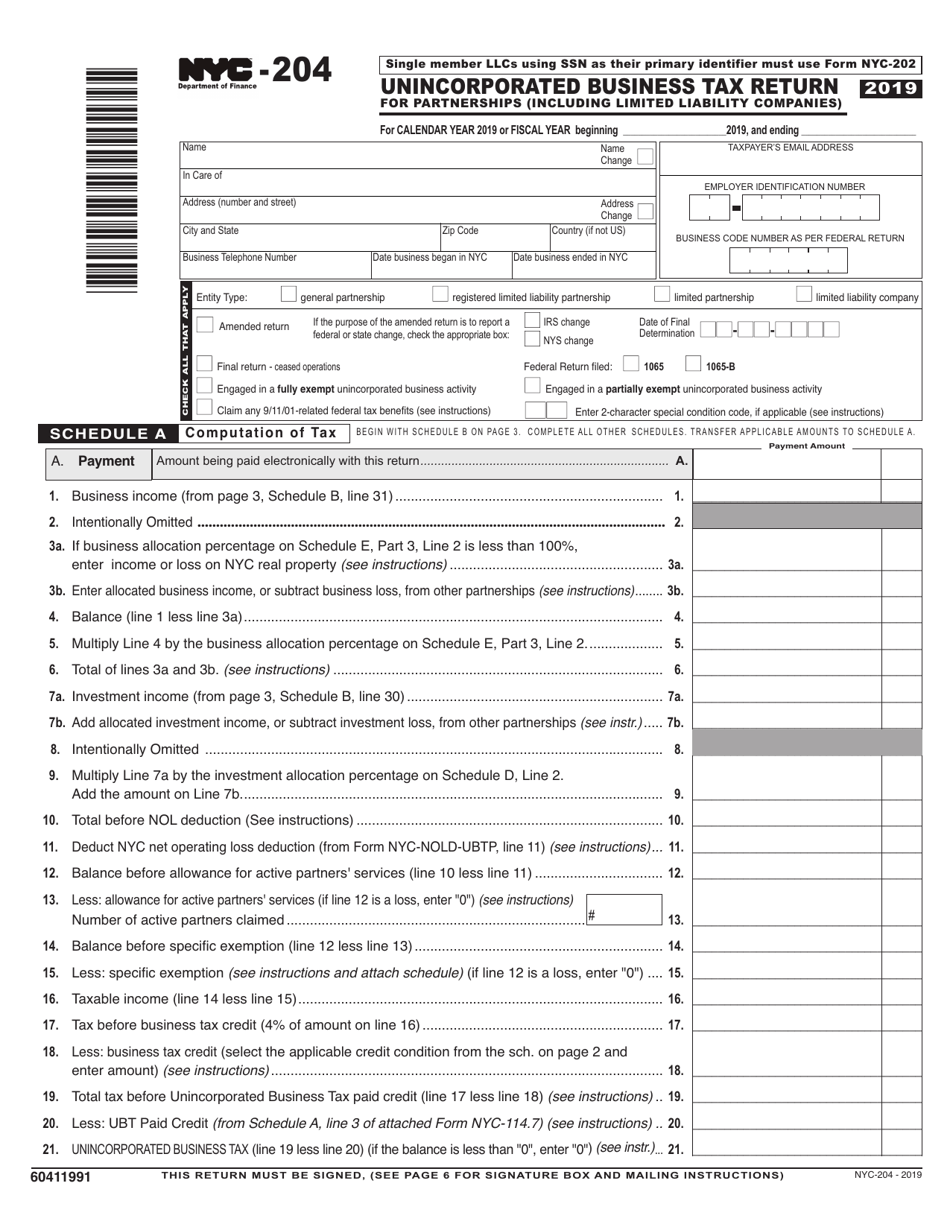

Form Nyc 204

Form Nyc 204 - Ordinary income (loss) from federal form 1065, line 22 (see instructions).1. U you allocate total business income within and without nyc. Complete, edit or print tax forms instantly. U you allocate total business income within and without nyc. Column 1 column 2 column 3 column 4 partner (check one) employer. Net income (loss) from all rental real estate. (if you allocate 100% of your business income. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. Web welcome to nyc.gov | city of new york For a complete list of.

Complete, edit or print tax forms instantly. You may sign up for a free trial and then purchase a. For a complete list of. Payment amount included with form. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. U you allocate total business income within and without nyc. For tax years beginning on or after january 1, 2005, taxpayers must allocate unincorporated. Easy to install from the apple store. Net income (loss) from all rental real estate. Web welcome to nyc.gov | city of new york

Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. For a complete list of. Payment amount included with form. Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. You may sign up for a free trial and then purchase a. Net income (loss) from all rental real estate. Column 1 column 2 column 3 column 4 partner (check one) employer. Easy to install from the apple store. Web welcome to nyc.gov | city of new york Complete, edit or print tax forms instantly.

Notice Of Claim Form Nyc 20202021 Fill and Sign Printable Template

For a complete list of. For tax years beginning on or after january 1, 2005, taxpayers must allocate unincorporated. You may sign up for a free trial and then purchase a. (if you allocate 100% of your business income. U you allocate total business income within and without nyc.

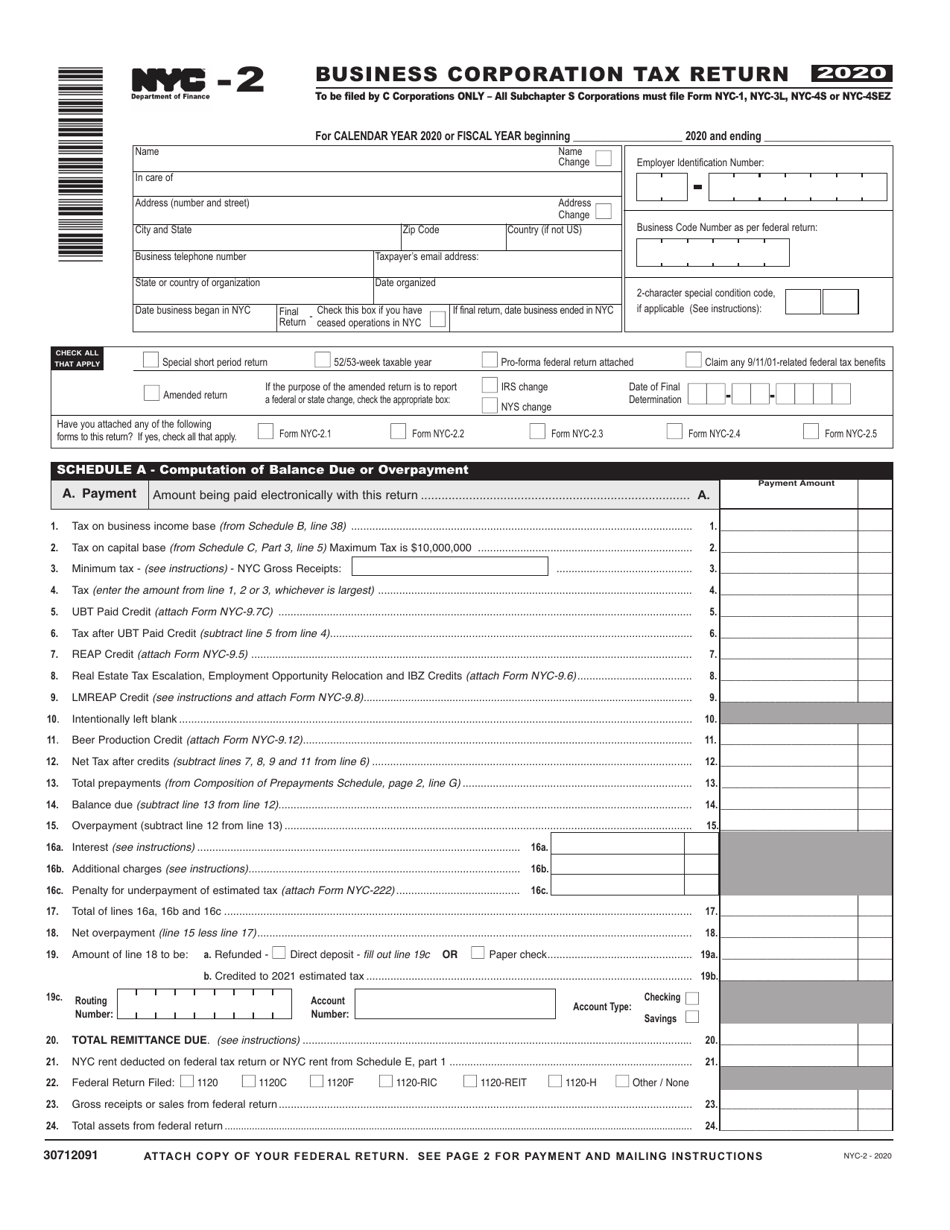

Form NYC2 Download Printable PDF or Fill Online Business Corporation

Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. You may sign up for a free trial and then purchase a. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. Net income (loss) from all rental real estate. (if you allocate 100% of your business.

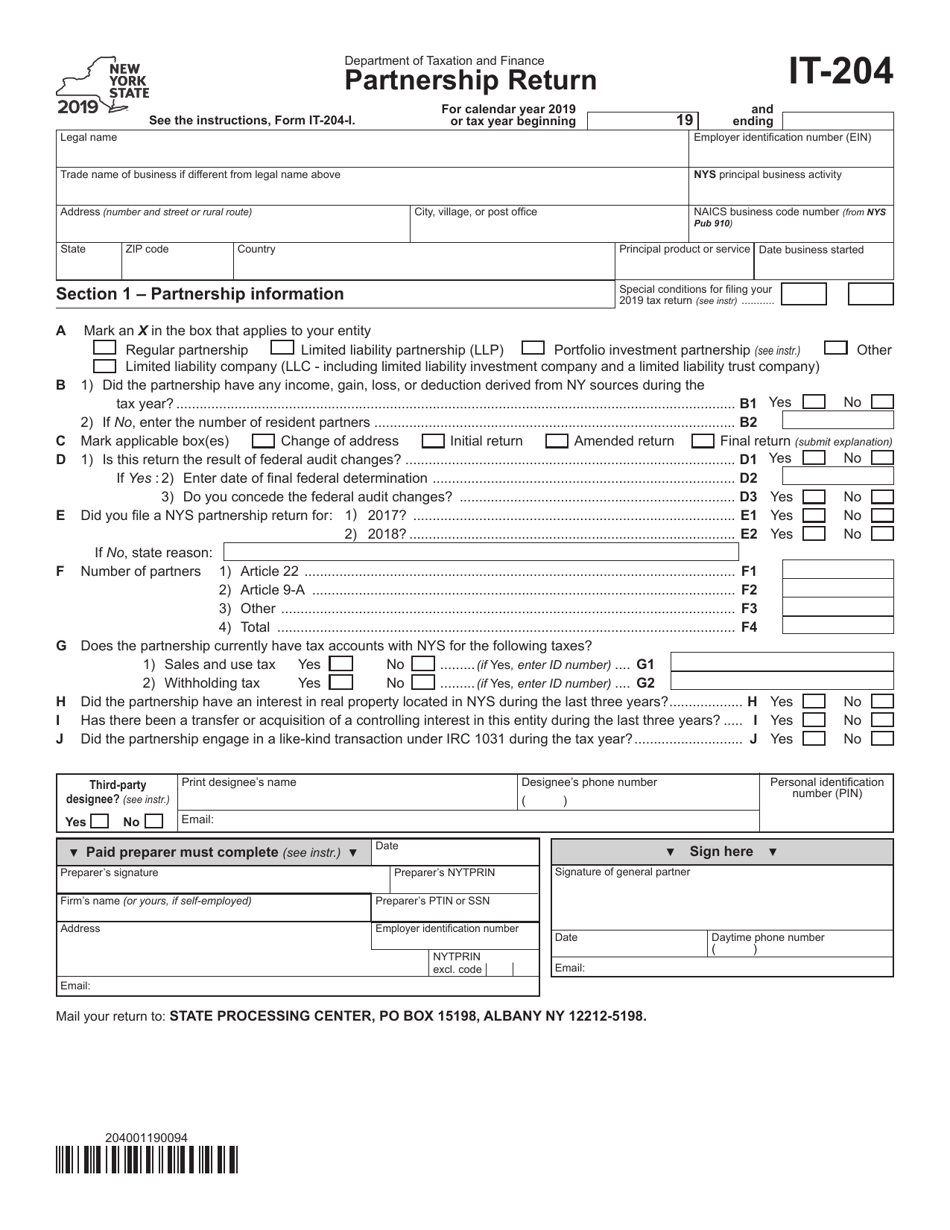

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Complete, edit or print tax forms instantly. U you allocate total business income within and without nyc. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. For a complete list of. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a.

NY IT204LL 20152021 Fill and Sign Printable Template Online US

Column 1 column 2 column 3 column 4 partner (check one) employer. For a complete list of. Easy to install from the apple store. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. Ordinary income (loss) from federal form 1065, line 22 (see instructions).1.

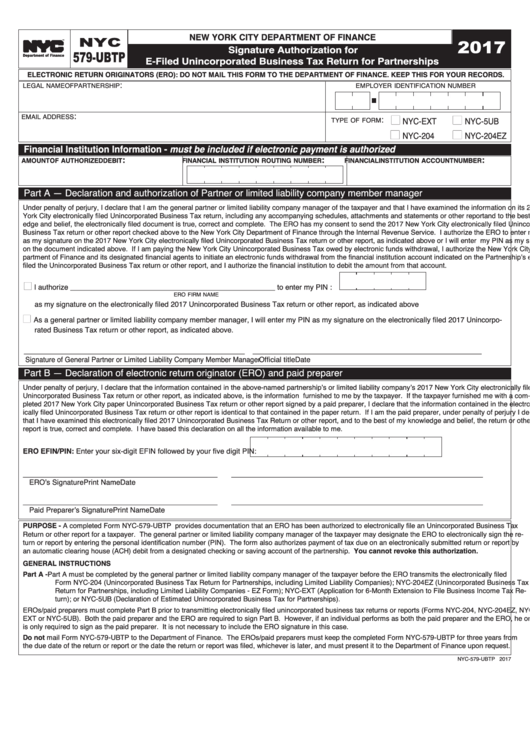

Form Nyc579Ubtp Signature Authorization For EFiled Unincorporated

Net income (loss) from all. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. Payment amount included with form. Ordinary income (loss) from federal form 1065, line 22 (see instructions).1. U you allocate total business income within and without nyc.

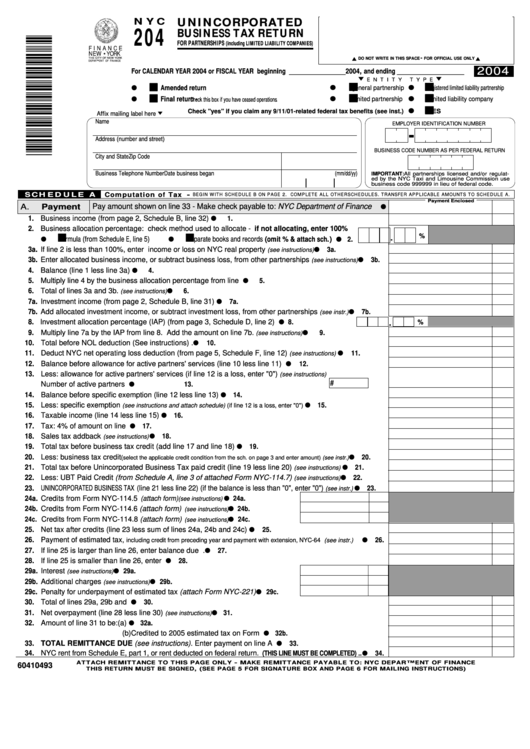

Fillable Form Nyc204 Unincorporated Business Tax Return 2004

Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. (if you allocate 100% of your business income. Ordinary income (loss) from federal form 1065, line 22 (see instructions).1. Net income (loss) from all. Payment amount included with form.

Form NYC204 Download Printable PDF or Fill Online Unincorporated

Column 1 column 2 column 3 column 4 partner (check one) employer. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a. U you allocate total business income within and without nyc. Easy to install from the apple store. U you allocate total business income within and without nyc.

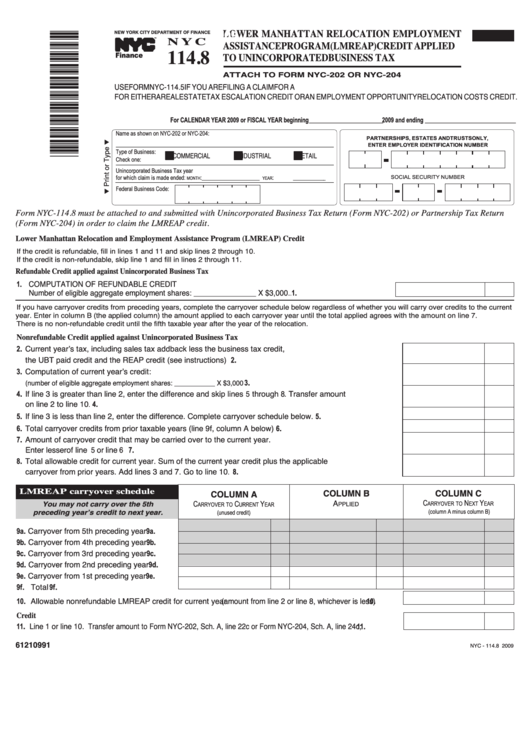

Form Nyc114.8 Lmreap Credit Applied To Unincorporated Business Tax

Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. Payment amount included with form. Easy to install from the apple store. You may sign up for a free trial and then purchase a. Web nyc 204 unincorporated business tax return for partnerships ( including limited liability companies) a.

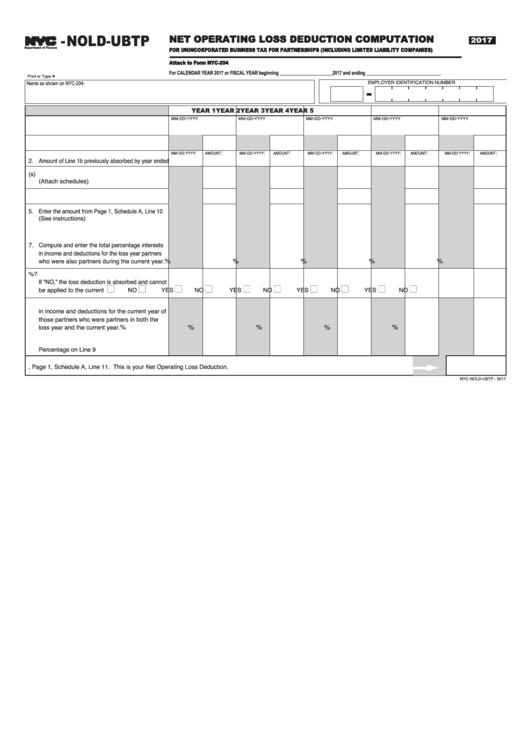

Form NycNoldUbtp Net Operating Loss Deduction Computation For

U you allocate total business income within and without nyc. Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. You may sign up for a free trial and then purchase a. Net income (loss) from all. Web welcome to nyc.gov | city of new york

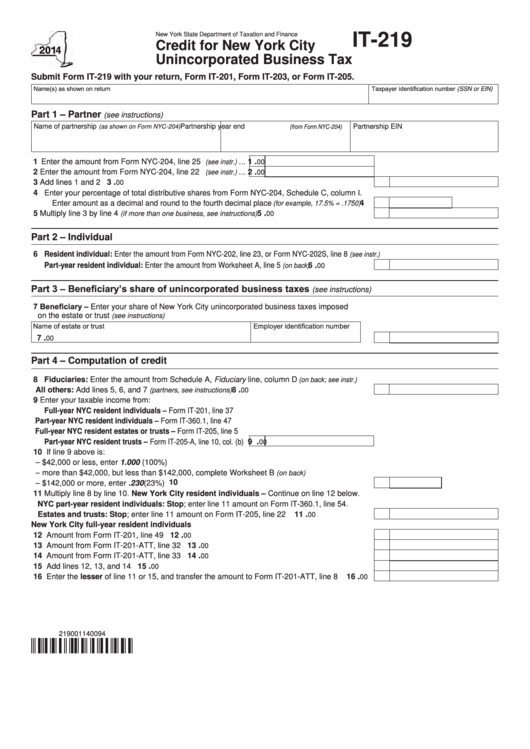

Fillable Form It219 Credit For New York City Unincorporated Business

Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. Ordinary income (loss) from federal form 1065, line 22 (see instructions).1. Payment amount included with form. Complete, edit or print tax forms instantly. U you allocate total business income within and without nyc.

Easy To Install From The Apple Store.

Web up to $40 cash back create, modify, and share form nyc 204 using the pdffiller ios app. Web welcome to nyc.gov | city of new york Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. U you allocate total business income within and without nyc.

Payment Amount Included With Form.

Column 1 column 2 column 3 column 4 partner (check one) employer. For tax years beginning on or after january 1, 2005, taxpayers must allocate unincorporated. Net income (loss) from all. (if you allocate 100% of your business income.

For A Complete List Of.

Net income (loss) from all rental real estate. You may sign up for a free trial and then purchase a. U you allocate total business income within and without nyc. Complete, edit or print tax forms instantly.

Web Nyc 204 Unincorporated Business Tax Return For Partnerships ( Including Limited Liability Companies) A.

Ordinary income (loss) from federal form 1065, line 22 (see instructions).1.