Indiana Withholding Form

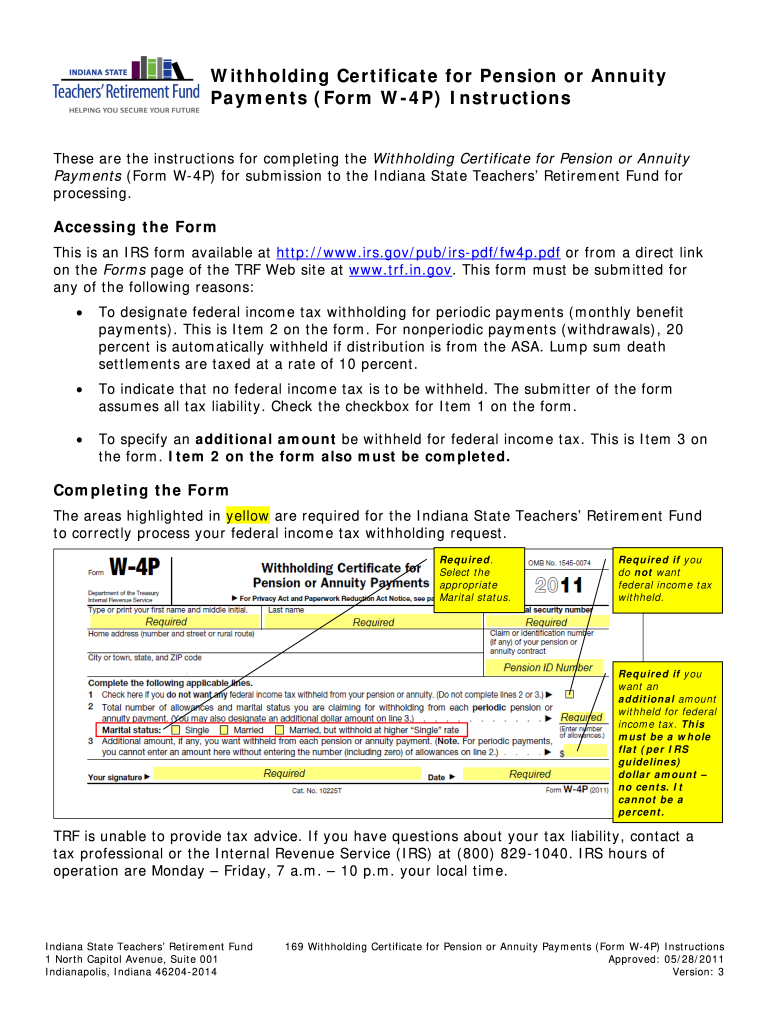

Indiana Withholding Form - Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Underpayment of indiana withholding filing. Enter your indiana county of residence and county of principal employment as of january of the current year. Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity or pension payment. Register and file this tax online via intime. Register and file this tax online via intime. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Print or type your full name, social. Print or type your full name, social security number or itin and home address.

Register and file this tax online via intime. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Do not send this form to the department of revenue. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity or pension payment. Enter your indiana county of residence and county of principal employment as of january of the current year. The completed form should be returned to your employer. Attach additional pages if withholding for more than three household employees. If too much is withheld, you will generally be due a refund. Print or type your full name, social security number or itin and home address.

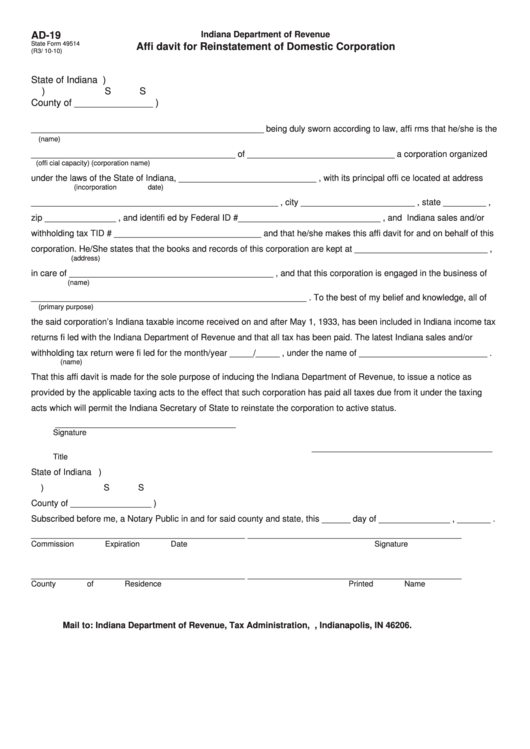

If too much is withheld, you will generally be due a refund. Register and file this tax online via intime. Register and file this tax online via intime. The completed form should be returned to your employer. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Do not send this form to the department of revenue. (a) this section applies to: Print or type your full name, social security number or itin and home address.

Indiana Tax Withholding Form

Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Print or type your full name, social. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web to register for withholding for indiana, the business must have an employer identification.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

If too much is withheld, you will generally be due a refund. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Attach additional pages if withholding for more than three household employees. Enter your indiana county of residence and county of principal employment as of january of the current year. The.

Indiana Tax Form Withholding

Underpayment of indiana withholding filing. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity.

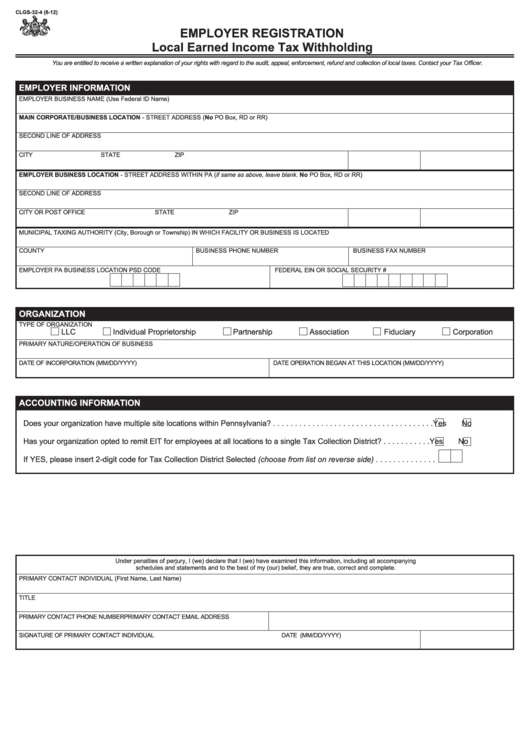

Lake County Indiana Withholding Tax Form

Attach additional pages if withholding for more than three household employees. (a) this section applies to: If too much is withheld, you will generally be due a refund. Register and file this tax online via intime. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government.

Employee's Withholding Exemption and County Status Certificate

Register and file this tax online via intime. If too much is withheld, you will generally be due a refund. Register and file this tax online via intime. Print or type your full name, social. Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records.

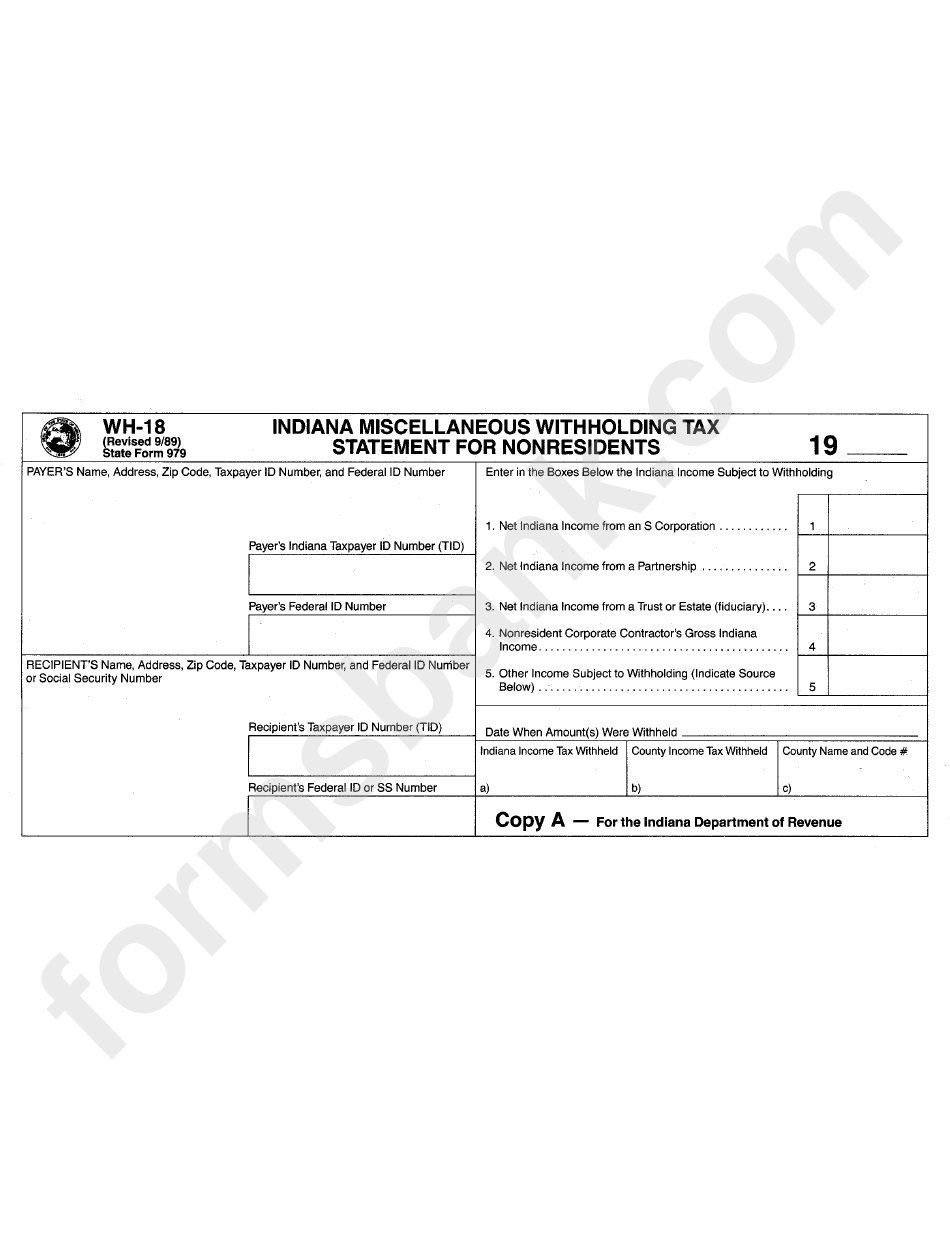

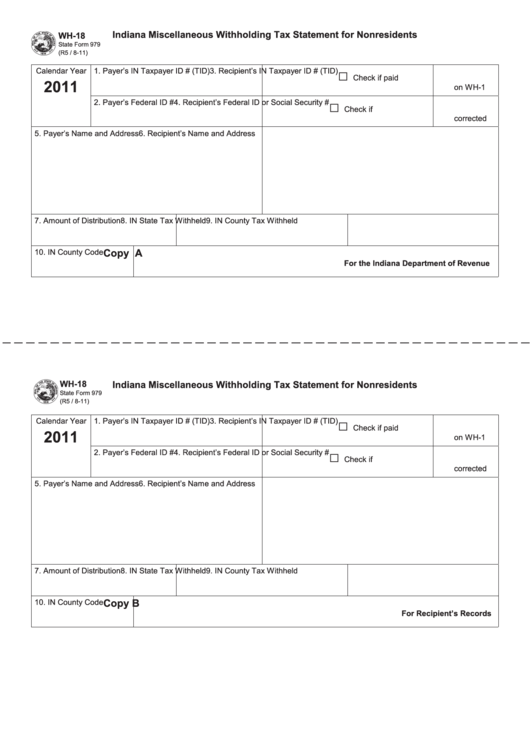

Fillable Form Wh18 Indiana Miscellaneous Withholding Tax Statement

Underpayment of indiana withholding filing. If too much is withheld, you will generally be due a refund. Print or type your full name, social. (a) this section applies to: Enter your indiana county of residence and county of principal employment as of january of the current year.

Indiana Withholding For Support Form

(a) this section applies to: Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity or pension payment. Register and file this tax online via intime. In addition, the employer should look at departmental notice #1 that details the withholding rates for each of indiana’s 92 counties. Attach additional pages if withholding for more than.

Top 13 Indiana Withholding Form Templates free to download in PDF format

If too much is withheld, you will generally be due a refund. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Enter your indiana county of residence and county of principal employment as of january of the current year. Register and file this tax online via intime. If too.

Indiana Employee State Withholding Form

Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity or pension payment. If too much is withheld, you will generally be due a refund. Enter your indiana county of residence and county of principal employment as of january of the current year. If too little is withheld, you will generally owe tax when you.

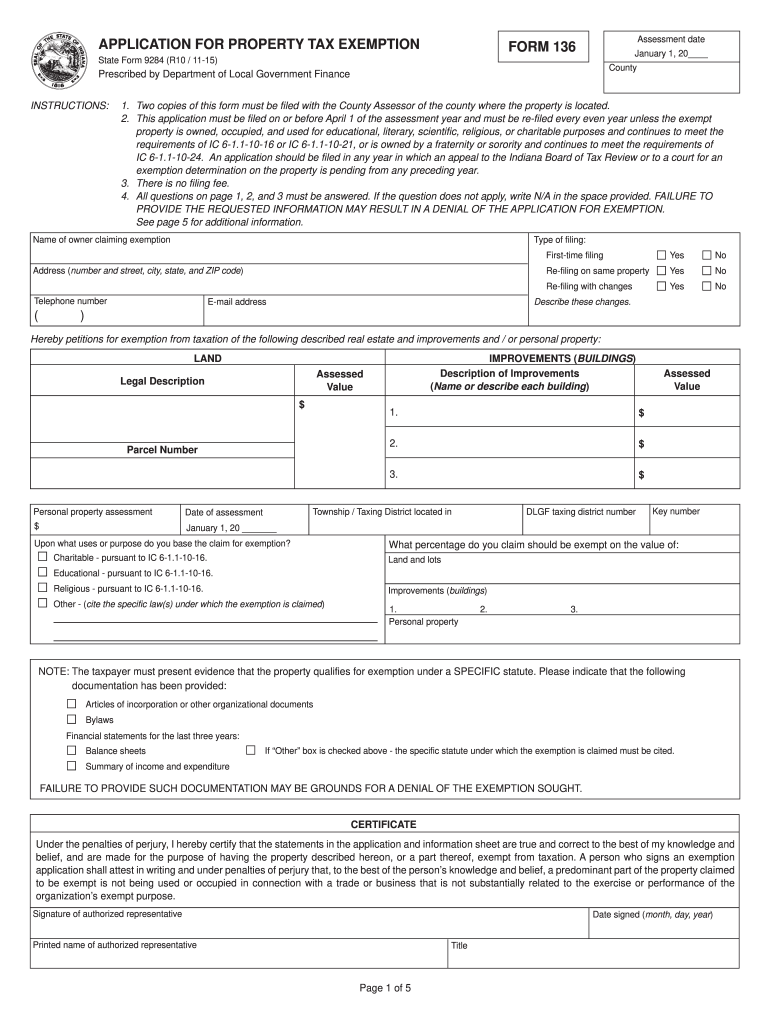

20152022 IN State Form 9284 Fill Online, Printable, Fillable, Blank

Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Register and file this tax online via intime. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government. Do not send this form to the department of revenue..

Print Or Type Your Full Name, Social.

The completed form should be returned to your employer. Register and file this tax online via intime. If too much is withheld, you will generally be due a refund. Web to register for withholding for indiana, the business must have an employer identification number (ein) from the federal government.

Register And File This Tax Online Via Intime.

Print or type your full name, social security number or itin and home address. Web ____________________________date you may select any amount over $10.00 to be withheld from your annuity or pension payment. (a) this section applies to: Attach additional pages if withholding for more than three household employees.

Web This Form Should Be Completed By All Resident And Nonresident Employees Having Income Subject To Indiana State And/Or County Income Tax.

Web state of indiana employee’s withholding exemption and county status certificate this form is for the employer’s records. Enter your indiana county of residence and county of principal employment as of january of the current year. Do not send this form to the department of revenue. Underpayment of indiana withholding filing.

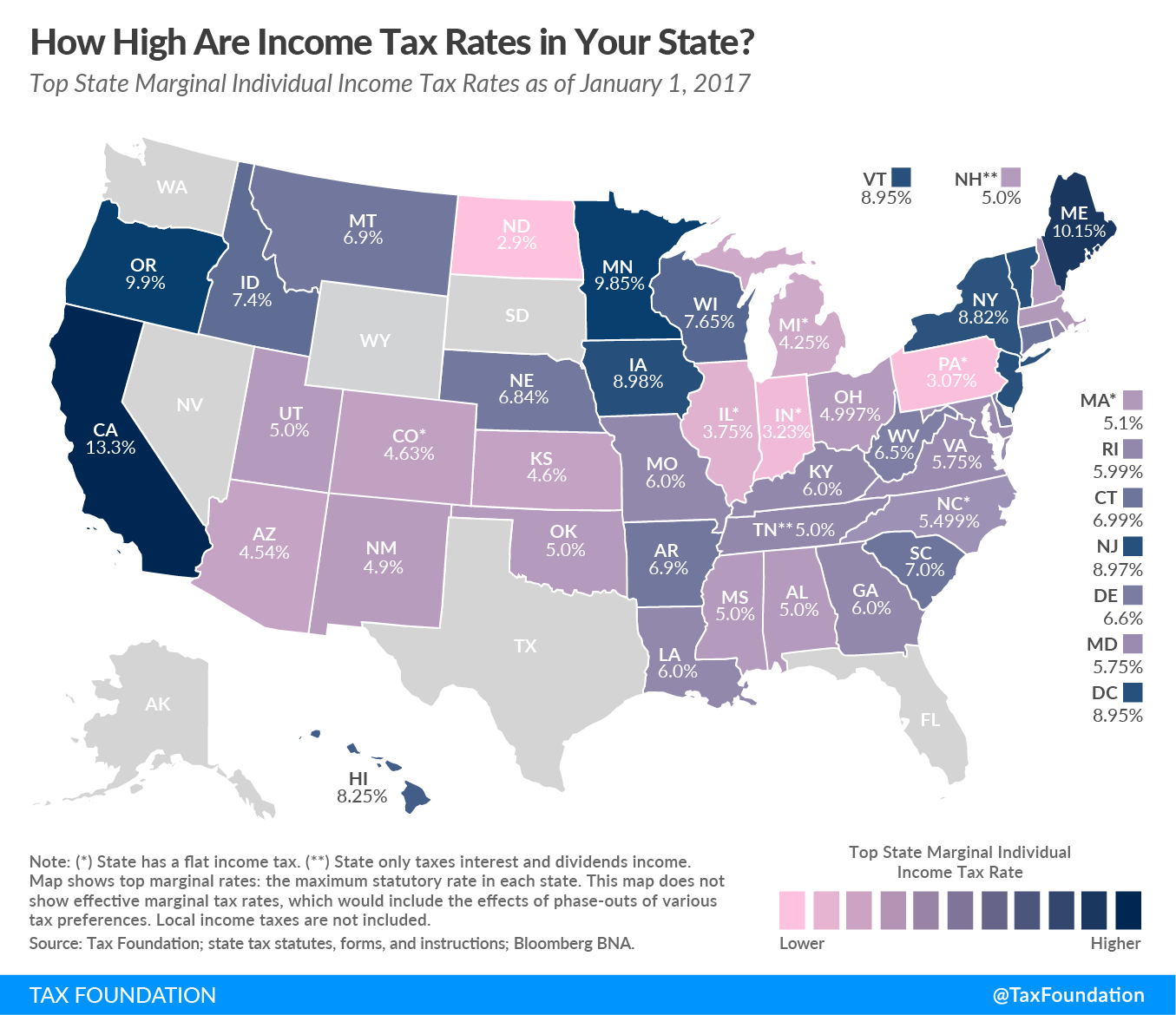

In Addition, The Employer Should Look At Departmental Notice #1 That Details The Withholding Rates For Each Of Indiana’s 92 Counties.

Register and file this tax online via intime. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.