Home Equity Loan During Chapter 13

Home Equity Loan During Chapter 13 - By tony guerra updated sep 5, 2012 7:34 a.m. But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. Since the impact on your credit of a chapter 13 bankruptcy is less than that of a chapter 7, you will have a lot more. Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Compare & save with lendingtree Not only does it ensure that creditors get the same amount regardless. Web home equity and chapter 13 bankruptcy. Web yes, if you have kept your credit clean, and if you have enough equity in your home, you will be able to get a heloc after chapter 13 bankruptcy. Home equity in chapter 13 bankruptcy: Your credit score and equity in.

Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it. Since the impact on your credit of a chapter 13 bankruptcy is less than that of a chapter 7, you will have a lot more. The only restriction is that the “loan” (the case) would need to be paid back within 5 years. Chapter 13 bankruptcy lets you pay off a mortgage arrearage (late, unpaid payments) over the length of the. Luckily, most states allow you to protect a certain amount of equity in your home. Check out top home equity loan options within minutes. Ad the average american has gained $113,000 in equity over the last 3 years. Check out top home equity loan options within minutes. If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. Check your three credit reports for free at.

Since the impact on your credit of a chapter 13 bankruptcy is less than that of a chapter 7, you will have a lot more. Pick your best rate and save. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in chapter 13. In either case, the payment is sent to your bankruptcy trustee, and the bankruptcy trustee will disburse the funds to your mortgage. Once again, things are a little different if you go for chapter 13 bankruptcy. Web exempting equity in chapter 13 you don't lose property in chapter 13if you can afford to keep it. Unless the court orders otherwise, the debtor must also file with the court: Each state decides the type of property filers can protect, including the amount of home equity. Currently own a home and have equity? Web in chapter 13 bankruptcy, you pay all or a portion of your debts over time through a repayment plan.

How Does A Home Equity Loan Work And How To Get One?

These figures appear in the state's bankruptcy exemptions. Web in general, home equity loans can be pursued shortly after purchasing a home, often within the first year — but each lender has unique requirements for approval. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Check your three credit reports for.

Equity Loan Interest Rate >

Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Ease of obtaining a home equity loan after release. Your credit score and equity in. Pick your best rate and save. By tony guerra updated sep 5, 2012 7:34 a.m.

Should You Use A Home Equity Loan For Debt Consolidation?

Currently own a home and have equity? Web chapter 13 bankruptcy. Get more from your home equity line of credit. Compare & save with lendingtree Ad don't overpay on your loan.

Understanding the Home Equity Loan Affiliated Home Solutions, LLC

Get more from your home equity line of credit. Web if you can't exempt all of your home equity, you risk losing your home in chapter 7 or paying back more unsecured debts in chapter 13. A heloc can sometimes be eliminated through chapter 13 bankruptcy. Currently own a home and have equity? The conventional lenders who provide heloc loans.

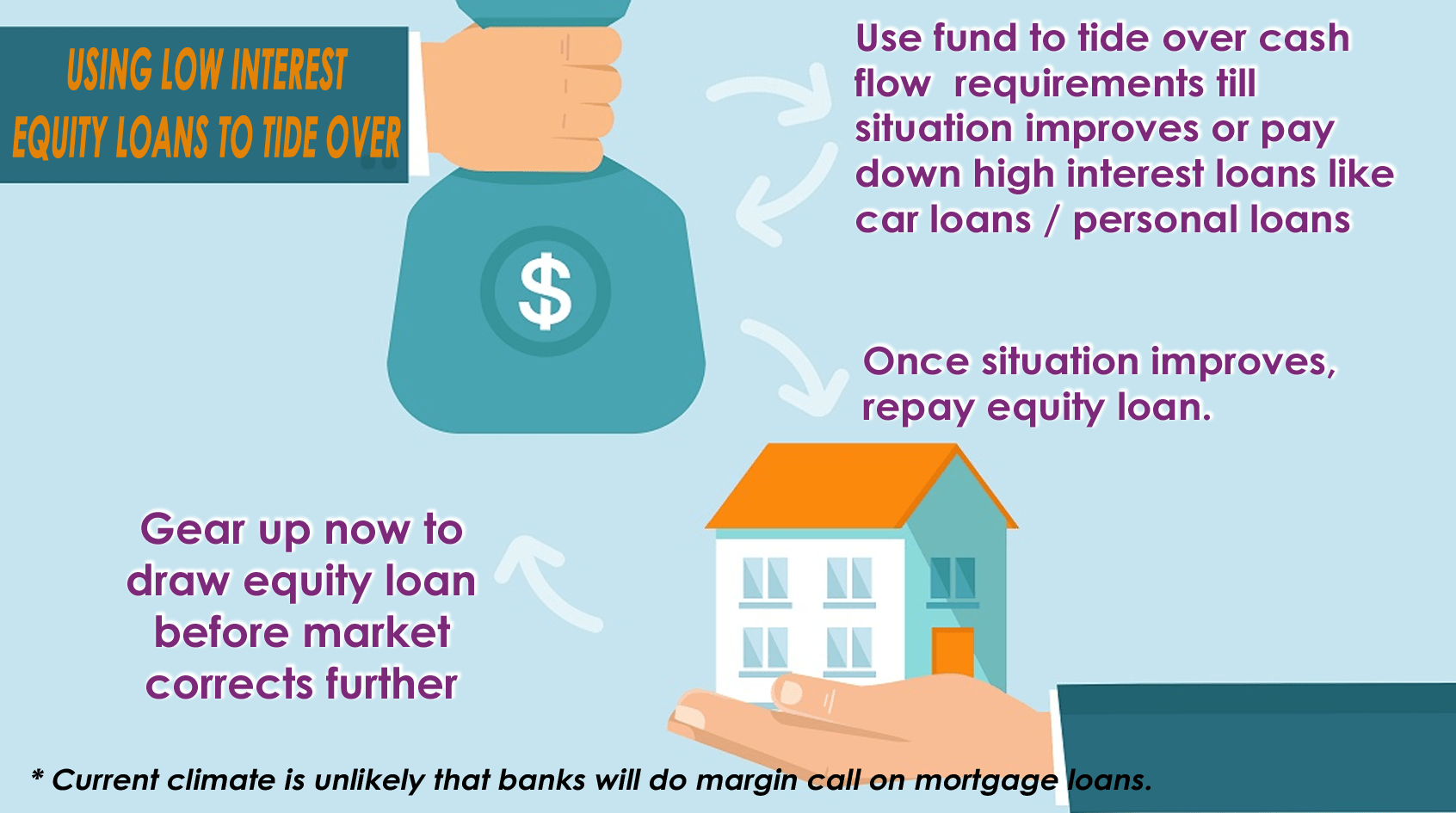

How a home equity term loan might save you from cash flow issue without

Ad don't overpay on your loan. Web august 3, 2022 chapter 13 can serve the same purpose as a home equity loan. Filling out loan applications can be tedious. Unless the court orders otherwise, the debtor must also file with the court: Web how does a home equity loan affect filing chapter 13?

5 Reasons to Tap Into Your Home Equity

Unless the court orders otherwise, the debtor must also file with the court: Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Web usually, losing your home to foreclosure is not a concern during chapter 13 bankruptcy unless you offer your home as part of the repayment agreement. Web the rule that requires a chapter.

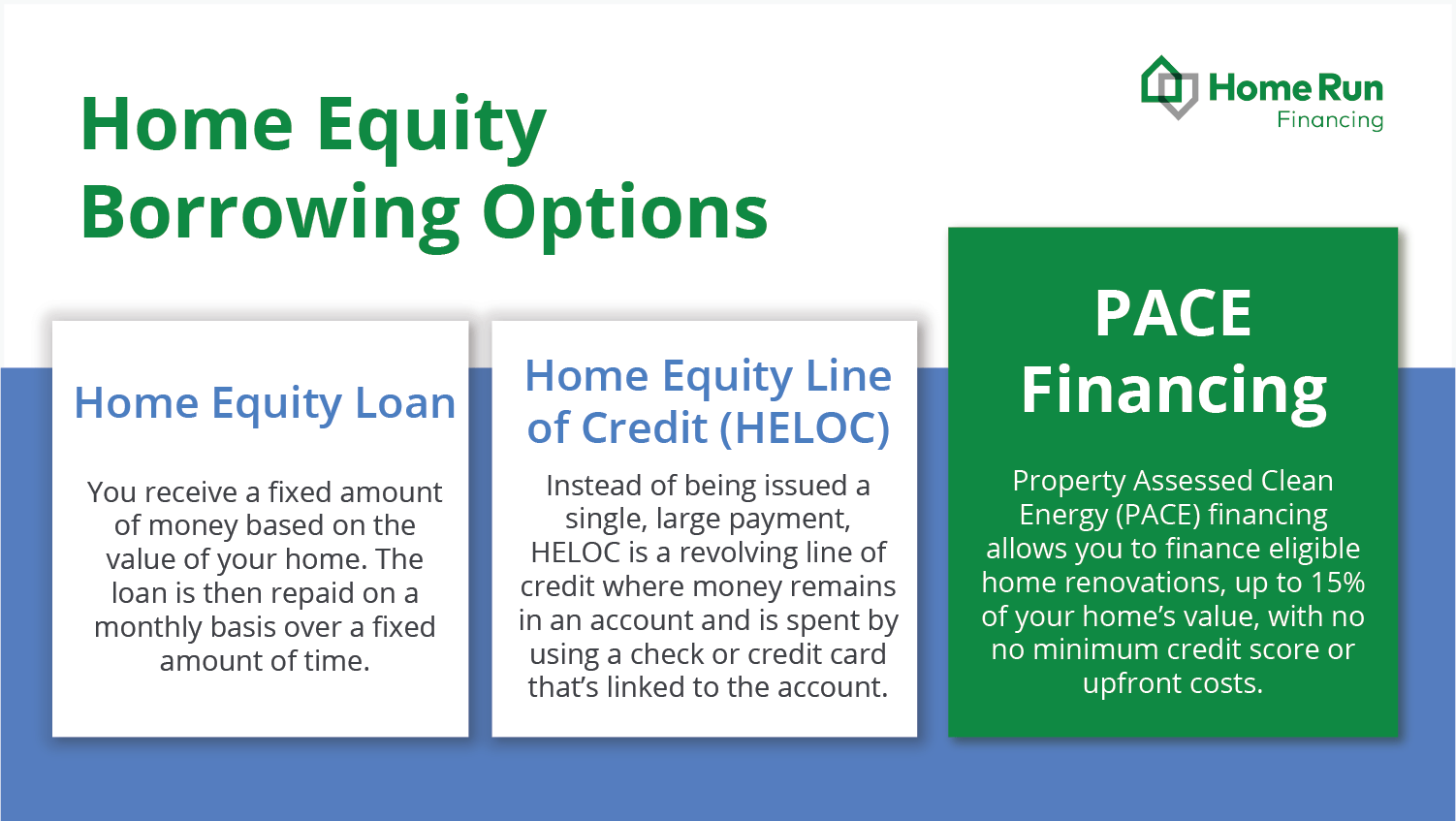

What Home Equity Is & How to Use It Home Run Financing

The conventional lenders who provide heloc loans are not. Web how does a home equity loan affect filing chapter 13? Get more from your home equity line of credit. Each state decides the type of property filers can protect, including the amount of home equity. Chapter 13 bankruptcy lets you pay off a mortgage arrearage (late, unpaid payments) over the.

Using a Home Equity Loan for Debt Consolidation NextAdvisor with TIME

Chapter 13 bankruptcy lets you pay off a mortgage arrearage (late, unpaid payments) over the length of the. Web a chapter 13 case begins by filing a petition with the bankruptcy court serving the area where the debtor has a domicile or residence. In either case, the payment is sent to your bankruptcy trustee, and the bankruptcy trustee will disburse.

A Complete Guide To Home Equity Loans Revenues & Profits

Web how does a home equity loan affect filing chapter 13? But if you only apply with one lender, you won’t be able to compare your offer with others, which limits your. Ease of obtaining a home equity loan after release. Check out top home equity loan options within minutes. Luckily, most states allow you to protect a certain amount.

Fixed Rate Home Equity Line >

Web chapter 13 provides two advantages in dealing with a heloc in certain situations. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of creditors test. Unless the court orders otherwise, the debtor must also file with the court: Ad don't overpay on your loan..

Stripping Off Helocs In Chapter 13 If The Market Value Of Your Home Is Less Than The Balance On Your First Mortgage, You Can.

A heloc can sometimes be eliminated through chapter 13 bankruptcy. If you are unable to get a home equity loan or refinance, you can use chapter 13 instead to achieve nearly identical goals. Web during chapter 13, your monthly payments will be made either voluntarily, or directly through a paycheck withdrawal. Compare the 5 best home equity loan companies of 2023.

Each State Decides The Type Of Property Filers Can Protect, Including The Amount Of Home Equity.

Web it is something that a “pro se” (no attorney) debtor will find out the hard way—after filing the chapter 13 bankruptcy case. Luckily, most states allow you to protect a certain amount of equity in your home. Web the rule that requires a chapter 13 debtor to pay an amount equal to any nonexempt equity is known as the best interest of creditors test. Since the impact on your credit of a chapter 13 bankruptcy is less than that of a chapter 7, you will have a lot more.

These Figures Appear In The State's Bankruptcy Exemptions.

By tony guerra updated sep 5, 2012 7:34 a.m. The conventional lenders who provide heloc loans are not. Ad don't overpay on your loan. Check your three credit reports for free at.

Check Out Top Home Equity Loan Options Within Minutes.

The only restriction is that the “loan” (the case) would need to be paid back within 5 years. In either case, the payment is sent to your bankruptcy trustee, and the bankruptcy trustee will disburse the funds to your mortgage. Check out top home equity loan options within minutes. However, it is doubtful that any bank will agree to let you take out a home equity loan during.