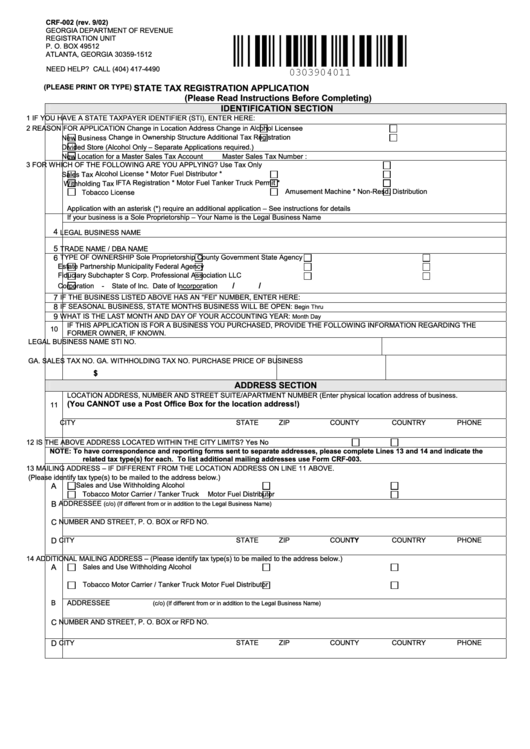

Georgia State Tax Exempt Form

Georgia State Tax Exempt Form - Letter of authorization (7.05) sales of tangible personal property (i.e., not services) to a nonprofit health center in georgia which has been established under the authority of and is Web the payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Web upon verification of the identity of the government official or employee identified below, georgia hotel and motel operators are required to exempt the individual from any applicable tax(es), as outlined below. Nonprofit private schools any combination of. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: The american association of state troopers (aast) 2023 best looking cruiser contest is underway. This year, the contest began july 17 and will end july 31, at noon (est). Web local, state, and federal government websites often end in.gov. Web search for a tax exempt organization the irs tax exempt organization search, (eos) is an easy online search tool that provides certain information about the federal tax status and filings of exempt organizations. The aast hosts the calendar contest annually and encourages state law enforcement agencies across the u.s.

Web georgia depreciation and amortization form, includes information on listed property. 500 individual income tax return what's new? Web local, state, and federal government websites often end in.gov. As a further note, the $5/night state fee is never exempt in. To submit a photo entry that is unique to and. Web search for a tax exempt organization the irs tax exempt organization search, (eos) is an easy online search tool that provides certain information about the federal tax status and filings of exempt organizations. Eos can help you to check if an organization: Licensed nonprofit orphanages, adoption agencies, and maternity homes. Web july 24, 2023. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including:

Web more upcoming georgia board of nursing events. Letter of authorization (7.05) sales of tangible personal property (i.e., not services) to a nonprofit health center in georgia which has been established under the authority of and is The aast hosts the calendar contest annually and encourages state law enforcement agencies across the u.s. Web organization obtains an exemption determination letter from the commissioner. Web the payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Web upon verification of the identity of the government official or employee identified below, georgia hotel and motel operators are required to exempt the individual from any applicable tax(es), as outlined below. Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: Web july 24, 2023. This year, the contest began july 17 and will end july 31, at noon (est). Complete, save and print the form online using your browser.

Contact Number For Department Of Revenue customdbdesigns

Web georgia depreciation and amortization form, includes information on listed property. The american association of state troopers (aast) 2023 best looking cruiser contest is underway. Complete, save and print the form online using your browser. As a further note, the $5/night state fee is never exempt in. Web upon verification of the identity of the government official or employee identified.

GA Certificate of Exemption of Local Hotel/Motel Excise Tax 20132022

Web search for a tax exempt organization the irs tax exempt organization search, (eos) is an easy online search tool that provides certain information about the federal tax status and filings of exempt organizations. Web july 24, 2023. Web upon verification of the identity of the government official or employee identified below, georgia hotel and motel operators are required to.

20162021 Form GA DoR ST5 Fill Online, Printable, Fillable, Blank

This year, the contest began july 17 and will end july 31, at noon (est). Web july 24, 2023. As a further note, the $5/night state fee is never exempt in. Web local, state, and federal government websites often end in.gov. Web georgia depreciation and amortization form, includes information on listed property.

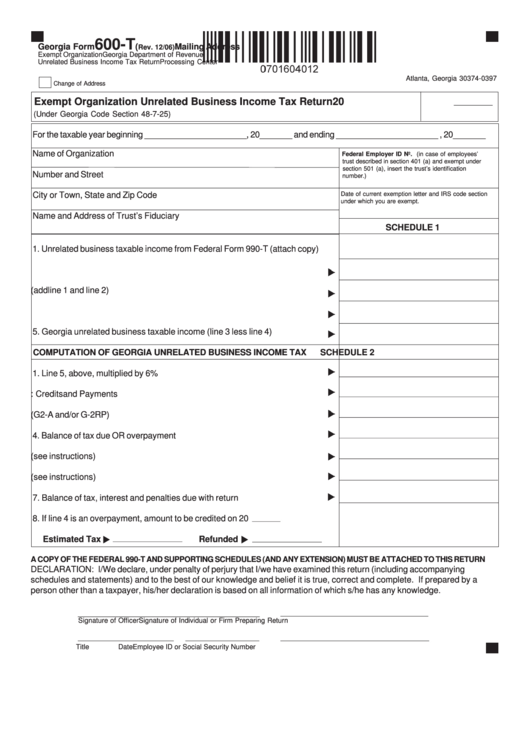

Form 600T Exempt Organization Unrelated Business Tax

Nonprofit private schools any combination of. Web georgia department of revenue Before sharing sensitive or personal information, make sure. Web more upcoming georgia board of nursing events. As a further note, the $5/night state fee is never exempt in.

Sales Tax Exemption Form St5

Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including: To submit a photo entry that is unique to and. Web the payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental.

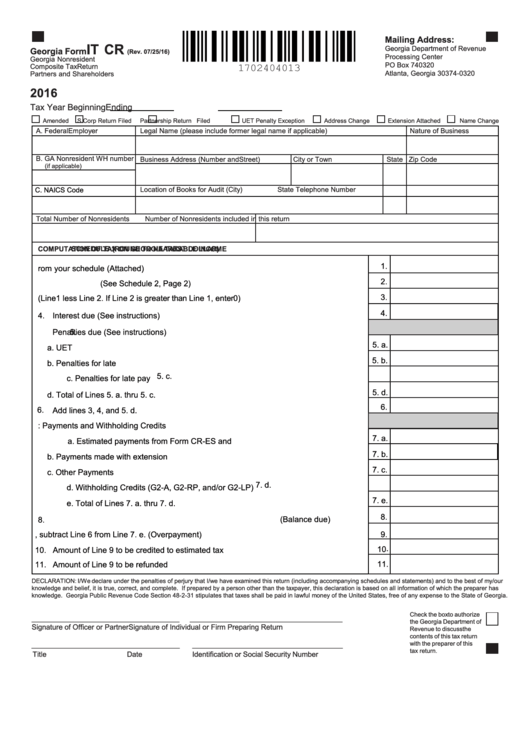

Fillable Form It Cr Nonresident Composite Tax Return

Licensed nonprofit orphanages, adoption agencies, and maternity homes. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. 500 individual income tax return what's new? The aast hosts the calendar contest annually and encourages state law enforcement agencies across the u.s. To submit a photo entry that is unique to and.

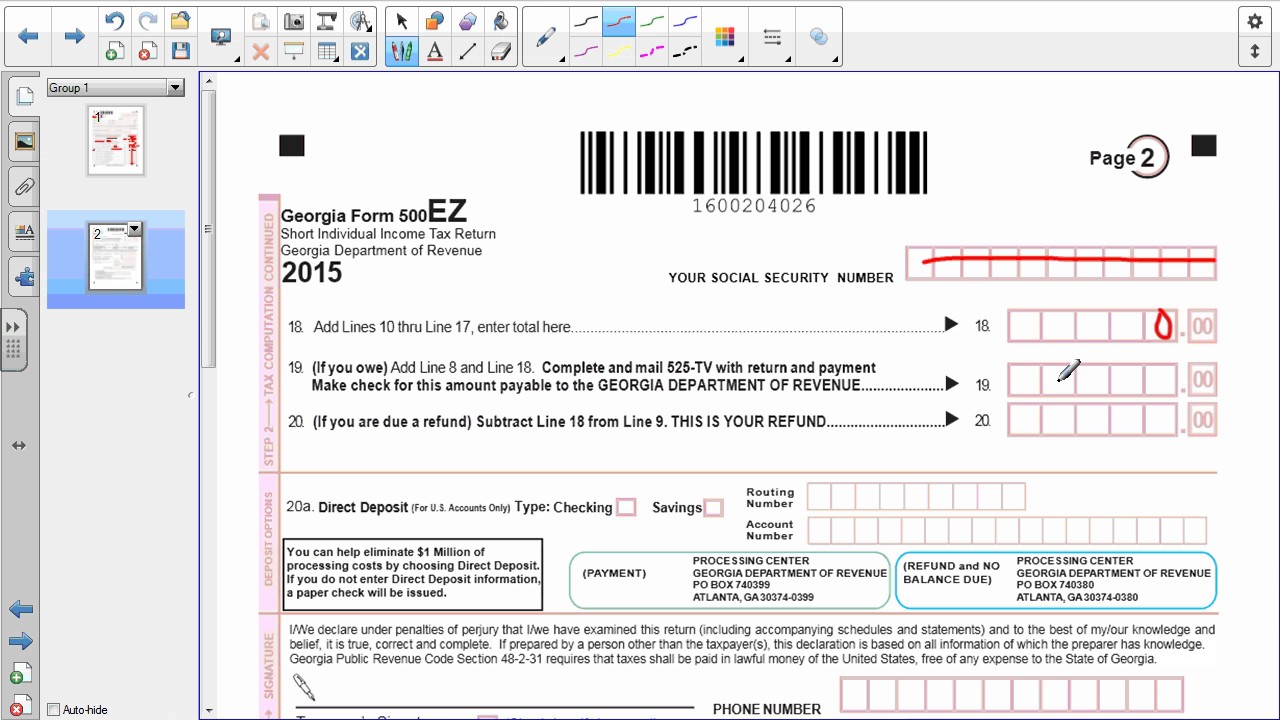

State of tax Form YouTube

The american association of state troopers (aast) 2023 best looking cruiser contest is underway. Web local, state, and federal government websites often end in.gov. As a further note, the $5/night state fee is never exempt in. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. This year, the contest began july.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

This year, the contest began july 17 and will end july 31, at noon (est). Web local, state, and federal government websites often end in.gov. Web search for a tax exempt organization the irs tax exempt organization search, (eos) is an easy online search tool that provides certain information about the federal tax status and filings of exempt organizations. Web.

Ga Out Of State Tax Exempt Form

Licensed nonprofit orphanages, adoption agencies, and maternity homes. Complete, save and print the form online using your browser. Web georgia depreciation and amortization form, includes information on listed property. Web organization obtains an exemption determination letter from the commissioner. Web local, state, and federal government websites often end in.gov.

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Nonprofit private schools any combination of. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the address. Web georgia department of revenue Before sharing sensitive or personal information, make sure. The aast hosts the calendar contest annually and encourages state law enforcement agencies across the u.s.

Licensed Nonprofit Orphanages, Adoption Agencies, And Maternity Homes.

Before sharing sensitive or personal information, make sure. To submit a photo entry that is unique to and. Web organization obtains an exemption determination letter from the commissioner. The american association of state troopers (aast) 2023 best looking cruiser contest is underway.

State Of Georgia Government Websites And Email Systems Use “Georgia.gov” Or “Ga.gov” At The End Of The Address.

As a further note, the $5/night state fee is never exempt in. Web the payment methods that are applicable to the exemption of this sales tax are either a state of georgia issued credit card or payments made by directly billing the governmental organization. Letter of authorization (7.05) sales of tangible personal property (i.e., not services) to a nonprofit health center in georgia which has been established under the authority of and is Web limited exemptions from the payment of georgia’s sales and use tax are available for qualifying nonprofit organizations including:

Eos Can Help You To Check If An Organization:

Complete, save and print the form online using your browser. This year, the contest began july 17 and will end july 31, at noon (est). Web upon verification of the identity of the government official or employee identified below, georgia hotel and motel operators are required to exempt the individual from any applicable tax(es), as outlined below. Web georgia depreciation and amortization form, includes information on listed property.

Web Local, State, And Federal Government Websites Often End In.gov.

Web july 24, 2023. The aast hosts the calendar contest annually and encourages state law enforcement agencies across the u.s. Web search for a tax exempt organization the irs tax exempt organization search, (eos) is an easy online search tool that provides certain information about the federal tax status and filings of exempt organizations. Web more upcoming georgia board of nursing events.