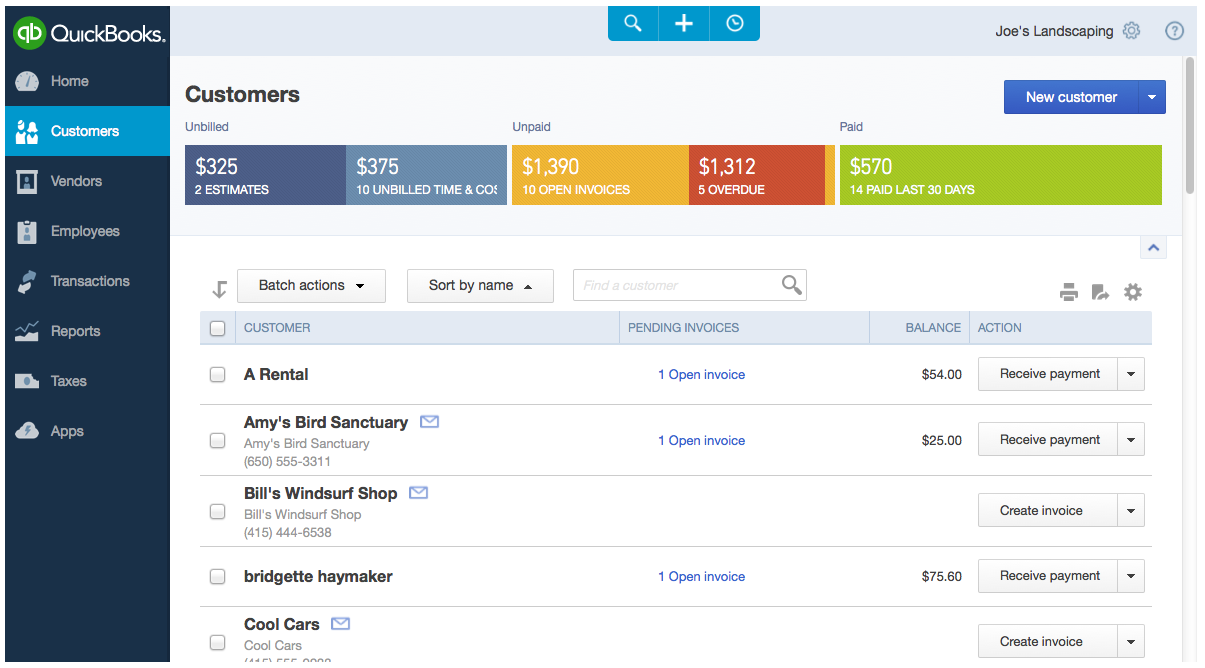

How To Get Form 941 In Quickbooks Online

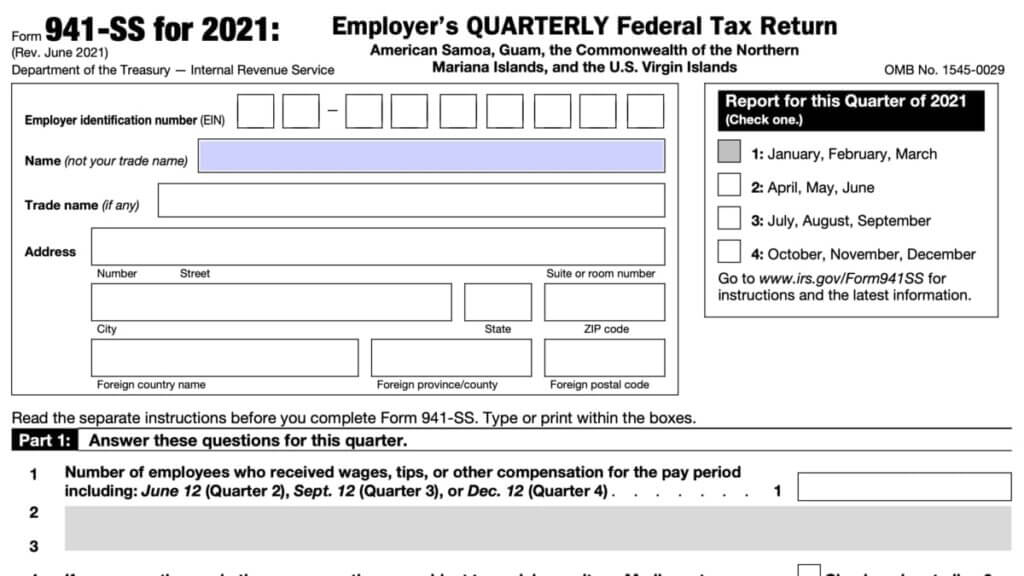

How To Get Form 941 In Quickbooks Online - But how do you file it online? Web opus 17 level 15 form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Go to the taxes menu and then choose the payroll tax tab. Now in your file form section select the. Web solved • by quickbooks • 624 • updated 3 weeks ago. Select either form 941 or 944 in the tax reports section of print reports. Click the taxes tab on the left panel. Indicate the appropriate tax quarter and year in the quarter and year fields. Go to the forms column, and then click the view archived forms link below the quarterly. We don't have a specific release date for the 2019 federal form 941.

Web this way, we'll able to check your account and guide you in preparing the necessary information to successfully file your form 941. Employers must file a quarterly form 941. But how do you file it online? In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Log in to your quickbooks online account. Now in your file form section select the. Web create irs tax form 941 in quickbooks. Click on the employees from the top menu bar. Web let me walk you through the steps on how you can view your previously filed quarterly 941 forms from last year.

You can do this through quickbook. Web to print form 941 or 944. Web track income & expenses. Web at the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Web how do i print 941 for a audit. Web best answers garlyngay moderator february 18, 2019 06:35 am hello mike16, let me show you how to print the filed 941 form so you can mail it to the irs. Go to the forms column, and then click the view archived forms link below the quarterly. Web this way, we'll able to check your account and guide you in preparing the necessary information to successfully file your form 941. Indicate the appropriate tax quarter and year in the quarter and year fields.

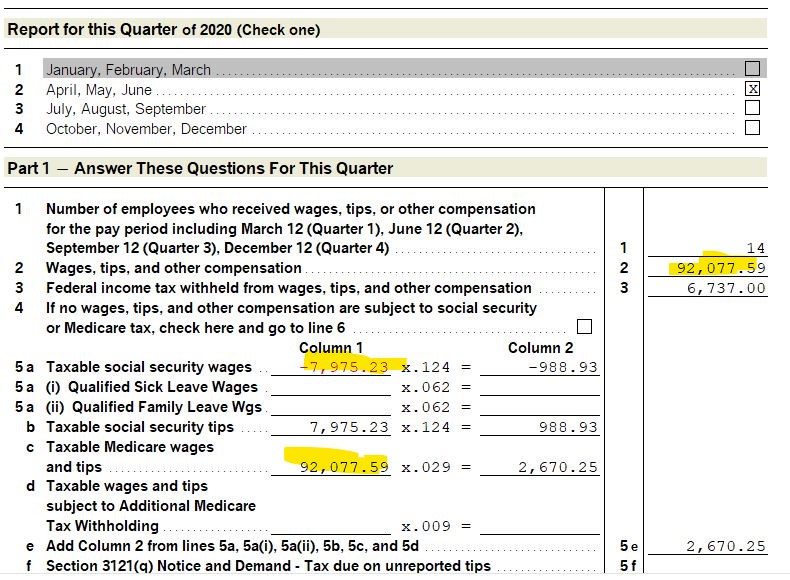

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Indicate the appropriate tax quarter and year in the quarter and year fields. We don't have a specific release date for the 2019 federal form 941. Track sales & sales tax. On the left panel, choose the taxes menu to select payroll tax. Employers must file a quarterly form 941.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

Click on the employees from the top menu bar. Log in to your quickbooks online account. Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Click taxes on the left navigation menu and choose payroll tax. Web best answers garlyngay moderator february 18, 2019 06:35.

QuickBooks 941 Feature Creates Tax Form 941 Fast Video YouTube

Learn how quickbooks online and desktop populates the lines on the form 941. Click on the employees from the top menu bar. Choose quarterly tax forms and 941 as your filter. Log in to your quickbooks online account. But how do you file it online?

QuickBooks form 941 error Fix with Following Guide by sarahwatsonsus

In the forms section, tap the view and print archived forms link under quarterly. It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. Web solved • by quickbooks • 624 • updated 3 weeks ago. Track sales & sales tax. Web i'd be happy to provide some insight about.

Where Is Form 941 In Quickbooks?

Web how to file federal payroll form 941 in quickbooks online? Go to the taxes menu and then choose the payroll tax tab. In the forms section, tap the view and print archived forms link under quarterly. Web create irs tax form 941 in quickbooks. Rely on your bookkeeper to accurately categorize transactions and reconcile your accounts.

Quickbooks Learn & Support Online QBO.Support I cannot efile 941

It has five parts and a payment voucher at the end if you’re submitting the form by mail with payment. We don't have a specific release date for the 2019 federal form 941. But how do you file it online? Web how do i print 941 for a audit. In the forms section, tap the view and print archived forms.

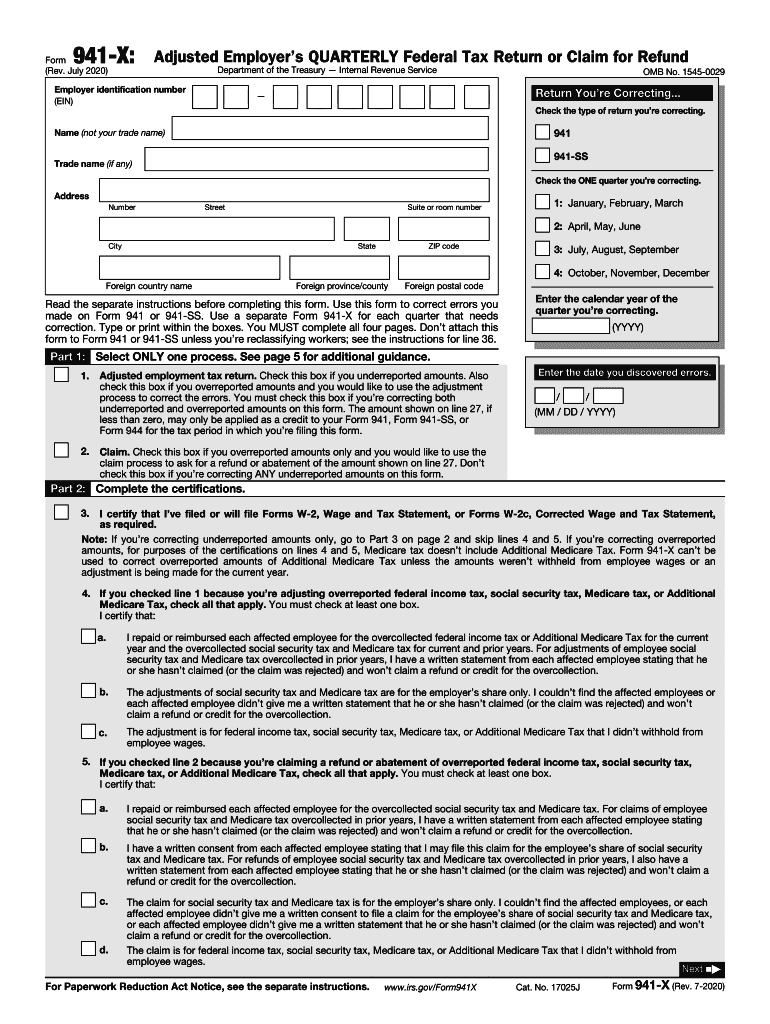

941 X Form Fill Out and Sign Printable PDF Template signNow

It must be filed at least quarterly. Choose quarterly tax forms and 941 as your filter. Employers must file a quarterly form 941. Web this way, we'll able to check your account and guide you in preparing the necessary information to successfully file your form 941. Click the taxes tab on the left panel.

Which Accounting Software Is Better? Compare Freshbooks & Quickbooks

In the forms section, tap the view and print archived forms link under quarterly. Web solved • by quickbooks • 624 • updated 3 weeks ago. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &. Web to find your form 941: Web best answers garlyngay moderator february 18, 2019 06:35 am.

Rushcard Direct Deposit Form Form Resume Examples djVarJG2Jk

Track sales & sales tax. Web how to file federal payroll form 941 in quickbooks online? Choose quarterly tax forms and 941 as your filter. You can do this through quickbook. Web to print form 941 or 944.

Form 941 PDF is Watermarked "Do Not File"

Web this way, we'll able to check your account and guide you in preparing the necessary information to successfully file your form 941. Web track income & expenses. Click taxes on the left navigation menu and choose payroll tax. On the left panel, choose the taxes menu to select payroll tax. Click the taxes tab on the left panel.

Employers Must File A Quarterly Form 941.

You can do this through quickbook. Web solved • by quickbooks • 624 • updated 3 weeks ago. Click on the employees from the top menu bar. Web opus 17 level 15 form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks.

Track Sales & Sales Tax.

Web i'd be happy to provide some insight about the form 941 update. We don't have a specific release date for the 2019 federal form 941. Log in to your quickbooks online account. Web how do i print 941 for a audit.

Web Let Me Walk You Through The Steps On How You Can View Your Previously Filed Quarterly 941 Forms From Last Year.

Learn how quickbooks online and desktop populates the lines on the form 941. Web at the end of each calendar quarter and year you’ll need to file federal and state tax forms with the appropriate agencies. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Choose quarterly tax forms and 941 as your filter.

Web January 10, 2022 02:29 Pm.

Select either form 941 or 944 in the tax reports section of print reports. It must be filed at least quarterly. Click the taxes tab on the left panel. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule &.