Income Tax Form 15H

Income Tax Form 15H - For each section, read the instructions carefully, answer every. These forms are used to declare that an individual's income is. Fill out the application below. 13844 (january 2018) application for reduced user fee for installment agreements. Quarterly payroll and excise tax returns normally due on may 1. Form 15h is a very popular form among investors and taxpayers. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more.

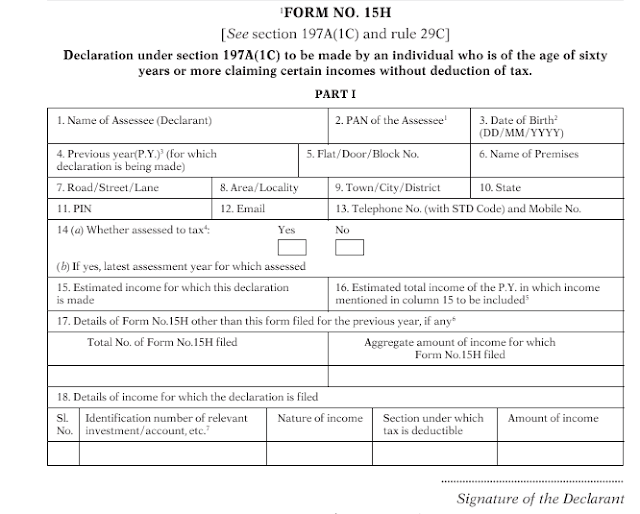

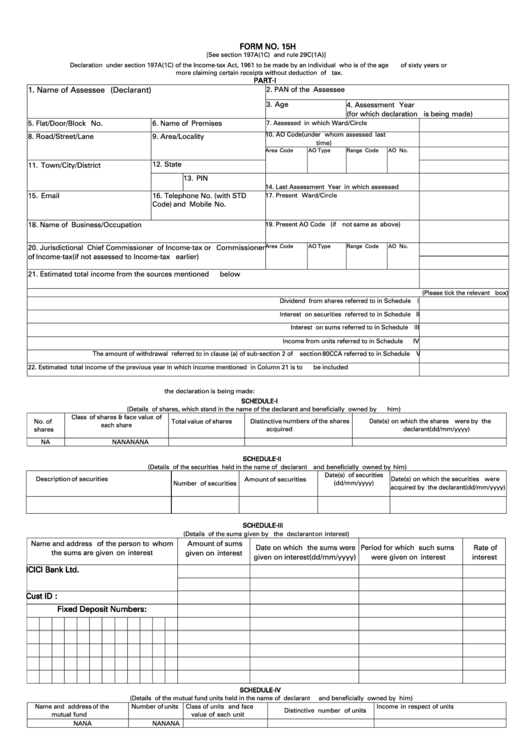

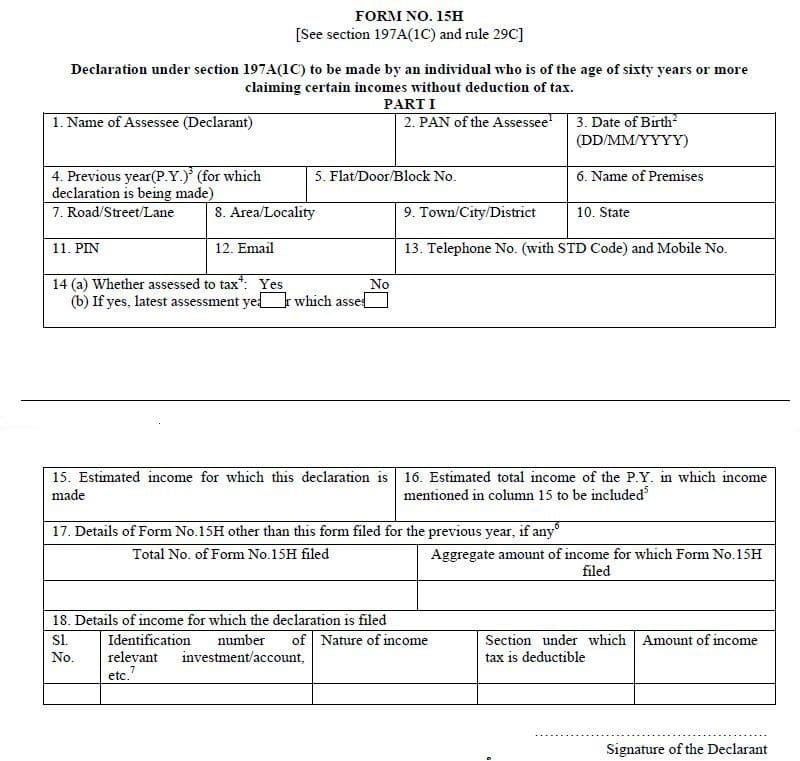

It is to be filed every financial year at the beginning of the year. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Resolving individual income tax notices. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Web low income home energy assistance program (liheap) how to apply for liheap 1. For each section, read the instructions carefully, answer every. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Updated on 30 sep, 2022. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more.

Fill out the application below. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Quarterly payroll and excise tax returns normally due on may 1. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Updated on 30 sep, 2022. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. These forms are used to declare that an individual's income is. This is a request to reduce the tds burden on interest earned on recurring deposits or. 13844 (january 2018) application for reduced user fee for installment agreements.

Form 15H (Save TDS on Interest How to Fill & Download

Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Web low income home energy assistance program (liheap) how to apply for liheap 1. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the.

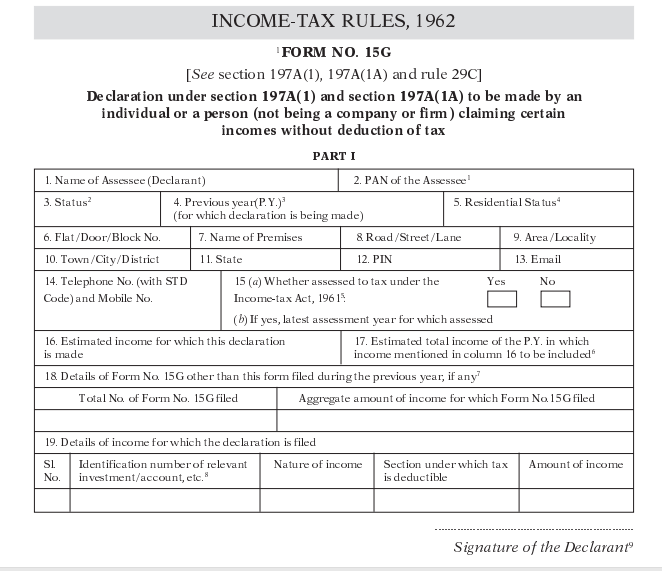

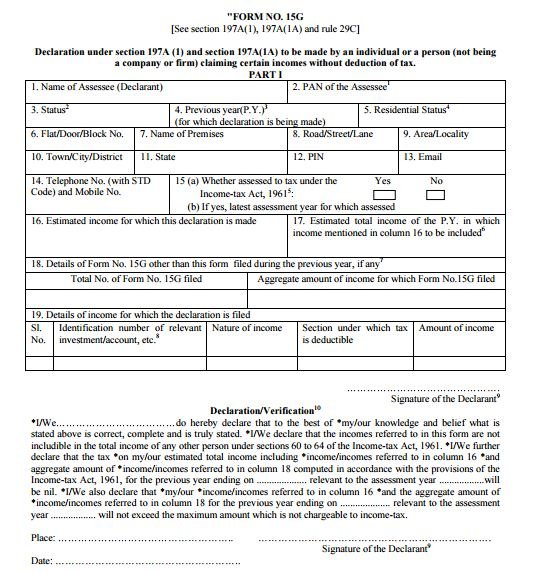

Form 15g Fillable Format Printable Forms Free Online

Form 15h is a very popular form among investors and taxpayers. Resolving individual income tax notices. This is a request to reduce the tds burden on interest earned on recurring deposits or. Updated on 30 sep, 2022. These forms are used to declare that an individual's income is.

Form 15G and Form 15H in Tax

Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Resolving individual income tax notices. Quarterly payroll and excise tax returns normally due on may 1. Updated on 30 sep, 2022. These forms are used to declare that an individual's income is.

Form 15H Declaration Download and Fill to Save Tax

15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Resolving.

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

Updated on 30 sep, 2022. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds,.

Form No. 15h Declaration Under Section 197a(1c) Of The Act

Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Updated on 30 sep, 2022. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the.

How to fill new FORM 15G or New FORM No.15H?

15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Fill out the application below. Quarterly payroll and excise tax returns normally due on may 1. It is to be filed every financial year at the beginning of the year. Web.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

Updated on 30 sep, 2022. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Resolving individual income tax notices. Quarterly payroll and excise tax returns normally due on may 1. These forms are used to.

Download New 15G 15 H Forms

13844 (january 2018) application for reduced user fee for installment agreements. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. These forms are used to declare that an individual's income is. 15h [see section 197a(1c), and rule 29c] declaration under section 197a(1c) to be.

New FORM 15H Applicable PY 201617 Government Finances Payments

Fill out the application below. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. For.

Web Form 15H Is A Declaration Form That Can Be Submitted To The Income Tax Department Of India By A Resident Who Is A Senior Citizen (60 Years Of Age Or Older) Or A.

Web form 15h is mandatory, if the individual's interest income from any kind of source except a deposit, for e.g, the interest of a loan, bonds, advance, etc., is more. Resolving individual income tax notices. Web low income home energy assistance program (liheap) how to apply for liheap 1. 15h [see section 197a(1c) and rule 29c(1a)] part‐i declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of.

Fill Out The Application Below.

Updated on 30 sep, 2022. Quarterly payroll and excise tax returns normally due on may 1. For each section, read the instructions carefully, answer every. 13844 (january 2018) application for reduced user fee for installment agreements.

15H [See Section 197A(1C), And Rule 29C] Declaration Under Section 197A(1C) To Be Made By An Individual Who Is Of The Age Of Sixty.

Form 15h is a very popular form among investors and taxpayers. These forms are used to declare that an individual's income is. Web section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. It is to be filed every financial year at the beginning of the year.