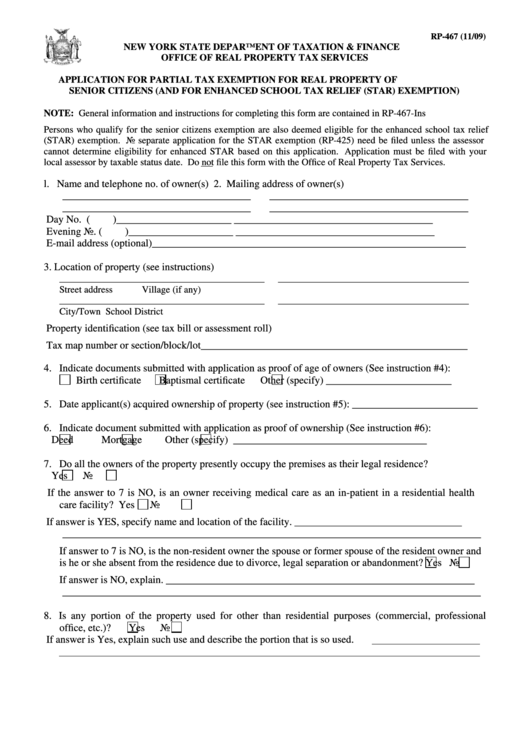

Form Rp 467

Form Rp 467 - The low income senior tax exemption is available to homeowners age 65 and over with a gross income. Web what is ny state form rp 467? Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. Real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount. Web application for partial tax exemption for real property of senior citizens. You must file this application with your local assessor by the taxable status date. You must file this application with your local assessor by the taxable status date. Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Web real property tax law § 467 authorizes school districts to adopt a resolution, after a public hearing, to eliminate the need for senior citizens to reapply if they received the exemption. Sign it in a few.

You must file this application with your local assessor by the taxable status date. Real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount. You must file this application with your local assessor by the taxable status date. Web follow the simple instructions below: We are pleased to report that the following forms are available online for 2023: Web real property tax law § 467 authorizes school districts to adopt a resolution, after a public hearing, to eliminate the need for senior citizens to reapply if they received the exemption. Sign it in a few. Web section 467 of the real property tax law gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by. Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. The low income senior tax exemption is available to homeowners age 65 and over with a gross income.

You must file this application with your local assessor by the taxable status date. Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a rp 467. You must file this application with your local assessor by the taxable status date. Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. Web follow the simple instructions below: The low income senior tax exemption is available to homeowners age 65 and over with a gross income. Web what is ny state form rp 467? We are pleased to report that the following forms are available online for 2023: Web section 467 of the real property tax law gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by. Web real property tax law § 467 authorizes school districts to adopt a resolution, after a public hearing, to eliminate the need for senior citizens to reapply if they received the exemption.

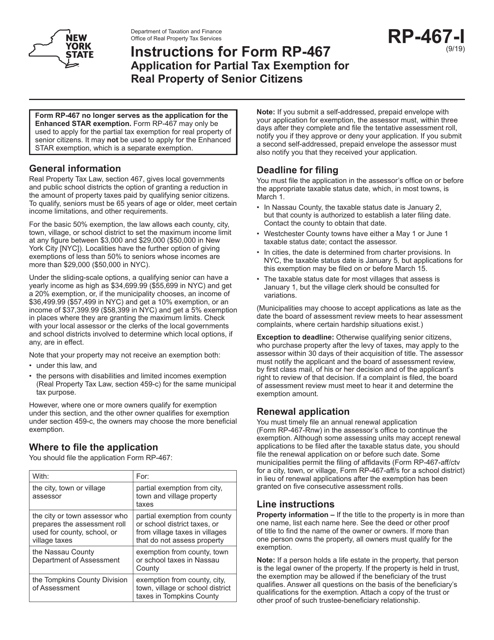

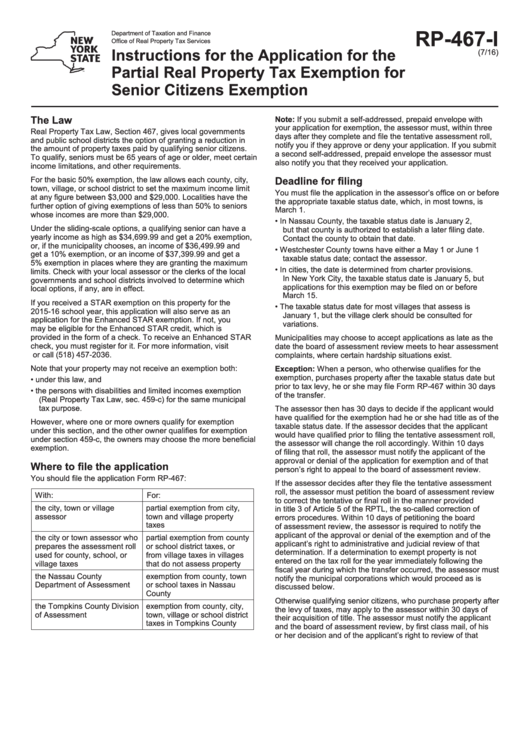

Download Instructions for Form RP467 Application for Partial Tax

Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount. Web real property tax law, section 467, gives local governments and public school districts.

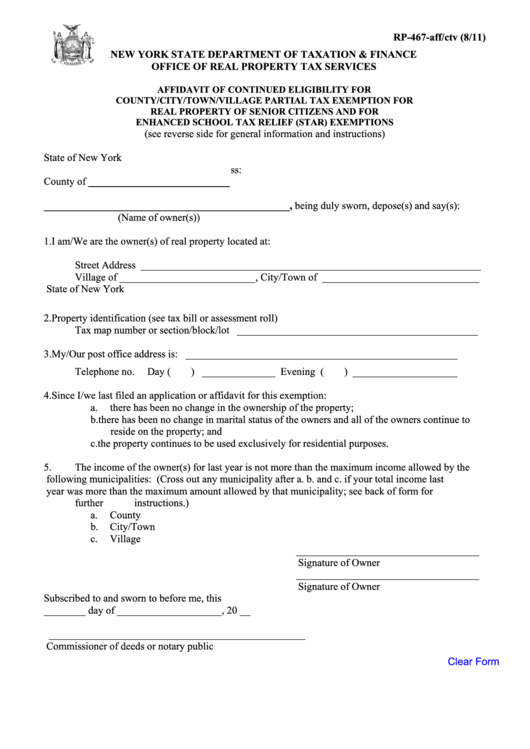

Fillable Form Rp467Aff/ctv Affidavit Of Continued Eligibility For

Real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount. Web what is ny state form rp 467? Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior..

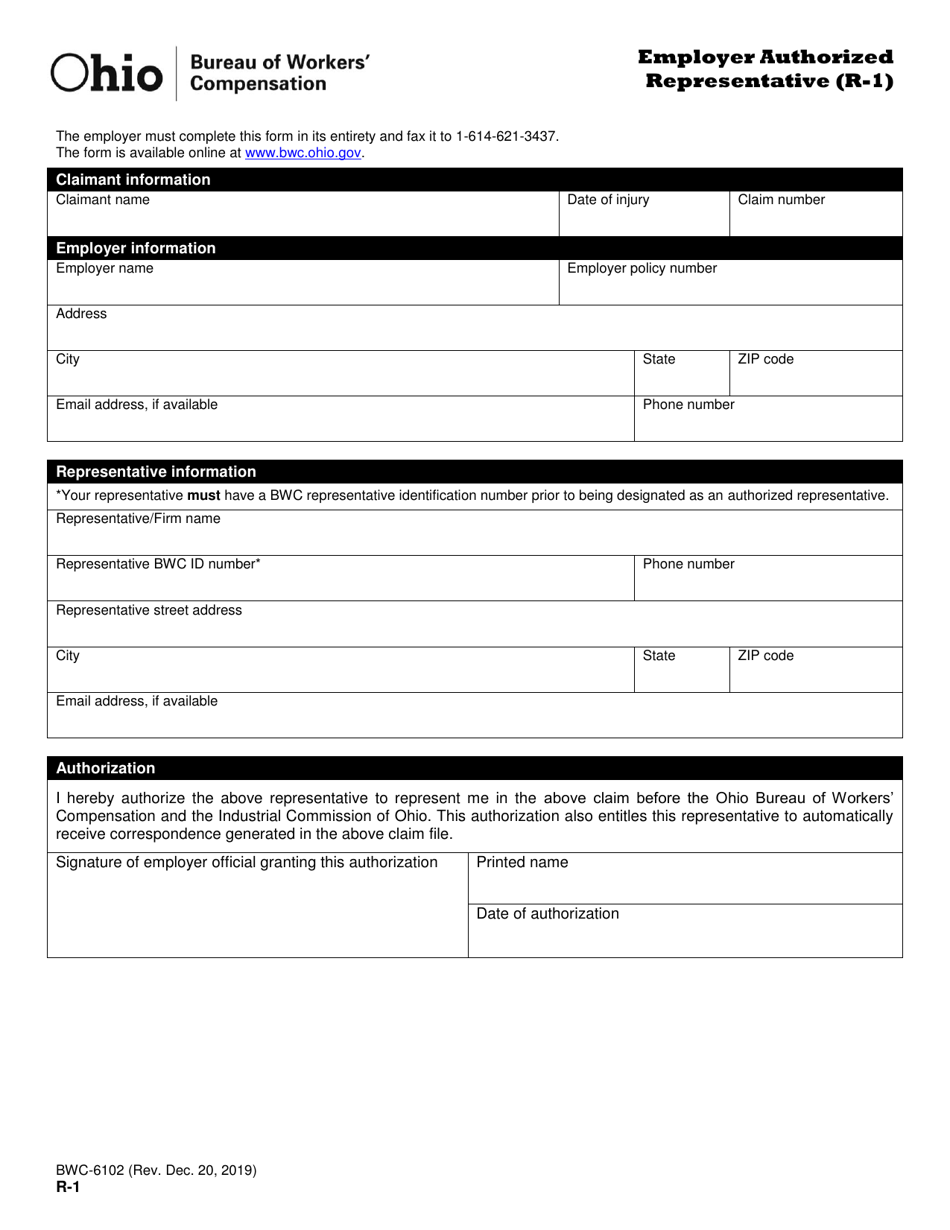

Form R1 (BWC6102) Download Printable PDF or Fill Online Employer

Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. You must file this application with your local assessor by the taxable status date. The low income senior tax exemption is available to homeowners age 65 and over with a gross income. Web what is ny.

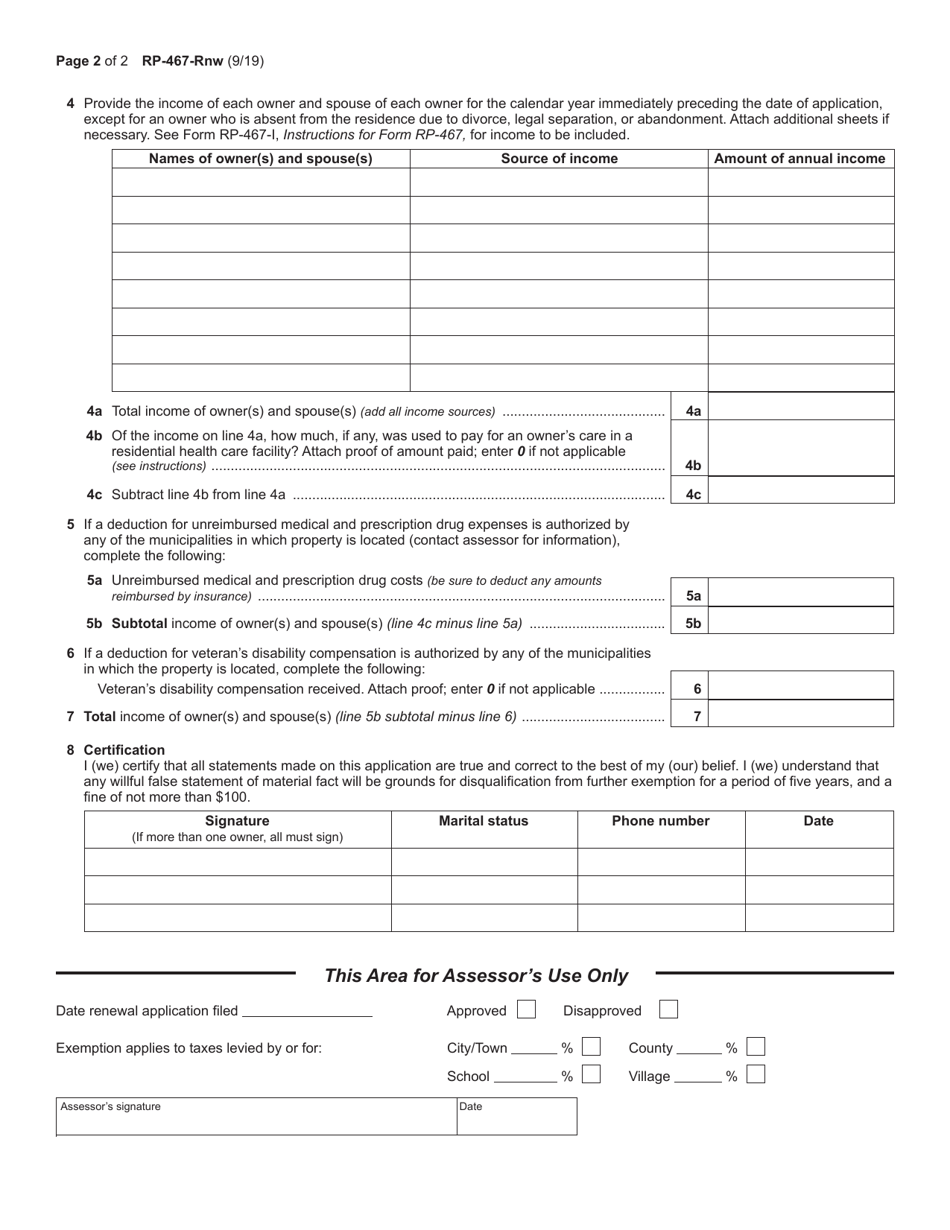

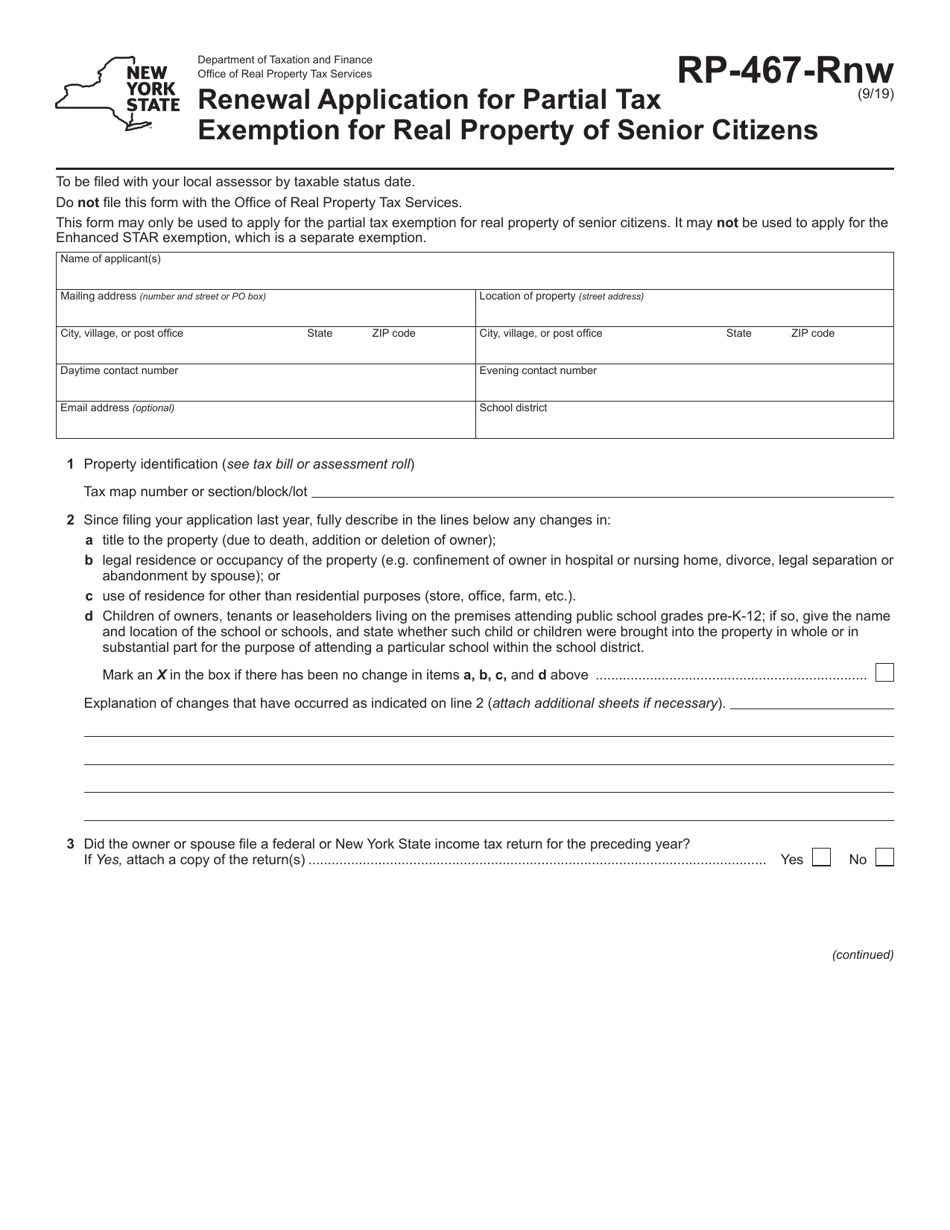

Form RP467RNW Fill Out, Sign Online and Download Fillable PDF, New

Web what is ny state form rp 467? Sign it in a few. Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Web real property tax law § 467 authorizes school districts to adopt a resolution, after a public hearing, to eliminate the need for.

Form RP467RNW Download Fillable PDF or Fill Online Renewal

Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. You must file this application with your local assessor by the taxable status date. Web follow the simple instructions below: Web section 467 of the real property tax law gives.

Instructions For Form Rp467I Application For The Partial Real

We are pleased to report that the following forms are available online for 2023: Web application for partial tax exemption for real property of senior citizens. Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Web what is ny state form rp 467? You must.

Tax file application form pdf Australian guide User Instructions

Web 2023 senior exemption forms now online. Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. Web section 467 of the real property tax law gives local governments and public school districts the option of granting a reduction in.

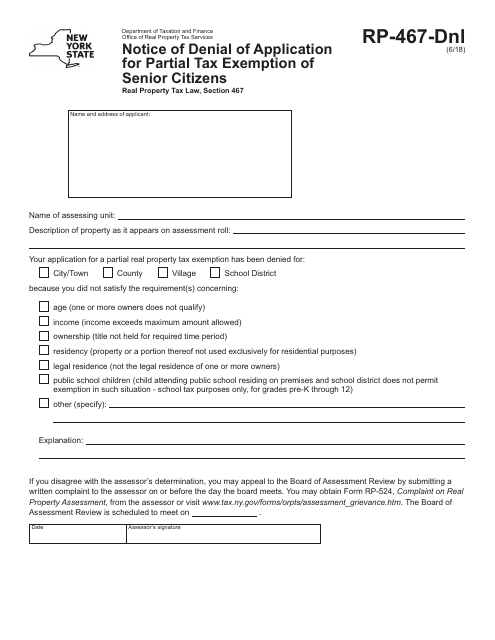

Form RP467DNL Download Fillable PDF or Fill Online Notice of Denial

Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior. Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few. Web.

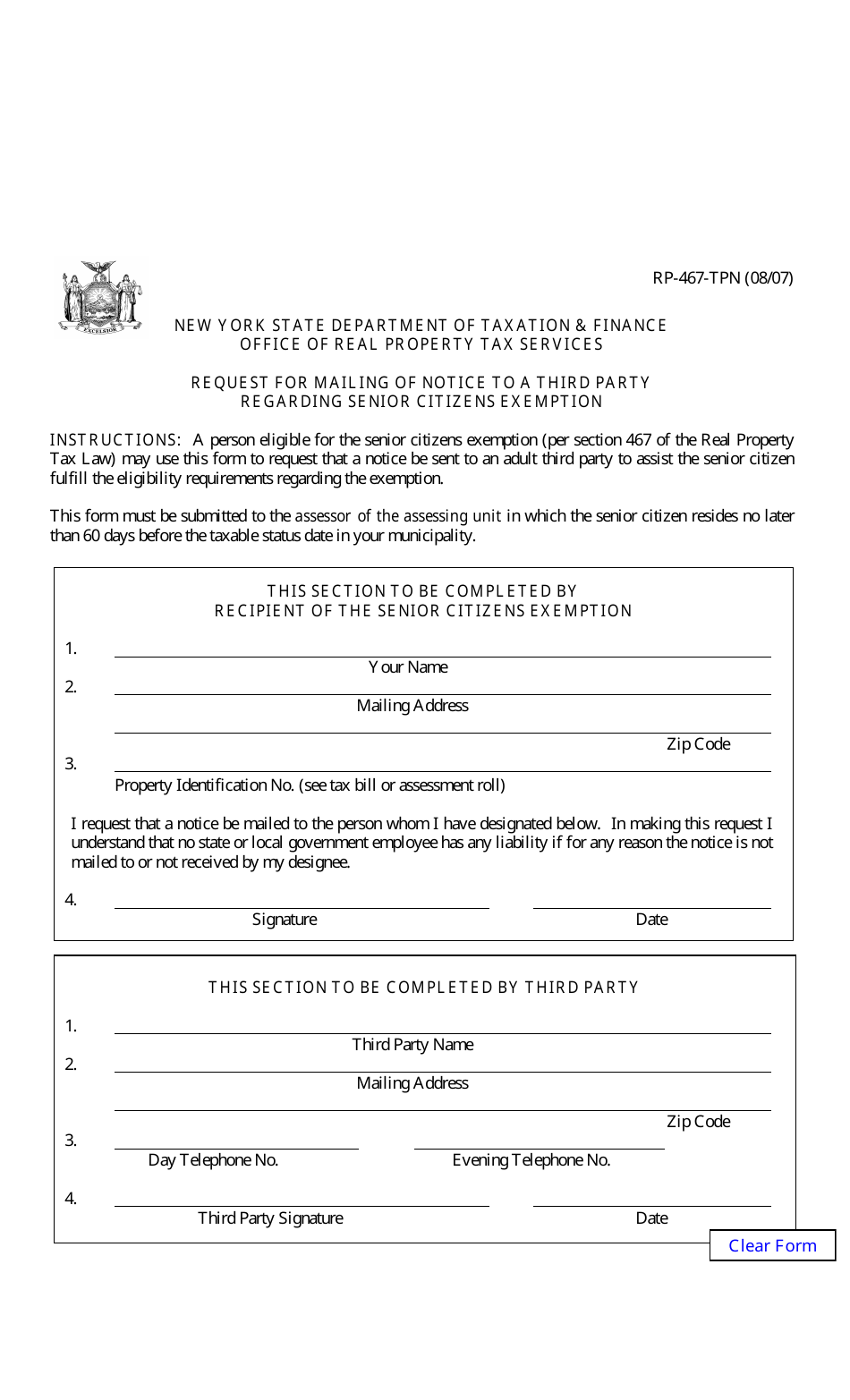

Form RP467TPN Download Fillable PDF or Fill Online Request for

Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. Web real property tax law § 467, authorizes municipalities (except new york city), to adopt a local law, ordinance, or resolution, after a public hearing, to eliminate the need for senior. Web 2023 senior exemption forms.

Fillable Form Rp467 Application For Partial Tax Exemption For Real

Web real property tax law § 467 authorizes school districts to adopt a resolution, after a public hearing, to eliminate the need for senior citizens to reapply if they received the exemption. You must file this application with your local assessor by the taxable status date. Edit your form rp 467 i instructions for form rp 467 online type text,.

Web What Is Ny State Form Rp 467?

Sign it in a few. You must file this application with your local assessor by the taxable status date. You must file this application with your local assessor by the taxable status date. Real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount.

Web Real Property Tax Law § 467 Authorizes School Districts To Adopt A Resolution, After A Public Hearing, To Eliminate The Need For Senior Citizens To Reapply If They Received The Exemption.

Web real property tax law § 467, authorizes municipalities (except new york city), to adopt a local law, ordinance, or resolution, after a public hearing, to eliminate the need for senior. Getting a legal specialist, creating a scheduled appointment and going to the office for a private conference makes finishing a rp 467. The low income senior tax exemption is available to homeowners age 65 and over with a gross income. Web real property tax law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior.

Web 2023 Senior Exemption Forms Now Online.

Web section 467 of the real property tax law gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by. Edit your form rp 467 i instructions for form rp 467 online type text, add images, blackout confidential details, add comments, highlights and more. We are pleased to report that the following forms are available online for 2023: Web follow the simple instructions below: