General Business Credit Form 3800

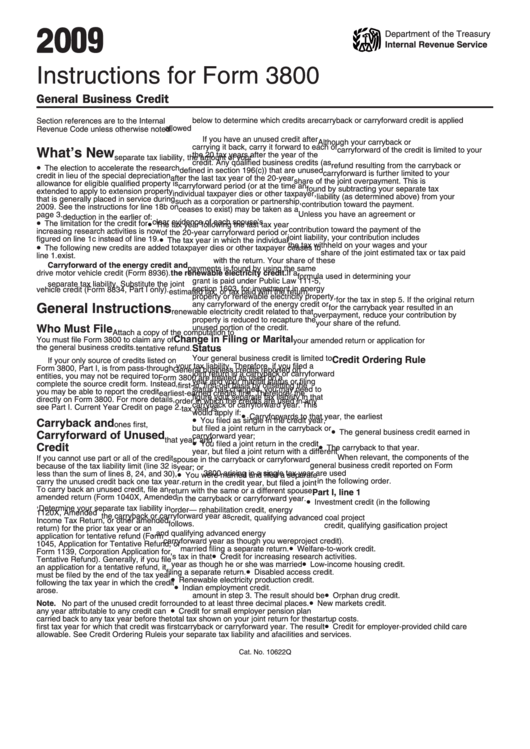

General Business Credit Form 3800 - Web solved • by intuit • 1 • updated july 14, 2022. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Web most of these small business tax credits are reported on a variety of tax forms, then consolidated on irs form 3800, general business credit. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web the general business credit (form 3800) is made up of many other credits, like: From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a tax provision. Web you must file form 3800 to claim any of the general business credits. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted.

Web solved • by intuit • 1 • updated july 14, 2022. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web must be removed before printing. Web most of these small business tax credits are reported on a variety of tax forms, then consolidated on irs form 3800, general business credit. Web what is the general business credit’s form 3800? Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Web you must file form 3800 if you have business tax credits to claim.

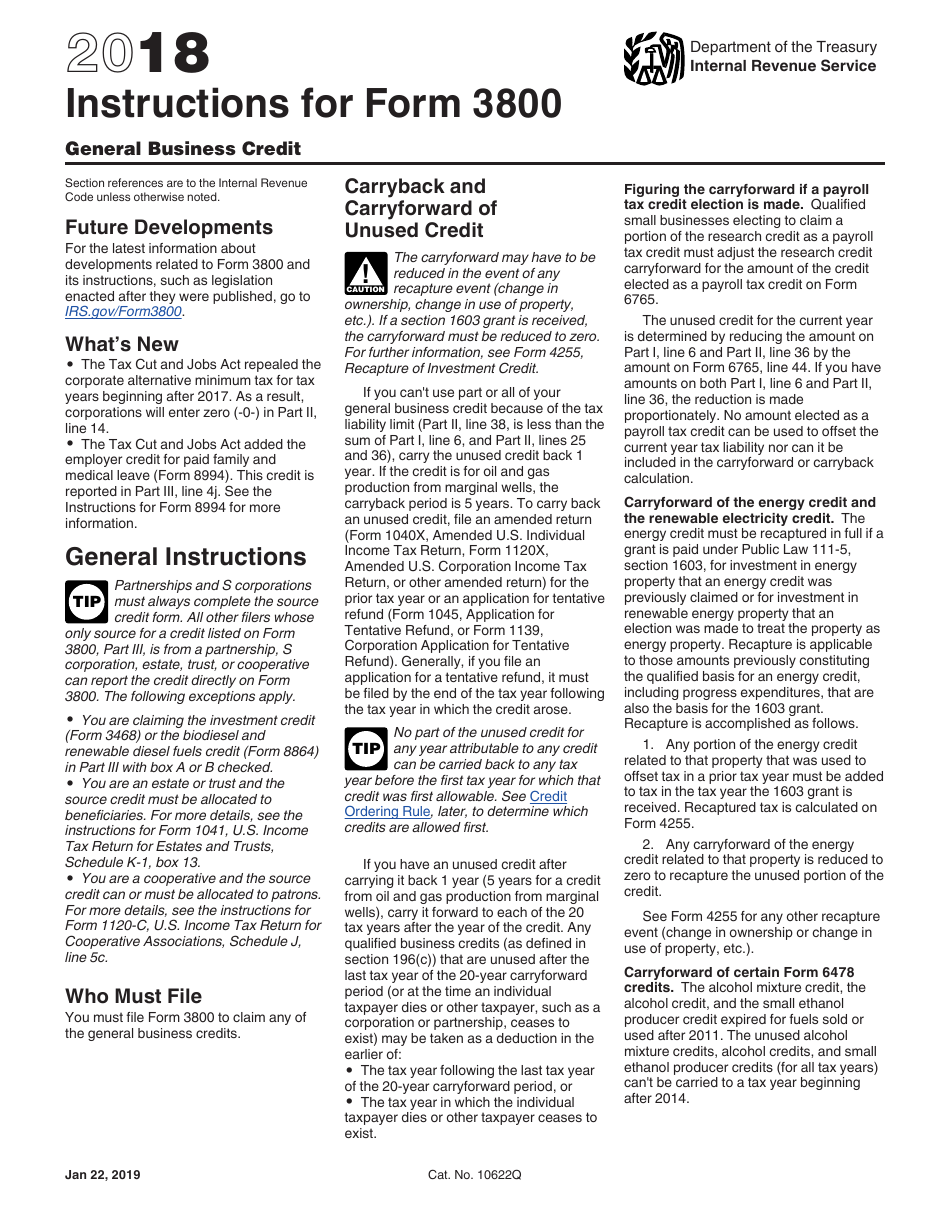

Future developments for the latest information. Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Web most of these small business tax credits are reported on a variety of tax forms, then consolidated on irs form 3800, general business credit. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Web anyone claiming general business credits must file form 3800. Web what is the general business credit’s form 3800? Web what is form 3800?

How to File General Business Credit Form 3800 for Tax Credits

Web file form 3800 to claim any of the general business credits. From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a tax provision. Web must be removed before printing. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. The credit.

Download Instructions for IRS Form 3800 General Business Credit PDF

From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a tax provision. Web you must file form 3800 if you have business tax credits to claim. Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web instructions for form 3800 general business.

Instructions For Form 3800 General Business Credit Internal Revenue

Web solved • by intuit • 1 • updated july 14, 2022. Web what is the general business credit’s form 3800? Web what is the general business credit, form 3800? The general business credit’s form 3800 is designed to add up all the tax credits your business is taking advantage of. The form has two main.

Form 3800General Business Credit

Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Ad compare cash back, travel rewards and no annual fee business credit cards. Web what is the general business credit’s.

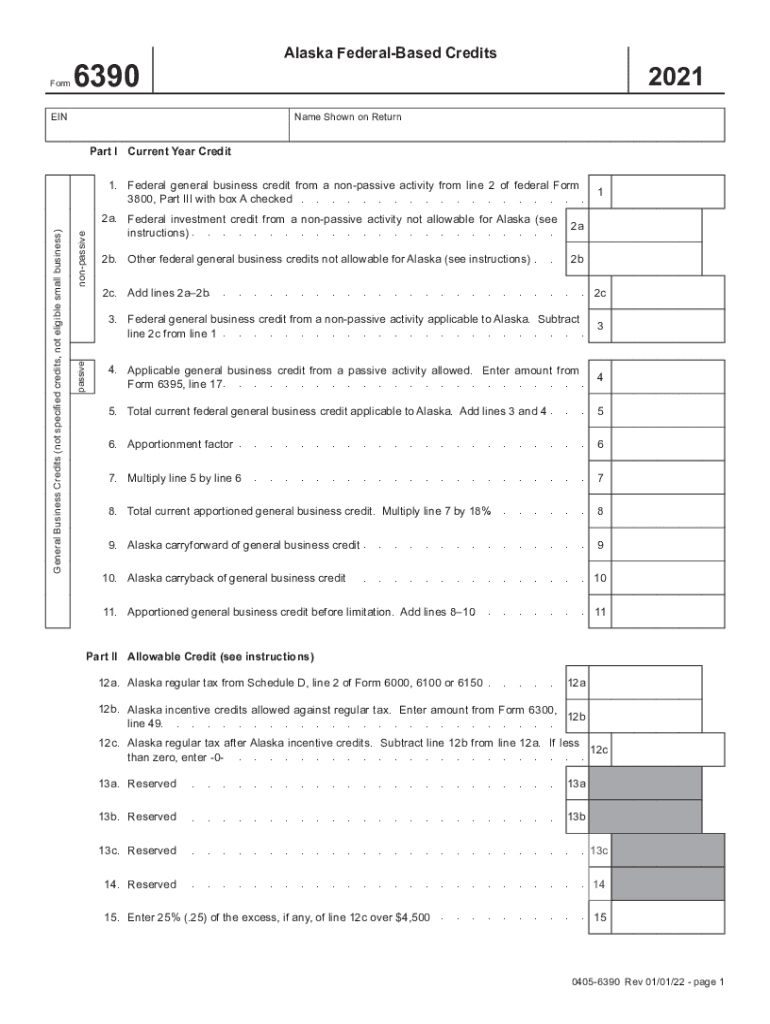

Alaska Form 6390 Fill Out and Sign Printable PDF Template signNow

The general business credit’s form 3800 is designed to add up all the tax credits your business is taking advantage of. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. To receive tax credits for business activities, you must first engage in an activity—e.g.,. Web you must file form 3800 to claim any of.

Instructions For Form 3800 General Business Credit Internal Revenue

Web what is the general business credit’s form 3800? Web form 3800 is used to summarize the credits that make up the general business credit, or to claim a carryback or carryforward of any of the credits. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Web anyone claiming general business credits must file form 3800..

Instructions For Form 3800 General Business Credit Internal Revenue

Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web anyone claiming general business credits must file form 3800. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a.

Form 3800 Instructions How to Fill out the General Business Credit

Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web you must file form 3800 if you have business tax credits to claim. In this guide, we’ll show. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Web most of these small business tax credits are.

Form 3800 General Business Credit (2014) Free Download

Web file form 3800 to claim any of the general business credits. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Carryback and carryforward of unused credit The form has two main. In this guide, we’ll show.

General Business Credit Eligible Businesses, Form 3800 & How to Claim

Web you must file form 3800 to claim any of the general business credits. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. The form has two main. The general business credit’s form 3800 is designed to add up all the tax credits your business is taking advantage of. Web.

Web Anyone Claiming General Business Credits Must File Form 3800.

#didyouknow you can use tax credits. Web what is the general business credit, form 3800? Web file form 3800 to claim any of the general business credits. Web you must file form 3800 if you have business tax credits to claim.

The Form Has Two Main.

You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. Web must be removed before printing. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information.

To Receive Tax Credits For Business Activities, You Must First Engage In An Activity—E.g.,.

Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web most of these small business tax credits are reported on a variety of tax forms, then consolidated on irs form 3800, general business credit. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. For businesses who rely on credit, capital one® spark business cards keep it simple.

Carryback And Carryforward Of Unused Credit

Web solved • by intuit • 1 • updated july 14, 2022. Web you must file form 3800 to claim any of the general business credits. Future developments for the latest information. In this guide, we’ll show.