Hidalgo County Appraisal Protest Form

Hidalgo County Appraisal Protest Form - This is 29%, or $16 billion of the total appraised market value noticed for 2021, according to the state comptroller’s. One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb). Web appraisal protests and appeals translation: Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property tax. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. Application for residence homestead exemption. Web hidalgo county appraisal review board protest hearing procedures 4405 s. Web use this form april 1st to may 31st property owner’s note on protest. Web use this form april 1st to may 31st property owner’s notice of protest. Web values displayed are 2023 preliminary values and are subject to change prior to certification.

Web hidalgo county appraisal review board protest hearing procedures 4405 s. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. To file a protest, complete the notice of protest form following the instructions included in the form and no later. This is 29%, or $16 billion of the total appraised market value noticed for 2021, according to the state comptroller’s. Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property tax. Web use this form april 1st to may 31st property owner’s note on protest. File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. Click below for instrutctions to add another property to your user. Web appraisal protests and appeals translation: One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb).

File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. Viewing, accepting, or rejecting a settlement offer. Viewing documents and protest status. Web use this form april 1st to may 31st property owner’s notice of protest. Application for residence homestead exemption. This is 29%, or $16 billion of the total appraised market value noticed for 2021, according to the state comptroller’s. To file a protest, complete the notice of protest form following the instructions included in the form and no later. Click below for instrutctions to add another property to your user. Web appraisal protests and appeals translation: Web determine how much you pay in property taxes.

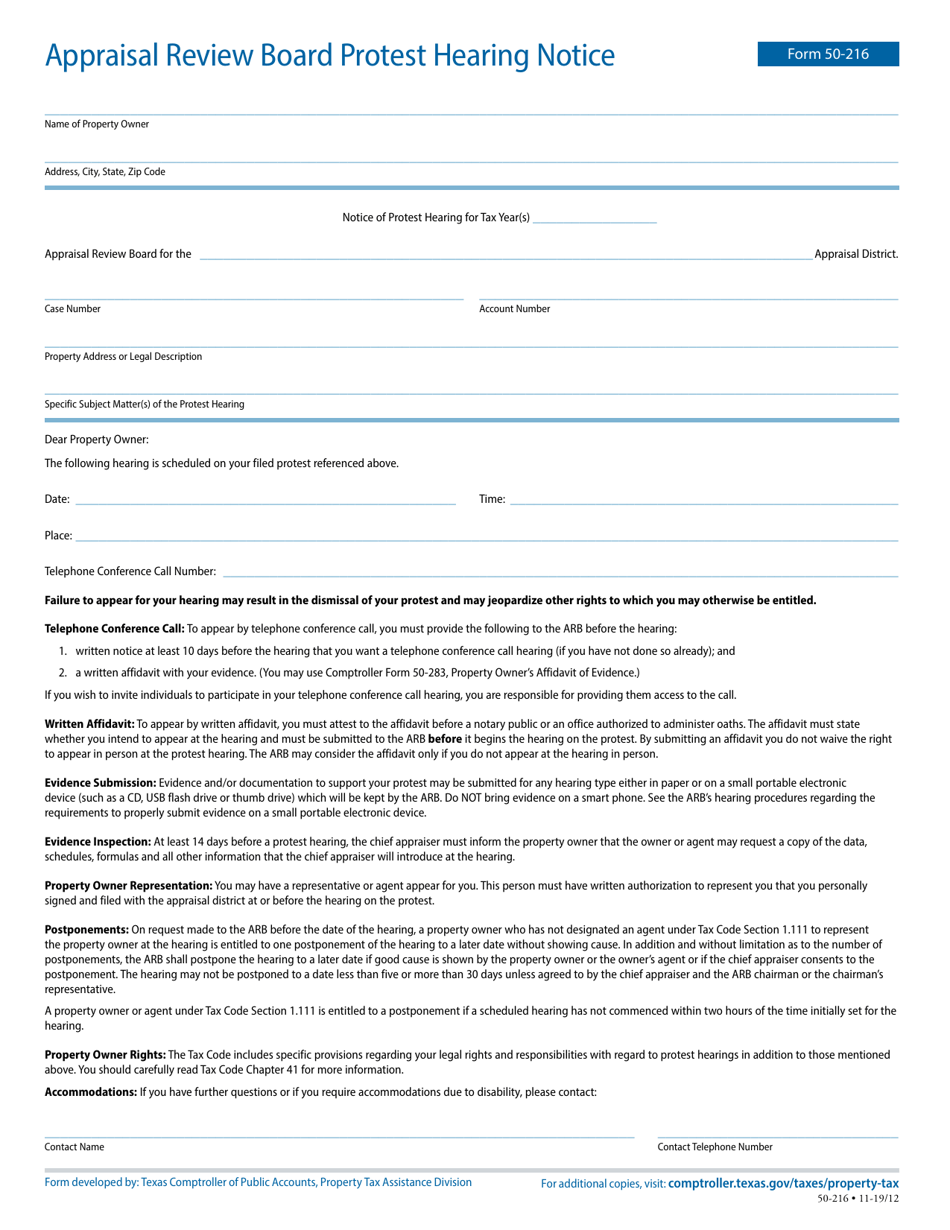

Form 50216 Download Fillable PDF or Fill Online Appraisal Review Board

Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property tax. Web if you have more than on property, you can add them to an existing user. This form is for use by a property owner to offer and submit evidence and/or.

Hidalgo County statement regarding COVID19 death totals The Advance

To file a protest, complete the notice of protest form following the instructions included in the form and no later. Application for residence homestead exemption. Web hidalgo county appraisal review board protest hearing procedures 4405 s. Viewing, accepting, or rejecting a settlement offer. Information provided for research purposes only.

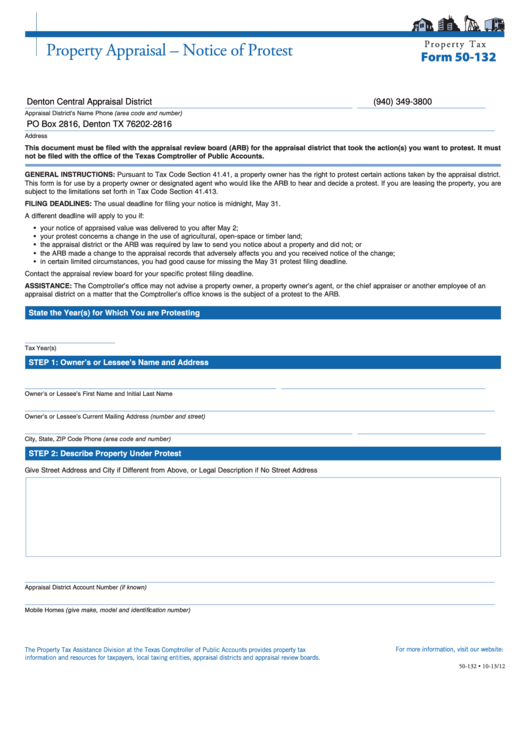

Fillable Form 50132 Property Appraisal Notice Of Protest printable

One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb). To file a protest, complete the notice of protest form following the instructions included in the form and no later. Web if you have more than on property, you can add them to an existing user. Web determine how much.

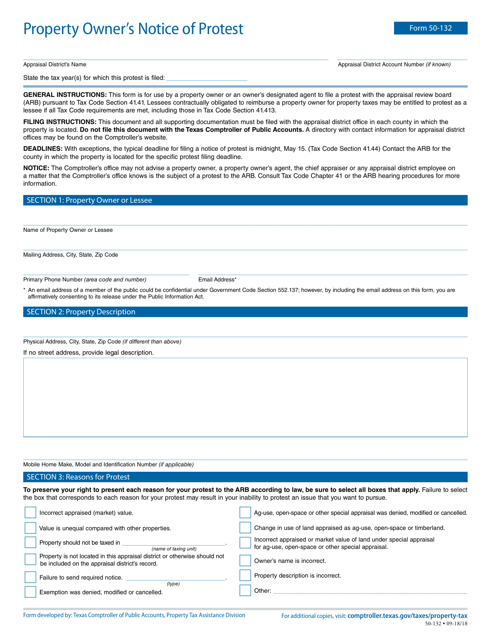

Form 50132 Download Fillable PDF or Fill Online Property Owner's

Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property tax. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. Web determine how much you pay.

Hidalgo County commissioners look to reestablish Precinct 5 KVEOTV

To file a protest, complete the notice of protest form following the instructions included in the form and no later. Web use this form april 1st to may 31st property owner’s note on protest. Web in 2021, 43,490 protests were filed for hidalgo county properties. Web if you have more than on property, you can add them to an existing.

Hidalgo County, TX Official Website

Application for residence homestead exemption. Web use this form april 1st to may 31st property owner’s note on protest. Web use this form april 1st to may 31st property owner’s notice of protest. Information provided for research purposes only. File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable.

Appraisal District Www.hidalgo County Appraisal District

Web hidalgo county appraisal review board protest hearing procedures 4405 s. File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property.

Hidalgo County GIS Shapefile and Property Data Texas County GIS Data

Web appraisal protests and appeals translation: File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. To file a protest, complete the notice of protest form following the instructions included in the form and no later. Viewing documents and protest status. Web hidalgo county appraisal review board protest hearing.

Hidalgo County Ag Exemptions Form

File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. Web determine how much you pay in property taxes. Application for residence homestead exemption. Web use this form april 1st to may 31st property owner’s notice of protest. Web in 2021, 43,490 protests were filed for hidalgo county properties.

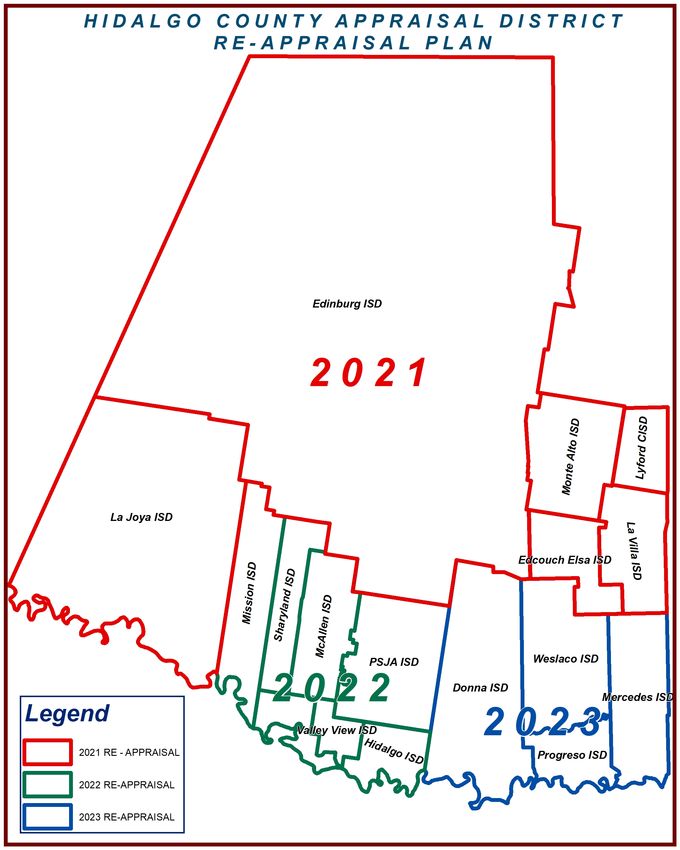

Hidalgo County Appraisal District ReAppraisal Plan 2021 2022

Viewing documents and protest status. This is 29%, or $16 billion of the total appraised market value noticed for 2021, according to the state comptroller’s. Web determine how much you pay in property taxes. Viewing, accepting, or rejecting a settlement offer. Web use this form april 1st to may 31st property owner’s notice of protest.

Web In 2021, 43,490 Protests Were Filed For Hidalgo County Properties.

Information provided for research purposes only. Web use this form april 1st to may 31st property owner’s notice of protest. To file a protest, complete the notice of protest form following the instructions included in the form and no later. Web hidalgo county appraisal review board protest hearing procedures 4405 s.

One Of Your Most Important Rights As A Taxpayer Is Your Right To Protest To The Appraisal Review Board (Arb).

Viewing documents and protest status. Web if you have more than on property, you can add them to an existing user. Click below for instrutctions to add another property to your user. Web values displayed are 2023 preliminary values and are subject to change prior to certification.

Web Appraisal Protests And Appeals Translation:

Web use this form april 1st to may 31st property owner’s note on protest. Web the property tax parcels that make up hidalgo county are represented by 43,490 tax protest letters filed in 2021, which accounts for 12% of the county's property tax. File this document and all supporting documentation with the appraisal district office in the county in which the property is taxable. Web determine how much you pay in property taxes.

This Is 29%, Or $16 Billion Of The Total Appraised Market Value Noticed For 2021, According To The State Comptroller’s.

Application for residence homestead exemption. Viewing, accepting, or rejecting a settlement offer. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by.