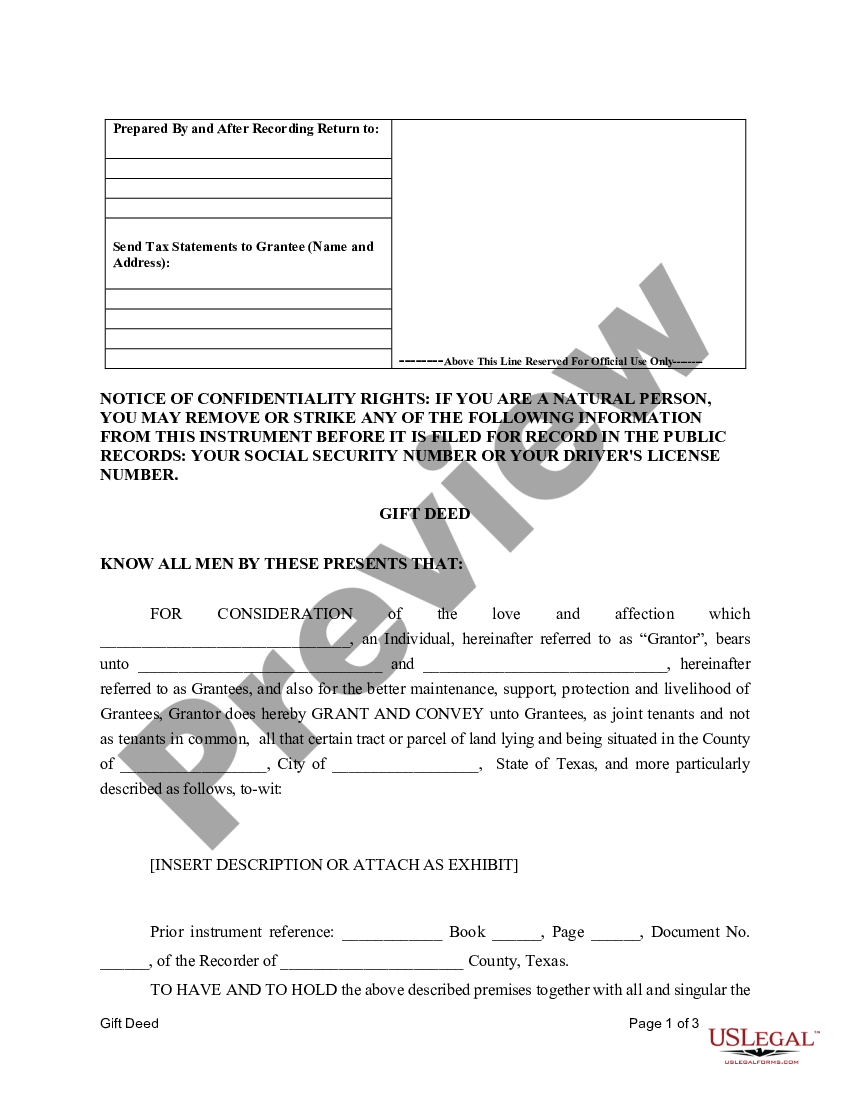

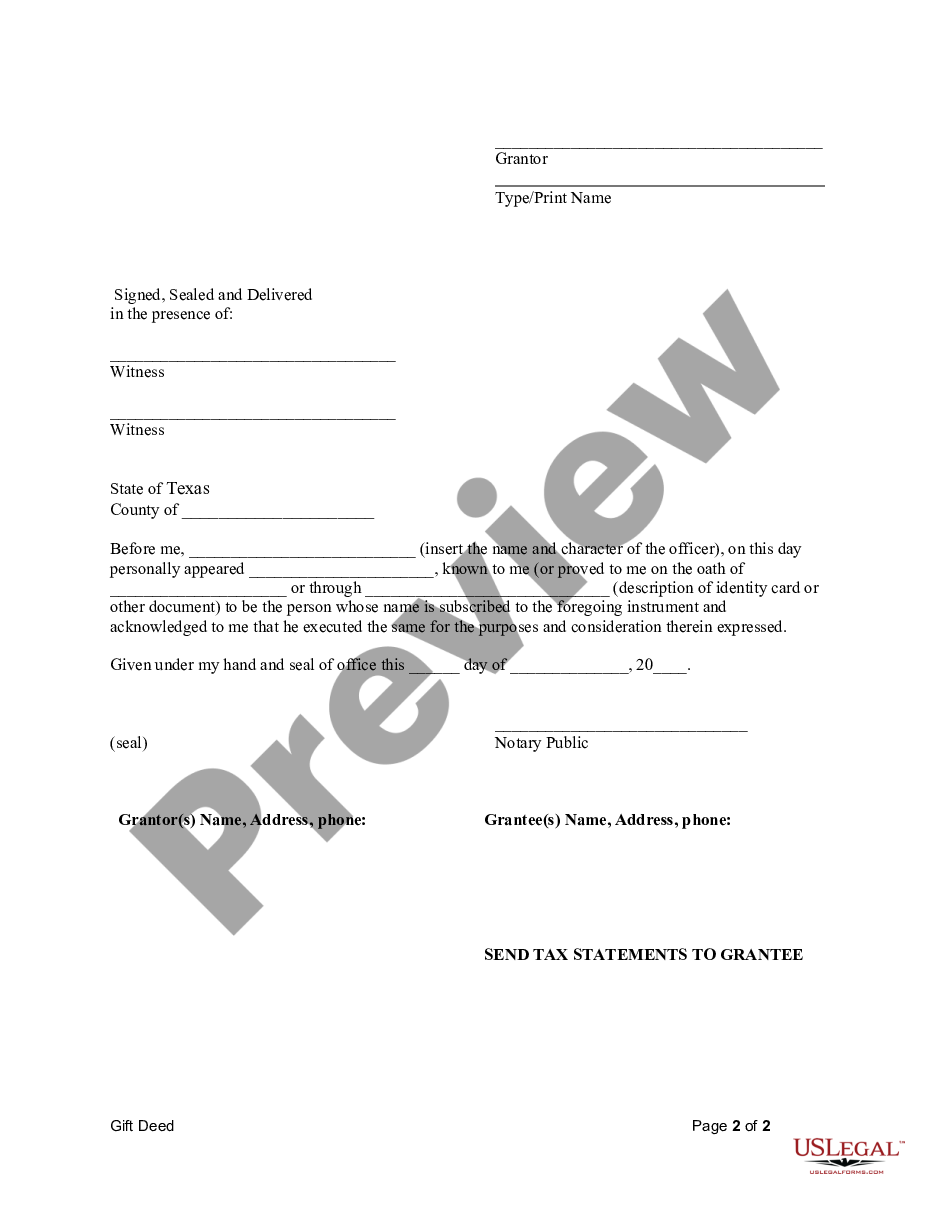

Gift Deed Form Texas

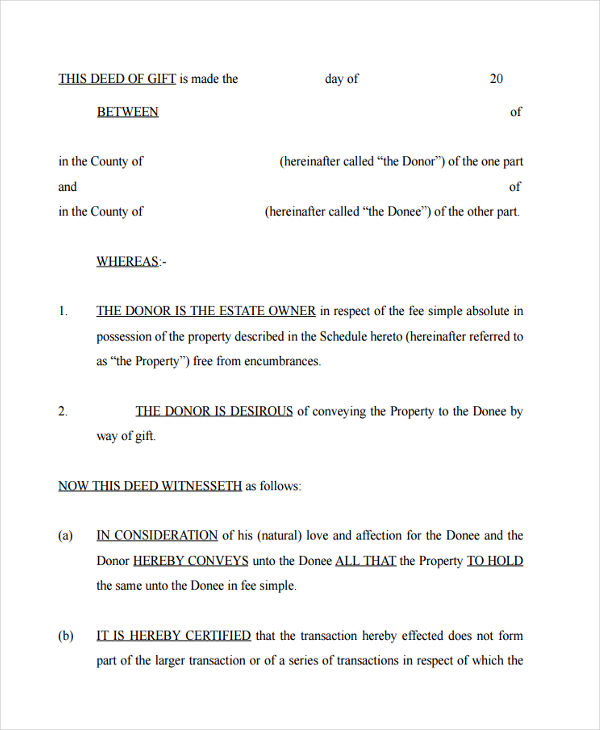

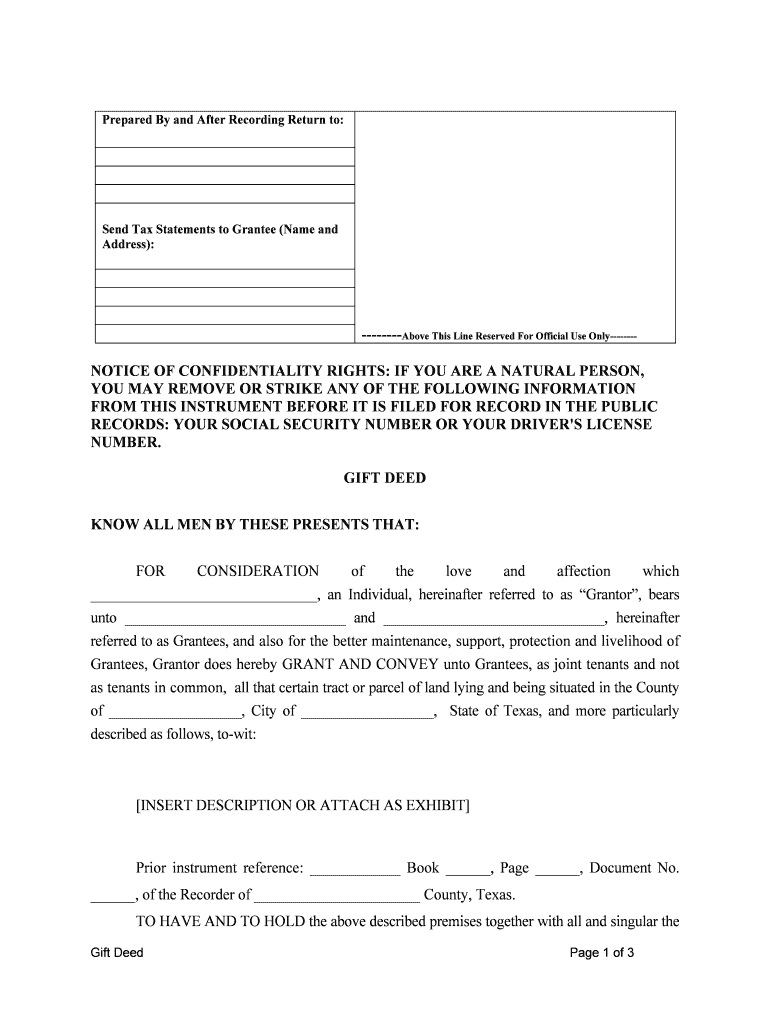

Gift Deed Form Texas - Fill pdf online download pdf. __________ this is an irrevocable inter vivos deed of gift given by me, __________, of __________, , united states. As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Web get printable gift deed form texas 2023 get form pdf editing your way complete or edit your printable gift deed form texas anytime and from any device using our web, desktop, and mobile apps. This means that, if a gift is valued below $15,000, a federal gift tax return (form 709) does not need to be filed. Web if you would like to order a gift deed, please click the button to fill out the deed order form. Web gift deeds in texas are valid; Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web when a person wants to transfer real property to another person not listed on the original deed, one option in texas for that type of transaction is a gift deed, which could take the form of either a special warranty deed or a general warranty deed.

Web if you would like to order a gift deed, please click the button to fill out the deed order form. As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Fill pdf online download pdf. Web gift deeds in texas are valid; Gift is the transfer of a motor vehicle between eligible parties for no consideration. Web est code 111.001, tex. __________ this is an irrevocable inter vivos deed of gift given by me, __________, of __________, , united states. However, there are strict requirements for gift deeds in texas. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. My purpose in completing this document is to give effect to my wishes regarding gifts i wish to make during my lifetime to family and friends.

This means that, if a gift is valued below $15,000, a federal gift tax return (form 709) does not need to be filed. My purpose in completing this document is to give effect to my wishes regarding gifts i wish to make during my lifetime to family and friends. Gift is the transfer of a motor vehicle between eligible parties for no consideration. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. __________ this is an irrevocable inter vivos deed of gift given by me, __________, of __________, , united states. Select the gift deed option from the drop down menu. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. However, there are strict requirements for gift deeds in texas. Fill pdf online download pdf. Web when a person wants to transfer real property to another person not listed on the original deed, one option in texas for that type of transaction is a gift deed, which could take the form of either a special warranty deed or a general warranty deed.

Gift Deed California Fill Online, Printable, Fillable, Blank pdfFiller

Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. We prepare gift deeds for $195. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. Fill pdf online download pdf. As with any conveyance of realty, a gift deed requires a complete legal description.

The Computer History Museum

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you. A texas gift deed is used when a person gifts property or real estate to.

Gift Deed Form Texas Gift Ftempo

Web however, if the donor does not pay the gift tax, the donee will be held liable [1]. Select the gift deed option from the drop down menu. My purpose in completing this document is to give effect to my wishes regarding gifts i wish to make during my lifetime to family and friends. Therefore, if you have a document.

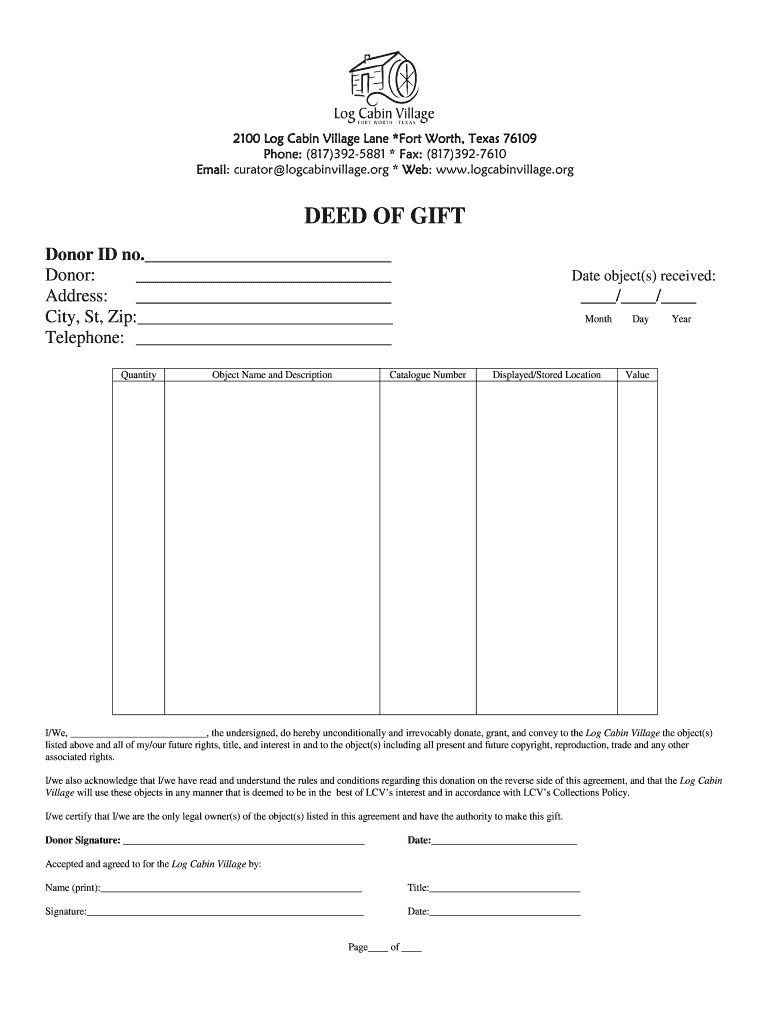

Deed of Gift Form Texas the Form in Seconds Fill Out and Sign

Web when a person wants to transfer real property to another person not listed on the original deed, one option in texas for that type of transaction is a gift deed, which could take the form of either a special warranty deed or a general warranty deed. Web the purpose of this afidavit is to document the gift of a.

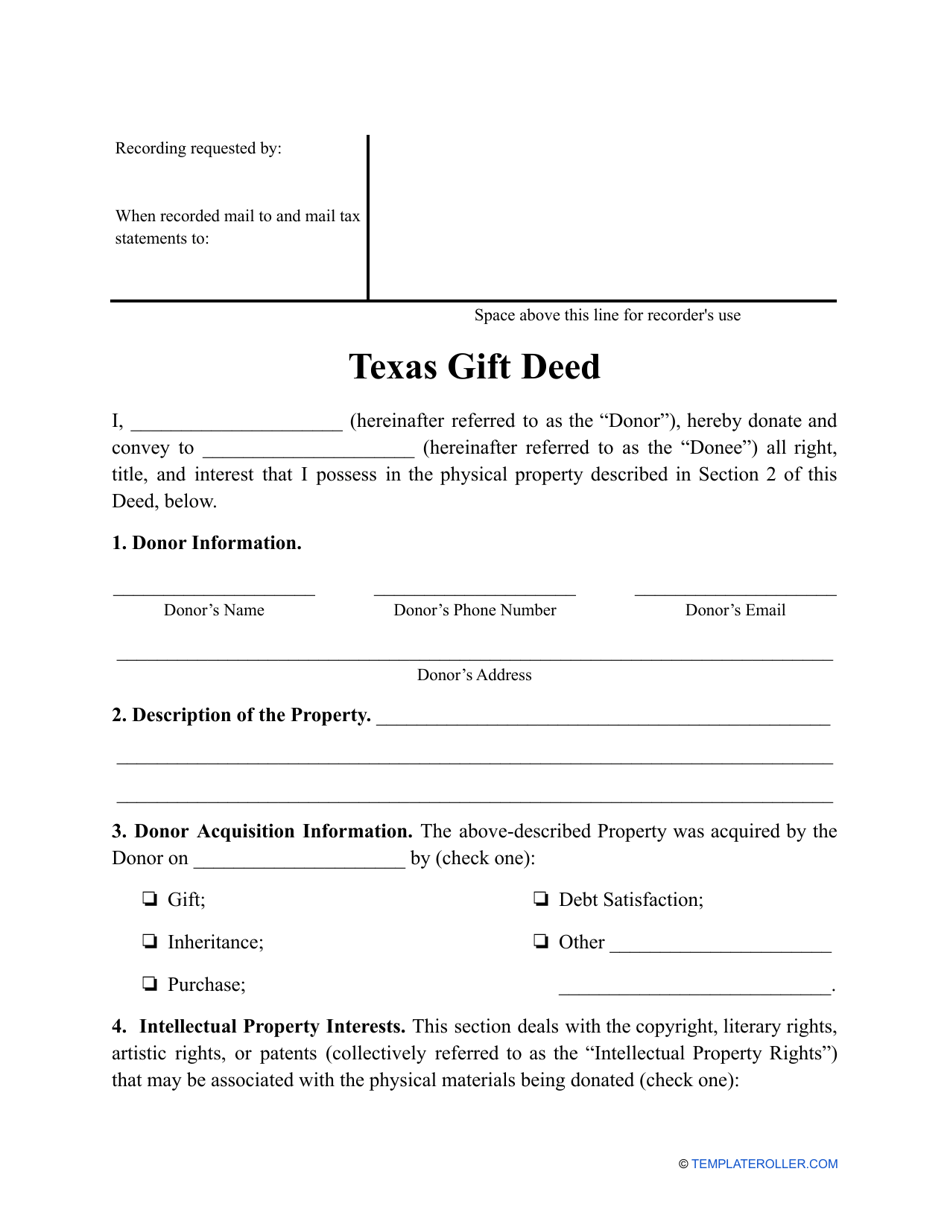

Texas Gift Deed Form Download Printable PDF Templateroller

This means that, if a gift is valued below $15,000, a federal gift tax return (form 709) does not need to be filed. Web gift deeds in texas are valid; Web get printable gift deed form texas 2023 get form pdf editing your way complete or edit your printable gift deed form texas anytime and from any device using our.

Gift Deed Form Texas Gift Ftempo

Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web gift deeds in texas are valid; We prepare gift deeds for $195. __________ this is an irrevocable inter vivos deed of gift given by me, __________, of __________, , united.

Gift Deed Texas Fill Online, Printable, Fillable, Blank pdfFiller

We prepare gift deeds for $195. Web get printable gift deed form texas 2023 get form pdf editing your way complete or edit your printable gift deed form texas anytime and from any device using our web, desktop, and mobile apps. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the.

Texas Gift Deed for Individual to Individuals as Joint Tenants Gift

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. Web if you would like to order a gift deed, please click the button to fill out the deed order form. My purpose in completing this document is to give effect to my wishes regarding gifts i wish to make during my lifetime to family.

Texas Gift Deed for Individual to Individual Texas Gift Deed US

Web when a person wants to transfer real property to another person not listed on the original deed, one option in texas for that type of transaction is a gift deed, which could take the form of either a special warranty deed or a general warranty deed. Web the purpose of this afidavit is to document the gift of a.

Gift Deed Form Texas Gift Ftempo

Web gift deeds in texas are valid; In order for the gift deed to be deemed legally valid, the document must clearly dictate a complete legal description of the property, chain of title, any. Create custom documents by adding smart fillable fields. Gift is the transfer of a motor vehicle between eligible parties for no consideration. Web however, if the.

This Means That, If A Gift Is Valued Below $15,000, A Federal Gift Tax Return (Form 709) Does Not Need To Be Filed.

Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you. __________ this is an irrevocable inter vivos deed of gift given by me, __________, of __________, , united states. As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Web est code 111.001, tex.

We Prepare Gift Deeds For $195.

Create custom documents by adding smart fillable fields. Web however, if the donor does not pay the gift tax, the donee will be held liable [1]. A texas gift deed is used when a person gifts property or real estate to another individual or party without an expectation of payment in return. Fill pdf online download pdf.

In Order For The Gift Deed To Be Deemed Legally Valid, The Document Must Clearly Dictate A Complete Legal Description Of The Property, Chain Of Title, Any.

However, there are strict requirements for gift deeds in texas. Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web irrevocable inter vivos deed of gift from: Gift is the transfer of a motor vehicle between eligible parties for no consideration.

In Accordance With Federal Law, Individuals Are Permitted An Annual Exclusion Of $15,000 On Gifts.

Web if you would like to order a gift deed, please click the button to fill out the deed order form. Web gift deeds in texas are valid; Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Web get printable gift deed form texas 2023 get form pdf editing your way complete or edit your printable gift deed form texas anytime and from any device using our web, desktop, and mobile apps.

.png)