Inheritance Tax Waiver Form Ny

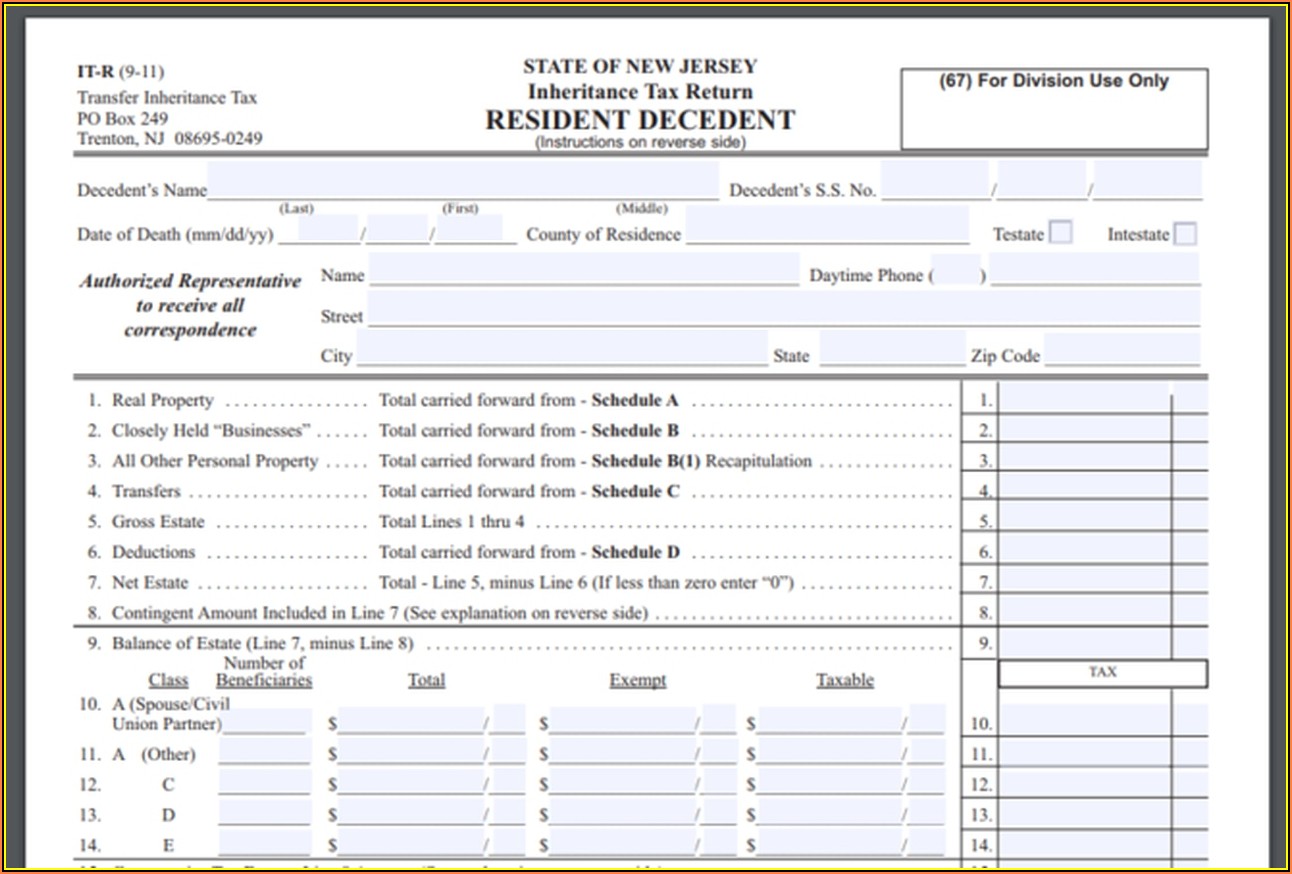

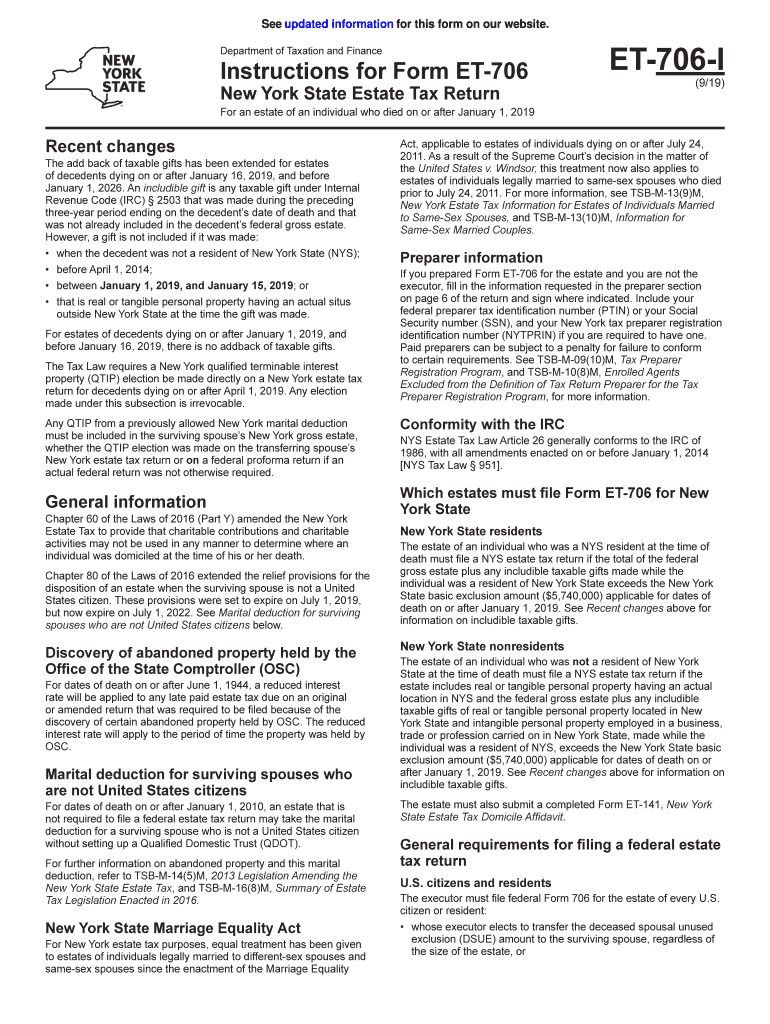

Inheritance Tax Waiver Form Ny - Web does new york state require an inheritance tax waiver? Web the minimum amount that an estate can be valued at without being subjected to an estate tax in new york is $5.93 million (at which point an estate executor must. Name address city, state, zip code type or print the name and mailing address of the person to whom this form should be returned. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Register and log in to your account. Sign in to the editor with your credentials or. Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. Web all requests for a waiver of citation and consent on any estate tax matter pending before the surrogate’s court are handled by estate tax audit. It’s usually issued by a state tax authority. On or afterjanuary 1, 2022;

Open the inheritance tax waiver form new york and follow the instructions. To ensure a timely issuance, you. Send filled & signed et 30 fillable form or save. Register and log in to your account. View a list of forms based on the individual's date of death: Sign in to the editor with your credentials or. Web make these fast steps to edit the pdf nys inheritance tax waiver form online free of charge: When authorization is required for the release of personal property, it is usually referred to as an estate. April 1, 2014 through december 31, 2021; Web does new york have an inheritance tax?

It’s usually issued by a state tax authority. Easily sign the et30 with your finger. Web aarp en español published march 09, 2022 / updated march 21, 2023 most people don't have to worry about the federal estate tax, which excludes up to $12.92. The state has set a $6.58 million estate tax exemption (up from $6.11. 10/20/2022 wiki user ∙ 12y ago study now see answer (1) best answer copy only required in nys if. When authorization is required for the release of personal property, it is usually referred to as an estate. Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. To ensure a timely issuance, you. If the deadline passes without a waiver being filed, the. Name address city, state, zip code type or print the name and mailing address of the person to whom this form should be returned.

Il Inheritance Tax Waiver Form Form Resume Examples EVKYl5g010

Inheritance tax was repealed for individuals dying after december 31, 2012. Send filled & signed et 30 fillable form or save. The state has set a $6.58 million estate tax exemption (up from $6.11. Web all requests for a waiver of citation and consent on any estate tax matter pending before the surrogate’s court are handled by estate tax audit..

Illinois Inheritance Tax Waiver Form Fill Online, Printable, Fillable

Web how do you obtain a ny inheritance tax waiver? Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. Register and log in to your account. For details, see publication 603, estate tax waivers. It’s usually issued by a state tax authority.

Missouri State Inheritance Tax Waiver Form NY TT102 1991 Fill out

The state has set a $6.58 million estate tax exemption (up from $6.11. Web make these fast steps to edit the pdf nys inheritance tax waiver form online free of charge: Send filled & signed et 30 fillable form or save. Web new york state does not require waivers for estates of anyone who died on or after february 1,.

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Register and log in to your account. Inheritance tax was repealed for individuals dying after december 31, 2012. April 1, 2014 through december 31, 2021; It’s usually issued by a state tax authority. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated.

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Inheritance tax was repealed for individuals dying after december 31, 2012. Register and log in to your account. Web does new york have an inheritance tax? Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. Web aarp en español published march 09, 2022 / updated march 21,.

Inheritance Tax Waiver Form New York State Form Resume Examples

Web make these fast steps to edit the pdf nys inheritance tax waiver form online free of charge: Inheritance tax was repealed for individuals dying after december 31, 2012. Web while new york doesn’t charge an inheritance tax, it does include an estate tax in its laws. Web search nycourts.gov new york state unified court system document 2021 estate tax.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

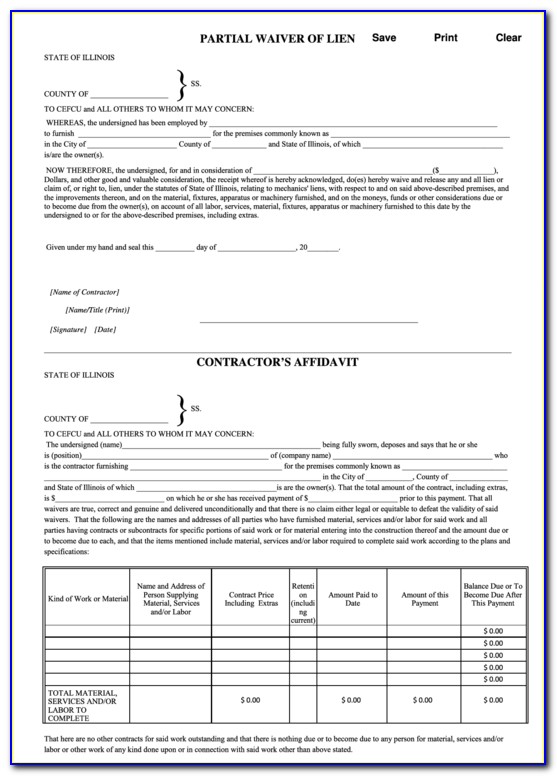

Web search nycourts.gov new york state unified court system document 2021 estate tax waiver your download should start automatically in a few seconds. Open the inheritance tax waiver form new york and follow the instructions. Web (10/16) there is no fee for a release of lien. Register and log in to your account. On or afterjanuary 1, 2022;

Inheritance Tax Waiver Form Form Resume Examples l6YNqRm93z

Not on most estates, but yes on very large estates. On or afterjanuary 1, 2022; For details, see publication 603, estate tax waivers. Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. If the deadline passes without a waiver being filed, the.

Inheritance Tax Illinois ellieldesign

Inheritance tax was repealed for individuals dying after december 31, 2012. And you also have to be mindful of the federal inheritance tax, which applies to. The state has set a $6.58 million estate tax exemption (up from $6.11. Easily sign the et30 with your finger. Web make these fast steps to edit the pdf nys inheritance tax waiver form.

Inheritance Tax Waiver Form Ny Fill Out and Sign Printable PDF

For details, see publication 603, estate tax waivers. Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. View a list of forms based on the individual's date of death: Send filled & signed et 30 fillable form or save. On or afterjanuary 1, 2022;

For Details, See Publication 603, Estate Tax Waivers.

Web how do you obtain a ny inheritance tax waiver? The state has set a $6.58 million estate tax exemption (up from $6.11. Register and log in to your account. Web does new york have an inheritance tax?

April 1, 2014 Through December 31, 2021;

And you also have to be mindful of the federal inheritance tax, which applies to. This is a new york form and can be use in dept of taxation. Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations.

On Or Afterjanuary 1, 2022;

Inheritance tax was repealed for individuals dying after december 31, 2012. 10/20/2022 wiki user ∙ 12y ago study now see answer (1) best answer copy only required in nys if. Web while new york doesn’t charge an inheritance tax, it does include an estate tax in its laws. Send filled & signed et 30 fillable form or save.

Easily Sign The Et30 With Your Finger.

Web does new york state require an inheritance tax waiver? Open the inheritance tax waiver form new york and follow the instructions. Web the minimum amount that an estate can be valued at without being subjected to an estate tax in new york is $5.93 million (at which point an estate executor must. Name address city, state, zip code type or print the name and mailing address of the person to whom this form should be returned.