How To Read A Commercial Insurance Policy

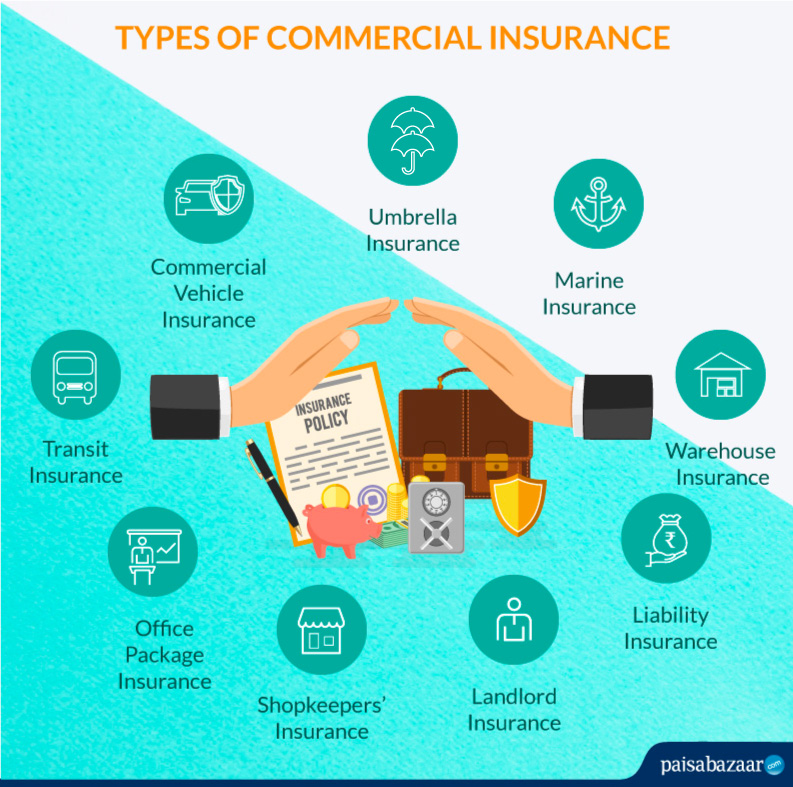

How To Read A Commercial Insurance Policy - Ad state farm can provide the extra financial protection your business needs. Web quickly learn the right way to read and interpret policy wording that is the foundation of your success. Web commercial insurance helps protect your organization from different claims and risks, such as: The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers’ compensation policy. These policies are not usually included in homeowners. There are many types of commercial insurance that you can get to protect your company. Web how to read an insurance policy by jeffrey ehrlich, southern california bad faith insurance and appellate lawyer. A helpful tip to review the basics of your coverage is to examine the policy sections using the acronym dice: Web gain an understanding of your company's insurance policies and provide guidance regarding the key coverages available to businesses. Learn how to read the key information in this document.

Web a business insurance policy declarations page gives you important details about your coverage. Web the first page of any commercial business insurance policy is usually the declarations page. No middle man fees or hassle. Definitions insurance policies contain many common words that have special meaning within the context of insurance. Best company and aaa by standard & poor's corp. Ad buy a commercial auto insurance policy direct from biberk. Web when applying for insurance, the first thing you do is get the proposal form of a particular insurance company. The name of the insurance company the name of the insured business the date and duration of the policy These policies are not usually included in homeowners. Understand the basics the first page of any commercial business insurance policy is usually the declarations page.

Web while lengthy, it is advisable to read the entire policy. Explore the state farm® products created to help you protect and grow your business. These policies are not usually included in homeowners. This page is basically an overview of your entire policy and lists a few fundamental features of your insurance, including: Web quickly learn the right way to read and interpret policy wording that is the foundation of your success. This makes it much easier to navigate and review the policy… Look to the insuring agreement section for a statement of the coverage. Web commercial insurance protects businesses and their employees from financial loss in the event of a catastrophe that’s covered by the company’s insurance policy. Web here is a list of our partners and here's how we make money. Best company and aaa by standard & poor's corp.

Business Insurance Webinar Series Session II, Intro to Commercial

Web quickly learn the right way to read and interpret policy wording that is the foundation of your success. This makes it much easier to navigate and review the policy… From commercial property insurance and general liability insurance to workers’ compensation insurance. Avoid wording and punctuation catastrophes in your current policies… Understand the basics the first page of any commercial.

How To Read An Insurance Policy Wheeler, DiUlio, & Barnabei

Ad state farm can provide the extra financial protection your business needs. There are many types of commercial insurance that you can get to protect your company. This page is basically an overview of your entire policy and lists a few fundamental features of your insurance, including: Web here is a list of our partners and here's how we make.

Compare My Policy LoPriore Insurance Agency

Web flood insurance is a type of policy that protects renters, homeowners, and business owners from damage caused by flooding. The name of the insurance company the name of the insured business the date and duration of the policy the type of insurance. Web quickly learn the right way to read and interpret policy wording that is the foundation of.

Factors that Influence Your Commercial Insurance Premiums Scavone

The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers’ compensation policy. More like this insurance homeowners insurance. Explore the state farm® products created to help you protect and grow your business. No middle man fees or hassle. Learn how to read an insurance policy to understand policy.

25+ Does Car Insurance Cover Inside Damage Images

Avoid wording and punctuation catastrophes in your current policies… Read our editorial standards for answers content.this information is not an insurance policy, does not refer to any specific insurance policy, and does not modify any provisions, limitations, or exclusions expressly stated in any insurance policy. Understand the basics the first page of any commercial business insurance policy is usually the.

How To Get Insurance Declaration Page news word

The name of the insurance company the name of the insured business the date and duration of the policy Please be advised that workers' compensation and liability insurance. There are many types of commercial insurance that you can get to protect your company. Ad state farm can provide the extra financial protection your business needs. The only exception is for.

Get the Most from a Commercial Insurance Policy First Insurance

The name of the insurance company the name of the insured business the date and duration of the policy the type of insurance. While the declarations page gives a useful summary, you probably want to know what your policy covers in more detail. This makes it much easier to navigate and review the policy… There are many types of commercial.

Here's Why You Need a Commercial Insurance Policy Wayfarer Insurance

Web quickly learn the right way to read and interpret policy wording that is the foundation of your success. Ad state farm can provide the extra financial protection your business needs. Declarations, insurance agreement, conditions, and exclusions. Avoid wording and punctuation catastrophes in your current policies… Web gain an understanding of your company's insurance policies and provide guidance regarding the.

Commercial Insurance Policy on a Desk. Stock Image Image of form

A helpful tip to review the basics of your coverage is to examine the policy sections using the acronym dice: Explore the state farm® products created to help you protect and grow your business. Definitions insurance policies contain many common words that have special meaning within the context of insurance. Web flood insurance is a type of policy that protects.

What to Do If Your Insurance Policy Lapses?Aegon Life Blog Read all

The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers’ compensation policy. Explore the state farm® products created to help you protect and grow your business. Business operations, risks, and industry dynamics. Understand the basics the first page of any commercial business insurance policy is usually the declarations.

Ad State Farm Can Provide The Extra Financial Protection Your Business Needs.

The only exception is for domestic employees who must work at least 16 hours a week to be covered under a workers’ compensation policy. Ad buy a commercial auto insurance policy direct from biberk. Take advantage of electronic formats — many insurance companies now issue policies in an electronic format with headings that can be clicked on to zero in on a particular policy section or particular endorsement. Web the first page of any commercial business insurance policy is usually the declarations page.

Identify Mistakes In Your Competitor's Policies To Pick Up New Business.

Ad state farm can provide the extra financial protection your business needs. Web a business insurance policy declarations page gives you important details about your coverage. Web commercial insurance helps protect your organization from different claims and risks, such as: Learn how to read the.

Business Operations, Risks, And Industry Dynamics.

The average cost of homeowners insurance in north dakota is $2,065 per year, or about. More like this insurance homeowners insurance. From commercial property insurance and general liability insurance to workers’ compensation insurance. Read the entire policy and refer back to the various insuring agreements and other provisions to understand the coverages and limitations.

This Page Is Basically An Overview Of Your Entire Policy And Lists A Few Fundamental Features Of Your Insurance, Including:

The name of the insurance company the name of the insured business the date and duration of the policy the type of insurance. These policies are not usually included in homeowners. This page is basically an overview of your entire policy and lists a few fundamental features of your insurance, including: Commercial insurance is a general term referring to a number of specific types of business insurance.