Form M-1310 Instructions

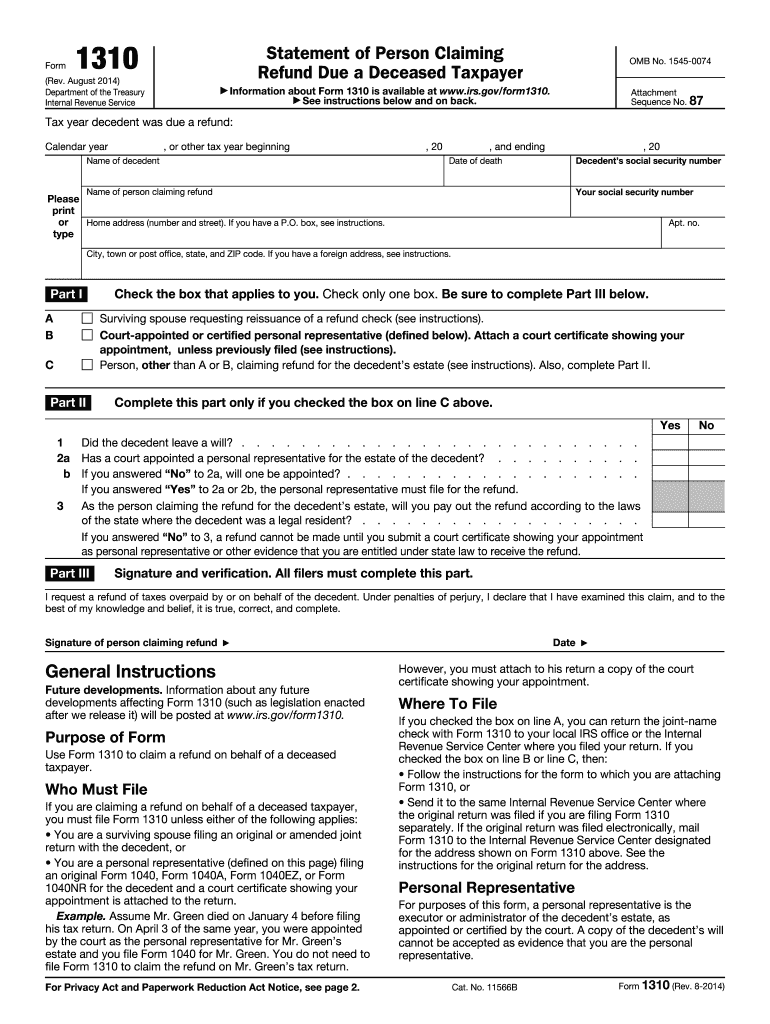

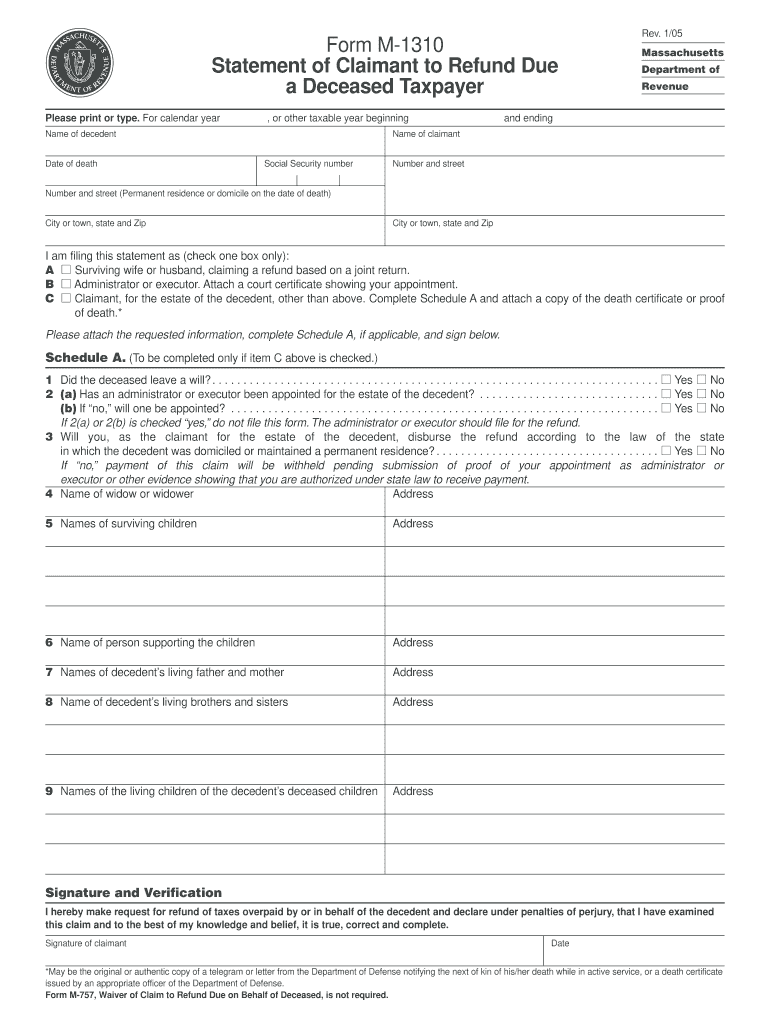

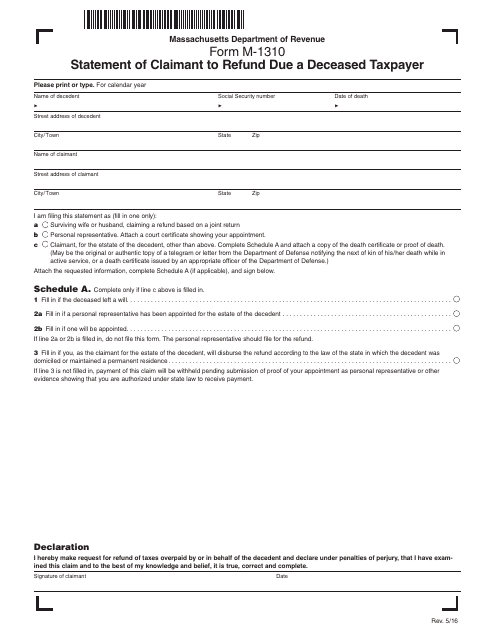

Form M-1310 Instructions - Web edit, sign, and share mass form m 1310 instructions 2005 online. The days of terrifying complex legal and tax forms are over. Edit, sign and save irs 1310 form. Web you must file this form to claim a refund that is being claimed for a deceased taxpayer. Web instructions included on form: Massachusetts resident income tax return 2019 form 1: You will not be able to. To access forms 2, 2g. Complete, edit or print tax forms instantly. For calendar year am filing this statement as (fill in one only):.

Web you must file this form to claim a refund that is being claimed for a deceased taxpayer. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: If you are the deceased’s surviving spouse filing a joint return, do not. Claim for refund due a deceased taxpayer: Edit, sign and save irs 1310 form. Select the document you want to sign and click upload. Web follow the simple instructions below: Underpayment of estimated income tax:. No need to install software, just go to dochub, and sign up instantly and for free. Statement of claimant to refund due a deceased taxpayer · to access forms 2, 2g.

Claim for refund due a deceased taxpayer: Select the document you want to sign and click upload. Please accept my condolences for your loss! Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. With us legal forms the whole process of submitting legal documents is anxiety. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: For calendar year am filing this statement as (fill in one only):. Web edit, sign, and share mass form m 1310 instructions 2005 online. Web follow the simple instructions below:

1310 Fill Out and Sign Printable PDF Template signNow

No need to install software, just go to dochub, and sign up instantly and for free. Massachusetts resident income tax return 2019 form 1: Refer to the explanation of the use of fso code. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Web follow the simple instructions below:

2005 Form MA DoR M1310 Fill Online, Printable, Fillable, Blank pdfFiller

Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Statement of claimant to refund due a deceased taxpayer · to access forms 2, 2g. Edit, sign and save irs 1310 form. No need to install software, just go to dochub, and sign up instantly and for free. For calendar year am filing this statement as (fill in.

Massachusetts M3 Instructions

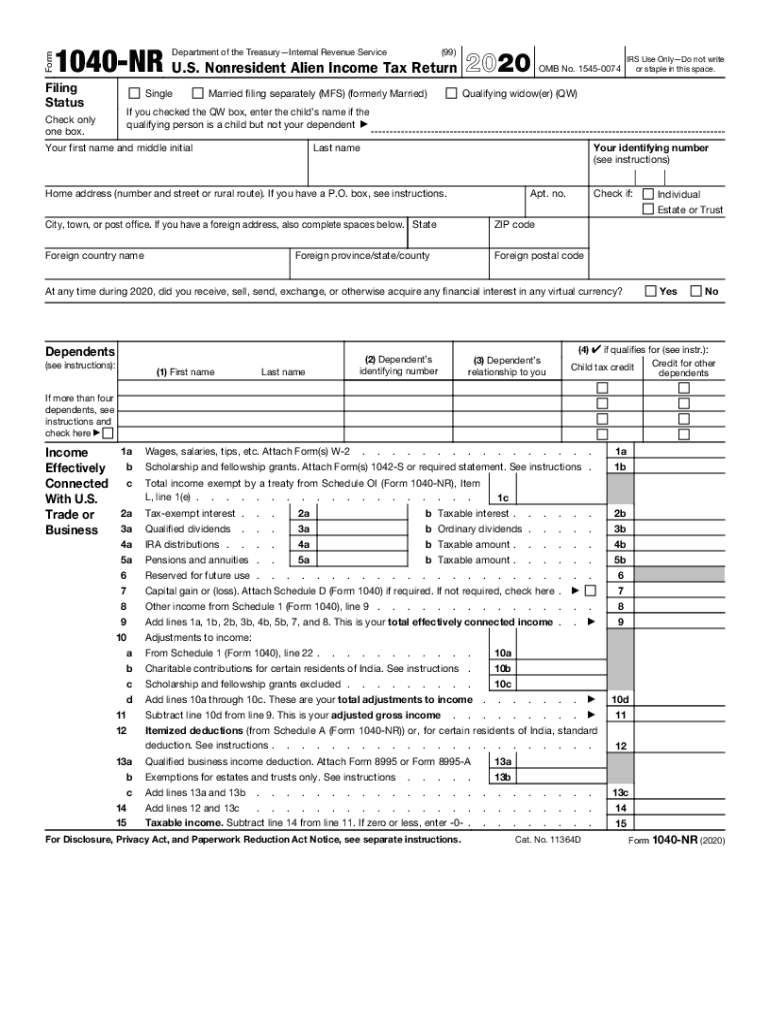

Massachusetts resident income tax return 2020 form 1: Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly. Underpayment of estimated income tax:.

Cat Tax Oregon Form Cat Meme Stock Pictures and Photos

If you are the deceased’s surviving spouse filing a joint return, do not. Massachusetts resident income tax return (english, pdf 211.37 kb) 2020 form 1. Web follow the simple instructions below: With us legal forms the whole process of submitting legal documents is anxiety. Massachusetts resident income tax return (english, pdf 156.53 kb) 2019 form 1.

Estimated Tax Payments 2022 Form Latest News Update

Please accept my condolences for your loss! Web follow the simple instructions below: Web instructions included on form: Complete, edit or print tax forms instantly. Statement of claimant to refund due a deceased taxpayer · to access forms 2, 2g.

Form M1310 Download Printable PDF or Fill Online Statement of Claimant

For calendar year am filing this statement as (fill in one only):. Underpayment of estimated income tax:. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. If you are the deceased’s surviving spouse filing a joint return, do not. Refer to the explanation of the use of fso code.

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

Web follow the simple instructions below: Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how. Web edit, sign, and share mass form m 1310 instructions 2005 online. Statement of claimant to refund due a deceased taxpayer; The days of terrifying complex legal and tax forms are.

Form 7004 Printable PDF Sample

For calendar year am filing this statement as (fill in one only):. Massachusetts resident income tax return (english, pdf 156.53 kb) 2019 form 1. Refer to the explanation of the use of fso code. Massachusetts resident income tax return 2020 form 1: Complete, edit or print tax forms instantly.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

Massachusetts resident income tax return 2020 form 1: Web use form 1310 to claim a refund on behalf of a deceased taxpayer. To access forms 2, 2g. Underpayment of estimated income tax:. Web edit, sign, and share mass form m 1310 instructions 2005 online.

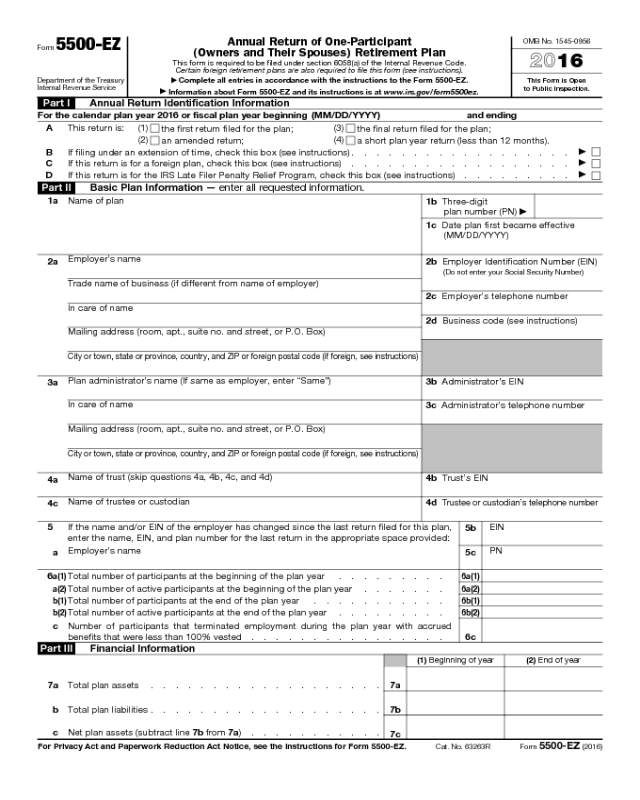

Form 5500EZ Edit, Fill, Sign Online Handypdf

Web you must file this form to claim a refund that is being claimed for a deceased taxpayer. If you are the deceased’s surviving spouse filing a joint return, do not. Web edit, sign, and share mass form m 1310 instructions 2005 online. Complete, edit or print tax forms instantly. Web information about form 1310, statement of person claiming refund.

Web Instructions Included On Form:

Web follow the simple instructions below: The days of terrifying complex legal and tax forms are over. Select the document you want to sign and click upload. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if:

Web You Must File This Form To Claim A Refund That Is Being Claimed For A Deceased Taxpayer.

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how. You will not be able to. Statement of claimant to refund due a deceased taxpayer · to access forms 2, 2g. For calendar year am filing this statement as (fill in one only):.

Massachusetts Resident Income Tax Return 2020 Form 1:

Complete, edit or print tax forms instantly. If you are the deceased’s surviving spouse filing a joint return, do not. Claim for refund due a deceased taxpayer: Web follow the simple instructions below:

Web Edit, Sign, And Share Mass Form M 1310 Instructions 2005 Online.

Refer to the explanation of the use of fso code. Massachusetts resident income tax return (english, pdf 156.53 kb) 2019 form 1. With us legal forms the whole process of submitting legal documents is anxiety. Web use form 1310 to claim a refund on behalf of a deceased taxpayer.