How To Read A Business Tax Return

How To Read A Business Tax Return - The larger font also makes the form longer—it takes up three pages instead of two. And (c) enable you to. Understanding the basics of business tax on the state and federal level will save you time, money, and frustration later down the line. If you earn less than that. (b) identify pertinent financial information; Web add up the extra $55 over 12 months and some could be looking at an extra $660 a year. Web recommended reading for small businesses a comprehensive list of helpful publications for small businesses. If you're trying to get a transcript to complete fafsa, refer to tax. Web these taxpayers now have until feb. Obtain a copy of a corporate tax return filed from a previous year.

Getting organized consider consulting an accountant to help you get organized. File an expected taxable income form. Income tax return for an s corporation. Understanding the basics of business tax on the state and federal level will save you time, money, and frustration later down the line. The larger font also makes the form longer—it takes up three pages instead of two. These seven courses explore how to analyze and interpret business financial statements and tax returns, including cash flow statements. Web analyzing business financial statements and tax returns suite. If you look at your. Web save increases the amount of income protected from repayment to 225 percent of the federal poverty guidelines, roughly equivalent to $15 an hour for a single borrower. Web thus, the goal of this practice point is to provide you with an overview of the following business tax returns, so that you can (a) understand the forms;

If you're trying to get a transcript to complete fafsa, refer to tax. Find the correct forms, given the structure of your business. Web need to set up a new company in quickbooks online? Form 1040 is your individual income tax return. The larger font also makes the form longer—it takes up three pages instead of two. 15, 2024, to file various federal individual and business tax returns and make tax payments. Review the top section of the return for significant details, including the business. Form 1040 will summarize your income sources, deductions, tax. Web if they amended and filed separate tax returns, the lower earner would have a tax of about $12,787 and the higher earner would have $31,809 of tax — for a total federal tax liability of $44,596. Web business taxes are an inevitable part of owning any business.

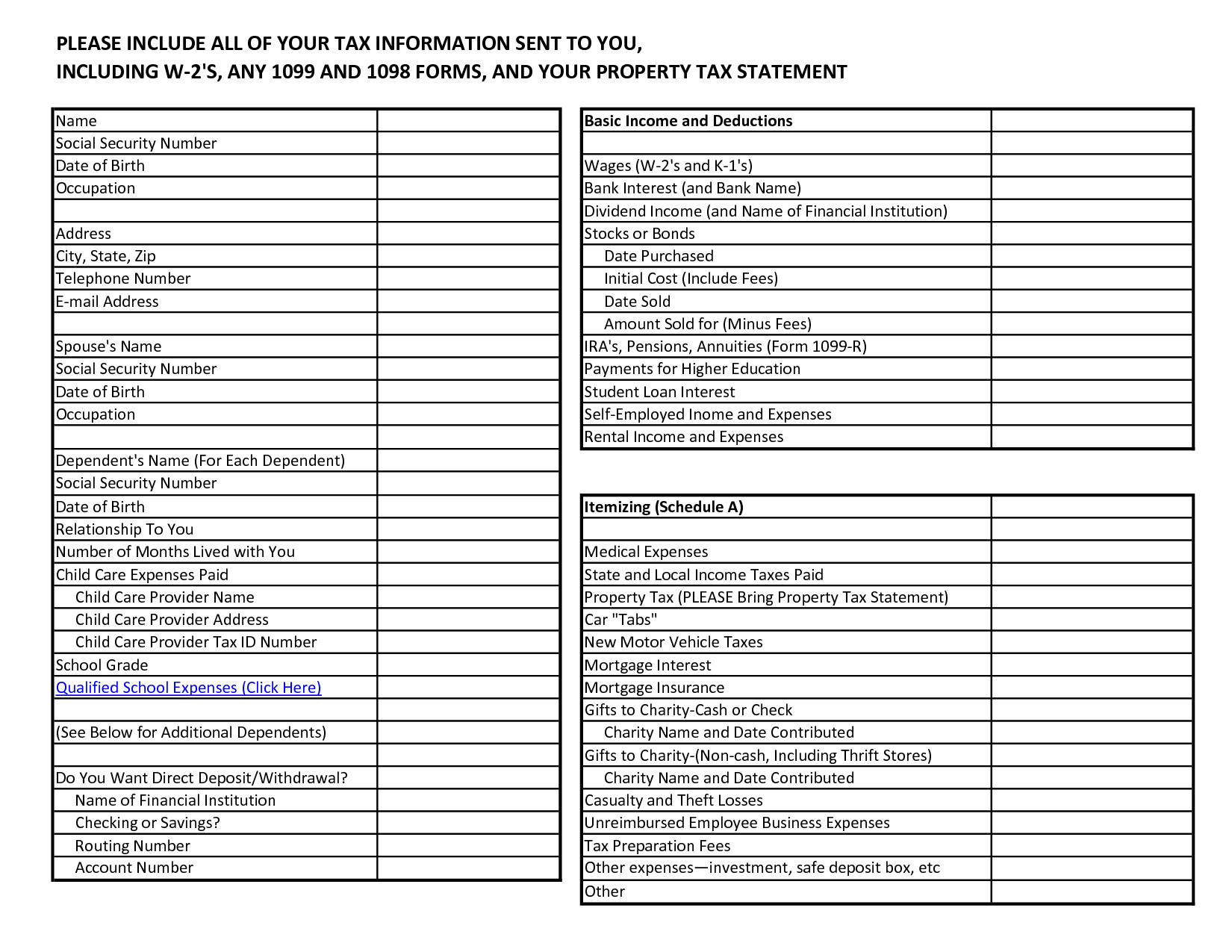

Small Business Tax Preparation Spreadsheet for Business Tax Deductions

Web irs form 1065 is an informational tax return filed annually to report the income, gains, losses, deductions and credits from the operation of a partnership. Getting organized consider consulting an accountant to help you get organized. Web add up the extra $55 over 12 months and some could be looking at an extra $660 a year. Web the only.

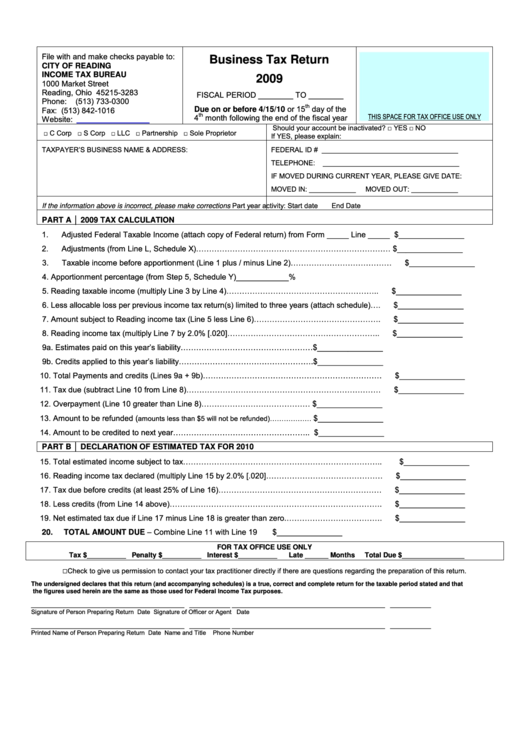

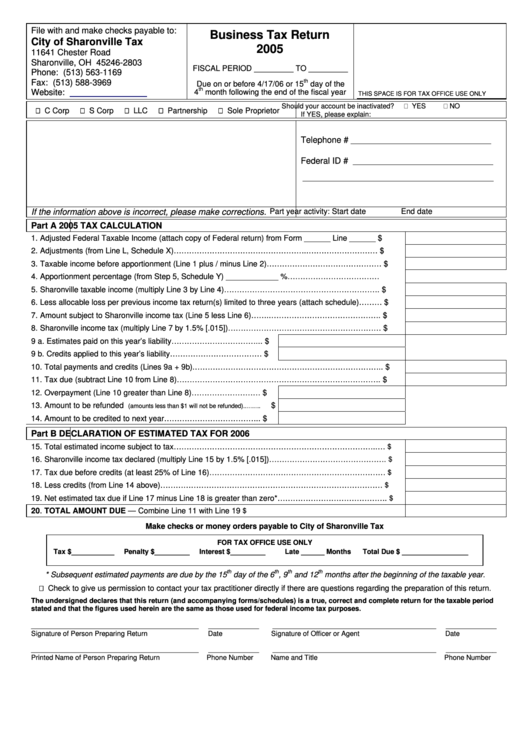

Business Tax Return Form City Of Reading Tax Bureau 2009

Understanding the basics of business tax on the state and federal level will save you time, money, and frustration later down the line. Form 1040 will summarize your income sources, deductions, tax. All may be downloaded in adobe pdf format and printed. Web these taxpayers now have until feb. Web the only difference is that the font is larger, so.

Small business tax return JG Accountants

Publication 15, (circular e), employer's tax. All may be downloaded in adobe pdf format and printed. Understand the type of form you have. Depending on the type of business you own, you will be required to submit different forms. Web need to set up a new company in quickbooks online?

Do I Need To File A Tax Return? Forbes Advisor

Most are available to browse online. Web what your business tax return says about the health of your business and its finances will be a big issue for the lender you choose to ask for a loan. Next, you’re going to add the amount on form 1040, line 12 (either your standard or itemized deduction) and your qualified business income.

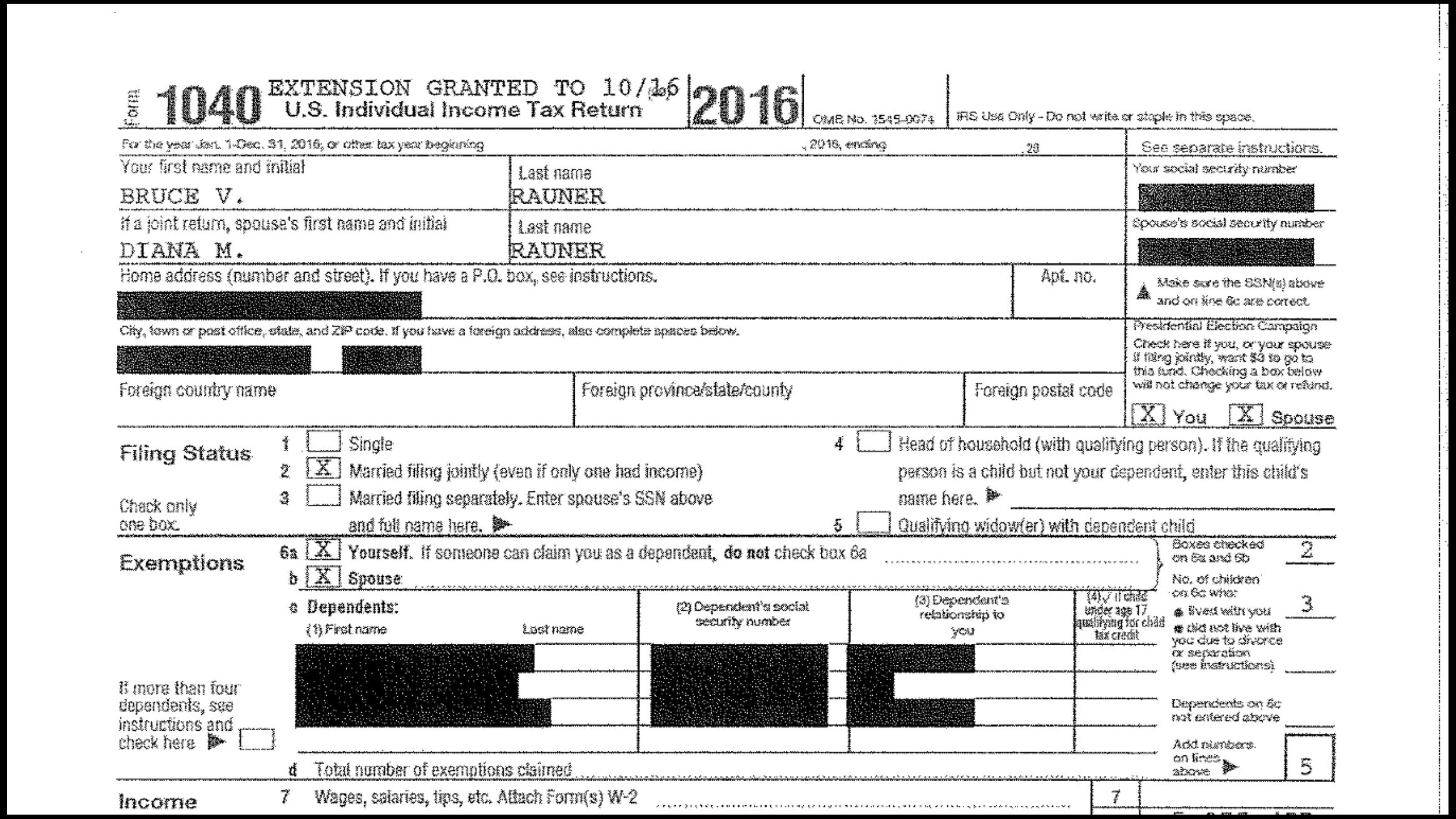

Gov. Bruce Rauner Earned 91 Million in 2016, Tax Returns Show

Web these taxpayers now have until feb. In 2023, the cola adjustment added up to an extra $146 a month based on an average benefit of. Web the only difference is that the font is larger, so it is easier to read. If you're trying to get a transcript to complete fafsa, refer to tax. Web save increases the amount.

A Guide To Business Tax Returns US Tax Filing

Payroll taxes and federal income tax. Form 1040 is your individual income tax return. Learn more about business tax in the hartford business. Review the top section of the return for significant details, including the business. There are many types of tax returns, but we are only looking at form 1040.

Corporate Tax Return Form Maryland Free Download

Web what your business tax return says about the health of your business and its finances will be a big issue for the lender you choose to ask for a loan. The larger font also makes the form longer—it takes up three pages instead of two. Web these taxpayers now have until feb. File an expected taxable income form. Web.

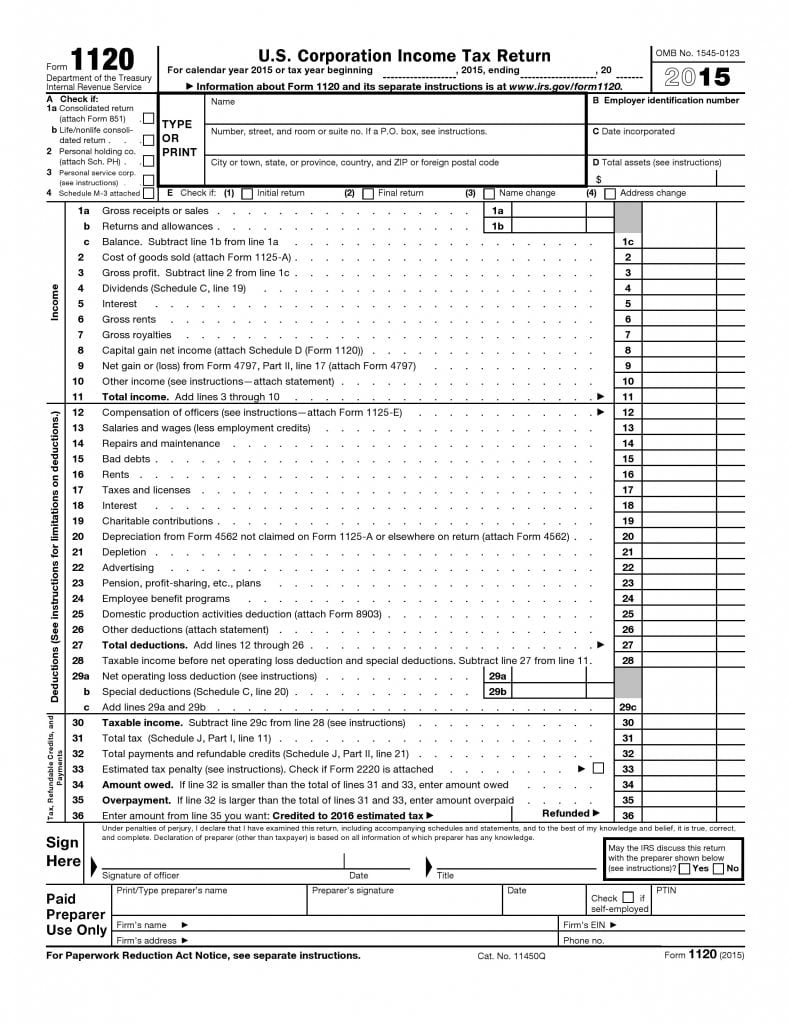

Free U.S. Corporation Tax Return Form 1120 PDF Template

14, 2018, file photo, h&r block signs are displayed in jackson, miss. Web irs form 1065 is an informational tax return filed annually to report the income, gains, losses, deductions and credits from the operation of a partnership. 15, 2024, to file various federal individual and business tax returns and make tax payments. Next, you’re going to add the amount.

Business Tax Return Form City Of Cincinnati 2005 printable pdf download

The larger font also makes the form longer—it takes up three pages instead of two. Form 1040 is your individual income tax return. Your average tax rate is 11.67% and your. Web analyzing business financial statements and tax returns suite. (b) identify pertinent financial information;

How to File Your LLC Tax Return The Tech Savvy CPA

Web thus, the goal of this practice point is to provide you with an overview of the following business tax returns, so that you can (a) understand the forms; Web these 14 tax tutorials will guide you through the basics of tax preparation, giving you the background you need to electronically file your tax return. Next, you’re going to add.

And (C) Enable You To.

All may be downloaded in adobe pdf format and printed. Web business taxes are an inevitable part of owning any business. These seven courses explore how to analyze and interpret business financial statements and tax returns, including cash flow statements. The larger font also makes the form longer—it takes up three pages instead of two.

Web Thus, The Goal Of This Practice Point Is To Provide You With An Overview Of The Following Business Tax Returns, So That You Can (A) Understand The Forms;

Web need to set up a new company in quickbooks online? Web analyzing business financial statements and tax returns suite. I can get you 50% off for the first year. For starters, check out the tax tutorials to find the answers to these frequently asked questions.

14, 2018, File Photo, H&R Block Signs Are Displayed In Jackson, Miss.

If you're trying to get a transcript to complete fafsa, refer to tax. Web what your business tax return says about the health of your business and its finances will be a big issue for the lender you choose to ask for a loan. Income tax return for an s corporation. Review the top section of the return for significant details, including the business.

The Corporate Tax Rate Is A Flat 21%.

Form 1040 is your individual income tax return. Payroll taxes and federal income tax. 18, 2023 washington — the internal revenue service today announced expansive tax. Learn more about business tax in the hartford business.