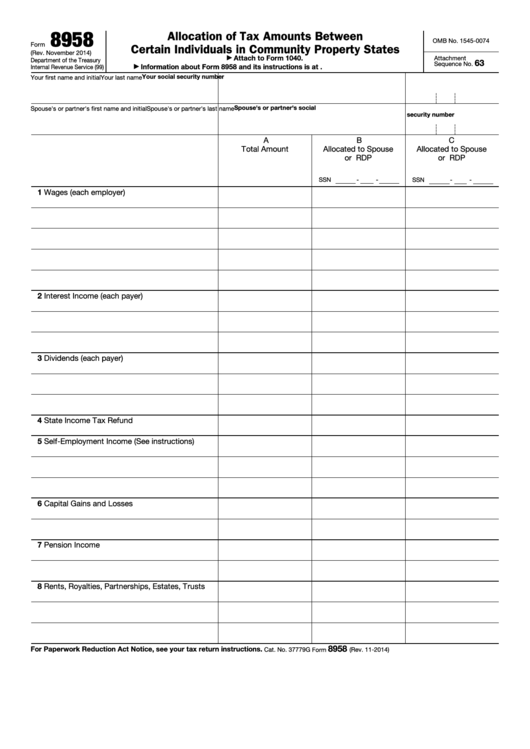

How To Complete Form 8958

How To Complete Form 8958 - Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Generally, the laws of the state in which you are. Web 1.you and your spouse lived apart all year. I got married in nov 2021. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. My wife and i are filing married, filing. 2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year.

Web level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web common questions about entering form 8958 income for community property allocation in lacerte. Web open the 1040 and supporting forms to complete the allocations needed for taxpayer and spouse before entering any information on the 8958. On the appropriate lines of your separate. To start the blank, use the fill camp; Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. I got married in nov 2021.

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. My wife and i are filing married, filing. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web open the 1040 and supporting forms to complete the allocations needed for taxpayer and spouse before entering any information on the 8958. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web how you can fill out the form 8958 fillable on the internet: To start the blank, use the fill camp; Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. I got married in nov 2021. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web you each must attach your form 8958 to your return.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web 1.you and your spouse lived apart all year. I got married in nov 2021. Generally, the laws of the state in which you are. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web to enter form.

Sonyma Form R7 12 14 Fill Online, Printable, Fillable, Blank pdfFiller

Web each of you must complete and attach form 8958 to your return showing how you figured the amount you are reporting on your return. Web 1.you and your spouse lived apart all year. Generally, the laws of the state in which you are. Web use this screen to enter information used to complete form 8958, allocation of tax amounts.

Care Agreement Fill Online, Printable, Fillable, Blank pdfFiller

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state, form 8958 must be completed and filed with the return. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. To.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web each of you must complete and attach form 8958 to your return showing how you figured the amount you are reporting on your return. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web how you can fill out the form 8958.

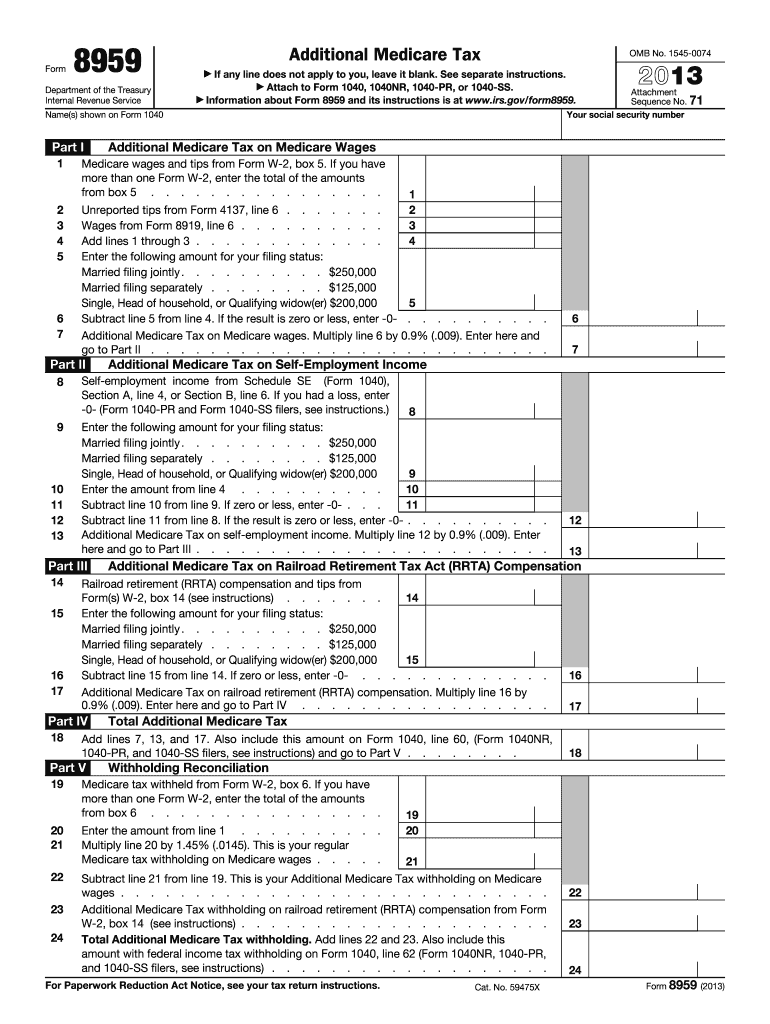

Form 8959 For Year Fill Out and Sign Printable PDF Template signNow

2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web you each must attach your form 8958 to your return showing how you.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Yes, loved it could be better no one. My wife and.

Community property / Form 8958 penalty for r/tax

Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. On the appropriate lines of your separate. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be..

Fill Free fillable Form 8958 Allocation of Tax Amounts 2014 PDF form

Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web 1.you and your spouse lived apart all year. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web you.

8958 Fill Online, Printable, Fillable, Blank pdfFiller

Web common questions about entering form 8958 income for community property allocation in lacerte. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web 1.you and your spouse lived apart all year. Web you must attach form 8958 to your tax form showing.

Web How You Can Fill Out The Form 8958 Fillable On The Internet:

Generally, the laws of the state in which you are. Web 1.you and your spouse lived apart all year. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state, form 8958 must be completed and filed with the return.

Income Allocation Information Is Required When Electronically Filing A Return.

Web open the 1040 and supporting forms to complete the allocations needed for taxpayer and spouse before entering any information on the 8958. Web common questions about entering form 8958 income for community property allocation in lacerte. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return.

Web You Must Attach Form 8958 To Your Tax Form Showing How You Figured The Amount You’re Reporting On Your Return.

Sign online button or tick the preview image of the form. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. I got married in nov 2021. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Web each of you must complete and attach form 8958 to your return showing how you figured the amount you are reporting on your return. On the appropriate lines of your separate. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Yes, loved it could be better no one.