Form It 203 Instructions

Form It 203 Instructions - If you meet the definition of a resident of newyork state, new york city, or yonkers, you. We last updated the nonresident income tax return in february 2023, so this. • you have income from a new york source (see below and page 6) and your new york agi (federal. Were not a resident of new york state and received income during. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. See these forms and enter on enter code: • as a nonresident received certain income related to a profession or. This instruction booklet will help you to fill out and file form 203. We've partnered with the free file alliance again to offer you. Go to www.nystax.gov or see the back cover.

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. See these forms and enter on enter code: Go to www.nystax.gov or see the back cover. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. Were not a resident of new york state and received income during. We last updated the nonresident income tax return in february 2023, so this. If you meet the definition of a resident of newyork state, new york city, or yonkers, you. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. We've partnered with the free file alliance again to offer you. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203.

See these forms and enter on enter code: This instruction booklet will help you to fill out and file form 203. Go to www.nystax.gov or see the back cover. • you have income from a new york source (see below and page 6) and your new york agi (federal. We've partnered with the free file alliance again to offer you. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. • as a nonresident received certain income related to a profession or. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period.

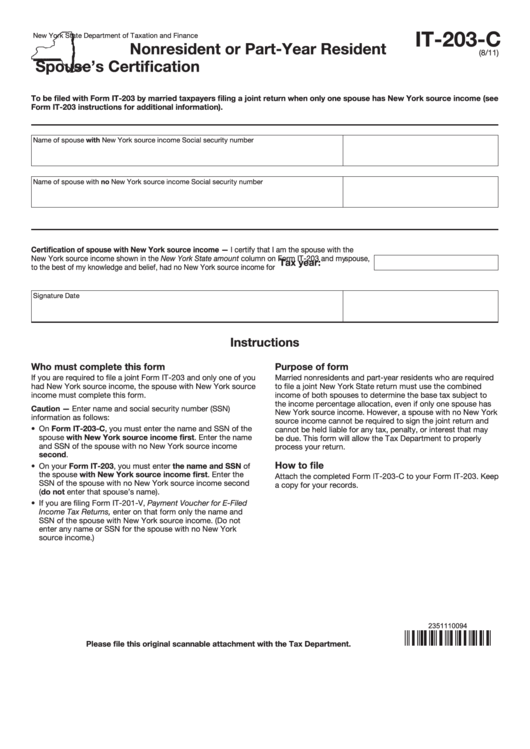

Fillable Form It203C Nonresident Or PartYear Resident Spouse'S

Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. If you meet the definition of a resident of newyork state, new york city, or yonkers, you. A part‑year.

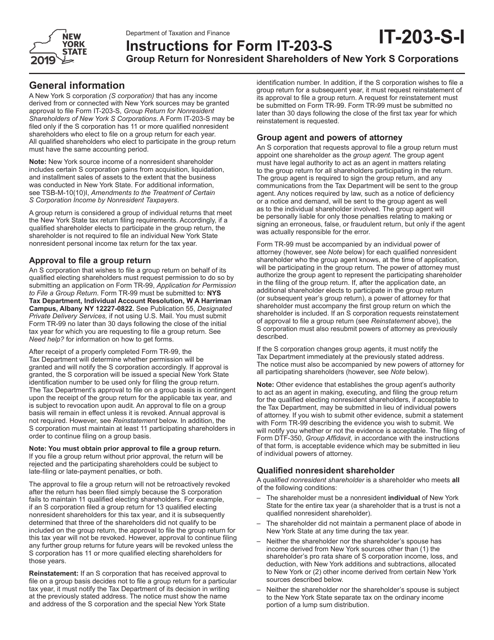

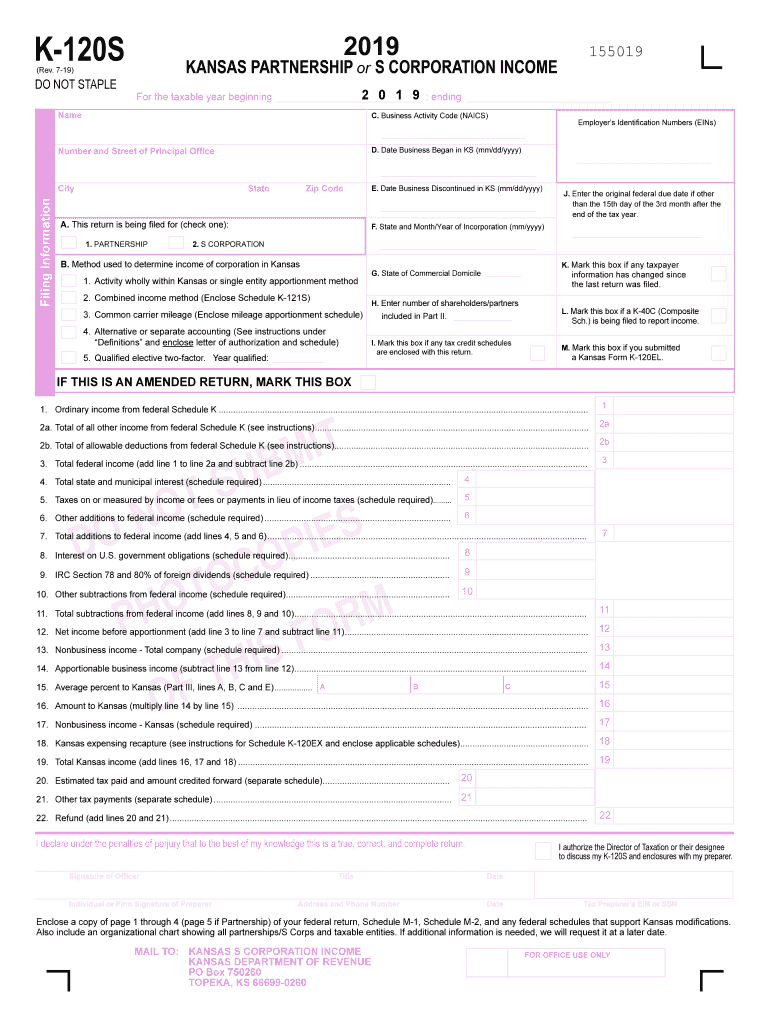

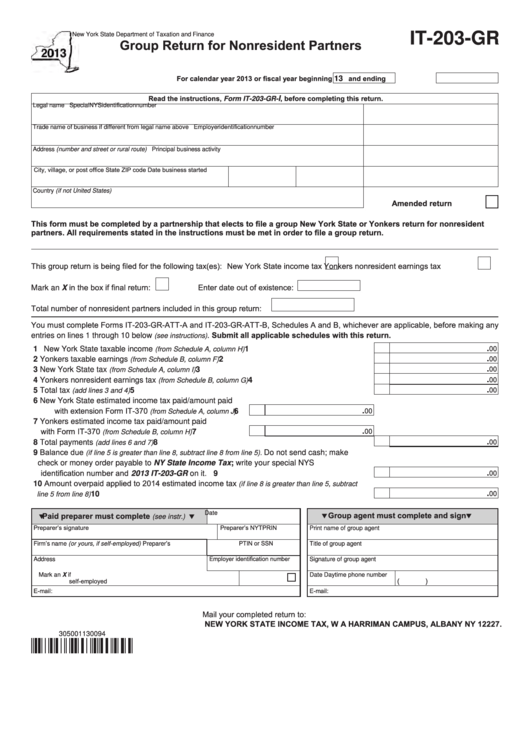

Download Instructions for Form IT203S Group Return for Nonresident

Go to www.nystax.gov or see the back cover. • you have income from a new york source (see below and page 6) and your new york agi (federal. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. See these forms and enter.

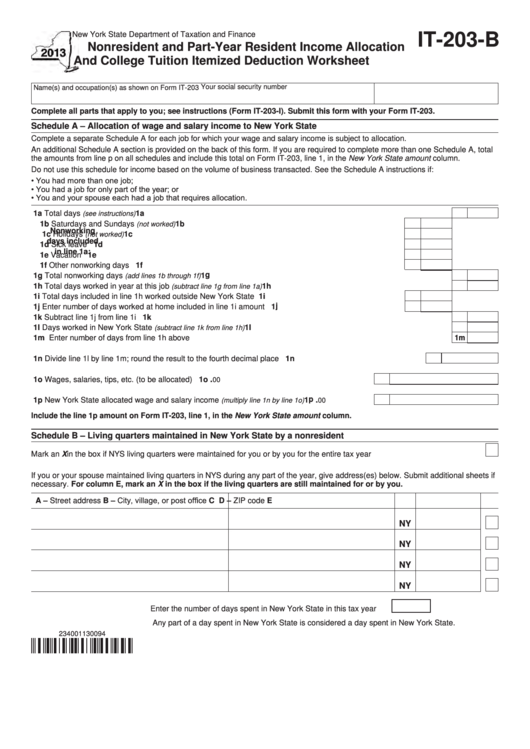

Form it 203 b instructions

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. We've partnered with the free file alliance again to offer you. If you meet the definition of a resident of newyork state, new york city, or yonkers, you. Your first name and middle initial your last name (for a.

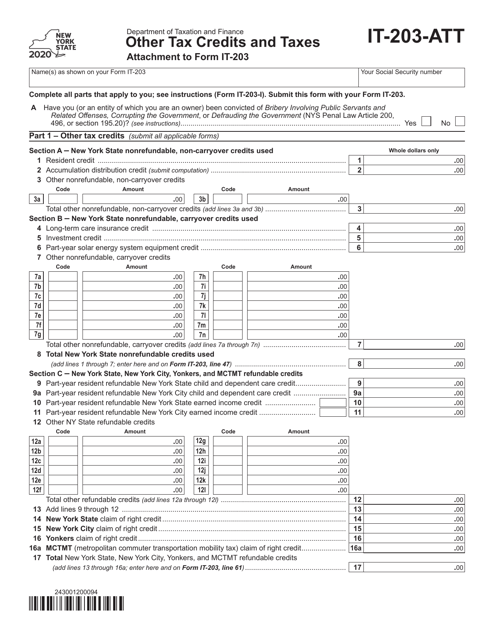

Form IT203ATT Download Fillable PDF or Fill Online Other Tax Credits

If you meet the definition of a resident of newyork state, new york city, or yonkers, you. See these forms and enter on enter code: Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. A part‑year resident of new york state who incurs losses in the.

Form it 203 b instructions

Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. This instruction booklet will help you to fill out and file form 203. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period..

It 203 Instructions Fill Out and Sign Printable PDF Template signNow

If you meet the definition of a resident of newyork state, new york city, or yonkers, you. • you have income from a new york source (see below and page 6) and your new york agi (federal. A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol.

Fillable Form It203Gr Group Return For Nonresident Partners 2013

A part‑year resident of new york state who incurs losses in the resident or nonresident period, or both, must make a separate nol computation for each period. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Were not a resident of new york state and received.

Form IT203C Nonresident or PartYear Resident Spouse's Certification,

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. We last updated the nonresident income tax return in february 2023, so this. We've partnered with the free file alliance again to offer you. Were not a resident of new york state and received income during. • you have.

2018 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

• you have income from a new york source (see below and page 6) and your new york agi (federal. Go to www.nystax.gov or see the back cover. We last updated the nonresident income tax return in february 2023, so this. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line.

Fillable Form It203B Nonresident And PartYear Resident

See these forms and enter on enter code: We last updated the nonresident income tax return in february 2023, so this. • you have income from a new york source (see below and page 6) and your new york agi (federal. Were not a resident of new york state and received income during. We've partnered with the free file alliance.

We've Partnered With The Free File Alliance Again To Offer You.

This instruction booklet will help you to fill out and file form 203. • you have income from a new york source (see below and page 6) and your new york agi (federal. • as a nonresident received certain income related to a profession or. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203.

A Part‑Year Resident Of New York State Who Incurs Losses In The Resident Or Nonresident Period, Or Both, Must Make A Separate Nol Computation For Each Period.

If you meet the definition of a resident of newyork state, new york city, or yonkers, you. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Your first name and middle initial your last name (for a joint return, enter spouse’s name on line below) your. Go to www.nystax.gov or see the back cover.

Your First Name And Middle Initial Your Last Name (For A Joint Return , Enter Spouse’s Name On Line Below) Your.

Were not a resident of new york state and received income during. We last updated the nonresident income tax return in february 2023, so this. See these forms and enter on enter code: