How To Find Agi On Tax Form

How To Find Agi On Tax Form - Married filing separately in 2018 but filing jointly in 2019? If you have your 1040 or 1040nr return you filed. Web where do i find my last year’s agi? Find out how much you owe. Use your online account to immediately view your agi on. Web depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or help you determine your agi. Web how can i find my agi if i don't have last year's tax return? Use the irs get transcript tool to receive a transcript online or. If you used taxact to file your return last year, you can retrieve your agi by following these steps: Here’s how to obtain your previous tax information:

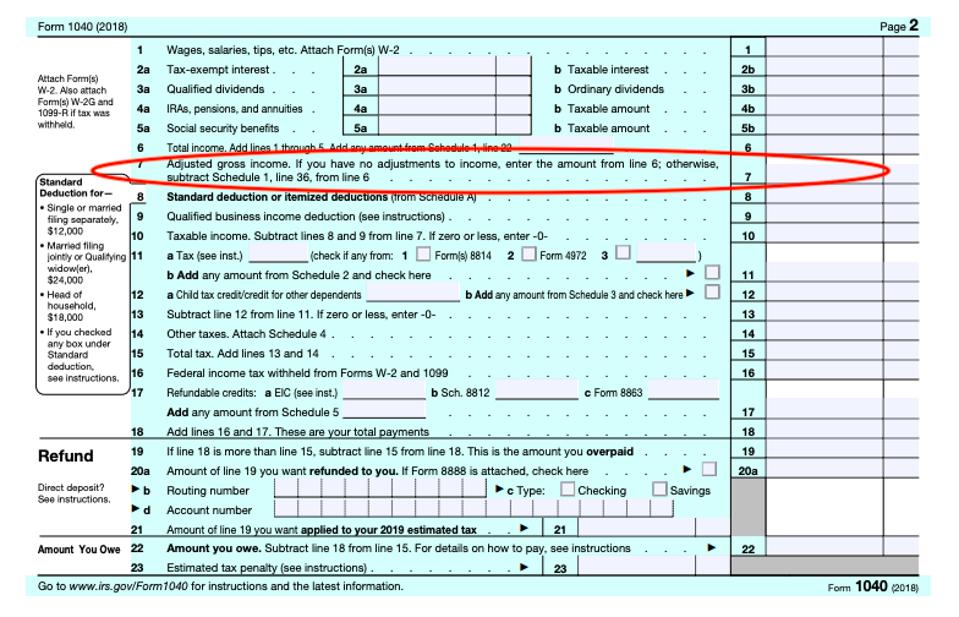

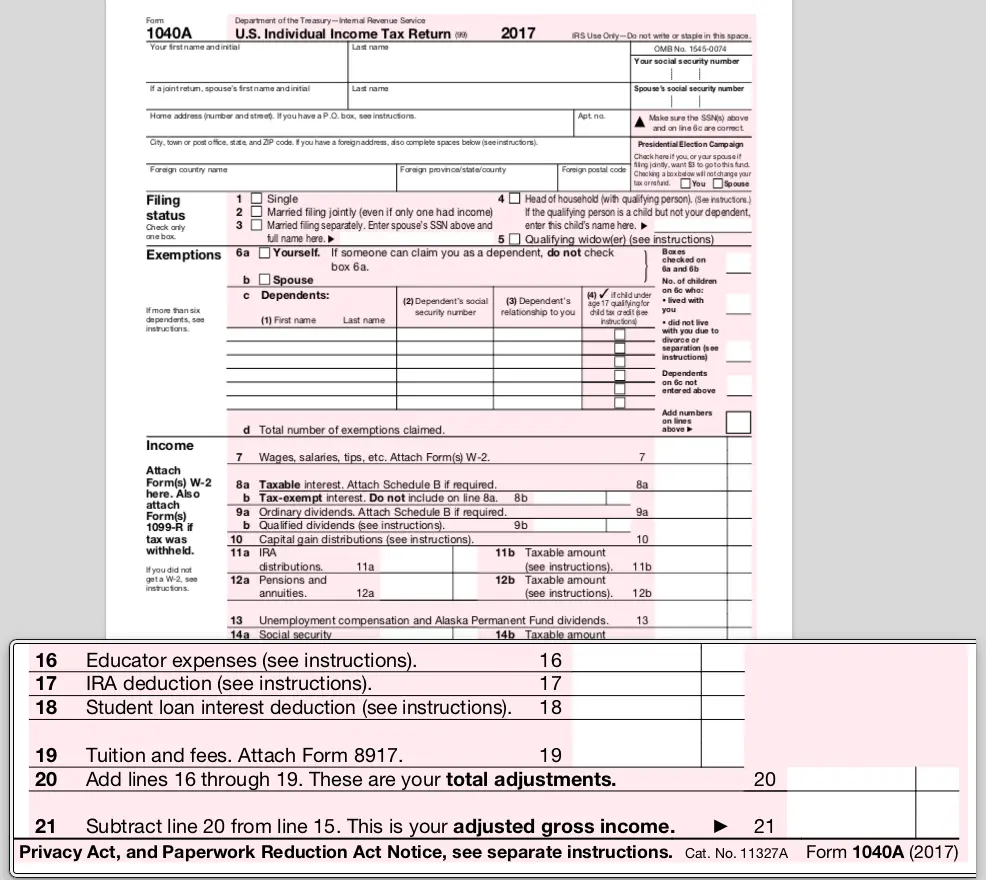

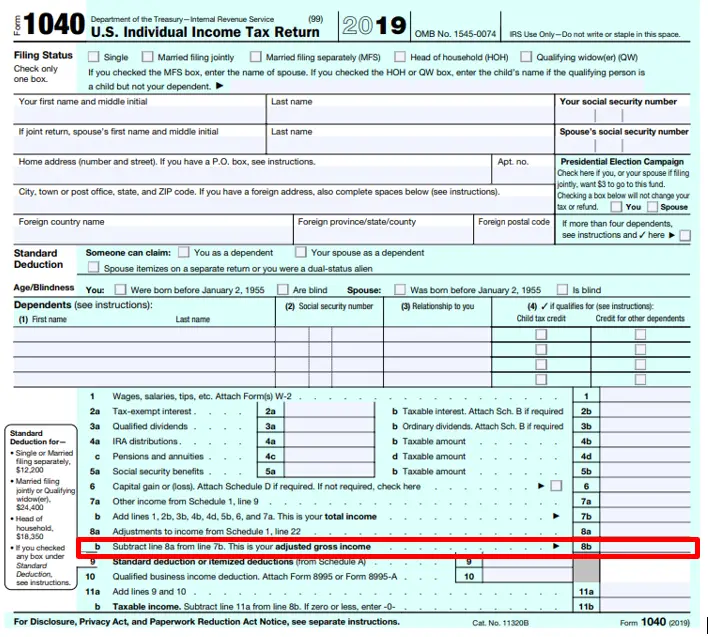

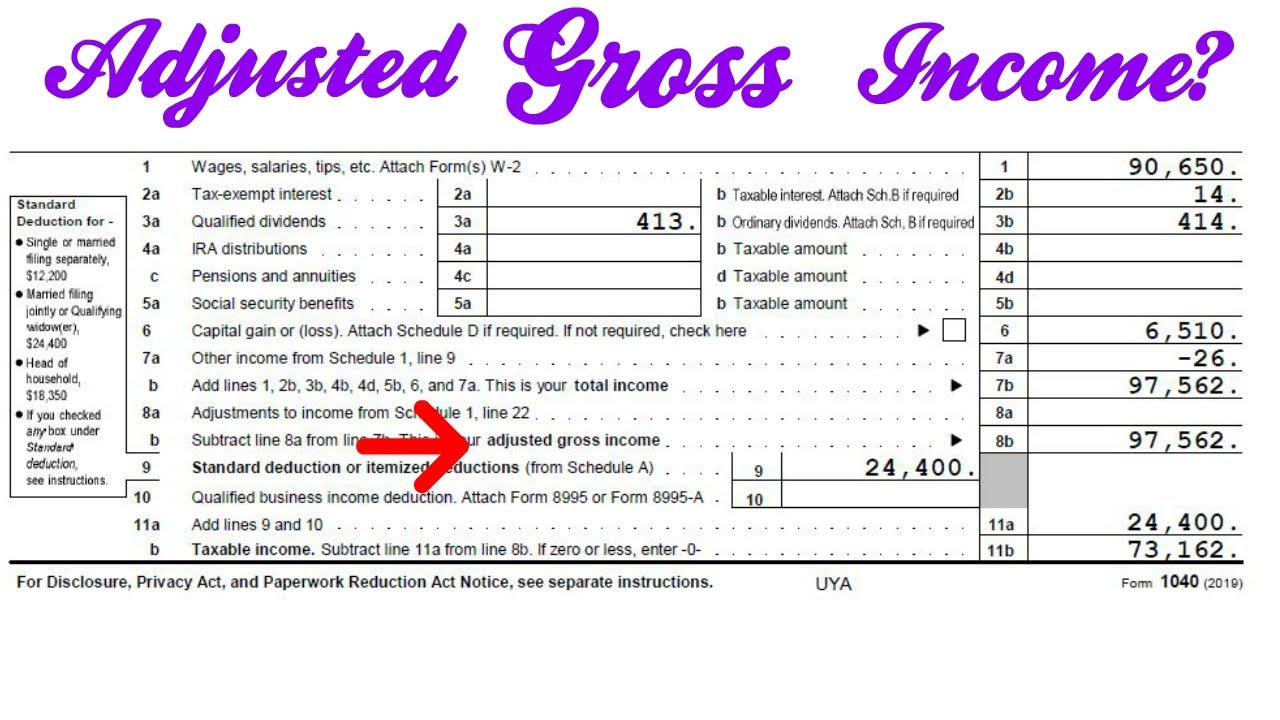

Sign into your taxact account here. If you used taxact to file your return last year, you can retrieve your agi by following these steps: Here’s how to obtain your previous tax information: Web how do i find my agi for this year (2022)? You can view your tax records now in your online account. Web access tax records in online account. If you have your tax return from 2020, you can find your agi from that year on line 11 of your 1040 form. Web form 1040ez, line 4. Use the irs get transcript tool to receive a transcript online or. Find out how much you owe.

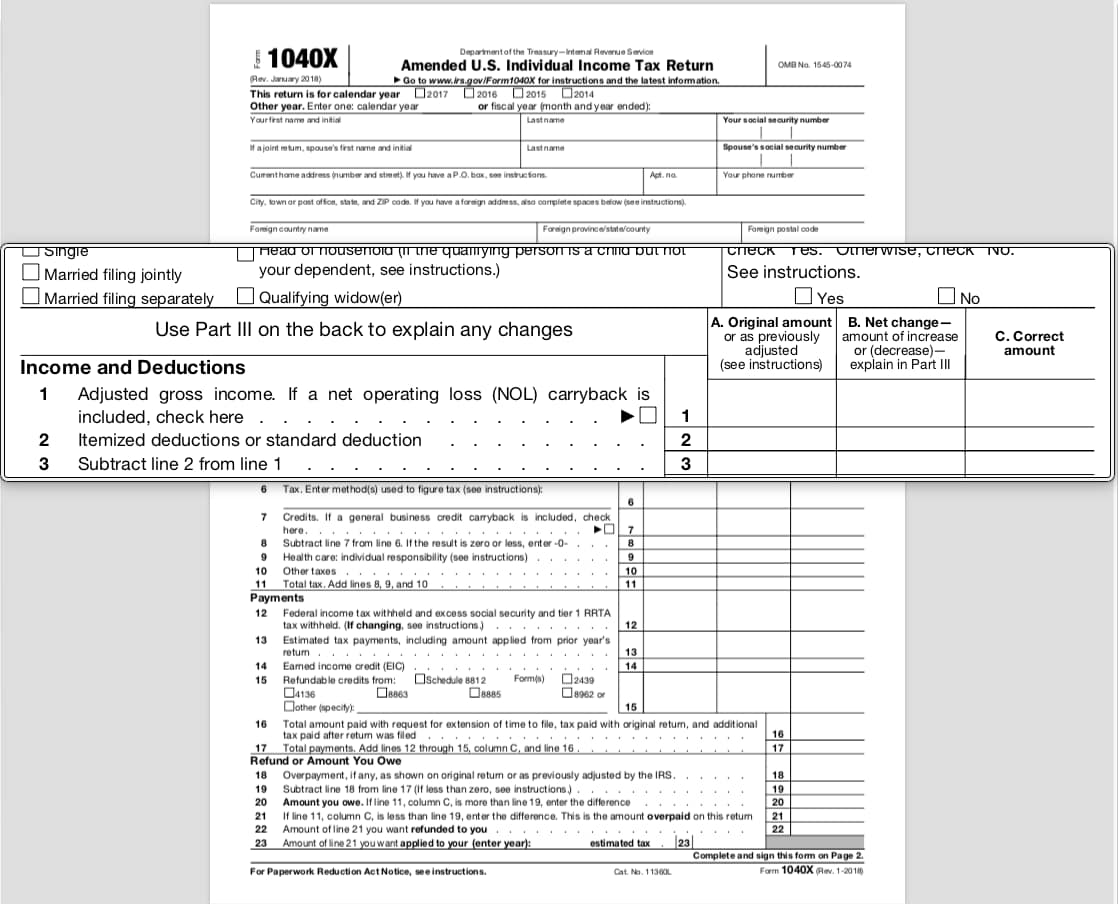

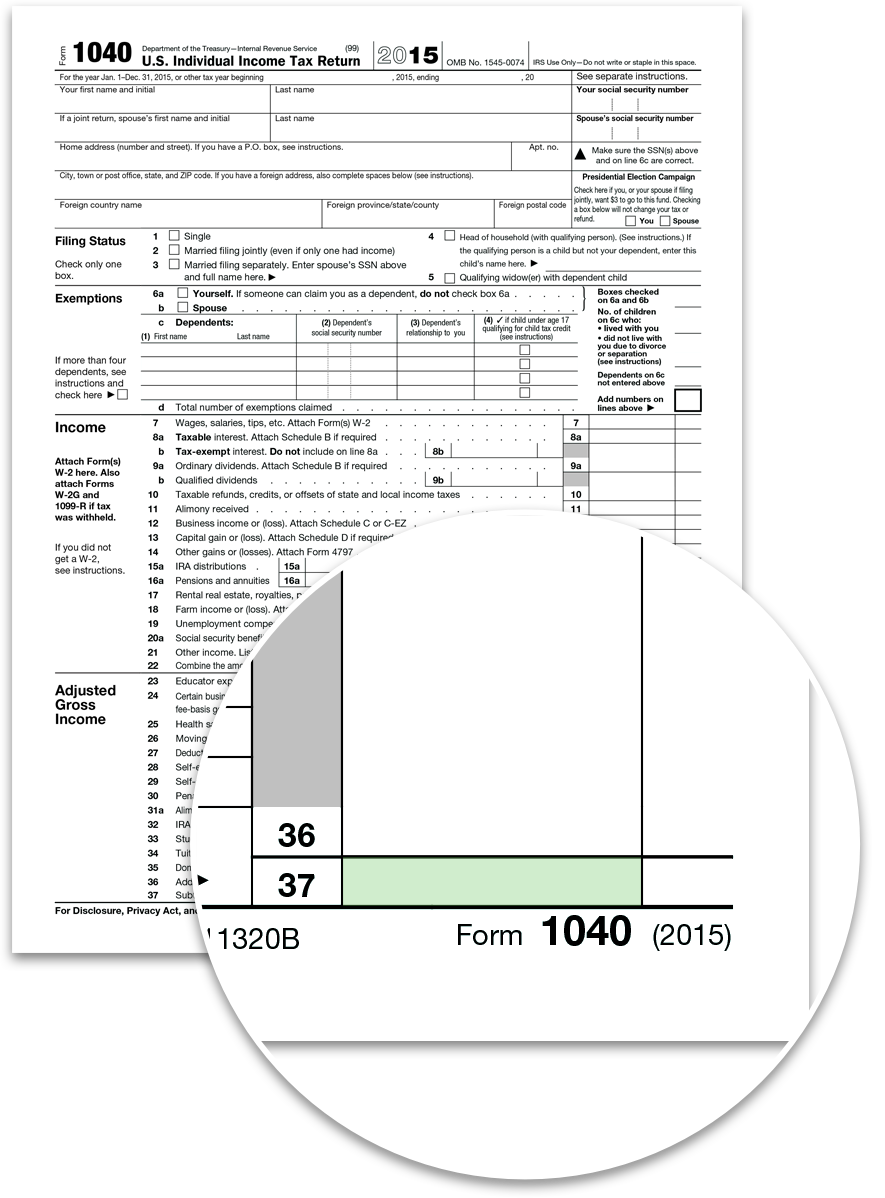

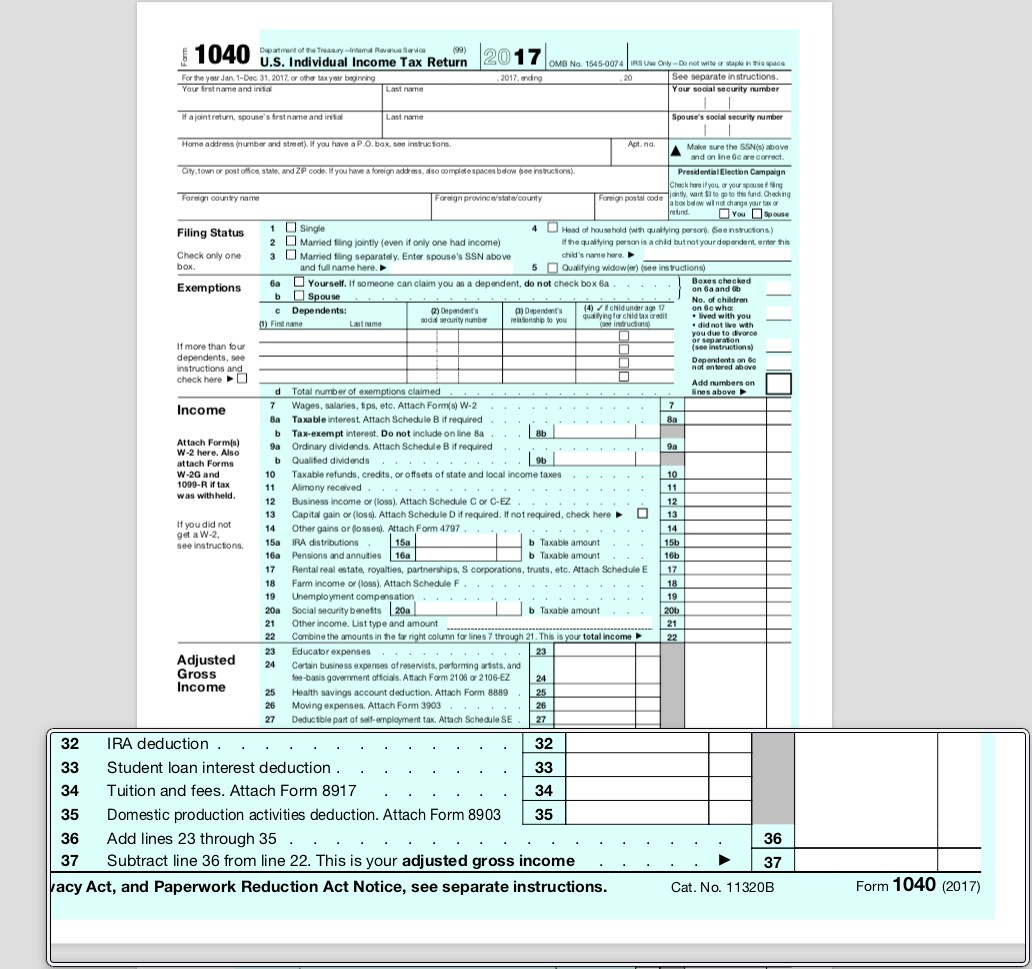

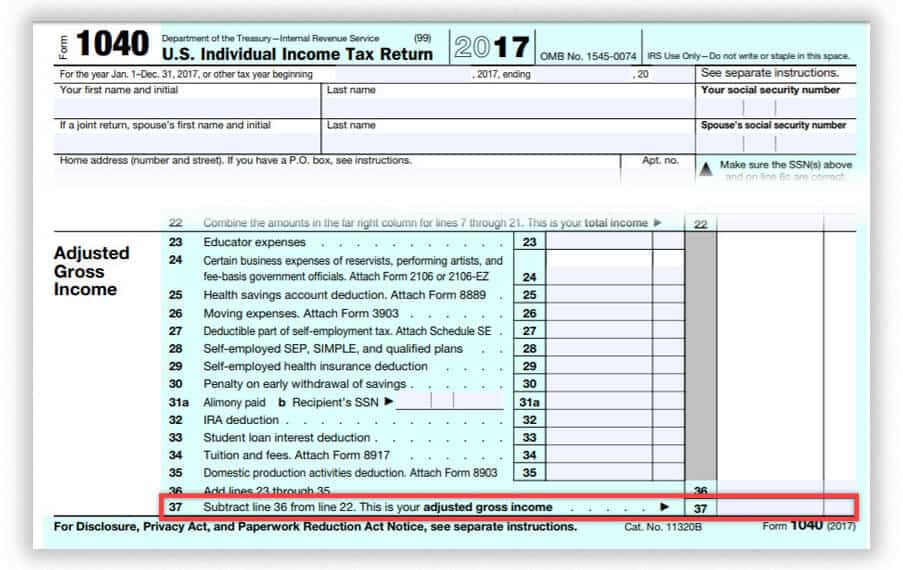

Web where do i find my last year’s agi? If you have your tax return from 2020, you can find your agi from that year on line 11 of your 1040 form. Learn how to calculate agi, the importance and the impact of agi on your taxes. Web to retrieve your original agi from your 2019 tax return (or from the original return if you filed an amended return), you may do one of the following: Web adjusted gross income (agi) and its significance in the u.s. Web there are a few places you can get your 2018 agi: Web how can i find my agi if i don't have last year's tax return? Find out how much you owe. This is the fastest, easiest way to: Web form 1040ez, line 4.

How do I find last year’s AGI? Intuit Turbo Real Money Talk

Web depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or help you determine your agi. Web to retrieve your original agi from your 2019 tax return (or from the original return if you filed an amended return), you may do one of the following: Here’s how.

Taxes From A To Z 2019 M Is For Medical Expenses

If you have your 1040 or 1040nr return you filed. Use the irs get transcript tool to receive a transcript online or. You can view your tax records now in your online account. Web there are a few places you can get your 2018 agi: Web how can i find my agi if i don't have last year's tax return?

What Is Agi On Tax Form

Sign into your taxact account here. Web adjusted gross income (agi) and its significance in the u.s. If you have your 1040 or 1040nr return you filed. If you used taxact to file your return last year, you can retrieve your agi by following these steps: Your agi for tax year 2019.

1040 Instructions 2015 Tax Year

Married filing separately in 2018 but filing jointly in 2019? Web adjusted gross income (agi) and its significance in the u.s. Web how do i find my agi for this year (2022)? Web form 1040ez, line 4. Adjusted gross income adjusted gross income (agi) is defined as gross.

2022 Standard Deduction Amounts Are Now Available Kiplinger

I filed my 2021 taxes with turbotax i didn't file my 2021. Solved•by turbotax•4258•updated april 07, 2023. Your 2020 agi will be on line. Here’s how to obtain your previous tax information: If you have your 1040 or 1040nr return you filed.

I am trying to find my agi number.. please help TurboTax® Support

Solved•by turbotax•4258•updated april 07, 2023. Web there are a few places you can get your 2018 agi: Your 2020 agi will be on line. Web form 1040ez, line 4. Filed jointly in 2018 but are married filing separately in.

What Is Agi On Tax Form

Your 2020 agi will be on line. Web to find last year's adjusted gross income (agi), select the option below that best describes your situation. Here’s how to obtain your previous tax information: Use your online account to immediately view your agi on. You can view your tax records now in your online account.

Where Do I Find My Agi On My Tax Return

Use the irs get transcript tool to receive a transcript online or. Married filing separately in 2018 but filing jointly in 2019? If you have your tax return from 2020, you can find your agi from that year on line 11 of your 1040 form. Use your online account to immediately view your agi on. Web find out what adjusted.

What is Adjusted Gross Qualify for the Coronavirus Economic

Find out how much you owe. Filed jointly in 2018 but are married filing separately in. Learn how to calculate agi, the importance and the impact of agi on your taxes. Your 2020 agi will be on line. Web form 1040ez, line 4.

Student Loans and Adjusted Gross (AGI) Tips for Low Payments

Web access tax records in online account. Your 2020 agi will be on line. Use the irs get transcript tool to receive a transcript online or. I filed my 2021 taxes with turbotax i didn't file my 2021. If you have your 1040 or 1040nr return you filed.

Use Your Online Account To Immediately View Your Agi On.

Web find out what adjusted gross income (agi) is and where to find it on your tax return. Web to retrieve your original agi from your 2019 tax return (or from the original return if you filed an amended return), you may do one of the following: Web how can i find my agi if i don't have last year's tax return? If you have your 1040 or 1040nr return you filed.

Web How Do I Find My Agi For This Year (2022)?

Web depending upon your filing status, this step will ask you to enter your adjusted gross income (agi), your total combined household agi, or help you determine your agi. Web adjusted gross income (agi) and its significance in the u.s. I filed my 2021 taxes with turbotax i didn't file my 2021. If you used taxact to file your return last year, you can retrieve your agi by following these steps:

Here’s How To Obtain Your Previous Tax Information:

What do i use for my agi if i filed late, amended, or got a notice changing my return? Web there are a few places you can get your 2018 agi: Use the irs get transcript tool to receive a transcript online or. Your 2020 agi will be on line.

You Can View Your Tax Records Now In Your Online Account.

Filed jointly in 2018 but are married filing separately in. Solved•by turbotax•4258•updated april 07, 2023. Web form 1040ez, line 4. Web to find last year's adjusted gross income (agi), select the option below that best describes your situation.