Form Ar Tx

Form Ar Tx - Web the following tips will allow you to fill out form ar tx 2019 quickly and easily: Edit your form ar tx online. Web follow the simple instructions below: You can also download it, export it or print it out. Web send arkansas form ar tx via email, link, or fax. Sign it in a few clicks draw your signature, type it,. Fiduciary and estate income tax forms; You would still need to file an ar return, and file form ar. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. The most significant rule change ahead of the 2023 season is the clock will continue to run after first downs unless chains.

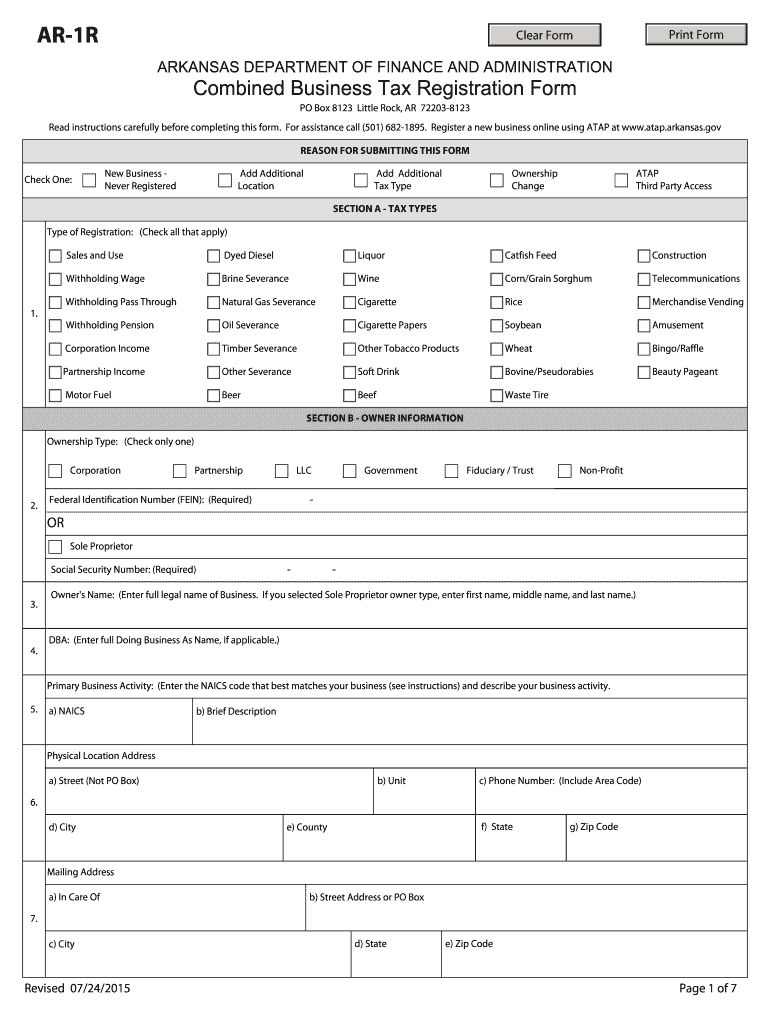

Web 42 rows arkansas efile; Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Applicant's or recipient's signature on one of the following hhsc applications for benefits containing the ar designation: Web the following tips will allow you to fill out form ar tx 2019 quickly and easily: The most significant rule change ahead of the 2023 season is the clock will continue to run after first downs unless chains. Web arkansas has a state income tax that ranges between 2% and 6.6%. Type text, add images, blackout confidential. You would still need to file an ar return, and file form ar. 5, taxpayer provided a second “texarkana employee’s withholding exemption certificate” certifying.

Web if you are a texarkana, ar permanent resident, you are exempt from arkansas tax on all sources. Fill in the upper left portion with the employer’s identification. Type text, add images, blackout confidential. Edit your ar tx form online type text, add images, blackout confidential details, add comments, highlights and more. Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. Web an ar must be verified using a (n): The most significant rule change ahead of the 2023 season is the clock will continue to run after first downs unless chains. Withholding tax tables for employers. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. You would still need to file an ar return, and file form ar.

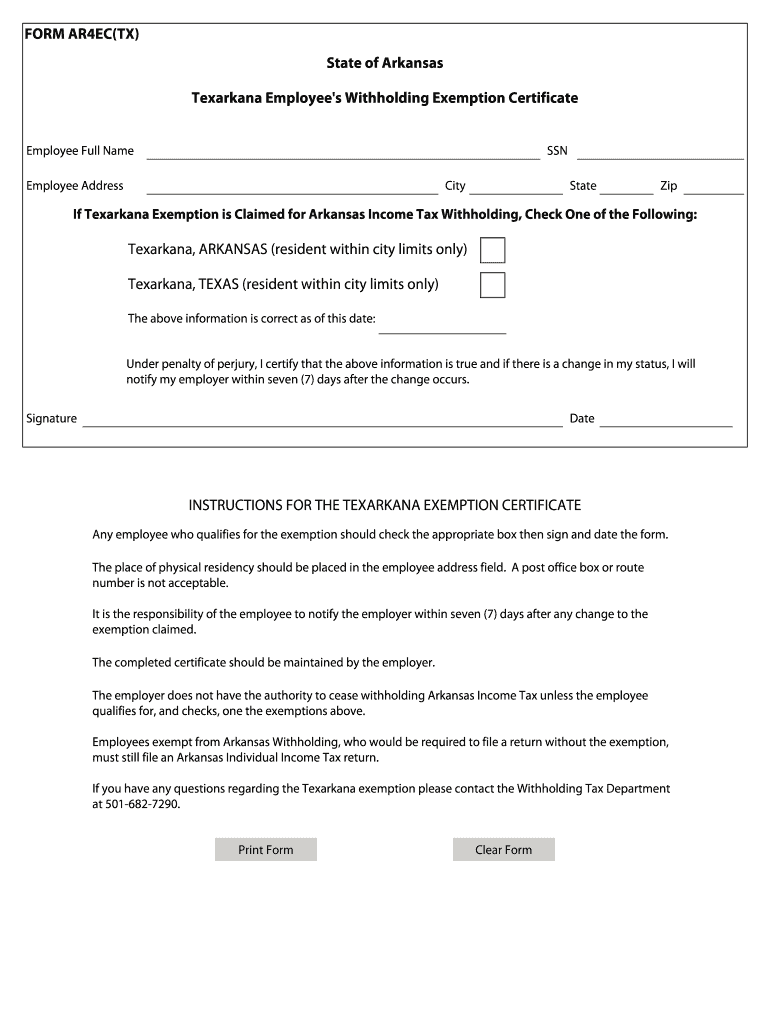

Ar4ec Fill Online, Printable, Fillable, Blank pdfFiller

Type text, add images, blackout confidential. Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Web an ar must be verified using a (n): Web the following tips will allow you to fill out form ar tx 2019 quickly and easily:

TX Comptroller AP114 2019 Fill out Tax Template Online US Legal Forms

Web three rules designed to shorten games. You would still need to file an ar return, and file form ar. Web if you are a texarkana, ar permanent resident, you are exempt from arkansas tax on all sources. Send the original copy of this form with one copy of each. Sign it in a few clicks draw your signature, type.

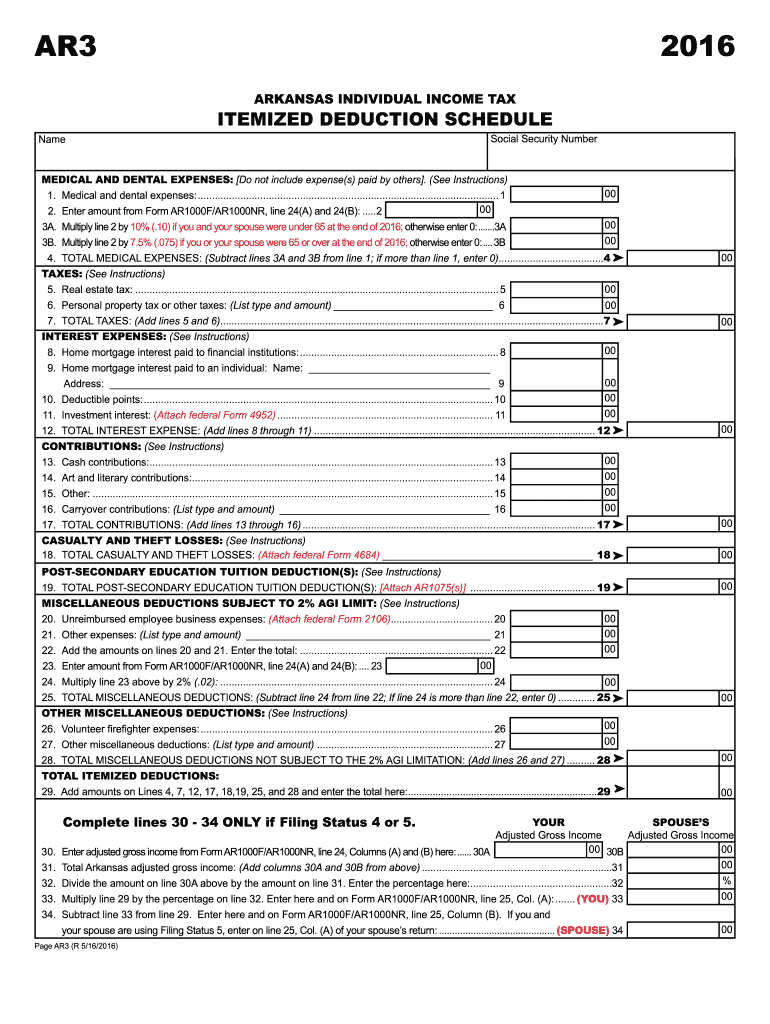

AR AR3 2016 Fill out Tax Template Online US Legal Forms

Edit your ar tx form online type text, add images, blackout confidential details, add comments, highlights and more. Web 42 rows arkansas efile; Web follow the simple instructions below: Sign it in a few clicks draw your signature, type it,. Fill in the upper left portion with the employer’s identification.

Arkansas Deposit Transmittal Form University of Arkansas Download

Web the following tips will allow you to fill out form ar tx 2019 quickly and easily: You would still need to file an ar return, and file form ar. Type text, add images, blackout confidential. Send the original copy of this form with one copy of each. Finding a legal expert, creating a scheduled appointment and going to the.

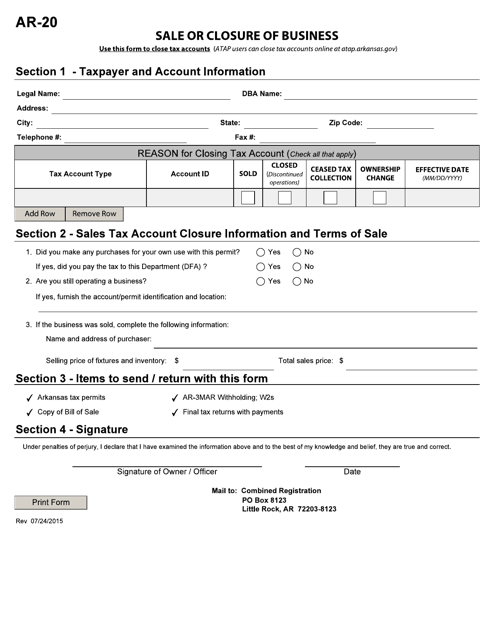

Form AR20 Download Fillable PDF or Fill Online Sale or Closure of

Web withholding tax formula (effective 06/01/2023) 06/05/2023. You can also download it, export it or print it out. Applicant's or recipient's signature on one of the following hhsc applications for benefits containing the ar designation: Web the following tips will allow you to fill out form ar tx 2019 quickly and easily: Web arkansas has a state income tax that.

Form Ar Tx Fill Out and Sign Printable PDF Template signNow

You can also download it, export it or print it out. Withholding tax tables for employers. Applicant's or recipient's signature on one of the following hhsc applications for benefits containing the ar designation: Edit your ar tx form online type text, add images, blackout confidential details, add comments, highlights and more. As the 2023/2024 school year draws near, parents are.

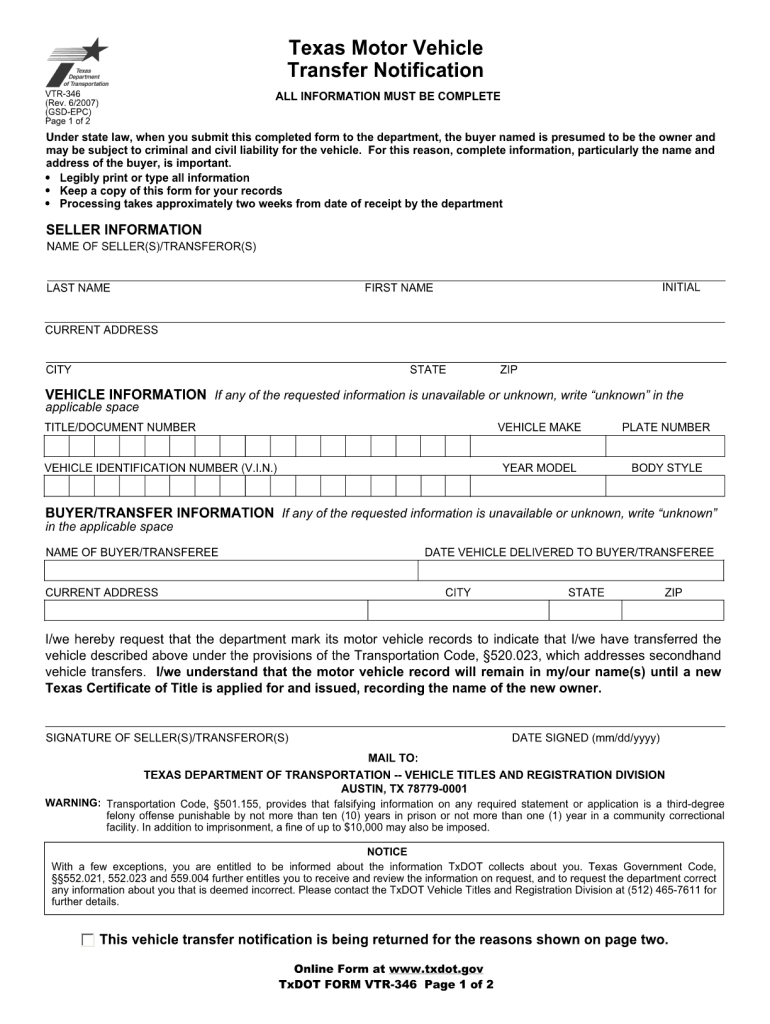

2007 TX Form VTR346 Fill Online, Printable, Fillable, Blank pdfFiller

Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. Web the following tips will allow you to fill out form ar tx 2019 quickly and easily: Fiduciary and estate income tax forms; Web if you are a texarkana, ar permanent resident, you are exempt from arkansas tax on.

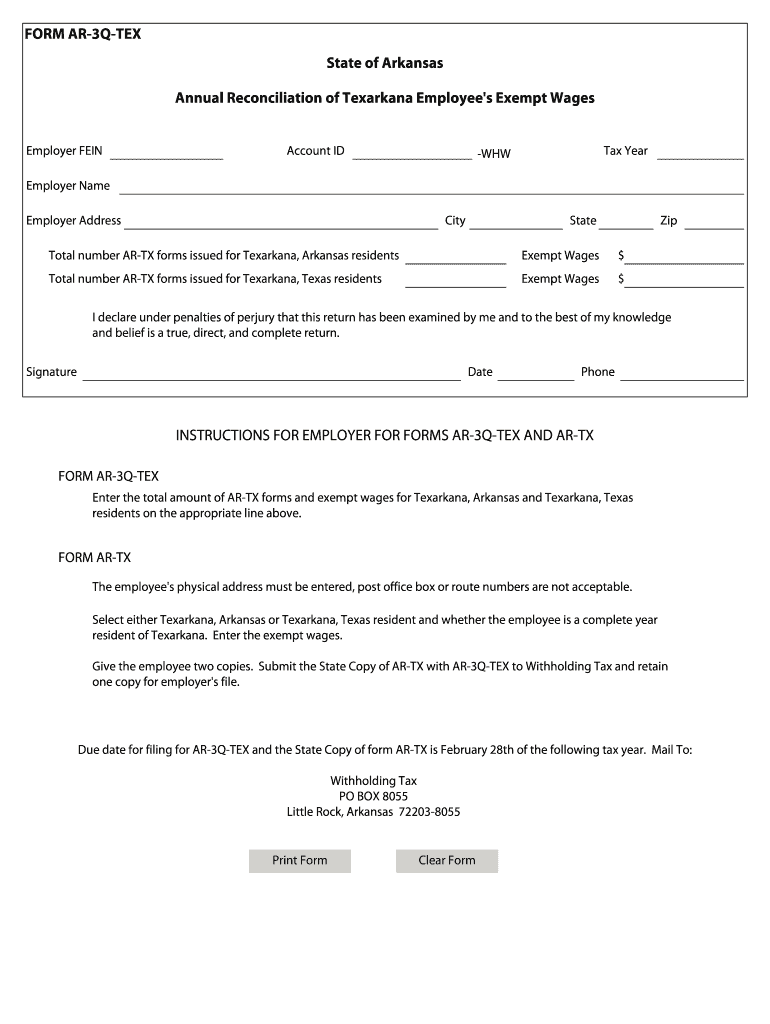

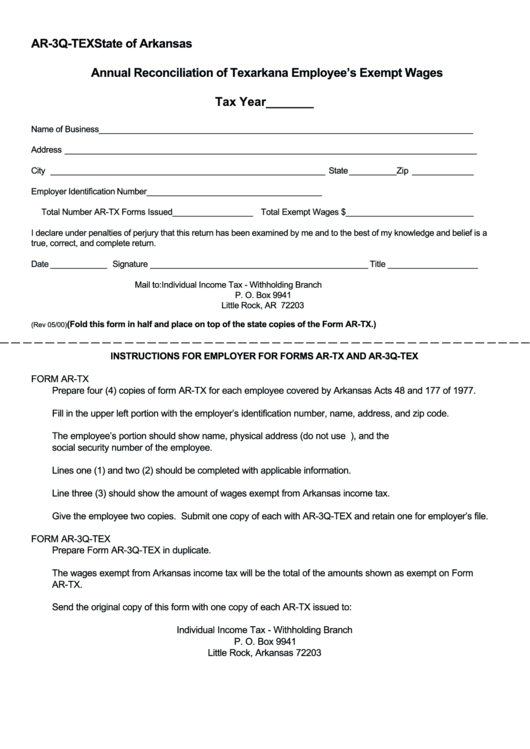

Form Ar3qTex Annual Reconciliation Of Texarkana Employee'S Exempt

Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web an ar must be verified using a (n): Edit your form ar tx online. Web 42 rows arkansas efile; Web follow the simple instructions below:

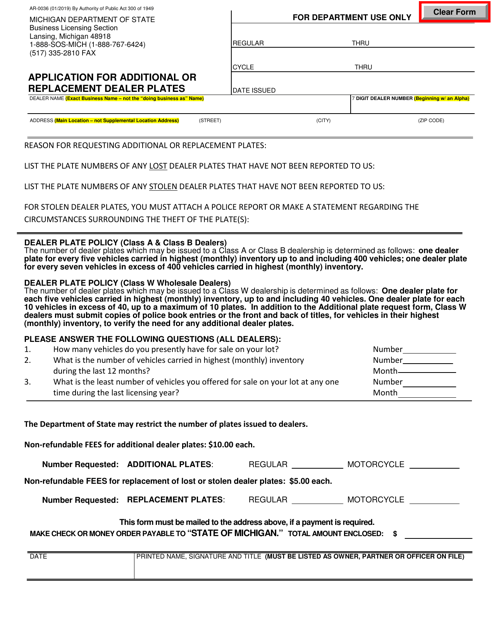

Form AR0036 Download Fillable PDF or Fill Online Application for

Withholding tax tables for employers. Fiduciary and estate income tax forms; Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web send arkansas form ar tx via email, link, or fax. Web three rules designed to shorten games.

Which Ar Arkansas Forms Fill Out and Sign Printable PDF Template

Withholding tax tables for employers. Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. Send the original copy of this form with one copy of each. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. As the 2023/2024 school year draws near, parents are looking at a bigger school.

Web Withholding Tax Formula (Effective 06/01/2023) 06/05/2023.

As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Web three rules designed to shorten games. Type text, add images, blackout confidential. Fill in the upper left portion with the employer’s identification.

Web Send Arkansas Form Ar Tx Via Email, Link, Or Fax.

Fiduciary and estate income tax forms; You would still need to file an ar return, and file form ar. Web arkansas has a state income tax that ranges between 2% and 6.6%. Web follow the simple instructions below:

Withholding Tax Instructions For Employers (Effective 10/01/2022) 09/02/2022.

Edit your ar tx form online type text, add images, blackout confidential details, add comments, highlights and more. Withholding tax tables for employers. Send the original copy of this form with one copy of each. Edit your form ar tx online.

Web 42 Rows Arkansas Efile;

Web an ar must be verified using a (n): You can also download it, export it or print it out. Finding a legal expert, creating a scheduled appointment and going to the business office for a personal conference makes finishing a. 5, taxpayer provided a second “texarkana employee’s withholding exemption certificate” certifying.