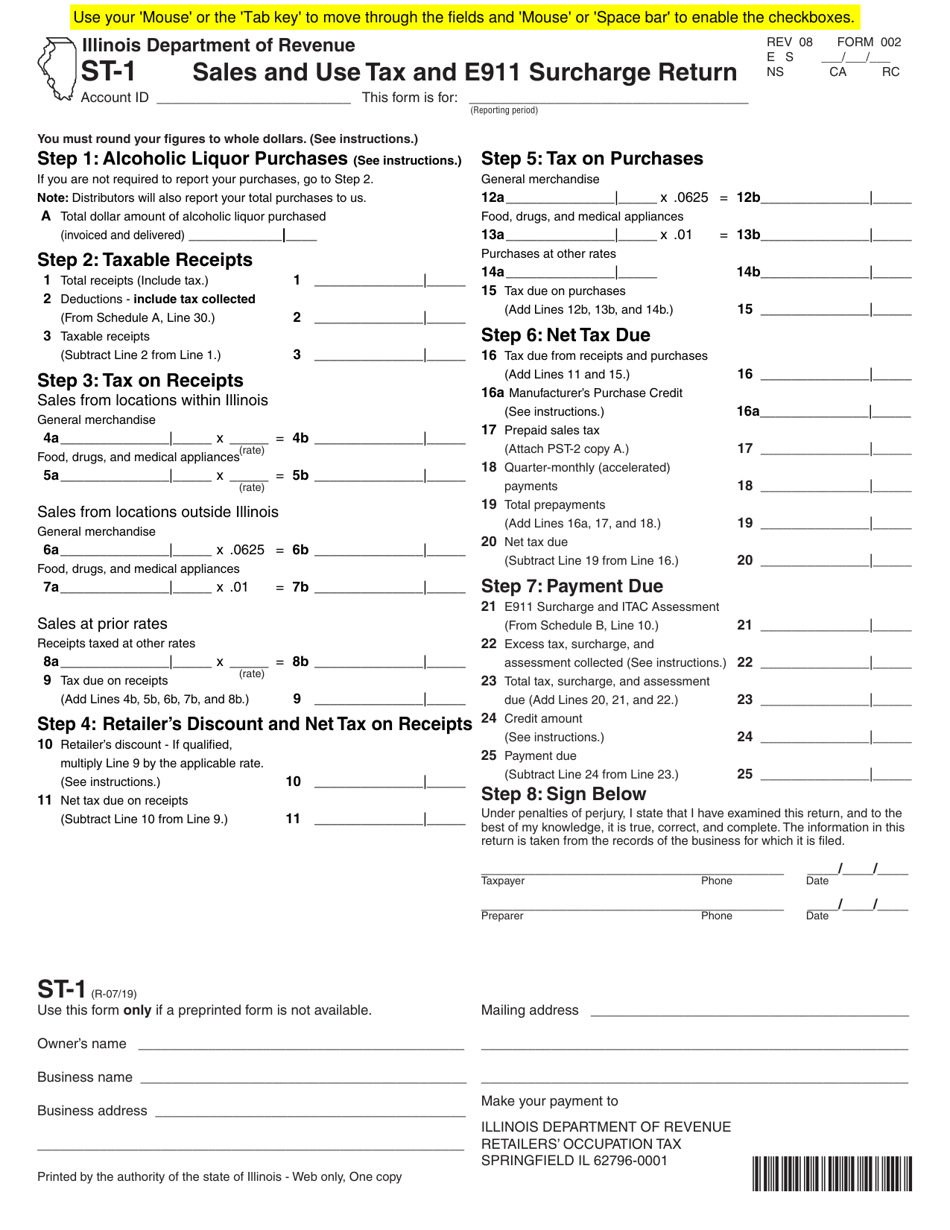

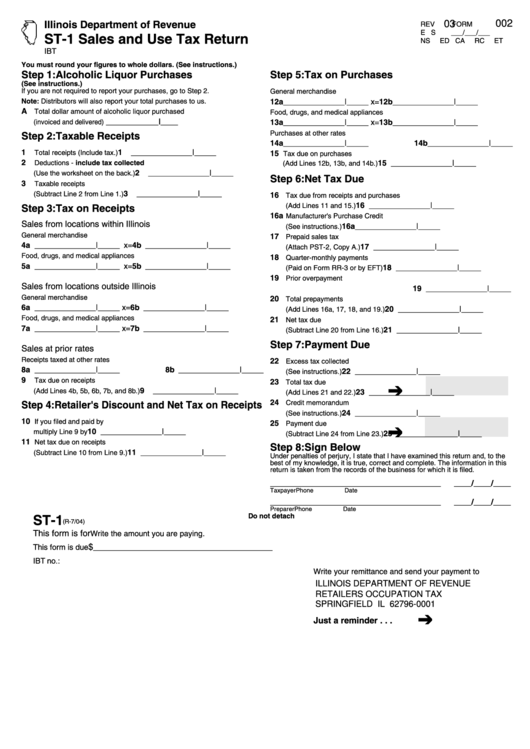

Illinois Form St 1

Illinois Form St 1 - Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. General information do not write above this line. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Add lines 2b, 3b, and 4b. If you are reporting sales for more than. Before viewing these documents you may need to download adobe acrobat reader. 4a _____ x 5% = 4b _____ 5. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. This is the amount of your credit for tax holiday items. Web electronic filing program for sales & use tax returns.

This is the amount of your credit for tax holiday items. Web illinois department of revenue. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Forms with fillable fields should be saved, opened and. This is the most commonly used form to file and pay. If you are reporting sales for more than. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Documents are in adobe acrobat portable document format (pdf). Before viewing these documents you may need to download adobe acrobat reader. 4a _____ x 5% = 4b _____ 5.

Documents are in adobe acrobat portable document format (pdf). Web electronic filing program for sales & use tax returns. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Forms with fillable fields should be saved, opened and. This is the most commonly used form to file and pay. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. If you are reporting sales for more than. This is the amount of your credit for tax holiday items. The department has the ability to electronically receive and process the.

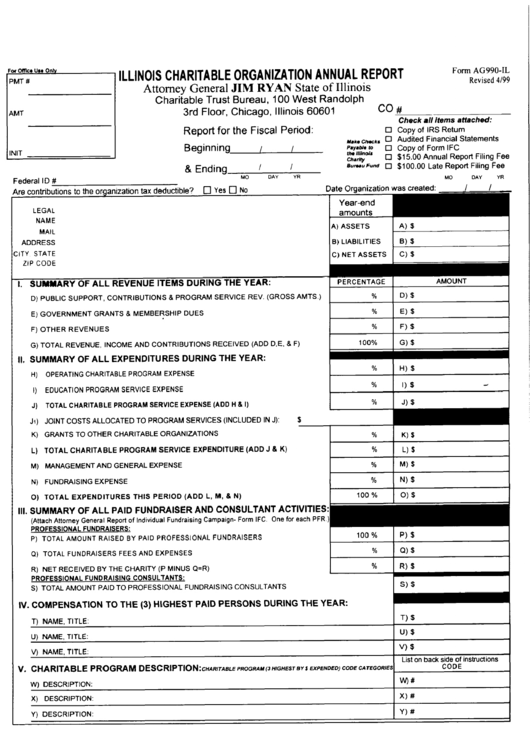

Form Ag990Il Illinois Charitable Organization Annual Report 1999

When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Documents are in adobe acrobat portable document format (pdf). 4a _____ x 5% = 4b _____ 5. Before viewing these documents you may need to download adobe acrobat reader. Web effective january 1,.

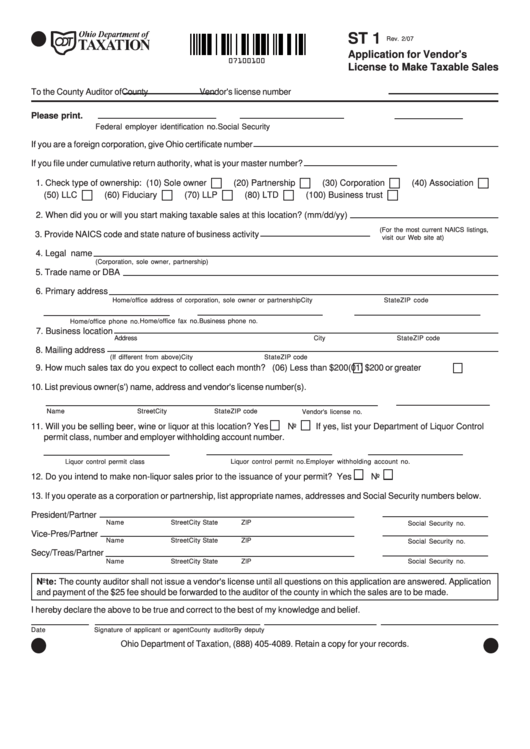

St 1 Fill Online, Printable, Fillable, Blank pdfFiller

Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Ad download or email & more fillable forms, register and subscribe now! This is the most commonly used form to file and pay. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and.

Form ST1 Download Fillable PDF or Fill Online Sales and Use Tax and

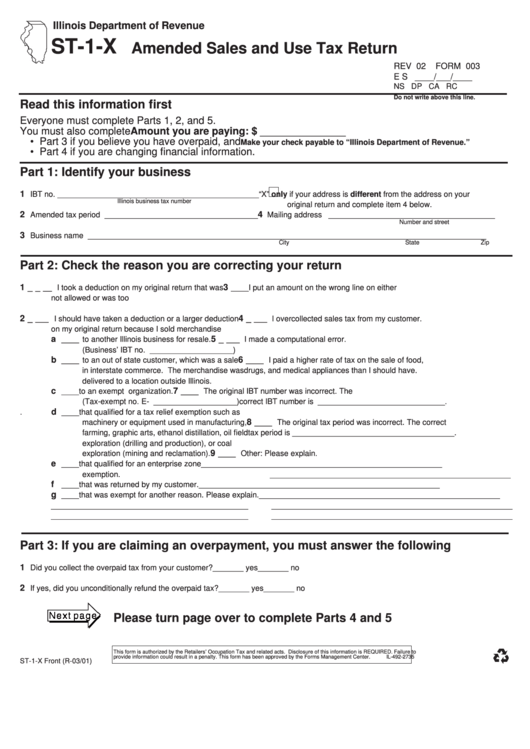

When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Taxable receipts.” the illinois filing system will automatically round this. Amended sales and use tax and e911 surcharge return. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow.

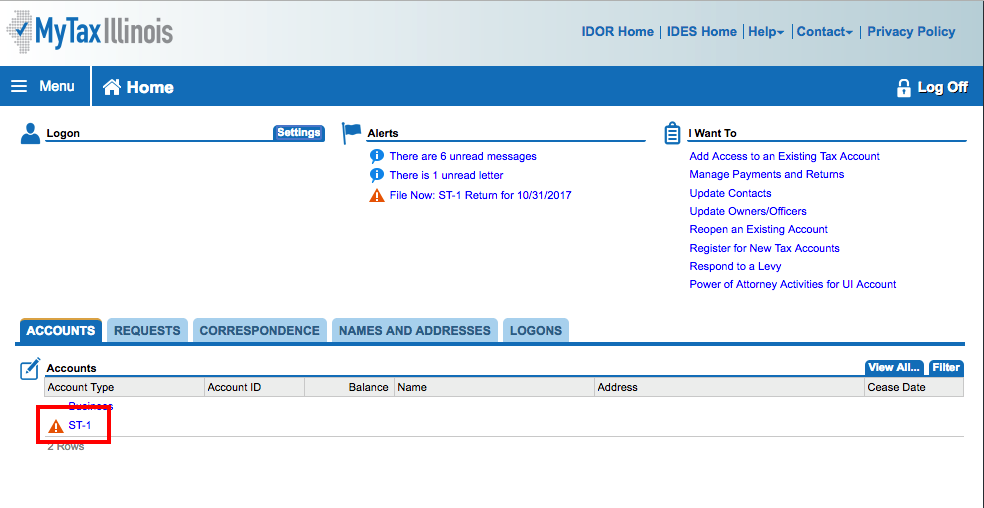

How to File an Illinois Sales Tax ReturnTaxJar Blog

Secretary of state publications are available in pdf (portable document format) unless stated otherwise. The department has the ability to electronically receive and process the. Web electronic filing program for sales & use tax returns. Taxable receipts.” the illinois filing system will automatically round this. Documents are in adobe acrobat portable document format (pdf).

Fillable Form St 1 Application For Vendor'S License To Make Taxable

Web electronic filing program for sales & use tax returns. If you are reporting sales for more than. The department has the ability to electronically receive and process the. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or. Forms with fillable fields.

Form St1/2 Sales And Use Tax Multiple Site Return printable pdf

Amended sales and use tax and e911 surcharge return. Add lines 2b, 3b, and 4b. General information do not write above this line. Easily sign the illinois sales tax form st 1 with your. If you are reporting sales for more than.

Form St1X Amended Sales And Use Tax Return Form State Of Illinois

If you are reporting sales for more than. This is the most commonly used form to file and pay. 4a _____ x 5% = 4b _____ 5. Forms with fillable fields should be saved, opened and. Amended sales and use tax and e911 surcharge return.

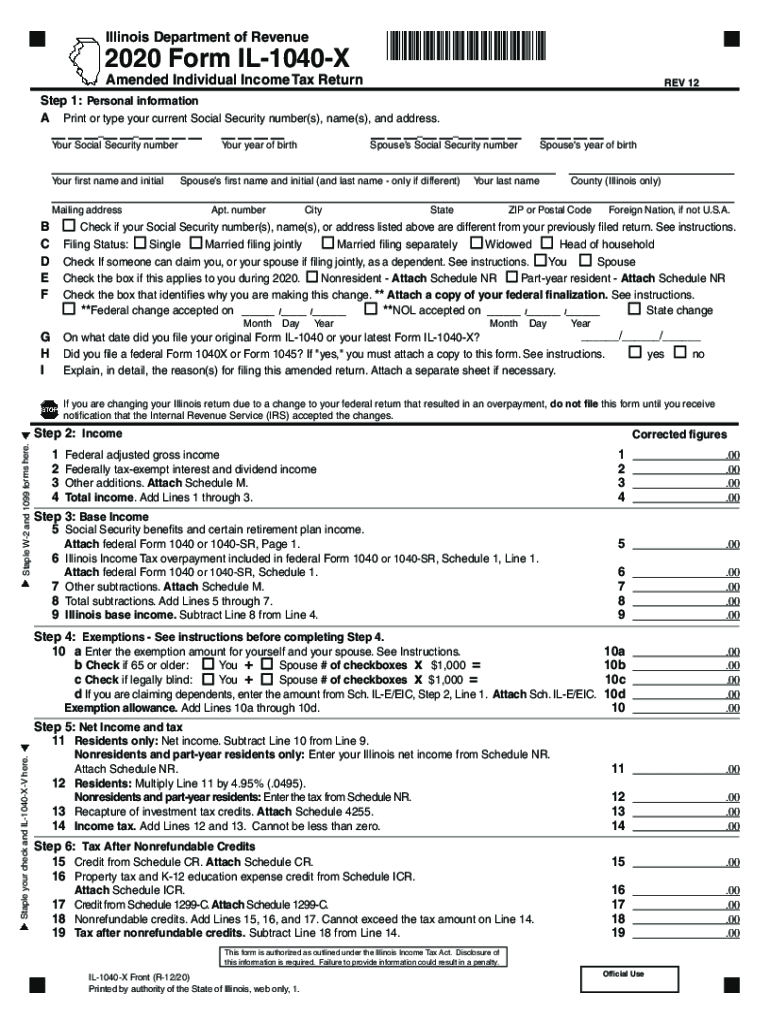

Il 1040 Fill Out and Sign Printable PDF Template signNow

This is the most commonly used form to file and pay. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Taxable receipts.” the illinois filing system will automatically round this. Before viewing these documents you may need to download adobe acrobat reader. 4a _____ x 5% = 4b _____ 5.

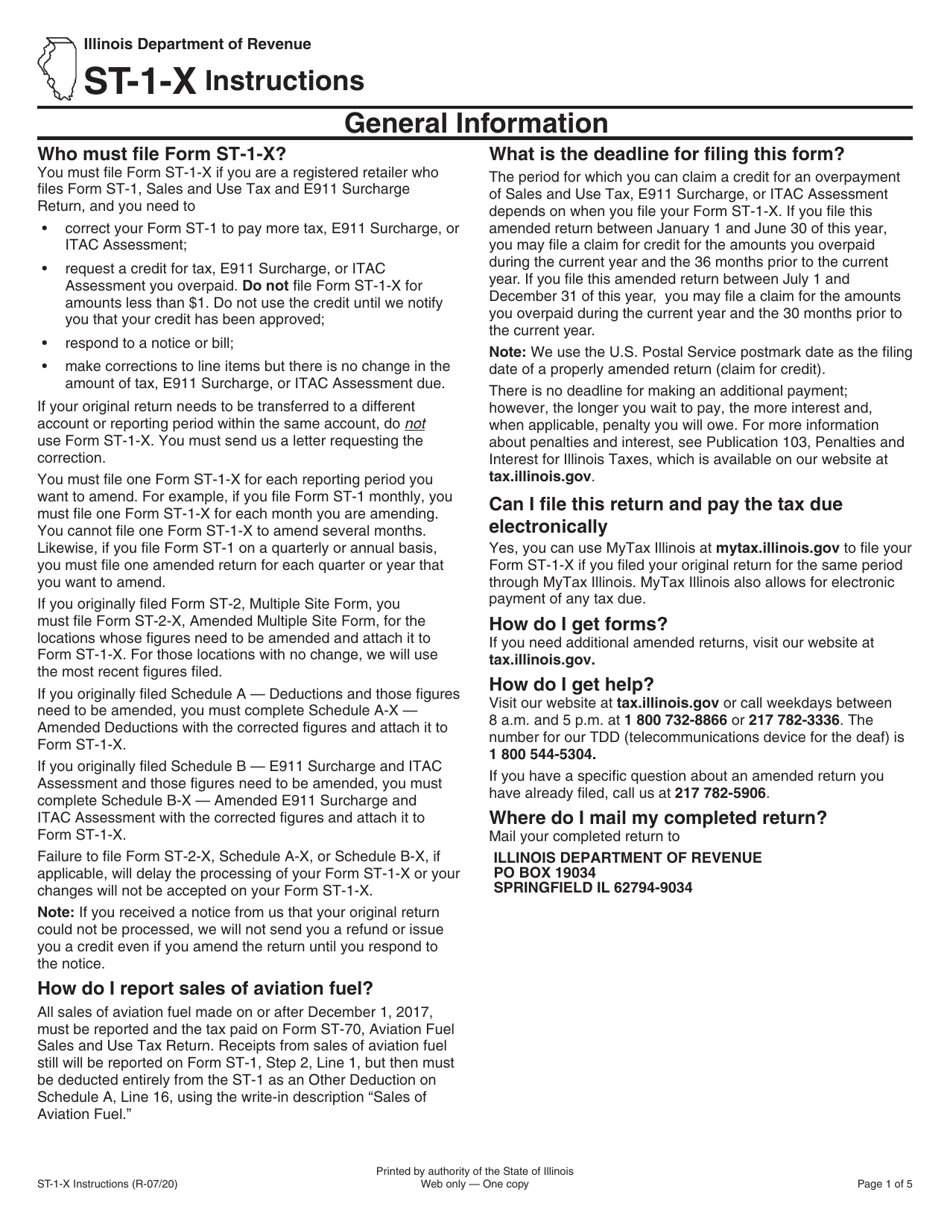

Download Instructions for Form ST1X, 003 Amended Sales and Use Tax

Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Add lines 2b, 3b, and 4b. Web electronic filing program for sales & use tax returns. If.

Illinois Polst Form 2022 Fill Out and Sign Printable PDF Template

General information do not write above this line. Amended sales and use tax and e911 surcharge return. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Web electronic filing program for sales & use tax returns. Secretary of state publications are available in pdf (portable document format) unless stated otherwise.

Web Illinois Department Of Revenue.

Forms with fillable fields should be saved, opened and. Open the tax illinois gov individuals a creditcard htm st1forms reporting periods and follow the instructions. Taxable receipts.” the illinois filing system will automatically round this. Figure your taxable receipts when completing this form, please round tothe nearest dollar by dropping amounts ofless than 50 cents and increasing amounts of 50 cents or.

Add Lines 2B, 3B, And 4B.

When completing this form, round to the nearest dollar by dropping amounts less than 50 cents and increasing amounts of 50 cents or more to the next. Secretary of state publications are available in pdf (portable document format) unless stated otherwise. 4a _____ x 5% = 4b _____ 5. This is the amount of your credit for tax holiday items.

Easily Sign The Illinois Sales Tax Form St 1 With Your.

Web effective january 1, 2021, remote retailers, as defined in section 1 of the retailers' occupation tax act (35 ilcs 120/1), and sometimes marketplace facilitators,. The department has the ability to electronically receive and process the. This is the most commonly used form to file and pay. Web the form 15:

General Information Do Not Write Above This Line.

Web electronic filing program for sales & use tax returns. Amended sales and use tax and e911 surcharge return. Documents are in adobe acrobat portable document format (pdf). Before viewing these documents you may need to download adobe acrobat reader.