Hotel Tax Exemption Form Texas

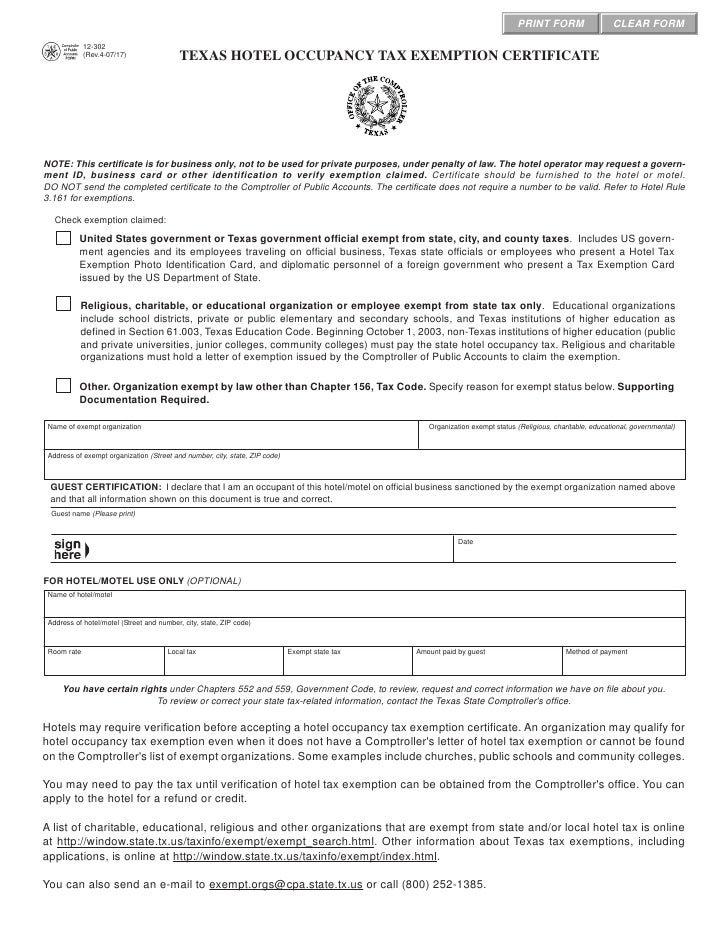

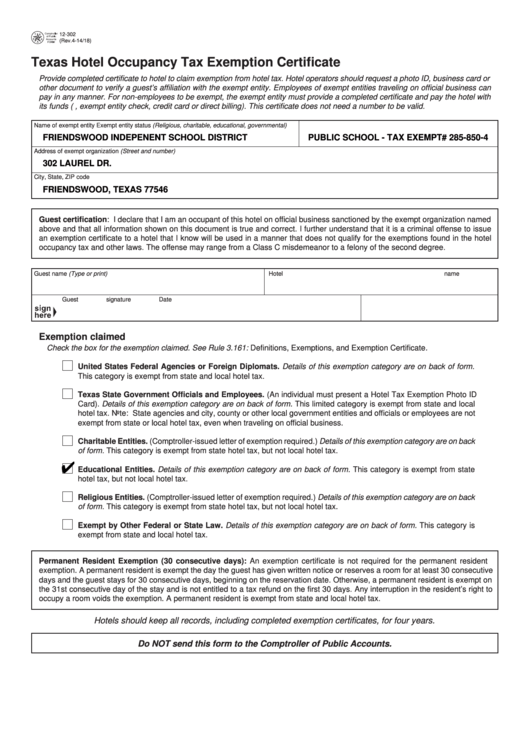

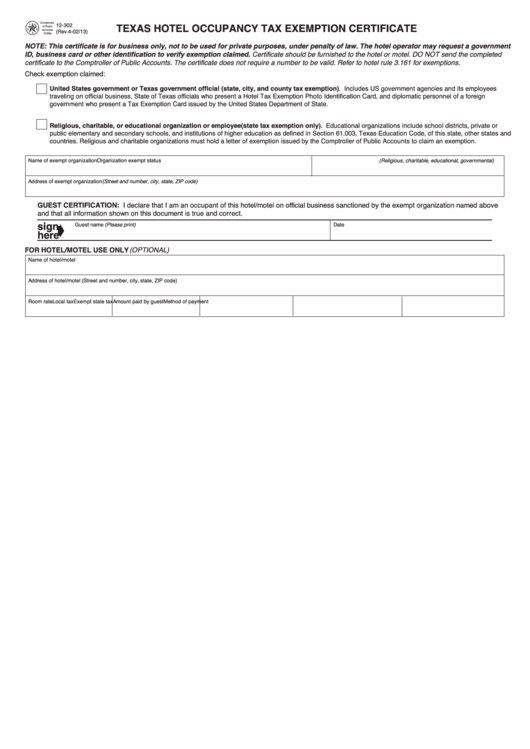

Hotel Tax Exemption Form Texas - Hotel operators should request a. Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo id, business. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Web provide completed certificate to hotel to claim exemption from hotel tax. Web provide completed certificate to hotel to claim exemption from hotel tax. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Make use of the tools we offer to fill out your form.

Web texas hotel occupancy tax exemption certificate. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Open it up using the online editor and start editing. Web locate state of georgia hotel tax exempt form and then click get form to get started. This certificate is for business only,. Hotel operators should request a. Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax. Highlight relevant segments of your. To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention:

Highlight relevant segments of your. Web (2) the rental of a room or space in a hotel is exempt from tax if the person required to collect the tax receives, in good faith from a guest, a properly completed exemption. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. Web provide completed certificate to hotel to claim exemption from hotel tax. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web a permanent resident is exempt from state and local hotel tax. Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. Web (a) a tax is imposed on a person who, under a lease, concession, permit, right of access, license, contract, or agreement, pays for the use or possession or for the right to the use. This certificate is for business only,. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention:

Texas Hotel Occupancy Tax Forms12302 Texas Hotel Occupancy Tax Exem…

This certificate is for business only,. To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or. Highlight relevant segments of your. Web locate state of georgia hotel tax exempt form and then click get form to get started. Web a permanent resident is exempt from state and local hotel tax.

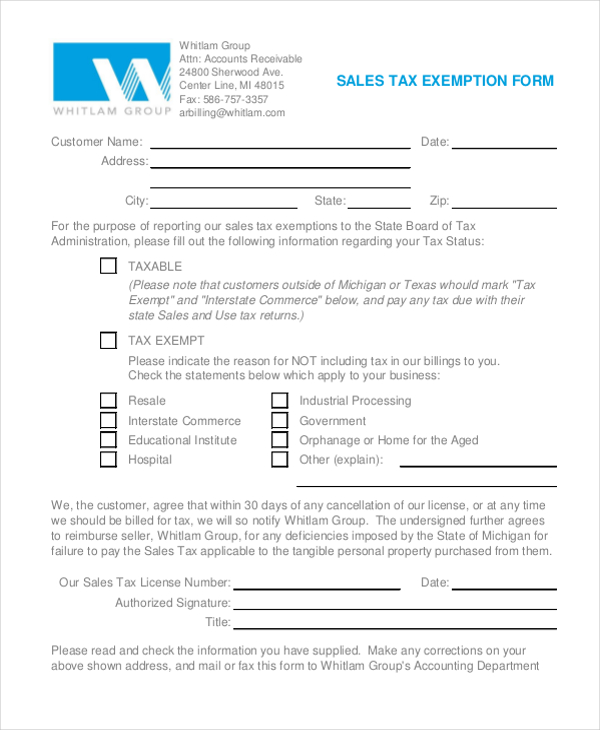

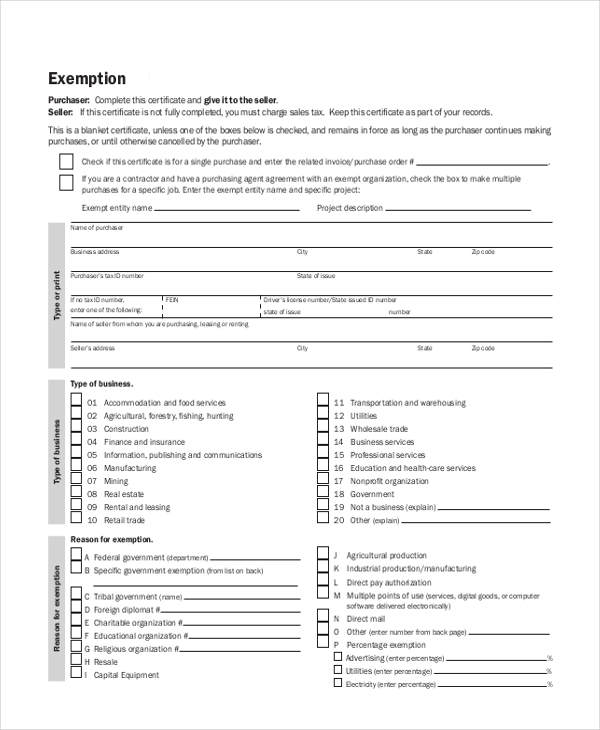

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Highlight relevant segments of your. Open it up using the online editor and start editing. Web locate state of georgia hotel tax exempt form and then click get form to get started. Web find the missouri hotel tax exempt form you need. Web a permanent resident is exempt from state and local hotel tax.

Download Into The Storm

To accept exemption certificate in good faith, copy of comptroller’s letter of exemption or. Involved parties names, places of residence and. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Web a permanent resident is exempt from state and local hotel tax. Open it up using the online editor and start editing.

Occupancy Tax Exempt Form

Open it up using the online editor and start editing. Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. For exemption information list of charitable, educational, religious and other organizations that have been issued.

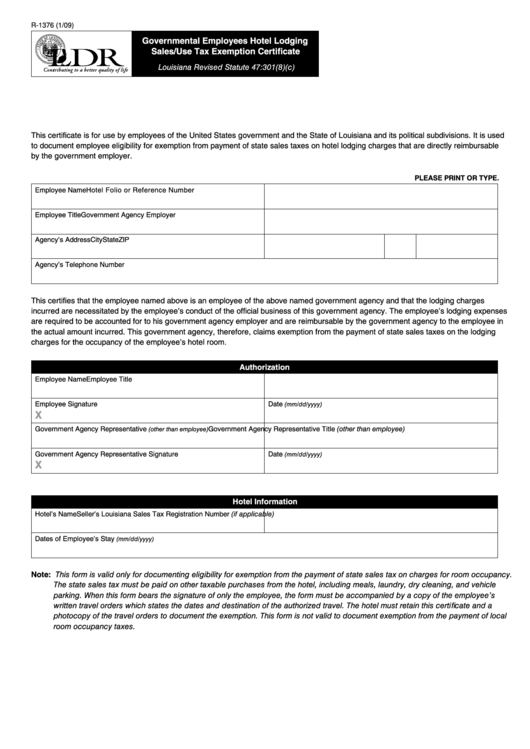

Fillable Form R1376 Governmental Employees Hotel Lodging Sales/use

Web texas hotel occupancy tax exemption certificate. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention: Yes, a form is required. Web provide completed certificate to hotel to claim exemption from hotel tax. Web locate state of georgia hotel tax exempt form and then click get form to.

Texas Hotel Tax Exempt Form cloudshareinfo

Web find the missouri hotel tax exempt form you need. Highlight relevant segments of your. Web provide completed certificate to hotel to claim exemption from hotel tax. Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local funds or state funds, we are considered exempt from the. Hotel operators should request a photo.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web provide completed certificate to hotel to claim exemption from hotel tax. Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at. Web up to $40 cash back clear footprint formulate of georgia certifi cate of exemption of local hotel/motel excise tax attention: Web (a) a tax is.

State Sales Tax Texas State Sales Tax Form

Open it up using the online editor and start editing. Texas comptroller of public accounts form used by utsa employees to claim exemption from. Highlight relevant segments of your. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Hotel operators should request a photo id, business card or other document to verify a.

Fillable Texas Hotel Occupancy Tax Exemption Certificate printable pdf

Web texas hotel occupancy tax exemption certificate. Hotel operators should request a photo id, business. Web provide completed certificate to hotel to claim exemption from hotel tax. Web a permanent resident is exempt from state and local hotel tax. Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local funds or state funds,.

Texas Hotel Occupancy Tax FormsAP102 Hotel Occupancy Tax Questionnaire

For exemption information list of charitable, educational, religious and other organizations that have been issued a. Web locate state of georgia hotel tax exempt form and then click get form to get started. Do i need a form? Hotel operators should request a. Make use of the tools we offer to fill out your form.

Web (A) A Tax Is Imposed On A Person Who, Under A Lease, Concession, Permit, Right Of Access, License, Contract, Or Agreement, Pays For The Use Or Possession Or For The Right To The Use.

Hotel operators should request a. Web provide completed certificate to hotel to claim exemption from hotel tax. Open it up using the online editor and start editing. Web a list of charitable, educational, religious and other organizations that are exempt from state and/or local hotel tax is online at.

Web (2) The Rental Of A Room Or Space In A Hotel Is Exempt From Tax If The Person Required To Collect The Tax Receives, In Good Faith From A Guest, A Properly Completed Exemption.

Make use of the tools we offer to fill out your form. Hotel operators should request a photo id, business. Do i need a form? Web texas hotel occupancy tax exemption certificate provide completed certificate to hotel to claim exemption from hotel tax.

Web Up To $40 Cash Back Clear Footprint Formulate Of Georgia Certifi Cate Of Exemption Of Local Hotel/Motel Excise Tax Attention:

Hotel occupancy tax exemption hotel occupancy tax exemption when traveling within the state of texas, using local funds or state funds, we are considered exempt from the. For exemption information list of charitable, educational, religious and other organizations that have been issued a. Yes, a form is required. Web a permanent resident is exempt from state and local hotel tax.

To Accept Exemption Certificate In Good Faith, Copy Of Comptroller’s Letter Of Exemption Or.

Highlight relevant segments of your. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation. This certificate is for business only,. Hotel operators should request a photo id, business card or other document to verify a guest’s affiliation.