How To Complete W 4P Form

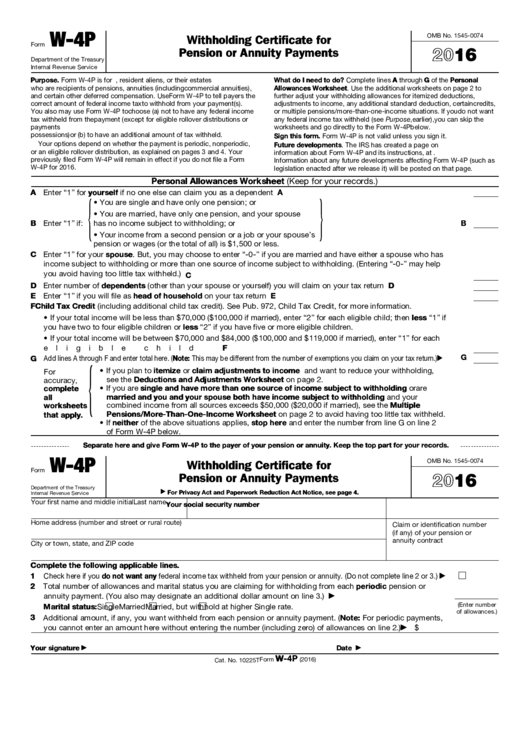

How To Complete W 4P Form - It is used by a payee to change the default withholding election on ineligible rollover periodic. The form will tell drs how much to withhold from your monthly pension income. However, you can designate an. Web form w‐4p is for u.s. You can have income tax withheld from all of those. You can’t designate a specific dollar amount to be withheld. Web 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who work jobs, but also those retired and. Upload, modify or create forms. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. For dcp or plan 3.

Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. · retirees will receive the form in their new retirement package “what do i need to do?” complete. Try it for free now! Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Complete, edit or print tax forms instantly. It is used by a payee to change the default withholding election on ineligible rollover periodic. You can have income tax withheld from all of those. Those employers can then withhold the correct federal income tax from each pay period. This form tells your employer how much federal income tax withholding to keep. You can’t designate a specific dollar amount to be withheld.

This form tells your employer how much federal income tax withholding to keep. You can have income tax withheld from all of those. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who work jobs, but also those retired and. The form will tell drs how much to withhold from your monthly pension income. Web form w‐4p is for u.s. Web form w‐4p is for u.s. · retirees will receive the form in their new retirement package “what do i need to do?” complete. You can’t designate a specific dollar amount to be withheld.

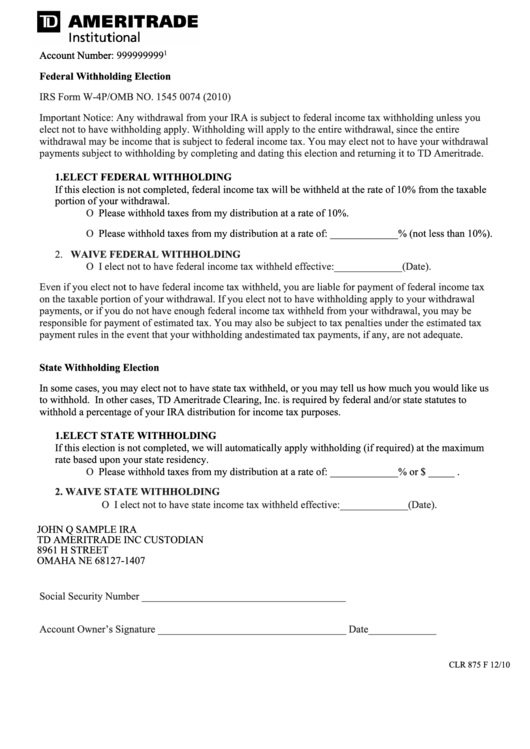

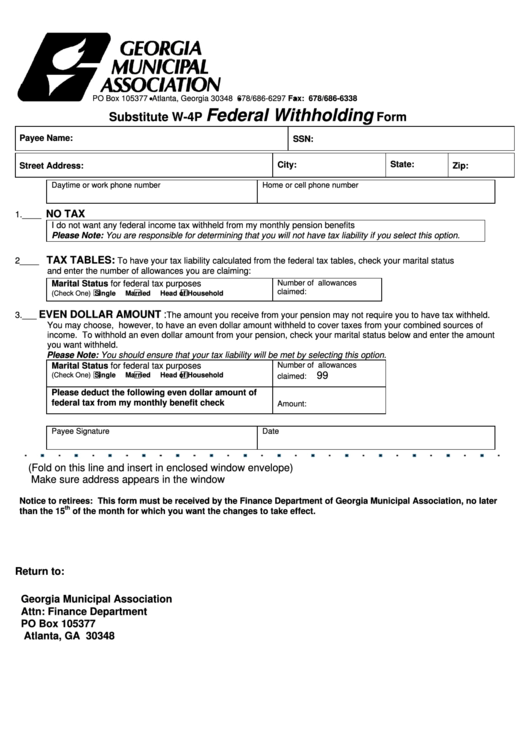

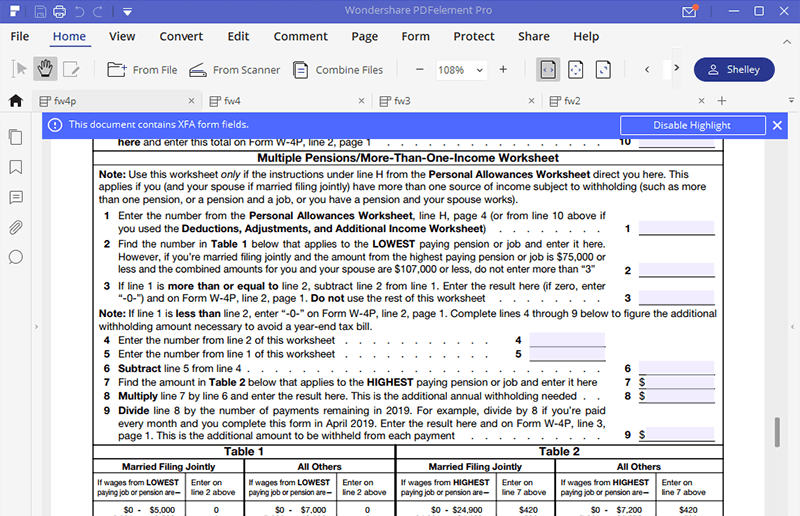

Form W4p State Withholding Election printable pdf download

It is used by a payee to change the default withholding election on ineligible rollover periodic. This form tells your employer how much federal income tax withholding to keep. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web form w‐4p is for u.s. Web form w‐4p is for u.s.

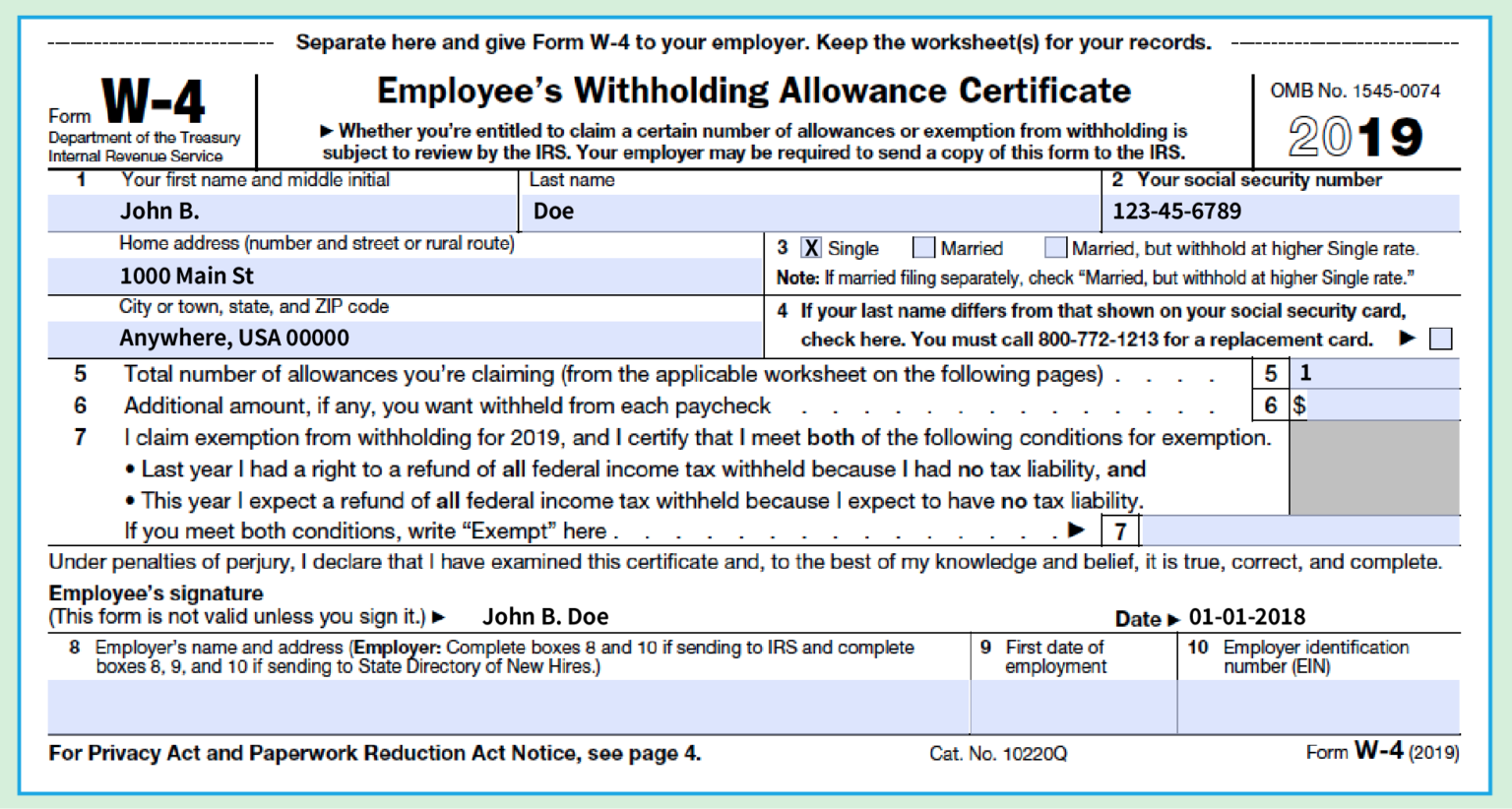

mo w4 form 2020 Fill Online, Printable, Fillable Blank w4form

Upload, modify or create forms. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. For dcp or plan 3. The form will tell drs how much to withhold from your monthly pension income. Those employers can then withhold the correct federal income tax from each pay period.

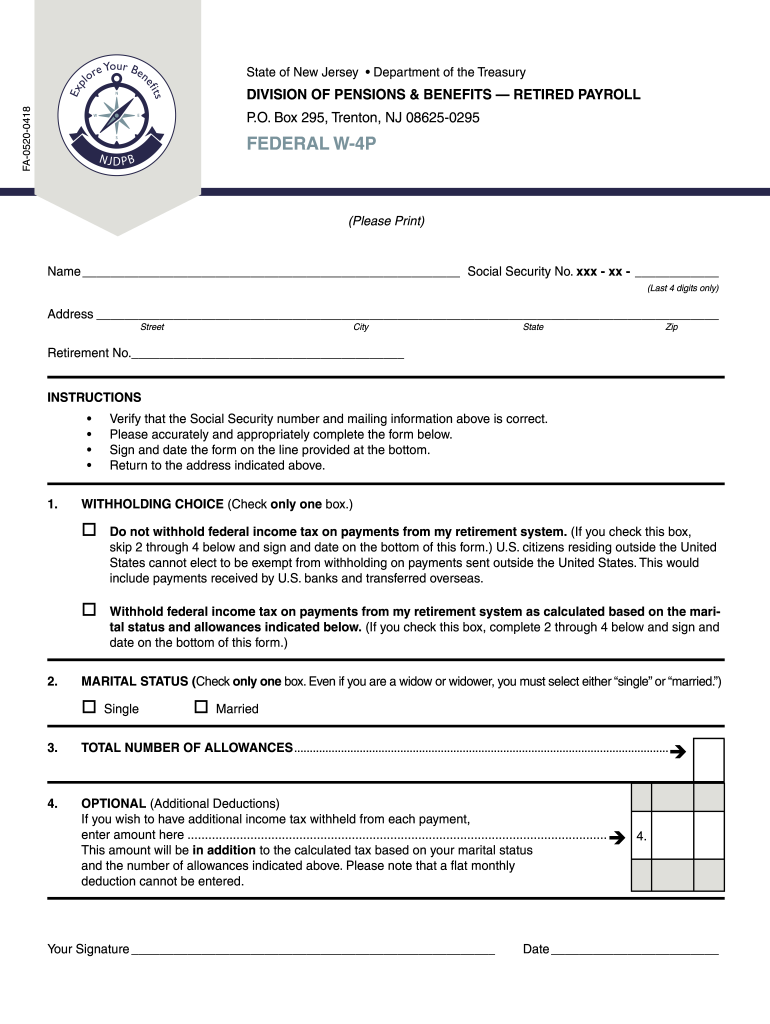

Nj W 4P Form Fill Out and Sign Printable PDF Template signNow

However, you can designate an. Complete, edit or print tax forms instantly. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. This form tells your employer how much federal income tax withholding to keep. You can have income tax withheld from all of those.

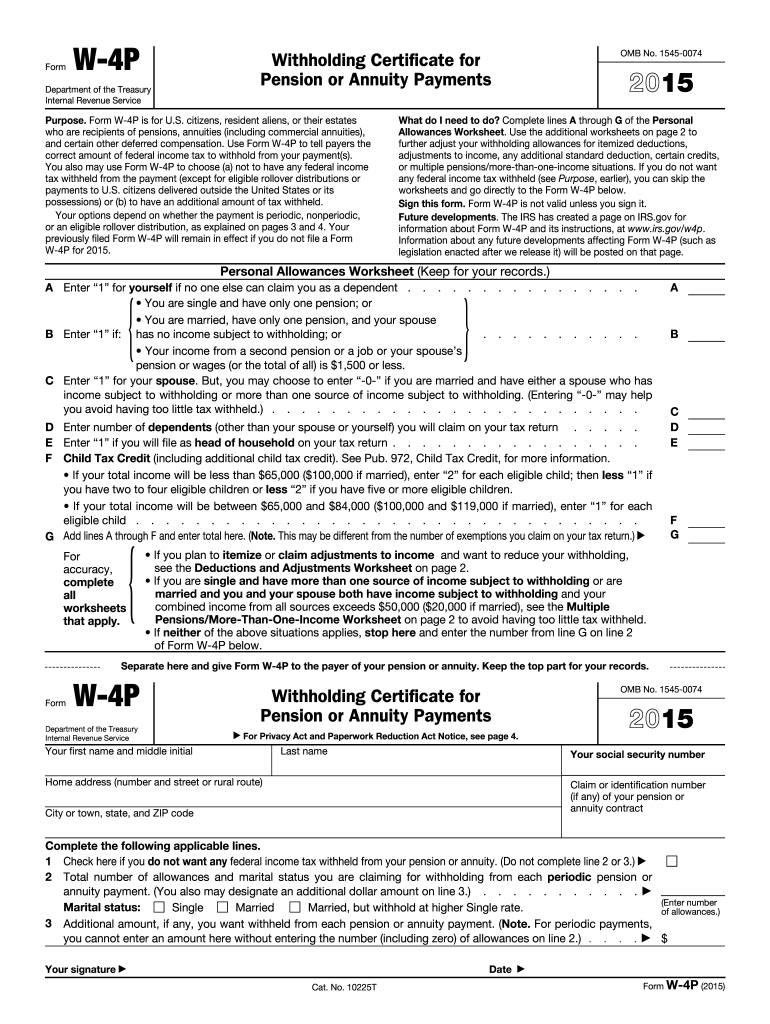

2015 Form IRS W4P Fill Online, Printable, Fillable, Blank pdfFiller

Upload, modify or create forms. For dcp or plan 3. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. Complete, edit or print tax forms instantly. This form tells your employer how much federal income tax withholding to keep.

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

You can’t designate a specific dollar amount to be withheld. It is used by a payee to change the default withholding election on ineligible rollover periodic. Upload, modify or create forms. Try it for free now! Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.

Substitute W4p Federal Withholding Form printable pdf download

However, you can designate an. · retirees will receive the form in their new retirement package “what do i need to do?” complete. This form tells your employer how much federal income tax withholding to keep. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web 4.1k subscribers 53 share.

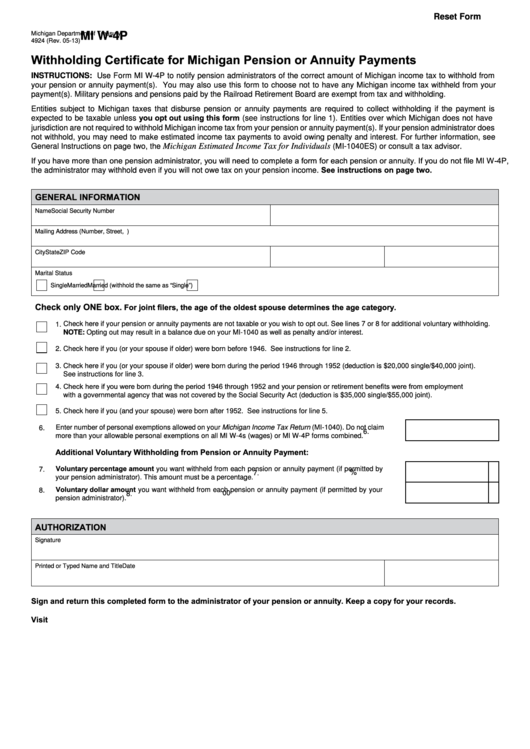

Fillable Form Mi W4p Withholding Certificate For Michigan Pension Or

Those employers can then withhold the correct federal income tax from each pay period. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. However, you can designate an. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web 4.1k subscribers.

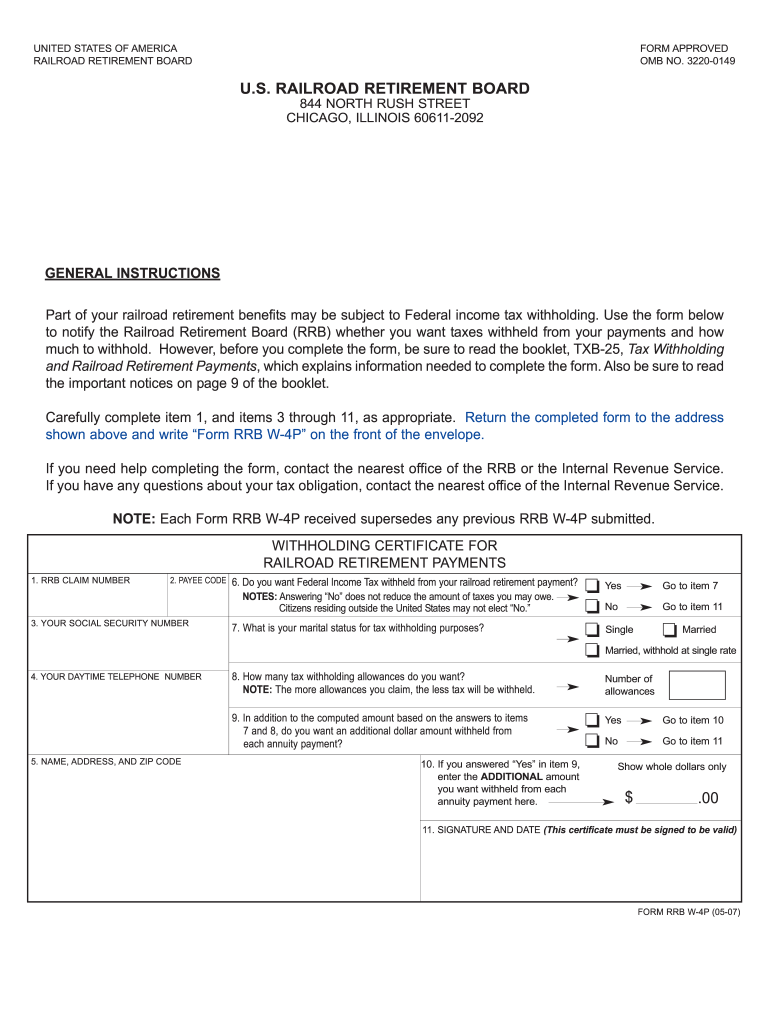

W 4P From Fill Out and Sign Printable PDF Template signNow

Web form w‐4p is for u.s. Web form w‐4p is for u.s. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable. The form will tell drs how much to withhold from your monthly pension income. It is used by a payee to change the default withholding election on ineligible rollover periodic.

Fillable W 4p Form Printable Printable Forms Free Online

· retirees will receive the form in their new retirement package “what do i need to do?” complete. Try it for free now! For dcp or plan 3. You can’t designate a specific dollar amount to be withheld. However, you can designate an.

IRS Form W4P Fill it out in an Efficient Way

You can have income tax withheld from all of those. Those employers can then withhold the correct federal income tax from each pay period. Upload, modify or create forms. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. It is used by a payee to change the default withholding election.

Those Employers Can Then Withhold The Correct Federal Income Tax From Each Pay Period.

This form tells your employer how much federal income tax withholding to keep. The form will tell drs how much to withhold from your monthly pension income. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. Web your pension, annuity, required minimum distributions and possibly part of your social security are taxable.

However, You Can Designate An.

Upload, modify or create forms. Web 4.1k subscribers 53 share 8k views 2 years ago how to w4 when it comes to the w4, it is not only beneficial to those who work jobs, but also those retired and. · retirees will receive the form in their new retirement package “what do i need to do?” complete. Complete, edit or print tax forms instantly.

It Is Used By A Payee To Change The Default Withholding Election On Ineligible Rollover Periodic.

You can’t designate a specific dollar amount to be withheld. Web form w‐4p is for u.s. Web form w‐4p is for u.s. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.

Try It For Free Now!

For dcp or plan 3. You can have income tax withheld from all of those.