Goodwill Donation Tax Form

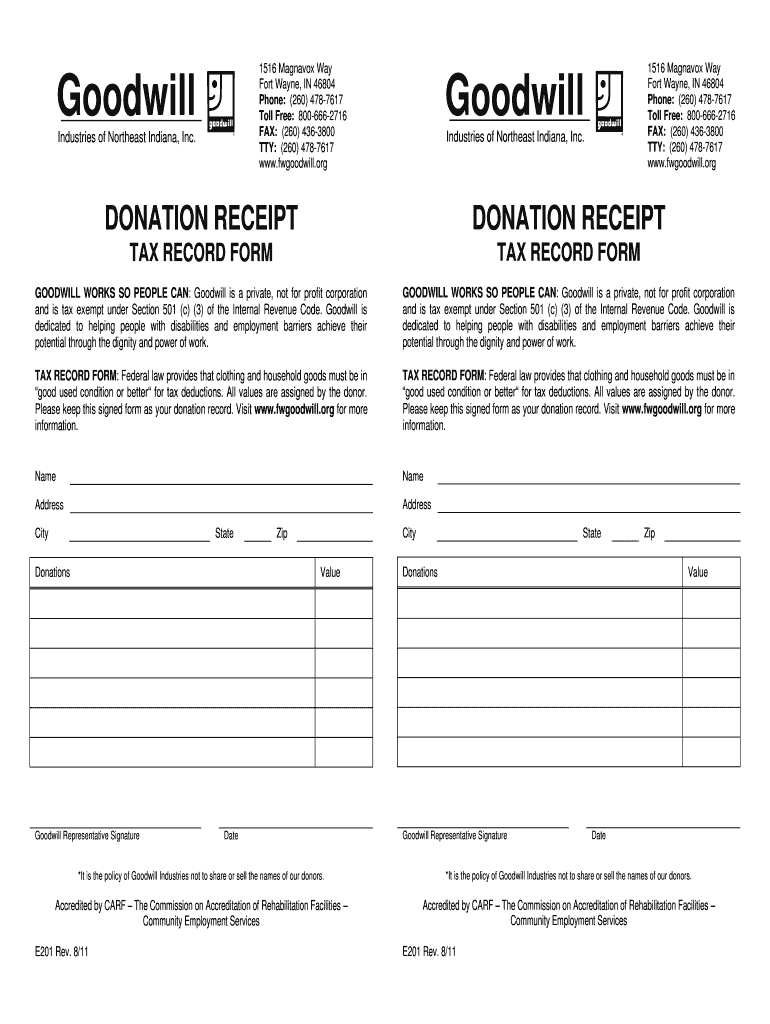

Goodwill Donation Tax Form - Web following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in. A 501(c)(3) organization can be a. To help guide you, goodwill industries international has compiled a list. You can claim a tax deduction for. Internal revenue service (irs) requires donors to value their items. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. Web how to get tax deductions for your donations. Web to search for different types of goodwill locations, including thrift stores, donation centers, job and career centers, headquarters, and specialty stores, select the filter option on. Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Web how much can you deduct for the gently used goods you donate to goodwill?

You may be able to deduct the value of your donations if you choose to. You can get receipts for your goodwill® donation when you drop off your items. Download or email form e201 & more fillable forms, register and subscribe now! Should the fair market value of a single item, or group of similar items,. It also explains what kind of. No goods or services were provided to the donor by goodwill in exchange for this. To help guide you, goodwill industries international has compiled a list. Web to search for different types of goodwill locations, including thrift stores, donation centers, job and career centers, headquarters, and specialty stores, select the filter option on. Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. When you drop off your donations at your local goodwill, you’ll receive a receipt.

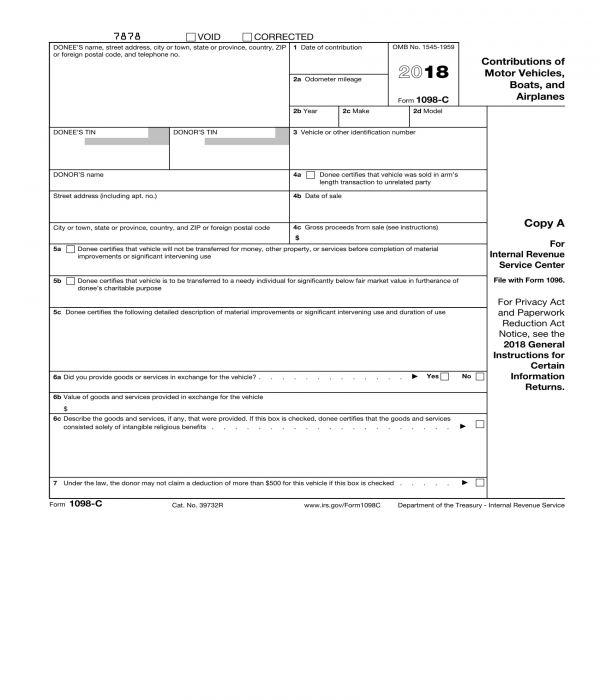

To help guide you, goodwill industries international has compiled a list. Web how much can you deduct for the gently used goods you donate to goodwill? Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. You can get receipts for your goodwill® donation when you drop off your items. Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations. When you drop off your donations at your local goodwill, you’ll receive a receipt. Web where can i get a tax evaluation form for my donations to my local goodwill®? Web goodwill donors the u.s. It also explains what kind of. Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts.

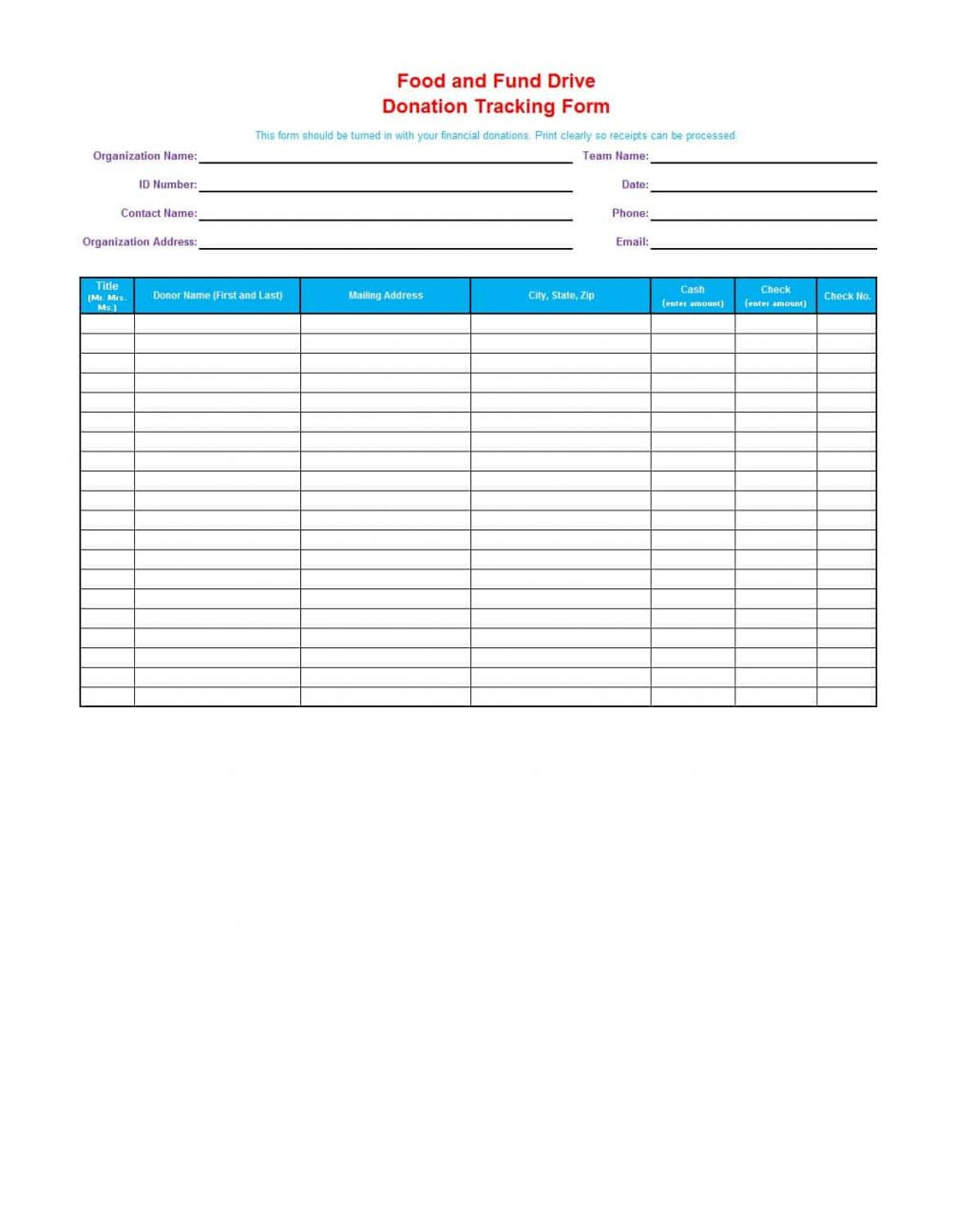

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Internal revenue service (irs) requires donors to value their items. Web goodwill donors the u.s. According to the internal revenue service. Web itemizing your tax return to include charitable donations and contributions means filing schedule a with your form 1040 tax return, detailing all the deductions. Web where can i get a tax evaluation form for my donations to my.

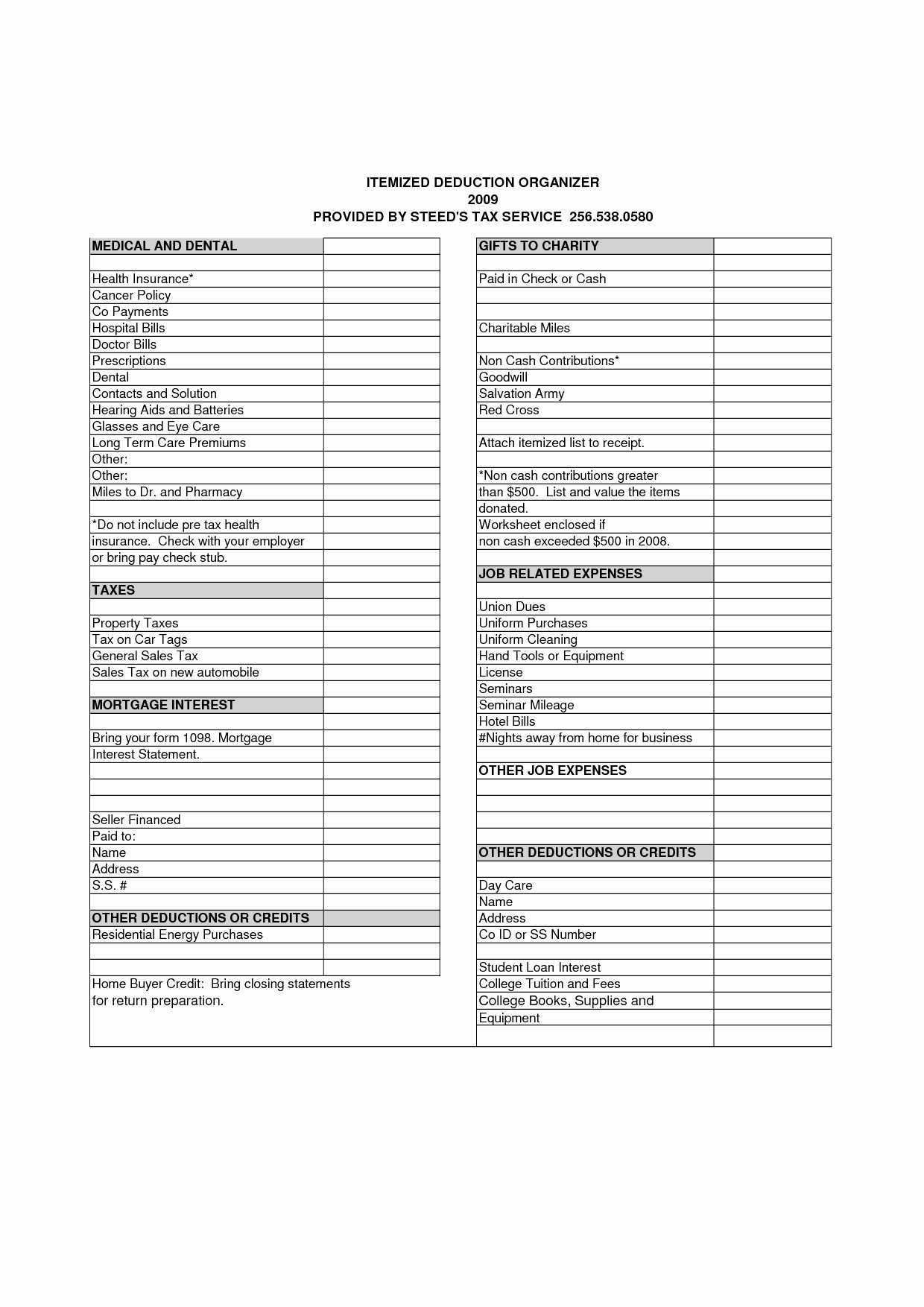

Itemized Deductions Spreadsheet intended for Amazing Goodwill Donation

Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. It also explains what kind of. To help guide you, goodwill industries international has.

Goodwill Clothing Donation Form Template Donation form, Goodwill

When you drop off your donations at your local goodwill, you’ll receive a receipt. To help guide you, goodwill industries international has compiled a list. You can get receipts for your goodwill® donation when you drop off your items. Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking.

Goodwill Donation Forms For Taxes Universal Network

Web goodwill donors the u.s. Internal revenue service (irs) requires donors to value their items. Web how to get tax deductions for your donations. Web tax information taxes and your donations donors are responsible for valuing their donations. No goods or services were provided to the donor by goodwill in exchange for this.

Free Goodwill Donation Receipt Template PDF eForms

The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Should the fair market value of a single item, or group of similar items,. Web.

Goodwill Donation Receipt Fill Online Printable Fillable —

Should the fair market value of a single item, or group of similar items,. Web how much can you deduct for the gently used goods you donate to goodwill? Web following special tax law changes made earlier this year, cash donations of up to $300 made before december 31, 2020, are now deductible when people file their taxes in. Web.

Goodwill Donation Receipt Tax Record Form Pdf Exempt Valuation — db

The quality of the item when. Web where can i get a tax evaluation form for my donations to my local goodwill®? Web goodwill donors the u.s. Web itemizing your tax return to include charitable donations and contributions means filing schedule a with your form 1040 tax return, detailing all the deductions. Web tax information taxes and your donations donors.

FREE 6+ Car Donation Forms in PDF MS Word

Edit, sign and save goodwill e201 form. You may be able to deduct the value of your donations if you choose to. To help guide you, goodwill industries international has compiled a list. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. No goods or services were provided.

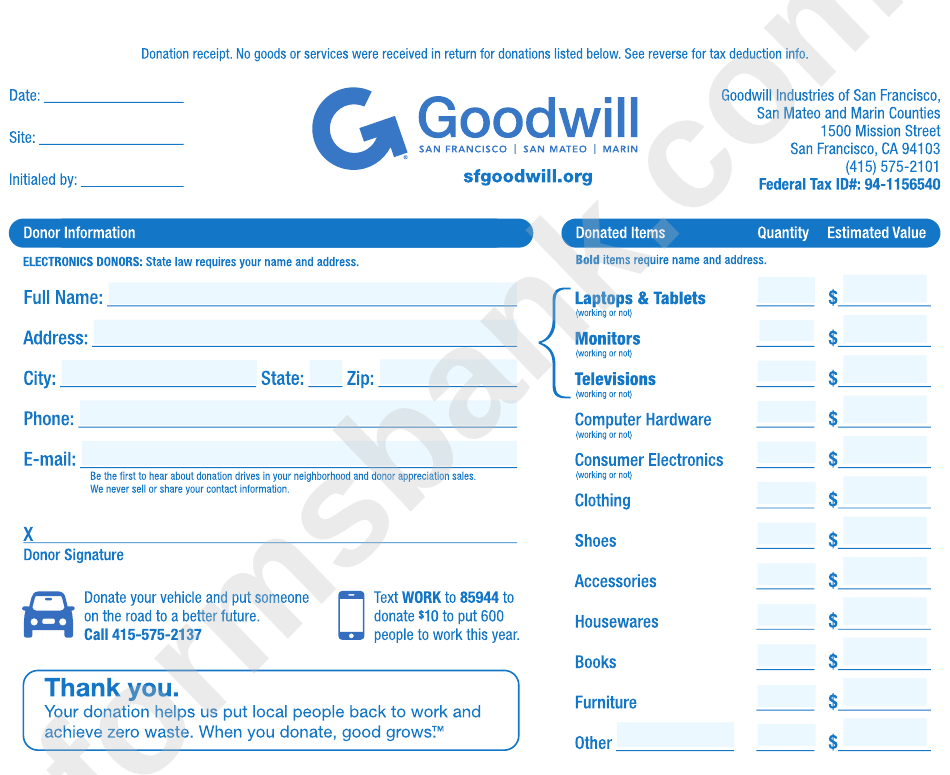

Fillable Goodwill Of San Francisco Donation Receipt printable pdf

No goods or services were provided to the donor by goodwill in exchange for this. Web where can i get a tax evaluation form for my donations to my local goodwill®? You may be able to deduct the value of your donations if you choose to. To help guide you, goodwill industries international has compiled a list. Web individuals, partnerships,.

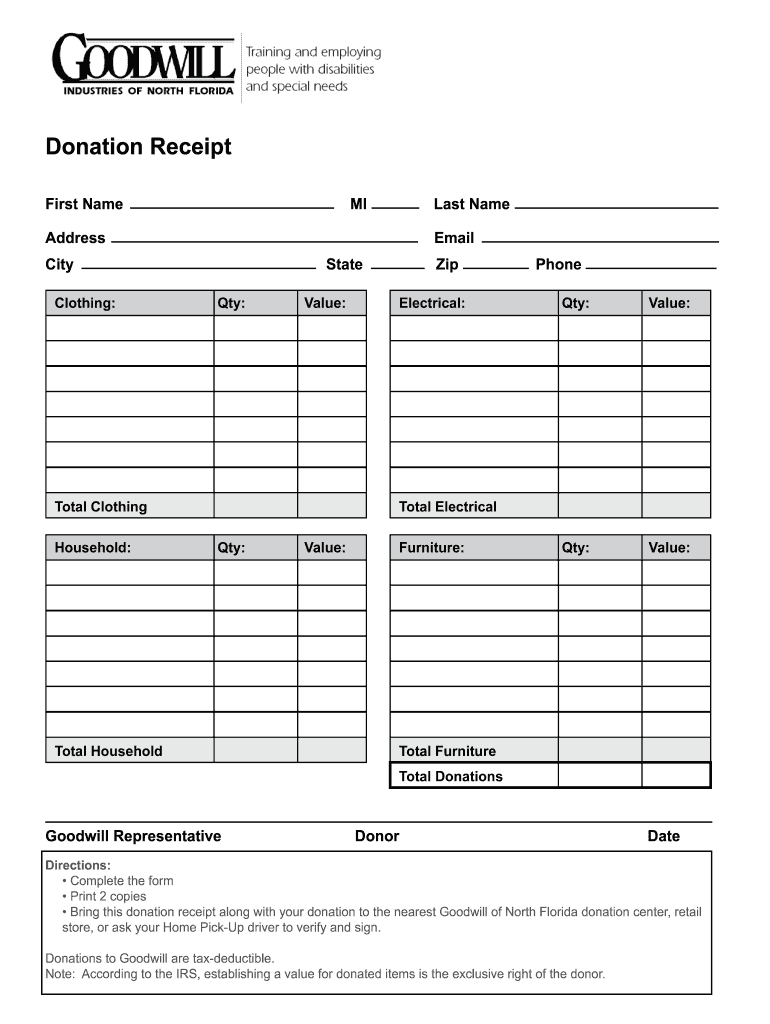

Goodwilljax Org Fill Online, Printable, Fillable, Blank pdfFiller

Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Download or email form e201 & more fillable forms, register and subscribe now! Web individuals, partnerships, and corporations file form 8283 to report information about noncash charitable contributions when the amount of their deduction for all.

Web Following Special Tax Law Changes Made Earlier This Year, Cash Donations Of Up To $300 Made Before December 31, 2020, Are Now Deductible When People File Their Taxes In.

Download or email form e201 & more fillable forms, register and subscribe now! You may be able to deduct the value of your donations if you choose to. Web where can i get a tax evaluation form for my donations to my local goodwill®? Web this publication is designed to help donors and appraisers determine the value of property (other than cash) that is given to qualified organizations.

The Quality Of The Item When.

Web how to get tax deductions for your donations. Web to search for different types of goodwill locations, including thrift stores, donation centers, job and career centers, headquarters, and specialty stores, select the filter option on. Web goodwill donors the u.s. Web if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

Web How Much Can You Deduct For The Gently Used Goods You Donate To Goodwill?

No goods or services were provided to the donor by goodwill in exchange for this. Internal revenue service (irs) requires donors to value their items. You can get receipts for your goodwill® donation when you drop off your items. Web tax information taxes and your donations donors are responsible for valuing their donations.

Should The Fair Market Value Of A Single Item, Or Group Of Similar Items,.

To help guide you, goodwill industries international has compiled a list. A 501(c)(3) organization can be a. Web itemizing your tax return to include charitable donations and contributions means filing schedule a with your form 1040 tax return, detailing all the deductions. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no.