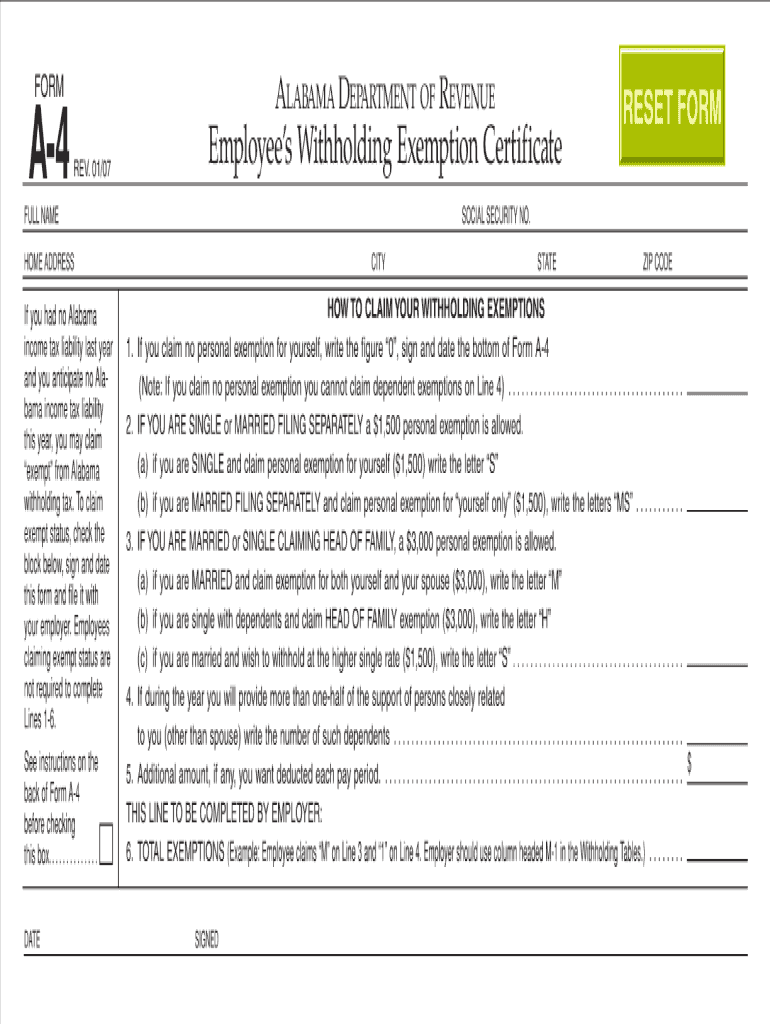

Form A4 Alabama

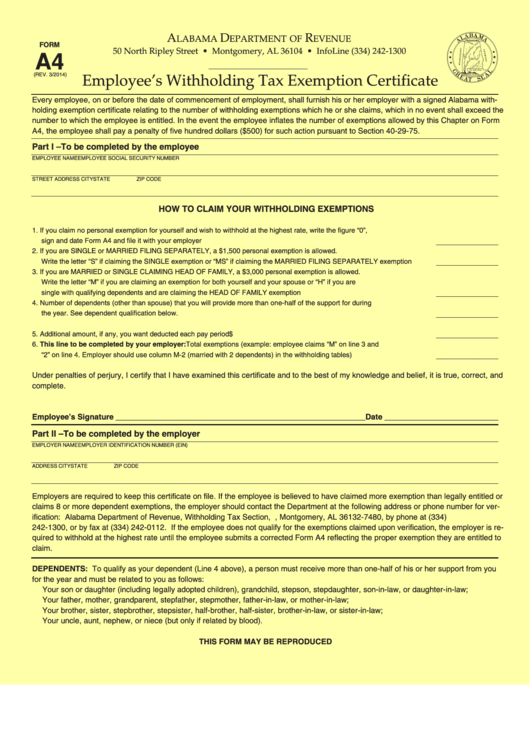

Form A4 Alabama - Insert graphics, crosses, check and text boxes, if needed. Web send alabama a4 form via email, link, or fax. Type text, add images, blackout confidential details, add comments, highlights and more. If you are single or married filing separately, a $1,500 personal exemption is allowed. View all forms, individual income tax faqs. Enter a 0 on this line. Edit your alabama a4 form 2019 printable online. Web employee:complete form a4 and file it with your employer. Ad get ready for tax season deadlines by completing any required tax forms today. How much should i withhold for alabama taxes?

Complete, edit or print tax forms instantly. Complete line 1 if you do not want to claim any exemptions. The number of exemptions claimed may not exceed the number of exemptions to which. Type text, add images, blackout confidential details, add comments, highlights and more. Web send alabama a4 form via email, link, or fax. If an employee is believed to have claimed more exemptions than that which they are legally entitled to claim, the department should be notified. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. You can also download it, export it or print it out. Alabama department of revenue, withholding tax section, p.o.

Keep this certificate on file. How much should i withhold for alabama taxes? If an employee is believed to have claimed more exemptions than that which they are legally entitled to claim, the department should be notified. Complete line 1, 2 or 3. Web find and fill out the correct a 4 form alabama. Web in addition to the federal income tax withholding form, w4, each employee needs to fill out an alabama state income tax withholding form, a4. Web send alabama a4 form via email, link, or fax. Sign it in a few clicks. Try it for free now! Only use the print form button if the form you are printing does not have a green print button.

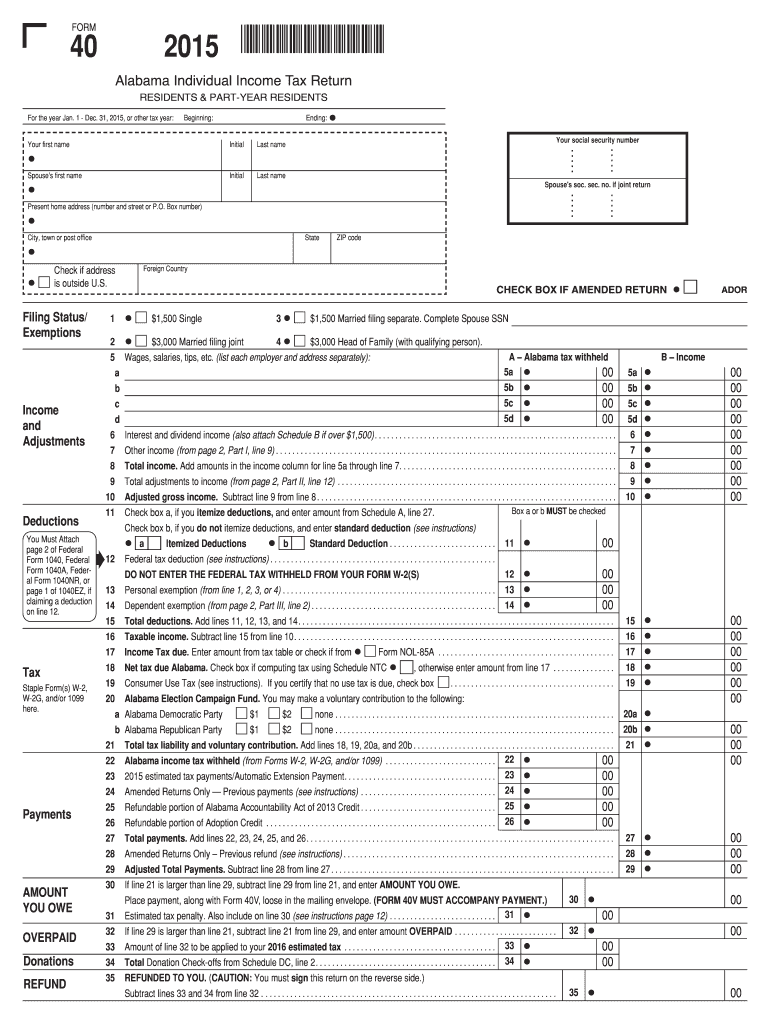

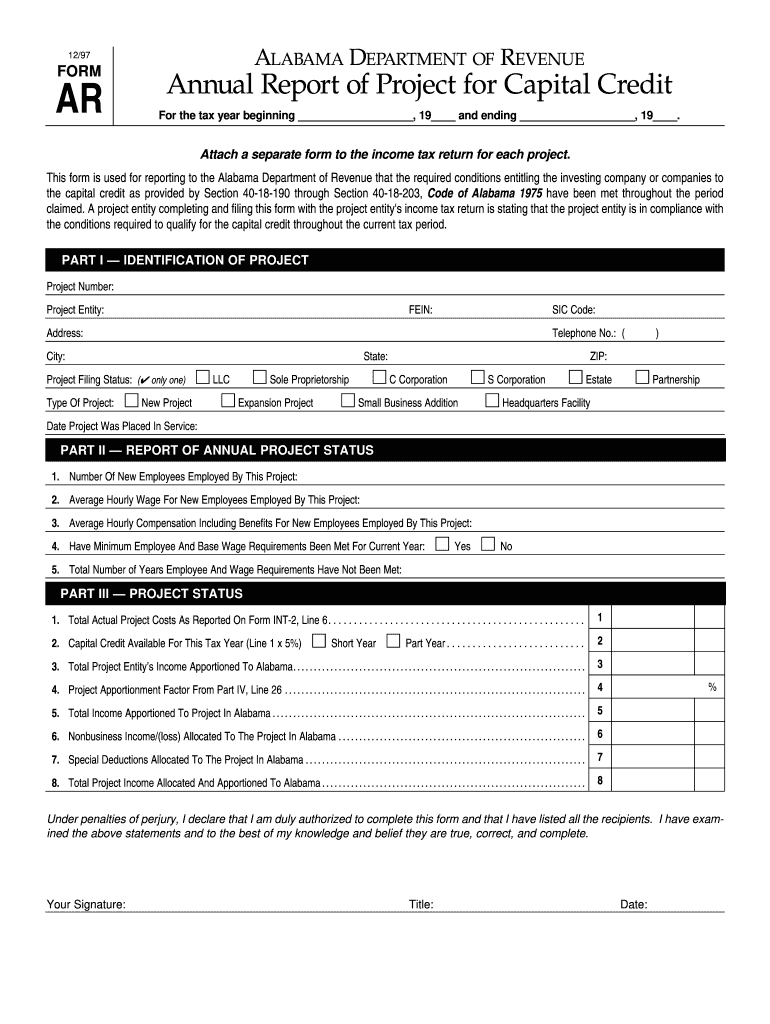

Fillable Alabama Tax Forms Fill and Sign Printable Template Online

Complete line 1 if you do not want to claim any exemptions. All wages will be reported to your state of legal residence by your employer. To obtain the best print quality, see additional instructions on the form faqs page. Keep this certificate on file. You can also download it, export it or print it out.

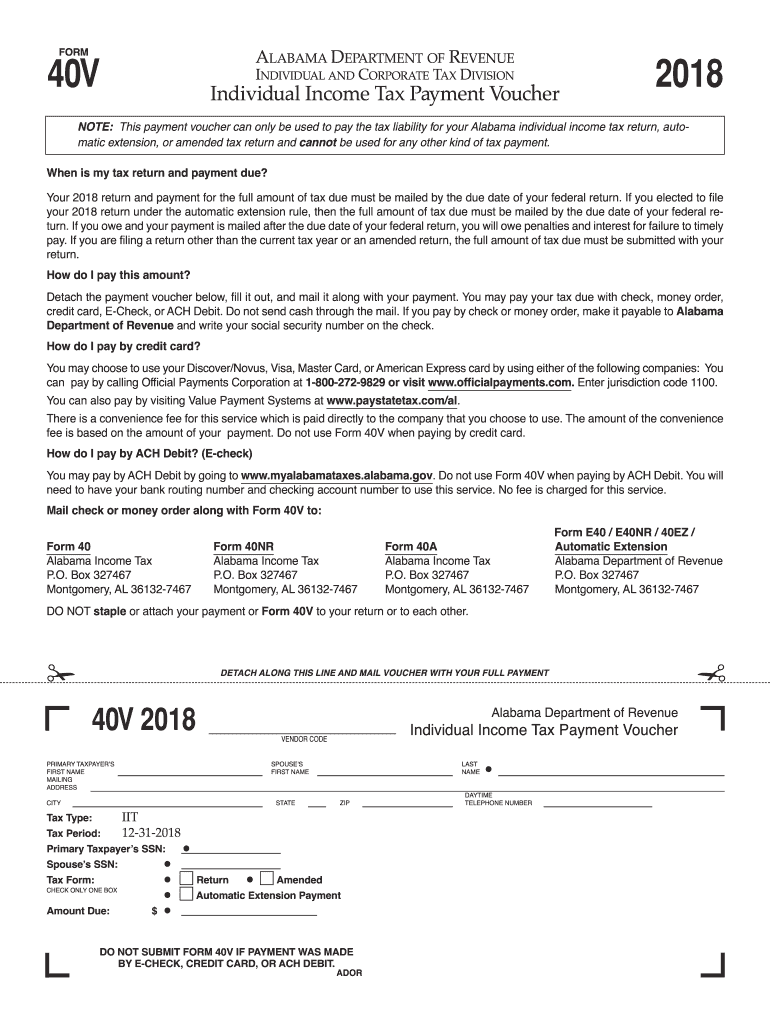

Alabama Form 40V Fill Out and Sign Printable PDF Template signNow

Sign it in a few clicks. Type text, add images, blackout confidential details, add comments, highlights and more. View all forms, individual income tax faqs. Alabama department of revenue, withholding tax section, p.o. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the.

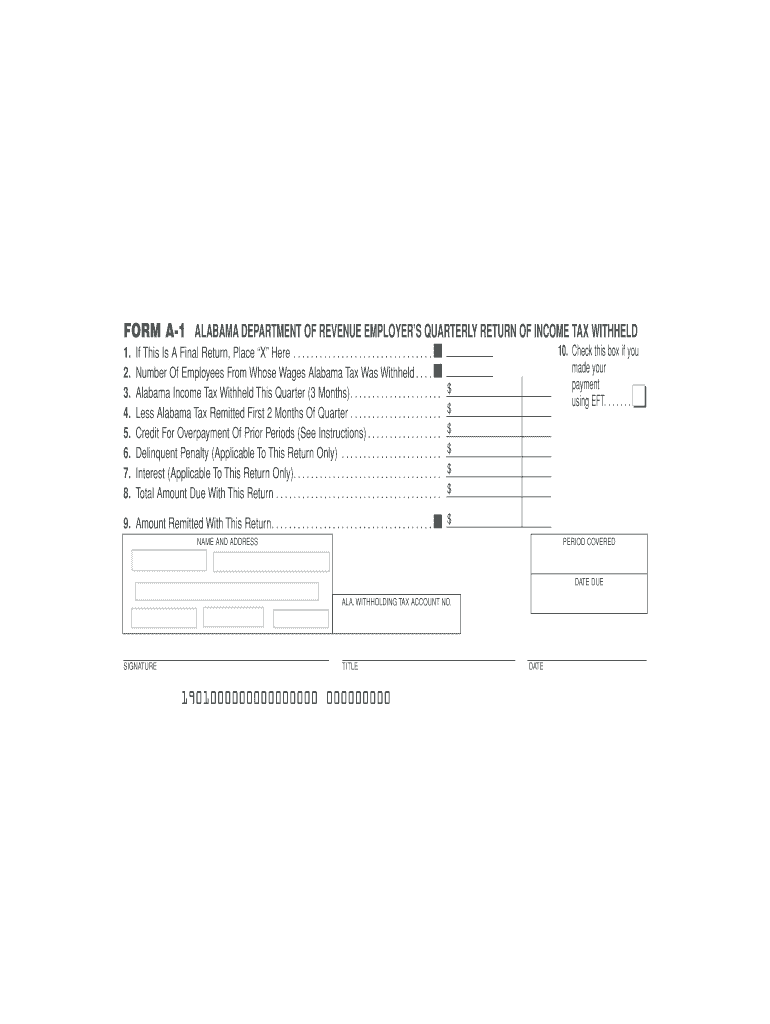

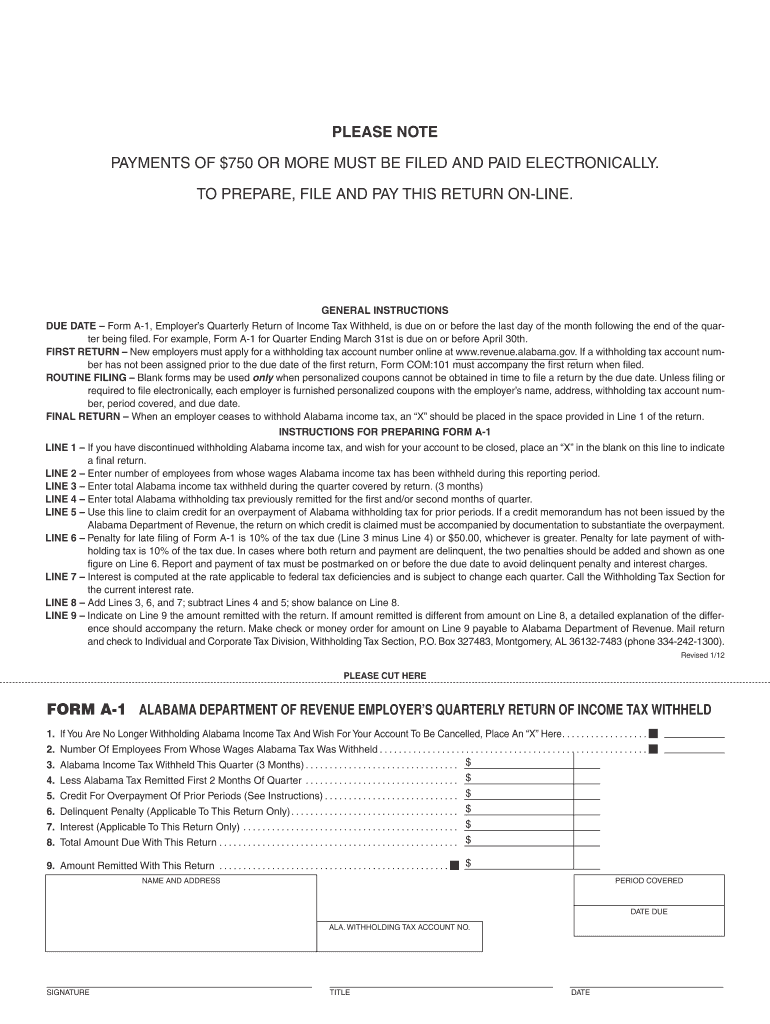

1998 Form AL A1 Fill Online, Printable, Fillable, Blank PDFfiller

Insert graphics, crosses, check and text boxes, if needed. Enter a 0 on this line. Web employee:complete form a4 and file it with your employer. Web send alabama a4 form via email, link, or fax. You can also download it, export it or print it out.

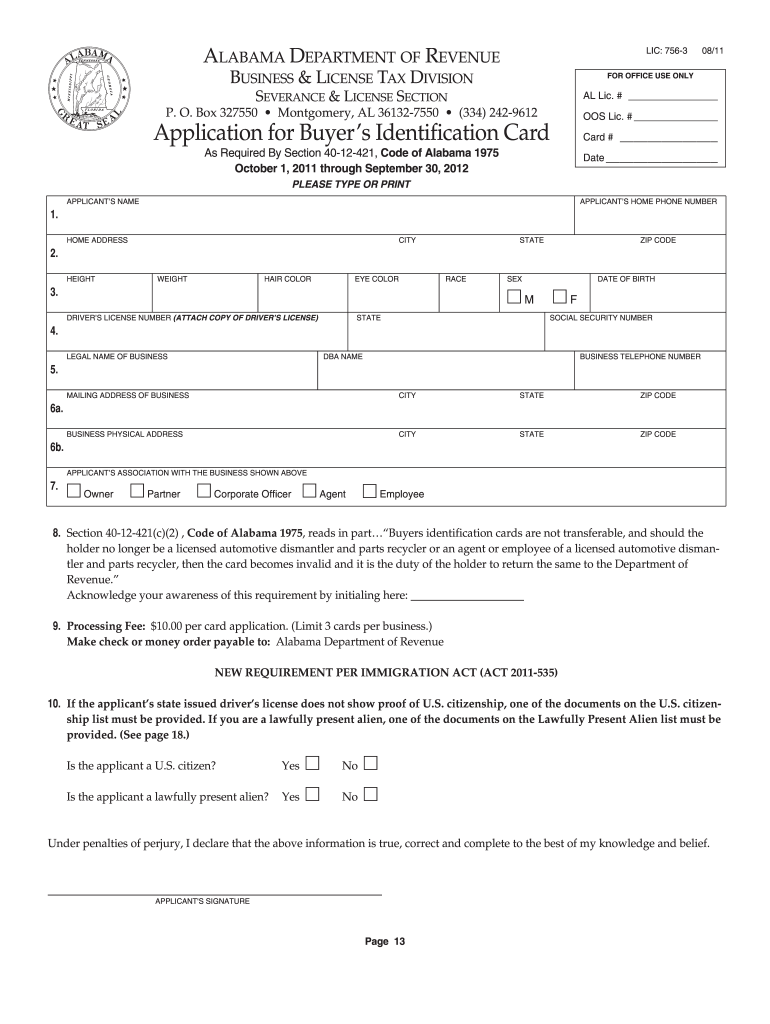

Blank Alabama Form Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Alabama department of revenue, withholding tax section, p.o. Type text, add images, blackout confidential details, add comments, highlights and more. If an employee is believed to have claimed more exemptions than that which they are legally entitled to claim, the department should be notified. Try it for free now!

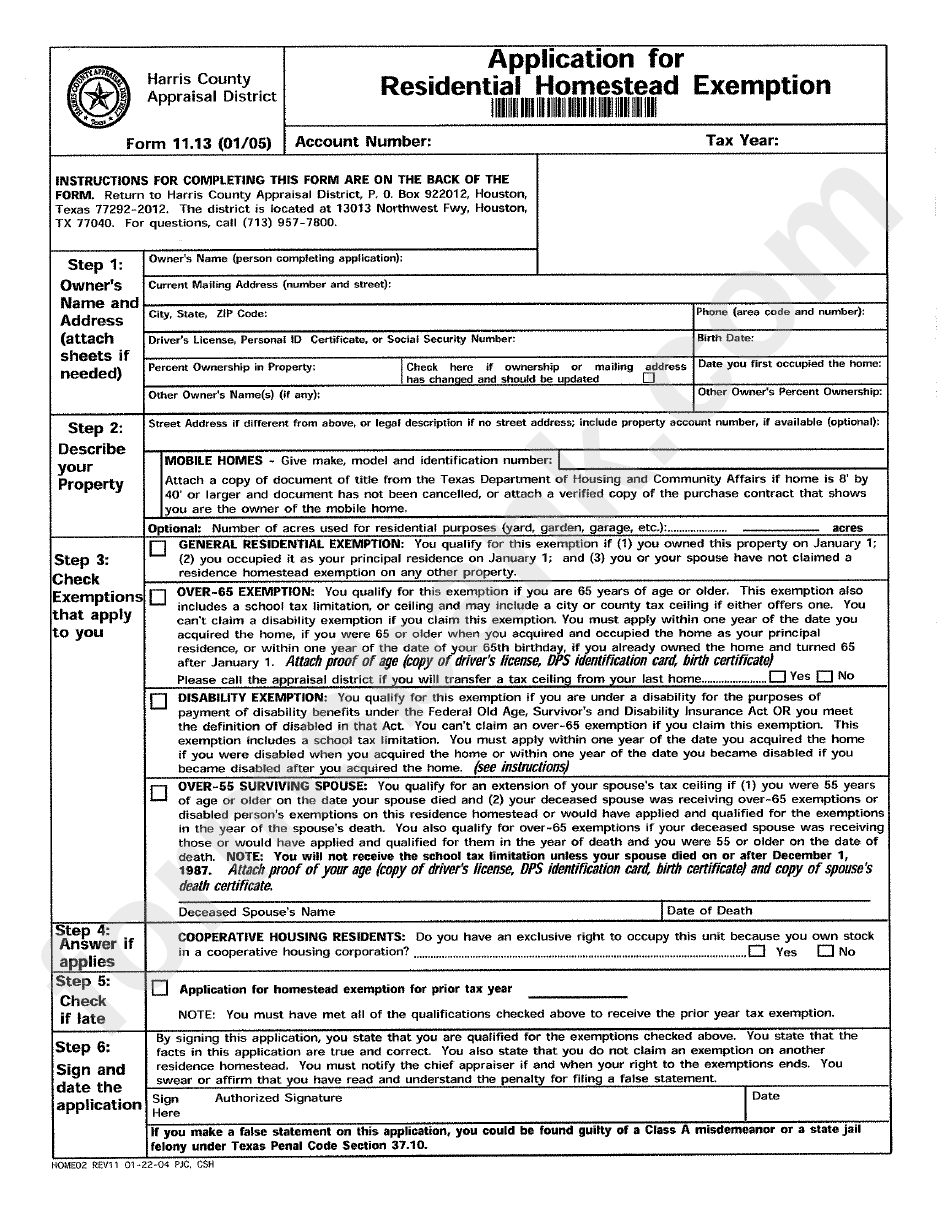

Harris County Homestead Exemption Form

Ad get ready for tax season deadlines by completing any required tax forms today. Web what is the al a4 ms form? Only use the print form button if the form you are printing does not have a green print button. Complete line 1, 2 or 3. Upload, modify or create forms.

2012 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

Keep this certificate on file. Complete line 1 if you do not want to claim any exemptions. Sign it in a few clicks. Alabama department of revenue, withholding tax section, p.o. Web share your form with others.

2007 Form AL DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

You can also download it, export it or print it out. Web send alabama a4 form via email, link, or fax. You can also download it, export it or print it out. Only use the print form button if the form you are printing does not have a green print button. Try it for free now!

Printable Alabama A Fill Online, Printable, Fillable, Blank pdfFiller

Upload, modify or create forms. Type text, add images, blackout confidential details, add comments, highlights and more. You can also download it, export it or print it out. Web share your form with others. Web find and fill out the correct a 4 form alabama.

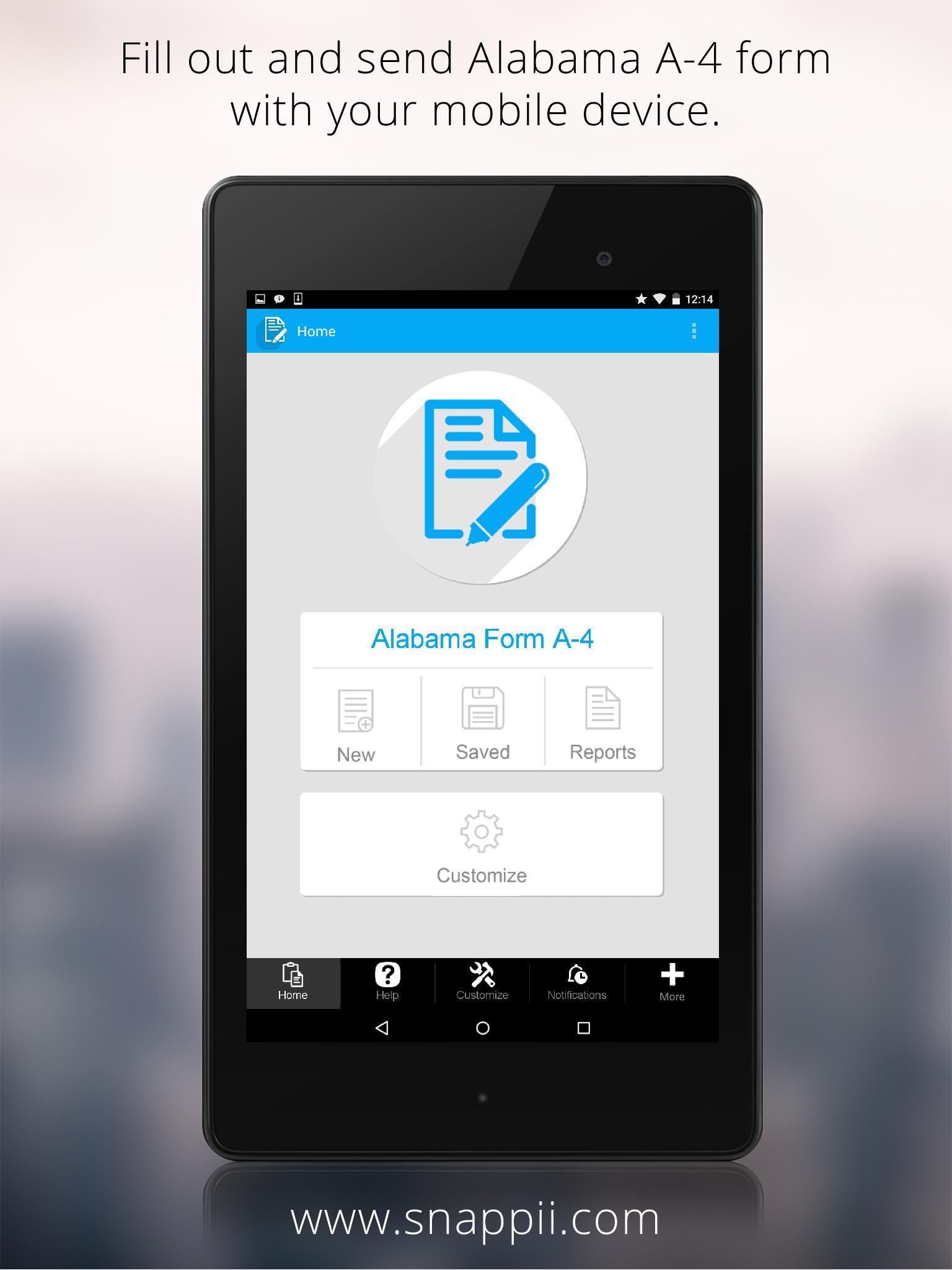

Alabama Form A4 for Android APK Download

If you are single or married filing separately, a $1,500 personal exemption is allowed. Web what is the al a4 ms form? Keep this certificate on file. Complete only one of these lines. Complete line 1 if you do not want to claim any exemptions.

Complete Only One Of These Lines.

Web what is the al a4 ms form? Edit your alabama a4 form 2019 printable online. Send alabama a4 form via email, link, or fax. To obtain the best print quality, see additional instructions on the form faqs page.

Repeating Details Will Be Filled Automatically After The First Input.

Try it for free now! If an employee is believed to have claimed more exemptions than that which they are legally entitled to claim, the department should be notified. You can also download it, export it or print it out. Complete line 1, 2 or 3.

Otherwise, Tax Will Be Withheld Without Exemption.

Web share your form with others. Web to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. View all forms, individual income tax faqs. Sign it in a few clicks.

All Wages Will Be Reported To Your State Of Legal Residence By Your Employer.

Web employee:complete form a4 and file it with your employer. Insert graphics, crosses, check and text boxes, if needed. If you are single or married filing separately, a $1,500 personal exemption is allowed. The maximum number of exemptions you can claim is 2.