.

Web Schedule D (Form 990) 2022 Schedule D (Form 990) 2022 Page Total.

Ad access irs tax forms. The organization is not a private foundation because it is: