How To Fill Out Form 8862 Online

How To Fill Out Form 8862 Online - If you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Ad download or email irs 8862 & more fillable forms, try for free now! Find the form you would like to sign and click on upload. Try it for free now! Web you can submit form 8862 online or in the tax office. Web 4k views 1 year ago #childtaxcredit. The notice instructs you to file. Start completing the fillable fields and. Web stick to these simple steps to get irs 8862 completely ready for submitting: Upload, modify or create forms.

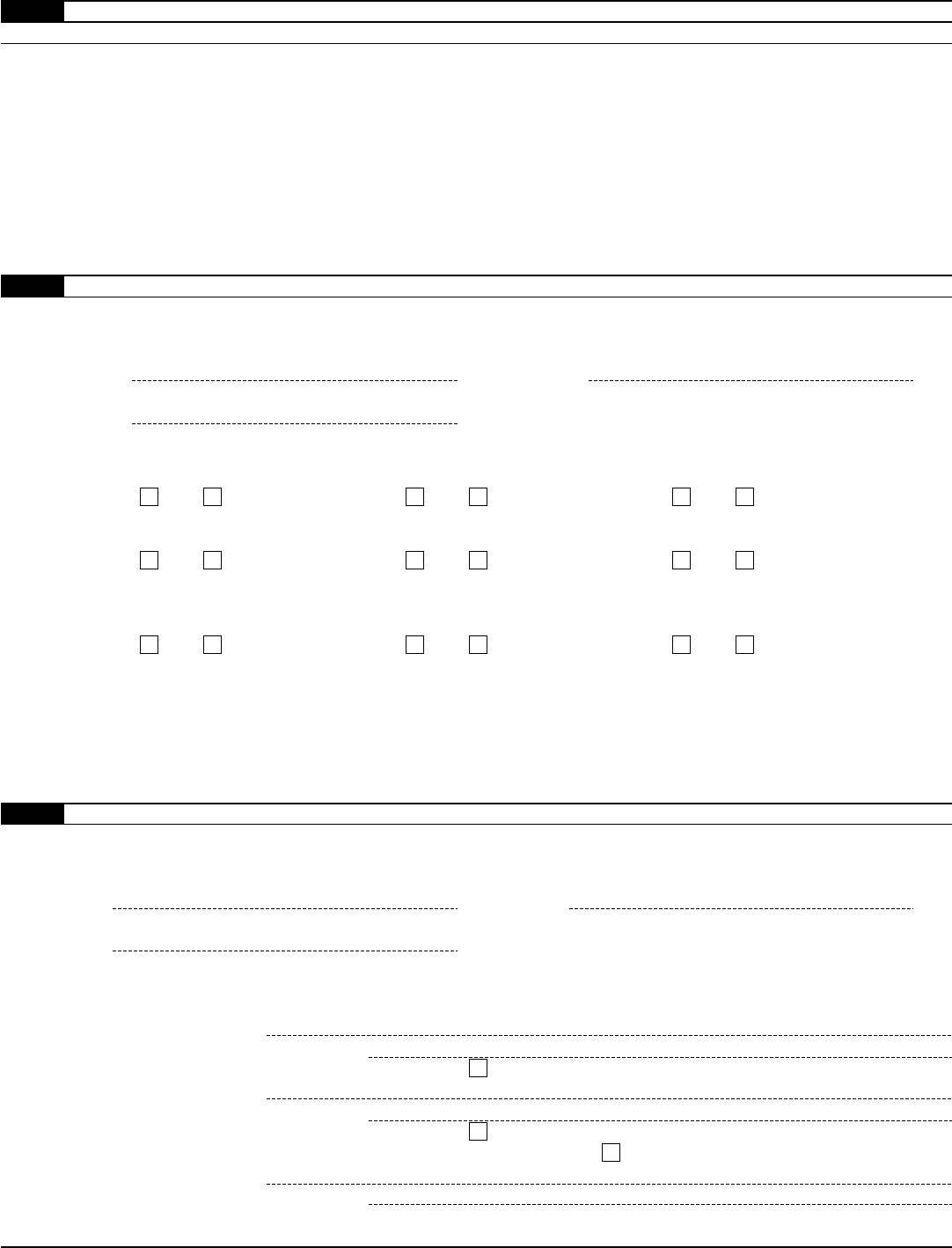

Start completing the fillable fields and. Check the appropriate box on line 2 and 3. If you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Web 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Web you'll be asked to share personal information such as your date of birth, parents' names and details about your current occupation and previous criminal. The notice instructs you to file. Filing this form allows you to reclaim credits. The earliest tax period for which the ein is required and. Ad download or email irs 8862 & more fillable forms, try for free now! If you checked, no on both lines 2 and 3,.

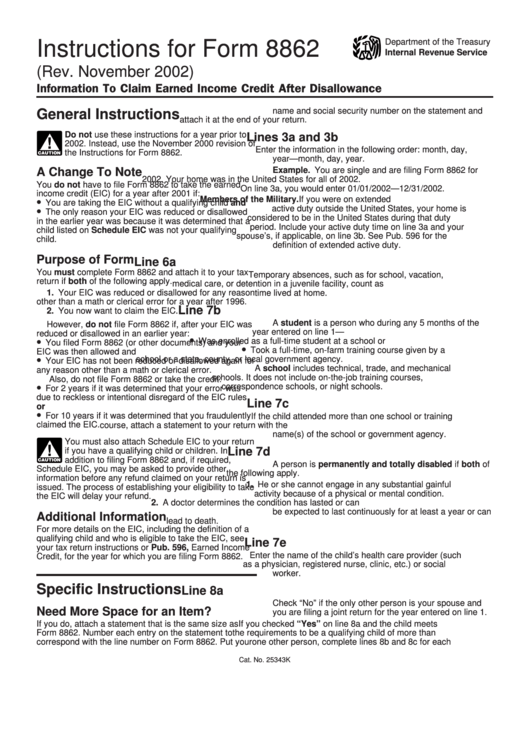

Web more about the federal form 8862 tax credit. Upload, modify or create forms. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Choose the my signature button. This form is for income. Web here's how to file form 8862 in turbotax. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Check the appropriate box on line 2 and 3. Sign it in a few clicks draw your. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit.

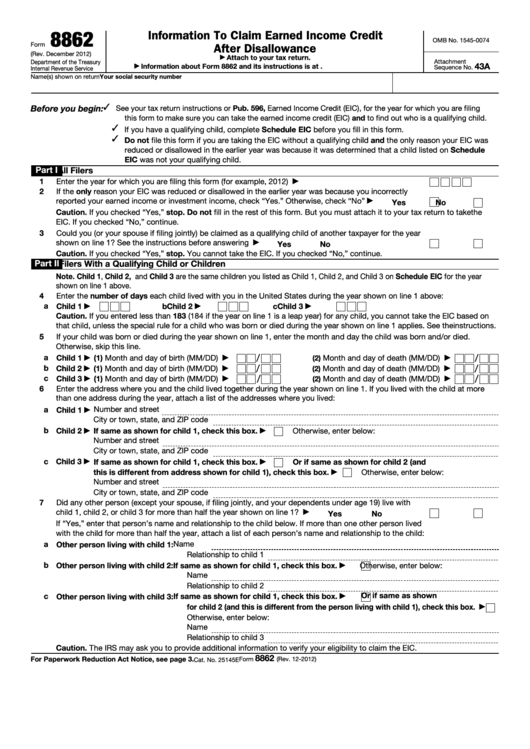

Fillable Form 8862 Information To Claim Earned Credit After

Use get form or simply click on the template preview to open it in the editor. Enter the year for the tax year you are filing the form 8862 for on line 1 in part 1. Check the appropriate box on line 2 and 3. Web more about the federal form 8862 tax credit. Web key takeaways form 8862 is.

Form 8862 Information to Claim Earned Credit After

Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search ,. Web 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. We last updated federal form 8862 in december 2022 from the federal.

How to Fill out IRS Form 8962 Correctly?

Put your name and social security number on the statement and attach it at. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Edit your 8862 form meaning online type text, add images, blackout confidential details, add comments, highlights and more. Web form irs 8862 easily fill out and sign forms download blank or.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Web stick to these simple steps to get irs 8862 completely ready for submitting: Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web taxpayers complete form 8862 and attach it to their tax return if: Claiming certain credits after disallowance form 8862;.

Instructions For Form 8862 Information To Claim Earned Credit

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Try it for free now! Web 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Web you'll be asked to share personal information such as your date of.

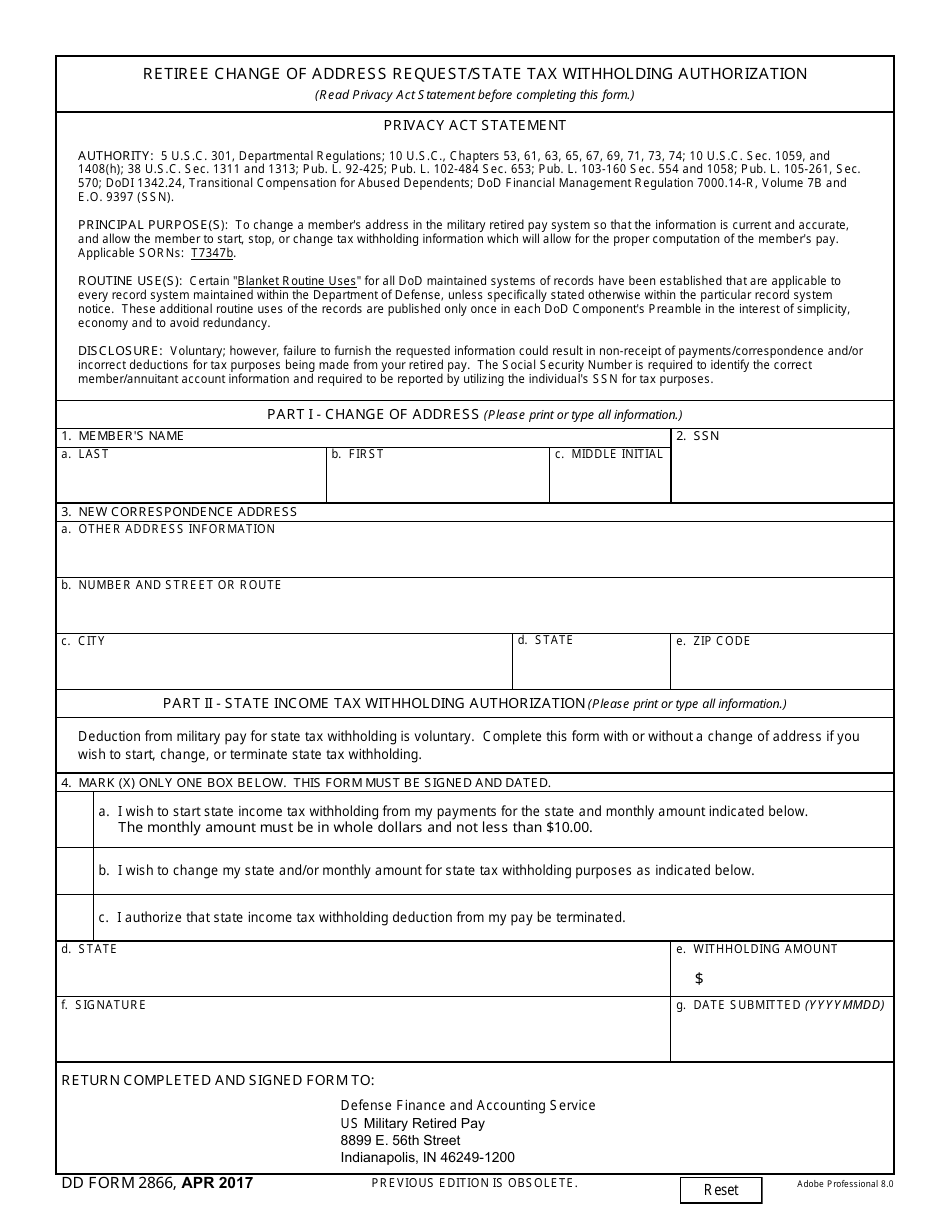

DD Form 2866 Fill Out, Sign Online and Download Fillable PDF

We last updated federal form 8862 in december 2022 from the federal internal revenue service. Web you can submit form 8862 online or in the tax office. Web key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits. Check the appropriate box on line 2 and 3. Web more about the federal.

Irs Form 8862 Printable Master of Documents

Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Enter the year for the tax year you are filing the form 8862 for on line 1 in part 1. Find the sample you want in our collection of legal templates. If you checked, no on both lines 2 and 3,. Find the form you.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

How do i enter form 8862?. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Find the sample you want in our collection of legal templates. Try it for free now! Upload, modify or create forms.

Irs Form 8862 Printable Master of Documents

Web taxpayers complete form 8862 and attach it to their tax return if: Put your name and social security number on the statement and attach it at. Web eic requirements several standards must be met for you to claim the eic: Upload, modify or create forms. Web more about the federal form 8862 tax credit.

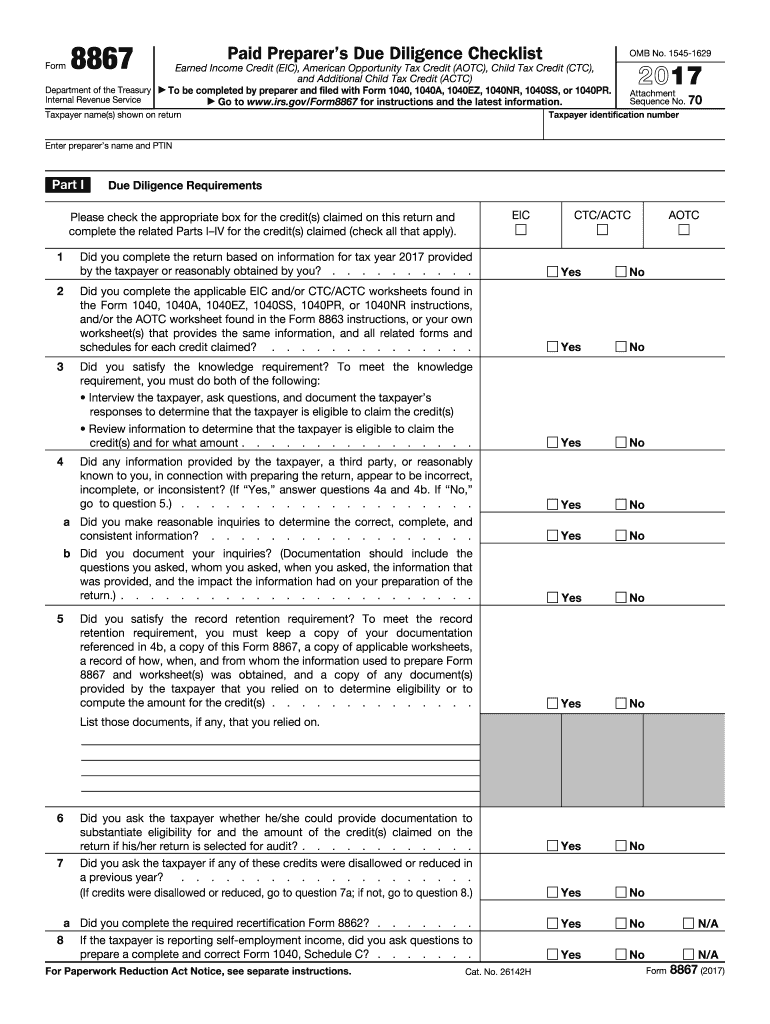

Form 8867 Fill Out and Sign Printable PDF Template signNow

Web eic requirements several standards must be met for you to claim the eic: In our review, you will discover who should fill out. Complete, edit or print tax forms instantly. Enter the year for the tax year you are filing the form 8862 for on line 1 in part 1. If you had a child tax credit (ctc) disallowed.

Web 1 Best Answer Andreac1 Level 9 You Can Use The Steps Below To Help You Get To Where To Fill Out Information For Form 8862 To Add It To Your Tax Return.

Web 18 13,264 reply 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Ad download or email irs 8862 & more fillable forms, try for free now! We last updated federal form 8862 in december 2022 from the federal internal revenue service. Web key takeaways form 8862 is required when the irs has previously disallowed one or more specific tax credits.

Web You'll Be Asked To Share Personal Information Such As Your Date Of Birth, Parents' Names And Details About Your Current Occupation And Previous Criminal.

Enter the year for the tax year you are filing the form 8862 for on line 1 in part 1. Start completing the fillable fields and. Sign it in a few clicks draw your. Open the form in the online editor.

The Notice Instructs You To File.

Web eic requirements several standards must be met for you to claim the eic: Web here's how to file form 8862 in turbotax. Web stick to these simple steps to get irs 8862 completely ready for submitting: In our review, you will discover who should fill out.

You Must Be A Citizen Of The United States, And Must Live In The U.s.

Complete, edit or print tax forms instantly. Web more about the federal form 8862 tax credit. Filing this form allows you to reclaim credits. If you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice.