How Long Does It Take To Form An S Corp

How Long Does It Take To Form An S Corp - May be individuals, certain trusts, and estates and. Election by a small business corporation with the irs. If you file paperwork and complete the process within two months and 15. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Ryan lasker many or all of the products here are from our partners. Form 2553 is due no more than two months and 15 days. S corps can provide significant tax savings and have limited. Web to qualify for s corporation status, the corporation must meet the following requirements:

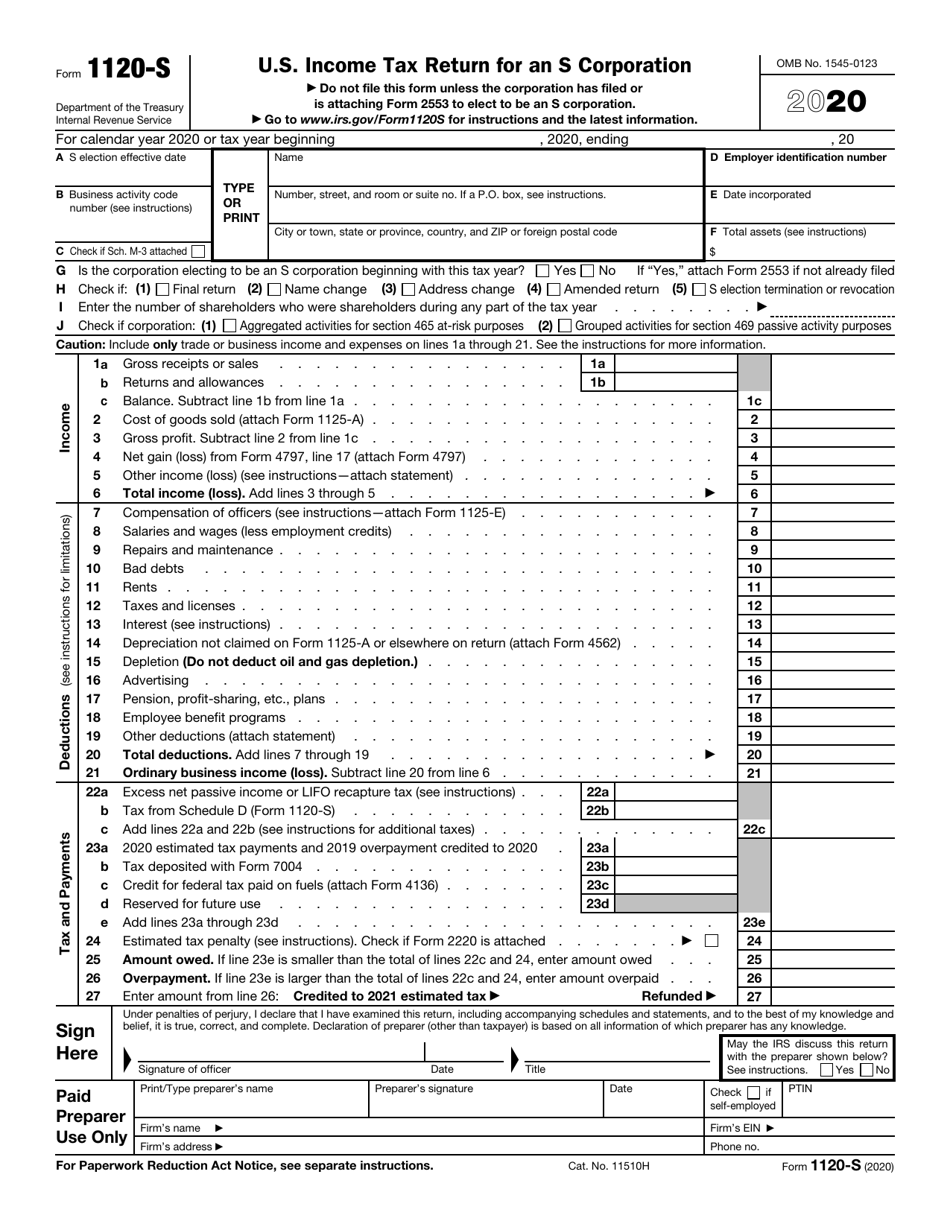

Web to qualify for s corporation status, the corporation must meet the following requirements: Web you’ll need the following information on hand before filling out 1120s: If you file paperwork and complete the process within two months and 15. Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. General information about your business, including your date of incorporation and the date you elected s corp status your business activity code and your employer identification number (ein) a profit and loss statement and a balance sheet for your business Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Have no more than 100 shareholders. S corps can provide significant tax savings and have limited. Form 2553 is due no more than two months and 15 days.

S corps can provide significant tax savings and have limited. Ryan lasker many or all of the products here are from our partners. Form 2553 is due no more than two months and 15 days. If you file paperwork and complete the process within two months and 15. Web you’ll need the following information on hand before filling out 1120s: Election by a small business corporation with the irs. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. May be individuals, certain trusts, and estates and. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web the ascent knowledge small business 4 steps to becoming an s corp updated aug.

Weight Loss Psychology How long does it take to form a new habit

If you file paperwork and complete the process within two months and 15. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Ryan.

How Long Does It Take to Form A Habit?

Web you’ll need the following information on hand before filling out 1120s: S corps can provide significant tax savings and have limited. Ryan lasker many or all of the products here are from our partners. Web to qualify for s corporation status, the corporation must meet the following requirements: Web the s corporation is a tax designation that a corporation.

Forming an SCorp What The Pros and Cons of Structuring One? Women

May be individuals, certain trusts, and estates and. Web to qualify for s corporation status, the corporation must meet the following requirements: Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: General information about your business, including your date of incorporation and the date you elected s corp status your.

IRS Form 1120S Download Fillable PDF or Fill Online U.S. Tax

Form 2553 is due no more than two months and 15 days. Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. S corps can provide significant tax savings and have limited. May be individuals, certain trusts, and estates and. Web to qualify for s corporation status, the corporation must meet the following requirements:

How Long Does It Take To Be A Phlebotomy How Long Does It Take to

Web you’ll need the following information on hand before filling out 1120s: Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Web the.

How Long Does it Take to Form a New Habit? Rewire The Mind Online

Form 2553 is due no more than two months and 15 days. If you file paperwork and complete the process within two months and 15. Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and.

What Is Business Name On W9

Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Form 2553 is due no more than two months and 15 days. Web you’ll need the following information on hand before filling out 1120s: Election by a small business corporation with the irs. Have no more than 100 shareholders.

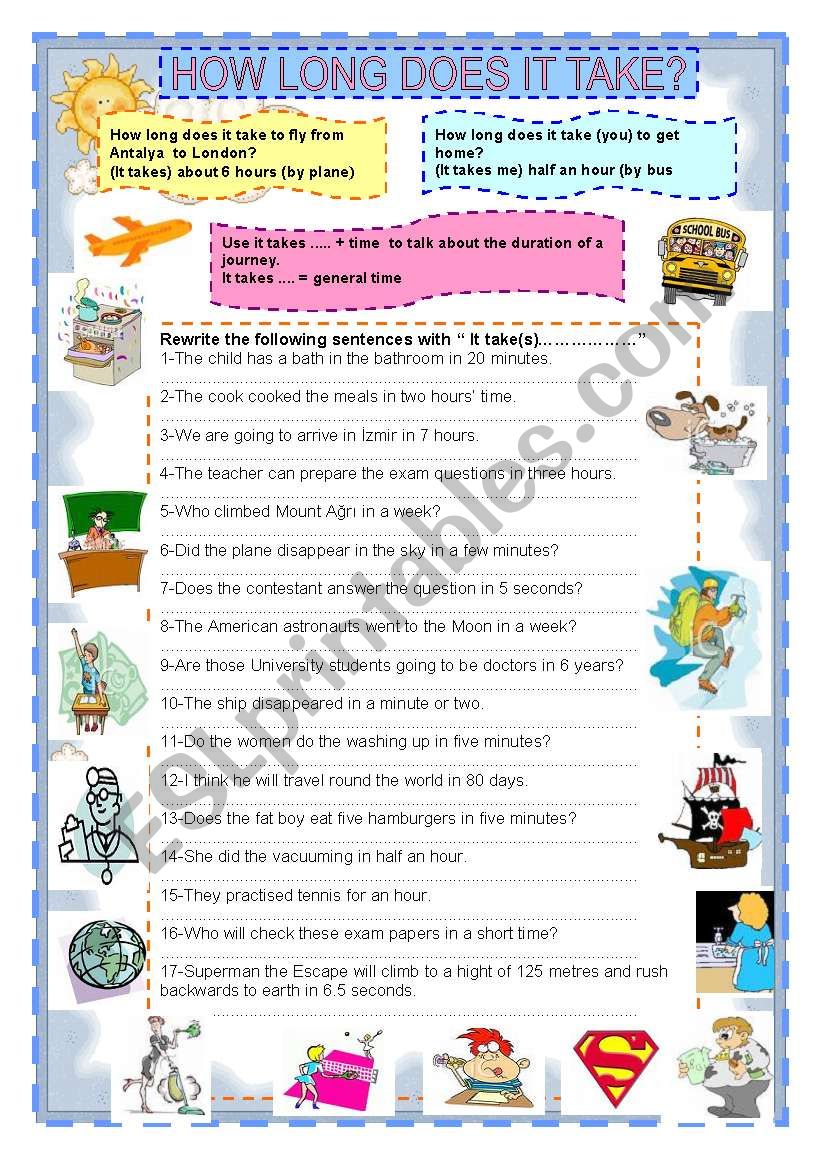

How long does it take you to...? ESL worksheet by COLOMBO

If you file paperwork and complete the process within two months and 15. Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders. Web to qualify for s corporation status, the corporation must meet the following requirements: Ryan lasker many or.

How Long Does It Take To Form Abs Darker colors == more posting

Form 2553 is due no more than two months and 15 days. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web you’ll need the following information on hand before filling out 1120s: Ryan lasker many or all of the products here are from our partners. Web to qualify for.

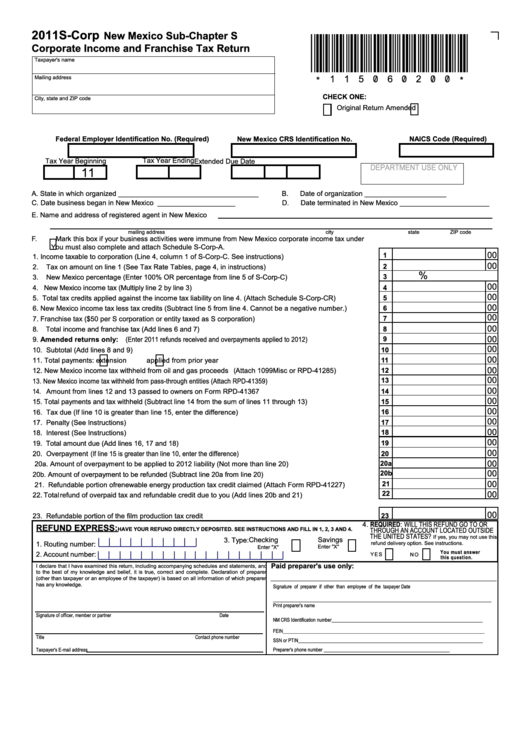

Form SCorp New Mexico SubChapter S Corporate And Franchise

Web to qualify for s corporation status, the corporation must meet the following requirements: General information about your business, including your date of incorporation and the date you elected s corp status your business activity code and your employer identification number (ein) a profit and loss statement and a balance sheet for your business Election by a small business corporation.

May Be Individuals, Certain Trusts, And Estates And.

Form 2553 is due no more than two months and 15 days. If you file paperwork and complete the process within two months and 15. Web to qualify for s corporation status, the corporation must meet the following requirements: Must be a domestic corporation, operating in the united states may not have more than 100 shareholders must have only one class of stock must only have allowable shareholders.

General Information About Your Business, Including Your Date Of Incorporation And The Date You Elected S Corp Status Your Business Activity Code And Your Employer Identification Number (Ein) A Profit And Loss Statement And A Balance Sheet For Your Business

Election by a small business corporation with the irs. S corps can provide significant tax savings and have limited. Web the s corporation is a tax designation that a corporation or llc can elect by filing form 553: Web you’ll need the following information on hand before filling out 1120s:

Have No More Than 100 Shareholders.

Web the ascent knowledge small business 4 steps to becoming an s corp updated aug. Web you can start an s corporation (s corp) by forming a limited liability company (llc) or a corporation and electing s corp status from the irs by filing form 2553 election by a small business corporation when you apply for your employer identification number (ein). Ryan lasker many or all of the products here are from our partners.