Il 941 Form 2022

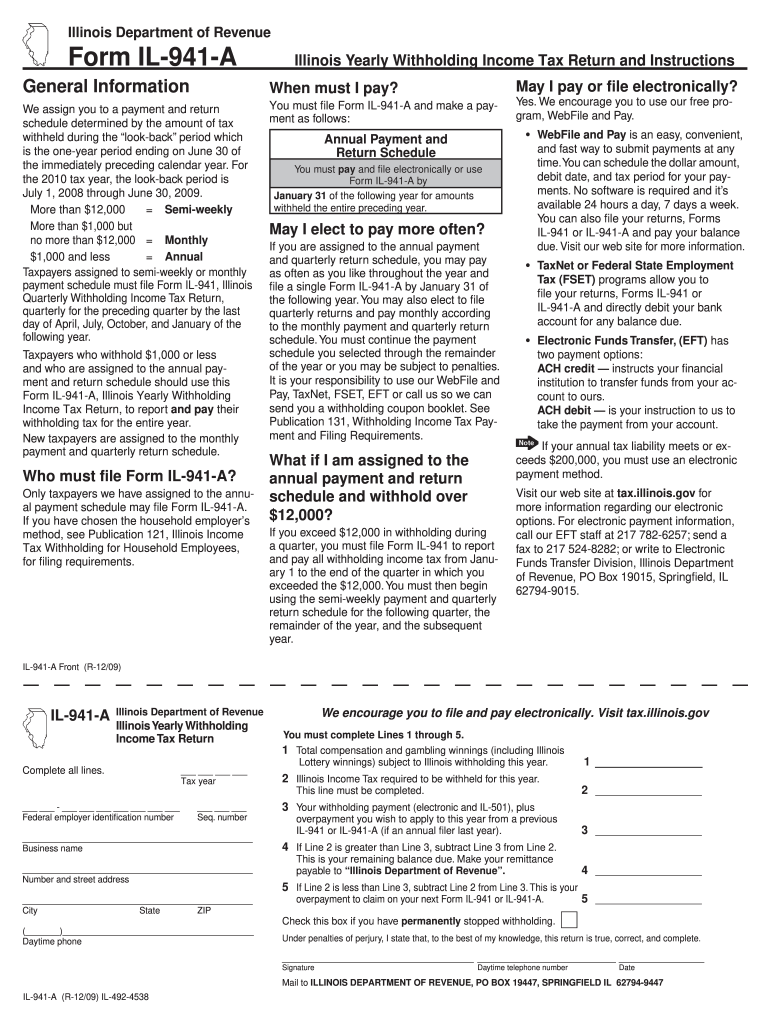

Il 941 Form 2022 - Web form 941 for 2023: The irs expects the june 2022 revision of form 941 and these instructions to. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Web mailing addresses for forms 941. Show sources > about the individual income tax the irs and most states collect. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. This form is for income earned in tax year 2022, with tax returns due in april.

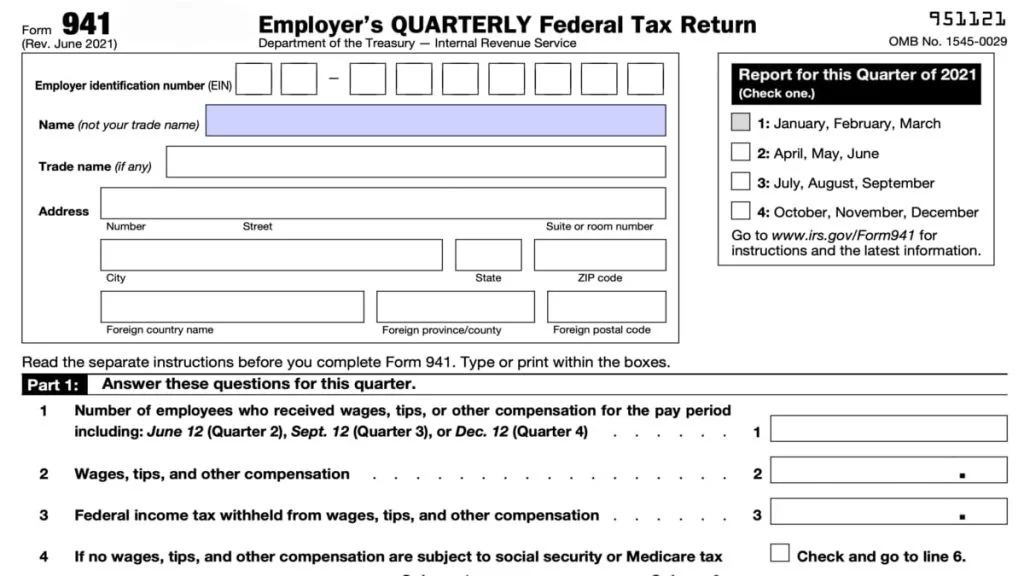

Web form 941 for 2023: Easily fill out pdf blank, edit, and sign them. Show sources > about the individual income tax the irs and most states collect. Unlike the federal government, illinois does not require. Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. This form is for income earned in tax year 2022, with tax returns due in april. The irs expects the june 2022 revision of form 941 and these instructions to. Web mailing addresses for forms 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

Web form 941 for 2023: Get ready for tax season deadlines by completing any required tax forms today. Show sources > about the individual income tax the irs and most states collect. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. Connecticut, delaware, district of columbia, georgia,. Ad get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web mailing addresses for forms 941.

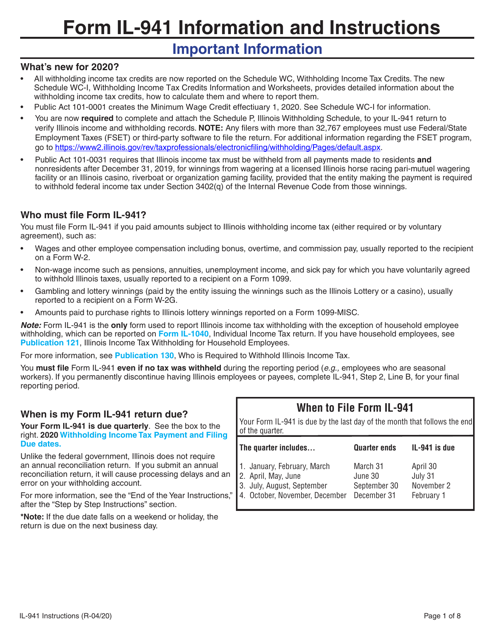

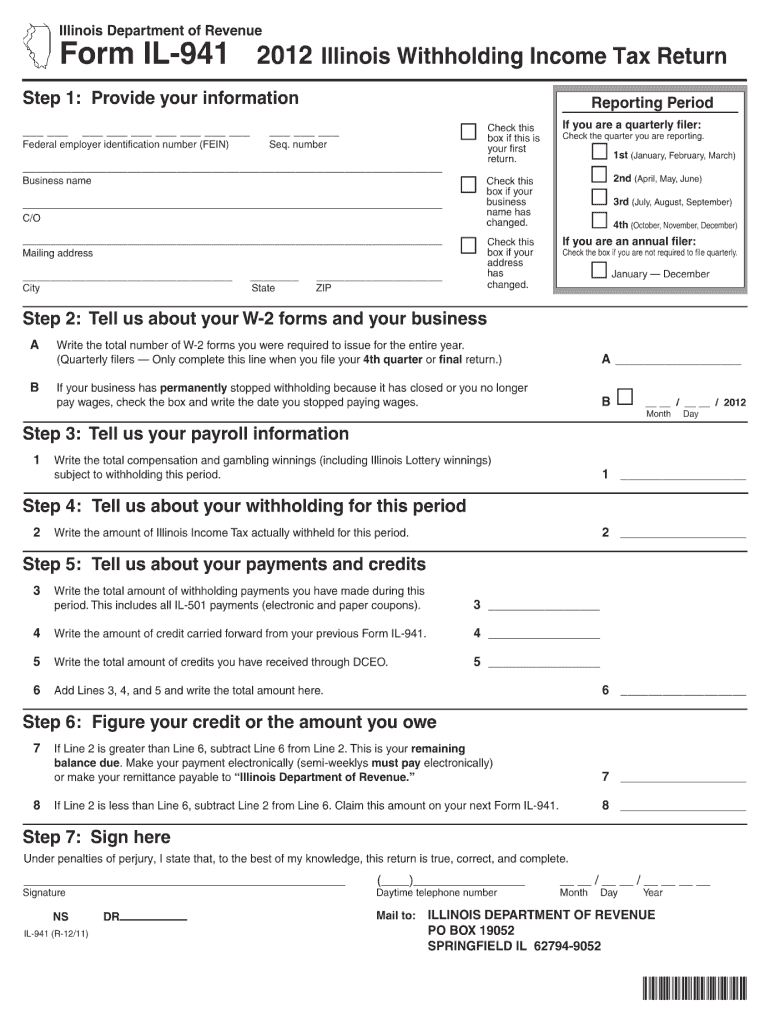

Download Instructions for Form IL941 Illinois Withholding Tax

The irs expects the june 2022 revision of form 941 and these instructions to. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Show sources > about the individual income tax the irs and most states collect. This form is for income earned in tax year 2022, with tax returns due in april.

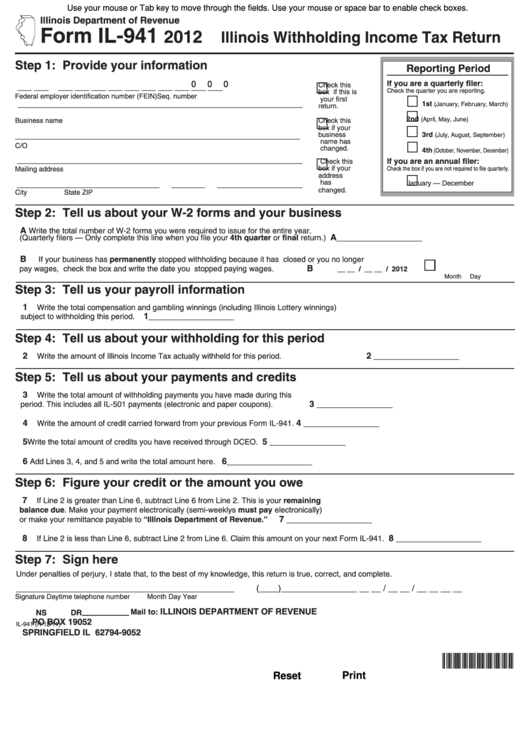

20182020 Form IL DoR IL941 Fill Online, Printable, Fillable, Blank

Ad edit, sign and print irs 941 tax form on any device with dochub. Web form 941 for 2023: The irs expects the june 2022 revision of form 941 and these instructions to. Connecticut, delaware, district of columbia, georgia,. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number.

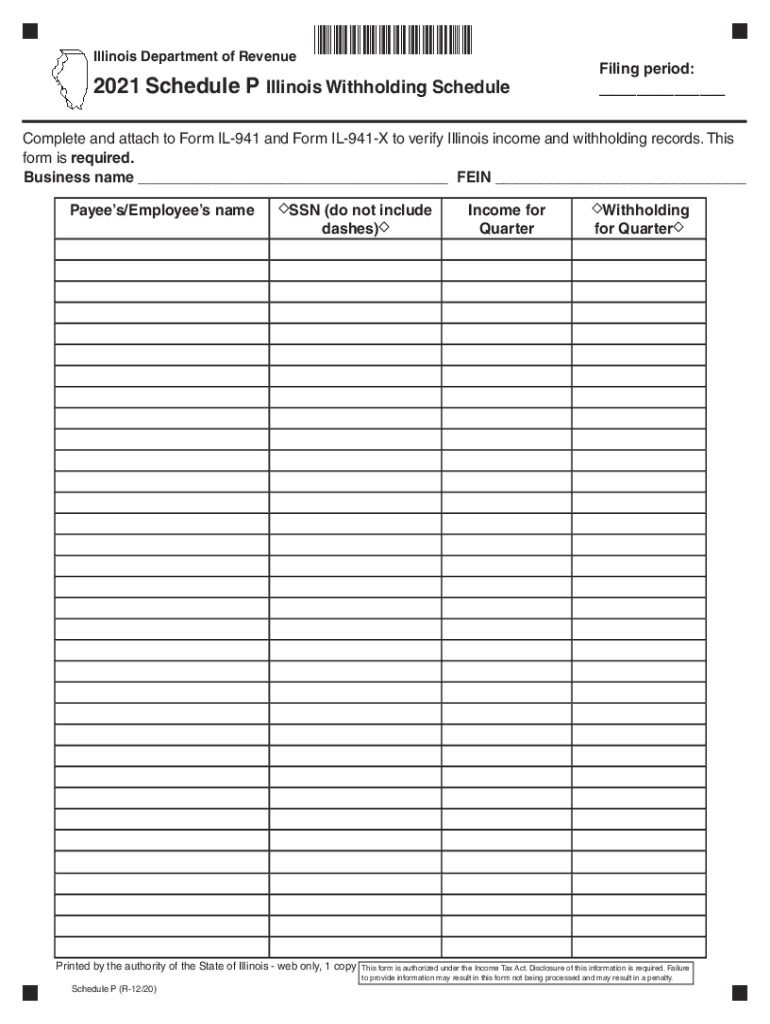

IL IL941X Schedule P 20212022 Fill out Tax Template Online US

Show sources > about the individual income tax the irs and most states collect. Ad edit, sign and print irs 941 tax form on any device with dochub. Web mailing addresses for forms 941. You’ll need to withhold illinois income taxes and pay. Save or instantly send your ready documents.

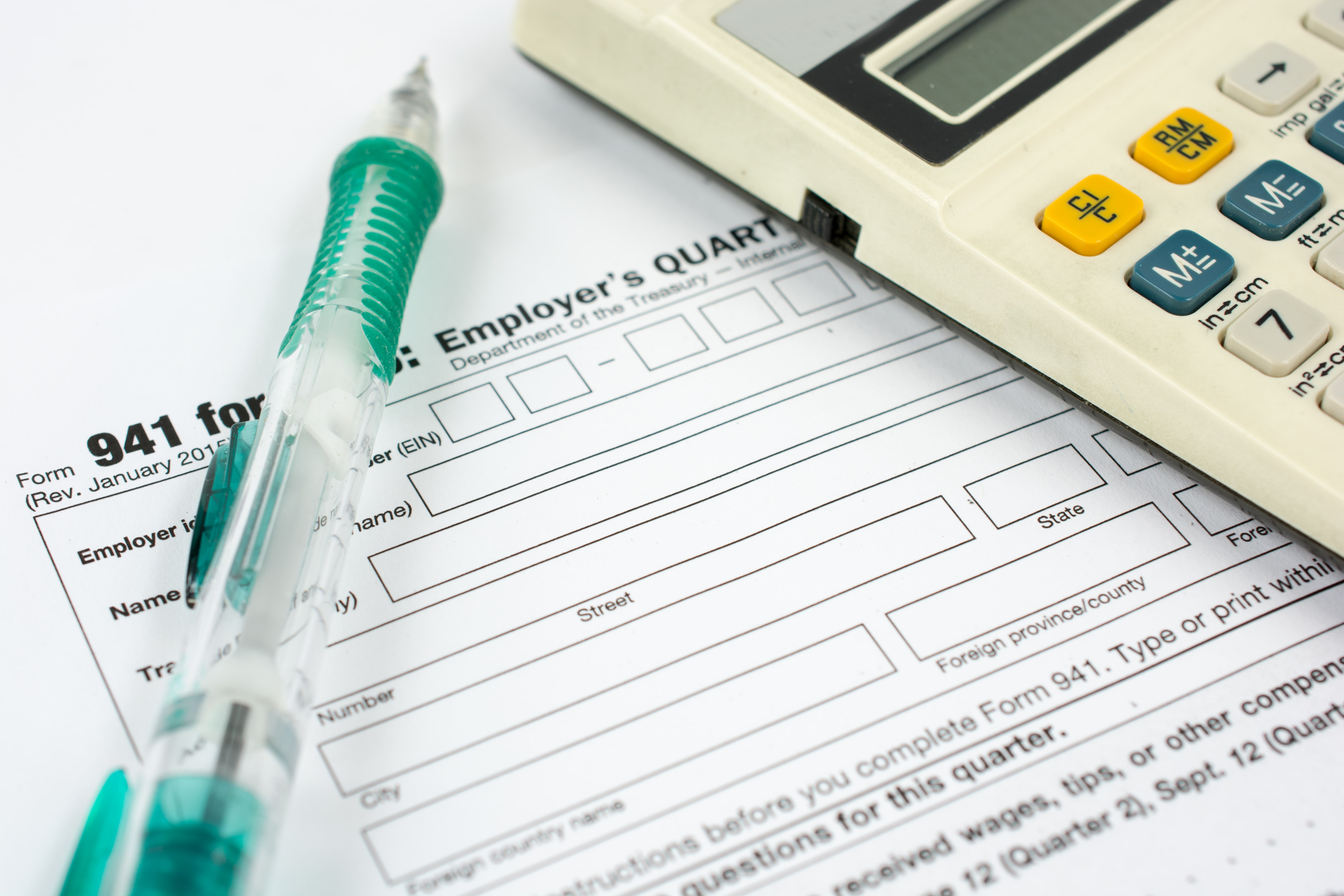

New 941 form for second quarter payroll reporting

Easily fill out pdf blank, edit, and sign them. You’ll need to withhold illinois income taxes and pay. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Annual payment and return schedule you must pay and file.

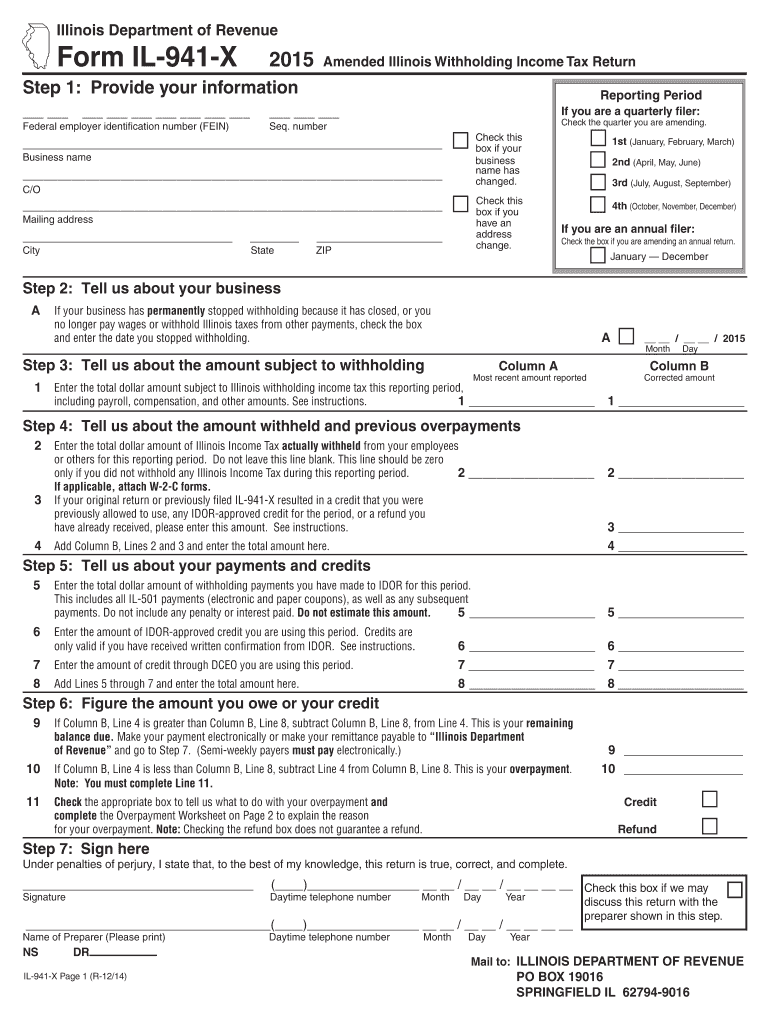

IL DoR IL941X 2015 Fill out Tax Template Online US Legal Forms

Easily fill out pdf blank, edit, and sign them. Unlike the federal government, illinois does not require. Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. Web form 941 for 2023: Connecticut, delaware, district of columbia, georgia,.

Form il 941 2012 Fill out & sign online DocHub

Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. Annual payment and return schedule you must pay and file. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Easily fill out pdf blank, edit, and sign them. Ad edit, sign and.

941 Form 2023

Ad get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Ad edit, sign and print irs 941 tax form on any device with dochub. March 2023) employer’s quarterly federal tax return department of the treasury —.

Fillable Form Il941 Illinois Withholding Tax Return 2012

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. This form is for income earned in tax year 2022, with tax returns due in april. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Complete, edit or print tax forms.

Gallery of Il 941 form 2018 Lovely Anthracene Based Semiconductors for

Unlike the federal government, illinois does not require. Show sources > about the individual income tax the irs and most states collect. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print irs 941 tax form on any device with dochub. March 2023) employer’s quarterly federal tax return department of the treasury.

941 form 2019 Fill out & sign online DocHub

Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print irs 941 tax form on any device with dochub. Web form 941 for 2023: You’ll need to withhold illinois income taxes and pay.

Unlike The Federal Government, Illinois Does Not Require.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them.

Connecticut, Delaware, District Of Columbia, Georgia,.

Ad edit, sign and print irs 941 tax form on any device with dochub. Show sources > about the individual income tax the irs and most states collect. Get ready for tax season deadlines by completing any required tax forms today. You’ll need to withhold illinois income taxes and pay.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Lding income tax return important information electronically file this form on mytax illinois at mytax.illinois.gov or using. Web mailing addresses for forms 941. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly.

Web Form 941 For 2023:

Annual payment and return schedule you must pay and file. The irs expects the june 2022 revision of form 941 and these instructions to.