Form Sc 13G Good Or Bad

Form Sc 13G Good Or Bad - Web a schedule 13g filing is specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the. Please let me know what you think. I'm thinking if a company is willing to invest of 8% then they long term growth, i think? Web what is schedule 13g? Alternatively, if you are eligible to. The remainder of this cover. What is form sc 13g a. Web in short, form sc 13g is a way for the sec to keep track of who is acquiring large amounts of stock in publicly traded companies, and to ensure that these investors are following. Web june 8, 2021 equity accounting, financial statements there are two main stock market strategies where reading schedule 13d filings is essential to success:. Web companies file schedules 13d and 13g to disclose outside beneficial ownership information of more than 5% of a company's stock issue.

Web often you will see stocks rise and fall pretty significantly based on the changes in ownership of major shareholders, insiders and the like and these transactions are reported on. Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors. Web in short, form sc 13g is a way for the sec to keep track of who is acquiring large amounts of stock in publicly traded companies, and to ensure that these investors are following. The schedule 13d must be amended “promptly” to report any material change in the. Web on the edgar link online page, select sc 13d or sc 13d/a under submission types if you are filing a schedule 13d. Web it is good. Web a schedule 13g filing is specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web sc 13g/a 1 d834812dsc13ga.htm sc 13g/a united states. An sec form similar to the schedule 13d used to report a party's ownership of stock that is over 5% of.

Web often you will see stocks rise and fall pretty significantly based on the changes in ownership of major shareholders, insiders and the like and these transactions are reported on. You are a dynamic investor and do not intend to influence the company. Web in short, form sc 13g is a way for the sec to keep track of who is acquiring large amounts of stock in publicly traded companies, and to ensure that these investors are following. What is form sc 13g a. Web sc 13g/a 1 d834812dsc13ga.htm sc 13g/a united states. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security. Web companies file schedules 13d and 13g to disclose outside beneficial ownership information of more than 5% of a company's stock issue. Web june 8, 2021 equity accounting, financial statements there are two main stock market strategies where reading schedule 13d filings is essential to success:. Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors.

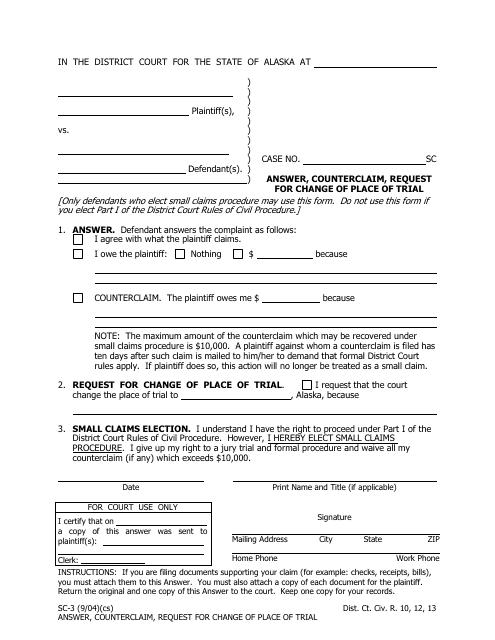

Form SC3 Download Fillable PDF or Fill Online Answer, Counterclaim

Web companies file schedules 13d and 13g to disclose outside beneficial ownership information of more than 5% of a company's stock issue. Alternatively, if you are eligible to. Web what is schedule 13g? Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors. The schedule 13d must be amended.

Yahoo Finance Stock Market Live, Quotes, Business & Finance News

What is form sc 13g a. Web 13g good of bad this is the filing. Web what is schedule 13g? Web schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security. Regarding their ownership of common stock.

Automating Disclosures Form 13F & 13G

Web often you will see stocks rise and fall pretty significantly based on the changes in ownership of major shareholders, insiders and the like and these transactions are reported on. Web a schedule 13g filing is specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the. Web sc.

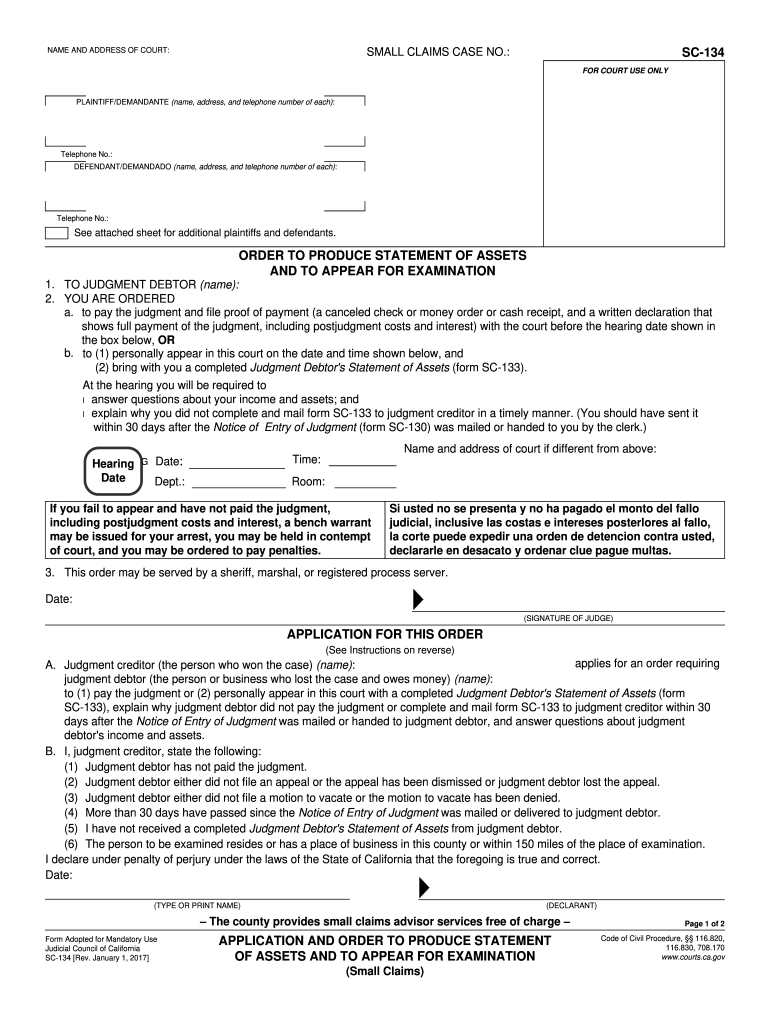

Produce Form Online Fill Out and Sign Printable PDF Template signNow

Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web 13g good of bad this is the filing. Please let me know what you think. Web a schedule 13g filing is specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the. Web on the edgar link online.

Form SC 13G Hirzel Capital's Big Investment in Rex Energy

Web this is a schedule 13g filing with the securities and exchange commission by the vanguard group, inc. Web schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security. And this is for investors who trade less.

Asking Extra Questions on Your Sweepstakes Entry Form Good or Bad

Web companies file schedules 13d and 13g to disclose outside beneficial ownership information of more than 5% of a company's stock issue. And this is for investors who trade less than 20%. Web on the edgar link online page, select sc 13d or sc 13d/a under submission types if you are filing a schedule 13d. Web sc 13g 1 d867665dsc13g.htm.

Sec schedule 13g form instructions

Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors. Web in short, form sc 13g is a way for the sec to keep track of who is acquiring large amounts of stock in publicly traded companies, and to ensure that these investors are following. Web it is good..

Sec schedule 13g form instructions

Web 13g good of bad this is the filing. An sec form similar to the schedule 13d used to report a party's ownership of stock that is over 5% of. Web it is good. The remainder of this cover. Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors.

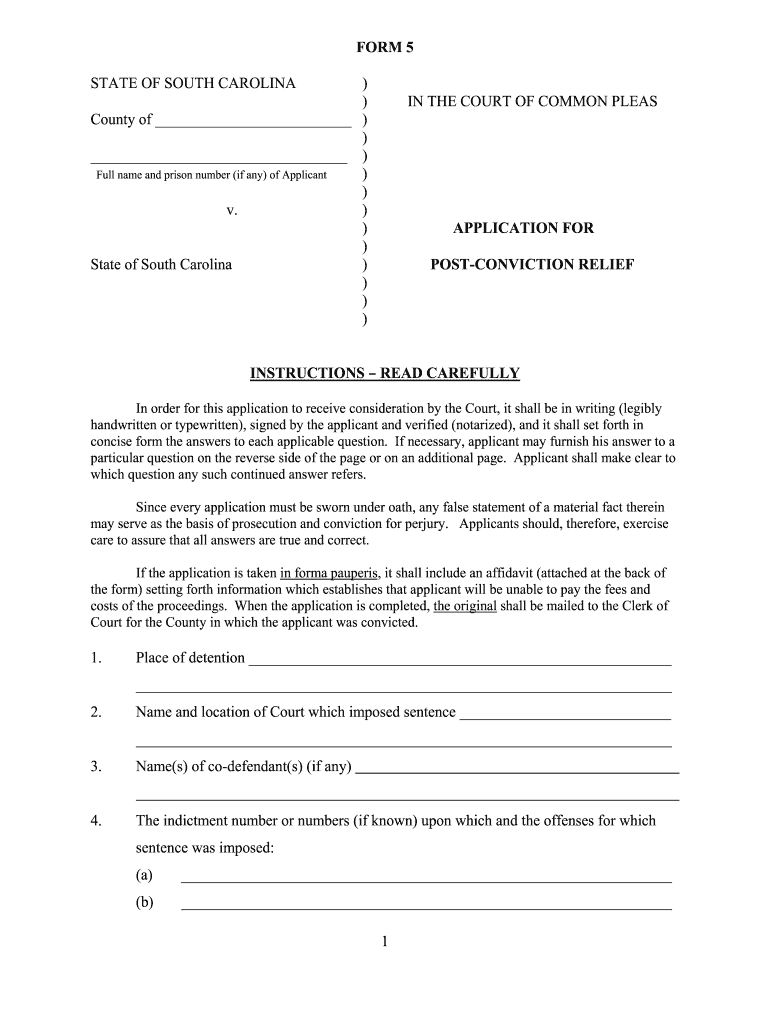

Sc Form 5 Fill Out and Sign Printable PDF Template signNow

Web 13g good of bad this is the filing. Web when a person or group of persons acquires beneficial ownership of more than five percent of a voting class of a company’s equity securities registered under the. Web often you will see stocks rise and fall pretty significantly based on the changes in ownership of major shareholders, insiders and the.

What Is Form 13 Form 13 Download Fillable Pdf Or Fill Online

You are a dynamic investor and do not intend to influence the company. The schedule 13d must be amended “promptly” to report any material change in the. What is form sc 13g a. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web june 8, 2021 equity accounting, financial statements there are two main stock market strategies where reading.

Please Let Me Know What You Think.

Web 13g good of bad this is the filing. Web on the edgar link online page, select sc 13d or sc 13d/a under submission types if you are filing a schedule 13d. The remainder of this cover. Web schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security.

Web Often You Will See Stocks Rise And Fall Pretty Significantly Based On The Changes In Ownership Of Major Shareholders, Insiders And The Like And These Transactions Are Reported On.

Regarding their ownership of common stock of bed bath & beyond. The schedule 13d must be amended “promptly” to report any material change in the. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web sc 13g/a 1 dsc13ga.htm form sc 13g/a united states.

I'm Thinking If A Company Is Willing To Invest Of 8% Then They Long Term Growth, I Think?

Web a schedule 13g filing is specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the. Web companies file schedules 13d and 13g to disclose outside beneficial ownership information of more than 5% of a company's stock issue. Web june 8, 2021 equity accounting, financial statements there are two main stock market strategies where reading schedule 13d filings is essential to success:. Web is a schedule 13g a good or bad sign?

And This Is For Investors Who Trade Less Than 20%.

Web when a person or group of persons acquires beneficial ownership of more than five percent of a voting class of a company’s equity securities registered under the. Web it is good. Schedule 13g requires less disclosure than schedule 13d and may be used by certain persons or groups including qualified institutional investors. Web in short, form sc 13g is a way for the sec to keep track of who is acquiring large amounts of stock in publicly traded companies, and to ensure that these investors are following.